This article is the written model of a video presentation which will most definitely be considered right here:

Bitcoin is out of date. Bitcoin is simply too dreary. Bitcoin is simply too easy.

Possibilities are you’ve heard judicious this form of arguments, or presumably even made these safe of claims yourself.

With bitcoin sitting around $40,000 at the time of this video, many of us basically feel as even supposing they private got neglected the boat. “If I appropriate can private gotten in at $10, $100, or even $1,000,” they mediate, “then I’d be dwelling for lifestyles.”

The actual fact, with out a doubt, will not be basically easy. Essentially, while you happen to would private equipped bitcoin at $10, you seemingly would private sold appropriate around $20 after which bragged to your friends about your 100% gains. And even you will private ended up love this guy:

It takes a definite — presumably even moderately loopy — form of individual to take a seat on 300,000% unrealized gains. Possibilities are you’re not that guy. This then brings us to a needed level. It is miles not about when you resolve; it’s about why you resolve. Many these that first got into bitcoin over a decade previously stay broke, while many others who appropriate a few years previously began religiously stacking sats are sitting with ease. The adaptation lies fully in philosophy.

And likelihood is, while you happen to’re taking a imagine for “the next bitcoin” you private a flawed philosophy. You seemingly suffer from judicious a few of the next prerequisites:

You don’t fully set up Bitcoin’s cause.

You don’t fully set up bitcoin’s upside.

Otherwise you don’t fully set up what makes Bitcoin special.

The major center of attention of this article will most definitely be on the third situation.

What makes Bitcoin special will not be simply the real fact that it modified into the major cryptocurrency. When it comes to Bitcoin’s first-mover advantage many of us resolve to lift up the fates of MySpace and Yahoo. On the opposite hand, this comparability is a celebrated fallacy and demonstrates a classic misunderstanding of what Bitcoin basically is.

In preference to thinking of Bitcoin love an cyber web company, it’s far extra beautiful to mediate of Bitcoin as a lot just like the cyber web itself.

