Mimesis Capital: Interior The Tournament Horizon, Document #16

Bitcoin Versus Ethereum And Other Alts

It’s been “alt season” for the previous couple months. Bitcoin has remained positioned around $50,000 while Dogecoin, Shiba Inu and Ethereum are soaring.

Whereas quick-sighted gamblers wish to assemble bets on the next mammoth dog meme coin, it’s fundamental to confirm the basics of why bitcoin has accumulated mark and compare bitcoin to assorted tokens.

Bitcoin is largely the most efficient monetary ideal.

Why? It has order credible properties: scarce, sturdy, moveable, transactable and heaps others.

From these properties, we are succesful of bag two peculiar traits:

- No counterparty risk

- No dilution risk

These two traits can simplest be maintained by having the flexibility to defend your maintain personal keys and scramble your maintain paunchy node.

No assorted coin or token would possibly perchance perchance perchance compete with bitcoin on these properties and traits.

Therefore, no assorted coin or token can compete with bitcoin as being basically the most efficient monetary ideal.

Love the invention of the amount zero, “Bitcoin is a course-dependent, one-time invention; its fundamental leap forward is the discovery of absolute scarcity — a monetary property never earlier than (and never yet again) achievable by mankind.” — Robert Breedlove, “The Quantity Zero and Bitcoin”

The level of cash is being succesful of send wealth thru time and placement. Bitcoin’s peculiar properties enable it to achieve that better than any assorted ideal. Since cash is a winner-procure-all, network shatter–pushed ideal, folks sport theoretically converge on bitcoin as a Schelling level due to the its order properties and traits.

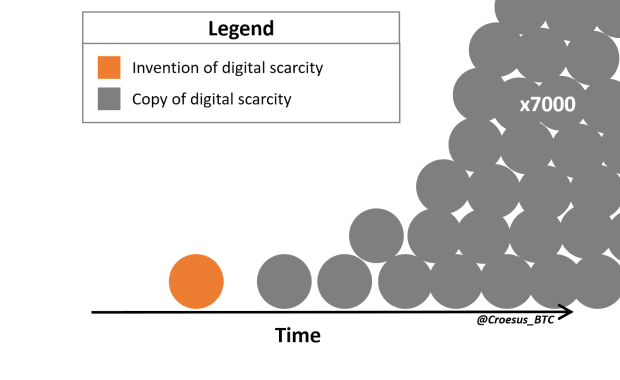

“Every digital mark network carries a network shatter, the strength of that would possibly perchance perchance perchance be approximated by the $ mark of every and each. (Shown right here as dimension of circle, with upright scale.)

Along with your arduous-earned cash at stake, procure which circle others will mark most.” — @croesus

Why Possess Ethereum And Other Alts Hold Cost?

First, ETH is a token.

Earlier than its open, 71% of ETH used to be premined. Some of this ETH used to be given to builders, nonetheless it used to be mostly allotted to ICO customers.

ETH clearly has no longer and would possibly perchance perchance perchance no longer compete with bitcoin on being a monetary ideal as its monetary protection has and never would perhaps be credibly supreme love bitcoin.

As one more ETH is “pitched” as a promise to be precious in a diversity of assorted capabilities. Since ETH is a token and no longer fairness in an organization, the community makes an strive to carry out both provide and predict narratives to incentivize speculators to eradicate and defend the token.

The ETH community must continue to approach relief up with peculiar narratives that rationalize a motive for holding ETH. It must continue changing if it wants to elevate in novel customers.

These form of are predict utilize cases love issuing ERC-20 tokens, DeFi, NFTs and DAOs.

Other narratives are provide pushed, love “Ultra-Sound Money,” the put the community has no longer too long ago began to argue that ETH provide would possibly perchance perchance perchance well also doubtlessly decrease over time.

The unethical a part of that is some of us pitch ETH as “ultra-sound” cash, one thing that is supposedly “better” than bitcoin.

This thought of ETH being “ultra-sound” cash is scammy and deceptive.

Truly, ETH is de facto copying the monetary protection of an ERC-20 token constructed on ETH, $BOMB. This token has a monetary protection that dictates that provide will endlessly decline.