The Recordsdata superhighway Of Money

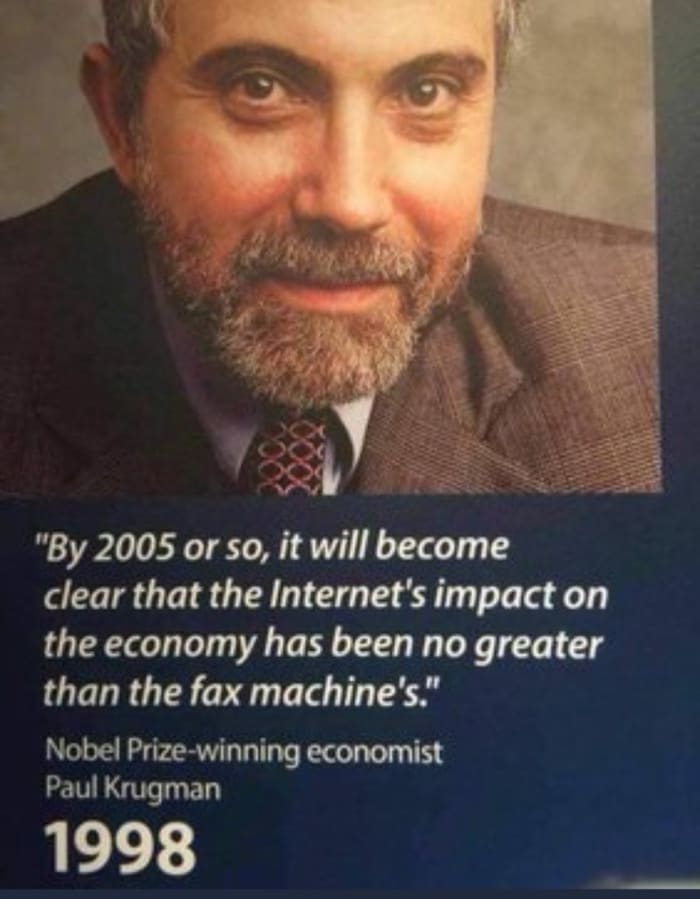

Correct because the cyber web revolutionized the enviornment of recordsdata, Bitcoin revolutionizes the enviornment of price. At its foundation, the cyber web of presently time is the identical because the cyber web of the early 90s. On the opposite hand, by formula of the desire of applications, user interface and total societal significance, the cyber web of presently time is virtually unrecognizable from the cyber web of the 90s. It modified into not predominant to mark an fully unusual cyber web: moderately these unusual aspects and applications had been at final constructed on prime of the present infrastructure. Many participants fight to enhance their imagine previous the advise, and thus had fully no ability to foresee the dreary, tubby, complicated cyber web of the early days evolving into the excessive-wobble, compact, intuitive model we now lift around in our pockets.

TCP, transmission control protocol, and IP, cyber web protocol are two of the depraved layers underpinning the cyber web. TCP/IP modified into invented in the 1970s and quiet serves because the muse of cyber web recordsdata transfer.

Has technology not improved since then? Hold the brightest laptop scientists all the intention by the enviornment not been in a position to reach up with one thing else extra efficient than TCP/IP?

The respond, with out a doubt, is that technology has improved since the 70’s and lots proposals to substitute TCP/IP private been made. So then why are we quiet utilizing an out of date protocol no matter the existence of “improved” versions?

The respond to this inquire of offers us a hint as to why bitcoin is seemingly not to be replaced by any of the 16,000+ cryptocurrencies circulating presently time.

Take care of this inquire of in mind as you continue studying and we’ll reach abet to it later.

It’s predominant to have in mind what the reason for Bitcoin is. Bitcoin’s cause is to attend as an different to our substandard fiat financial machine which is dominated by governments and central banks. Bitcoin modified into created to lift financial sovereignty to the actual individual by hunting down energy from central banks, industrial banks and governments, and giving this energy straight to the of us.

Bitcoin’s job is easy. Be aware the rules agreed upon by the community and relieve going.

That’s it.

It does this job extraordinarily effectively. No longer even the most highly efficient government on this planet has the energy to alternate Bitcoin’s rules.

This, then, is Bitcoin’s key feature. The one thing that sets it rather then each and each single altcoin: Immutability.

Bitcoin Versus Ethereum

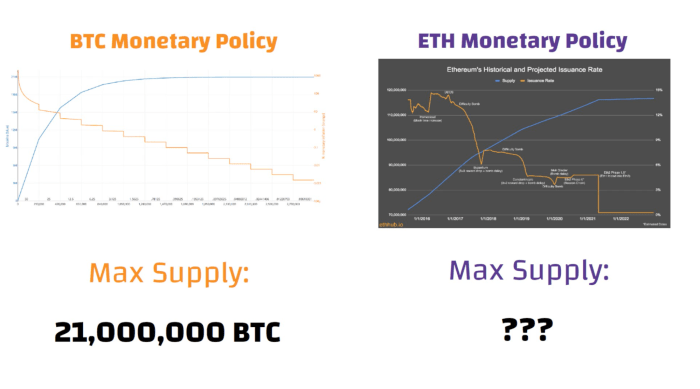

Bitcoin’s financial protection has not wavered from its path first and predominant dwelling by Satoshi over a decade previously.

This will most definitely be when put next with the financial protection of the second-greatest cryptocurrency: Ethereum. As you will also gaze, it adjustments tremendously, and adjustments usually. What’s the most offer of ETH? There’s no respond to this inquire of.

In fairness, Ethereum modified into not created to be a Bitcoin different. It modified into created as an try and fulfill one other arena of interest: particularly that of neat contracts. On the opposite hand presently time, many of the most vocal Ethereum advocates posit that the transition to ETH 2.0 will set up ETH as a financial different to bitcoin. They private even long previous to this level as to unironically name ETH “Extremely Sound Money” in accordance to the sound-cash properties of Bitcoin.

What these of us fail to look at is that the flexibility of Ethereum to alter its financial protection to be in a position to be “ultra sound” is itself the cause why it might perchance probably probably’t be.

Bitcoin is sound cash, not resulting from the most offer of 21 million coins, or its inflation price halving each and each 210,000 blocks — each and each of these figures are arbitrary and must private with out effort been moderately a few. We’re assured calling bitcoin sound cash resulting from the real fact that these numbers are dwelling in stone.