The market cap of $BOMB is $3 million. If ETH successfully copies $BOMB and becomes worth lawful as noteworthy, it will trade at $0.02 per ETH, a slightly dapper drawdown from $4,000.

Obviously, since this token has a constantly reducing provide, it need to tranquil confirm that provide itself (or “ultra-sound” cash) does no longer assemble a token a decent monetary ideal.

Not like bitcoin, whose mark accumulated as a sport thought Schelling level from the organically decentralized, credibly mounted nature of its monetary properties, ETH’s mark is derived from guarantees and hypothesis.

ETH must continue changing and promising more capabilities and worth otherwise why defend the token? The hope is merely that it becomes more scarce and more in predict, endlessly. Love most startups and bubbles, it’s no longer the underlying fundamentals that give the asset mark, it’s the hope and/or hypothesis of what it will probably perchance perchance well also change into.

Love acknowledged above, ETH is a token. It’s precious even as you would wish to make utilize of the Ethereum blockchain. It’s no longer cash.

The ETH token is love a Chuck E. Cheese token to make utilize of the Ethereum blockchain.

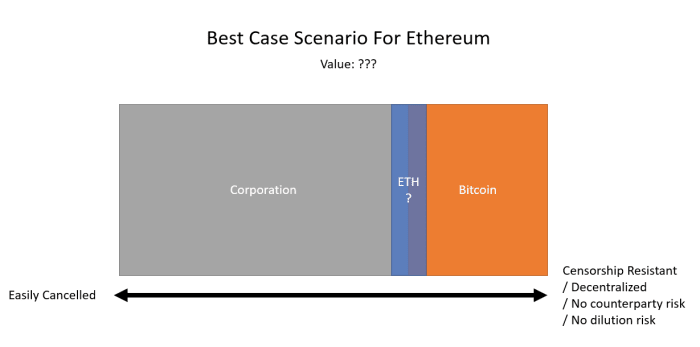

ETH’s simplest-case utter of affairs: There are sustainable, long-term, precious capabilities on the Ethereum blockchain which would perhaps be no longer succesful of be constructed on Bitcoin or Bitcoin 2d layers, don’t require supreme censorship resistance or decentralization (average person can’t scramble an Ethereum node), and wouldn’t lawful be more efficient as a products and services or merchandise provided by an organization.

- Accumulate an NFT or eradicate a Fortnite pores and skin (company)?

- Trade on DeFi alternate or trade on Binance or Coinbase (company)?

- Derive a DeFi loan or accumulate a loan from Unchained Capital, BlockFi or HodlHodl (company)?

- Casino, playing or hypothesis (e.g., Dogecoin, ETH, and all assorted alts)?

The ONLY fundamental utilize case for a blockchain is cash (bitcoin). For cash, you want censorship resistance and decentralization in dispute to possess basically the most efficient credible monetary properties.

With that acknowledged, even though these form of utilize cases attain play out, it doesn’t mean the token (ETH) would accrue mark.

When Chuck E. Cheese launched in 1977, it’s good to tranquil possess provided fairness in the trade, no longer their tokens.

ETH And Alts Are Utilizing Bitcoin’s Monetization

All alts are riding the success of bitcoin. On top of bitcoin’s monetization project, unparalleled monetary and monetary protection leads to a breakdown in the pricing mechanism of “free” monetary markets.

Former finance doesn’t realize bitcoin, and they elevate their thought of diversification to the realm of monetary goods (no longer a decent thought). Moreover, retail speculators are shortsighted and constantly looking out out the next mammoth ingredient (SPACs, GME, Dogecoin, ETH, Tron, and heaps others.) to construct up rich snappy. They tumble for unit bias and hotfoot mark.

On the shatter of the day, alts tumble to the upper fool thought. Can I promote my token to any individual else on the next mark?

The most entertaining monetary ideal (bitcoin) becomes cash, and the remainder are nothing more than playing in a on line casino. Dogecoin (nothing more than a humorous epic/meme) closing in on Ethereum as the amount three coin need to tranquil help shed more gentle on that.