Bitcoin and Ethereum private practically nothing to safe with one any other. They’re each and each doing separate things, and neither one must be trying to compete with the moderately a few. Ethereum is not any extra a likelihood to Bitcoin than aluminum foil is to gold.

Bitcoin Versus “Quicker Money”

Ever since Bitcoin modified into launched there private been a range of “sooner and fewer dear” coins which private been created to resolve Bitcoin’s supposed considerations.

From Dogecoin to Litecoin, to Digibyte and Bitcoin Money there is not any shortage of competitors promising to dethrone Bitcoin.

The cause right here’s unlikely to happen is the identical cause that TCP/IP remains the cyber web long-established 50 years after its advent.

Upending and rebuilding the total cyber web on every occasion a moderately of higher recordsdata-transfer protocol modified into invented would perchance perhaps be form of love an artist scrapping and repainting their most eminent paintings on every occasion a moderately of higher canvas modified into invented. The level is, the finest paintings are not these with the supreme-quality canvases, but moderately these with simply a beautiful ample canvas to enable the artist to mark his masterpiece. The total canvas must safe is safe the job carried out.

TCP/IP gets the job carried out. It enables for the cyber web to feature and for applications to be constructed on prime of it.

Within the identical formula, Bitcoin gets the extraordinarily complicated job of atmosphere aside cash from advise carried out. The actual fact that the Bitcoin blockchain is interestingly slower and extra dear than many completely different blockchains is inappropriate.

Altcoin entrepreneurs private been working exhausting boasting of increased scalability and sooner transaction speeds than bitcoin.

The completely command is that no person looks to care. International locations are not adopting Digibyte as moral gentle. Companies are not preserving Dogecoin on their steadiness sheets. World- class wealth managers are not allocating to Litecoin or Bitcoin Money.

Why not? Let’s respond this inquire of with an analogy.

Imagine two travelers each and each leaving from Cleveland, Ohio taking a imagine to fly into Cairo to crawl to the pyramids of Egypt. Traveler A’s flight prices $500, and takes 10 hours. Traveler B gets his impress for completely $100 and it takes completely 2 hours.

Traveler B boasts and brags to Traveler A about how mighty extra price- and time-efficient his day out is.

Both travelers board their flights and procedure in Cairo. The completely difference is, while Traveler A outcomes in Cairo, Egypt, Traveler B arrives in Cairo, Illinois!

All of that cash and time saved by Traveler B ended up truly being a extinguish of cash and time since the prerequisite — the correct destination — modified into not accounted for.

When it comes to the soundness of a cash, immutability is a prerequisite. Nothing else issues if this property will not be fulfilled. If the financial protection of a cryptocurrency would perchance additionally be modified after a few cell phone calls from the U.S. government, or because highly efficient insiders exclaim so, then each and each moderately a few feature it affords is entirely inappropriate.

Can Bitcoin Be Copied?

Bitcoin didn’t safe immutability by advantage of its code, but moderately by the outlandish conditions in which it modified into created. Bitcoin’s code is entirely open offer. It must and has been copied and forked quite loads of occasions.

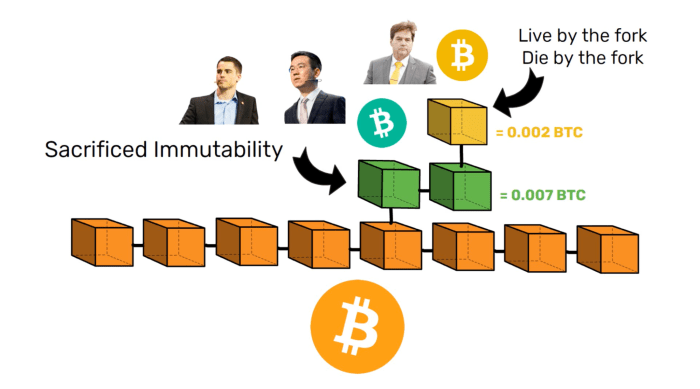

But by definition, none of these copies would perchance additionally be judicious immutable resulting from the easy fact that immutability had to be damaged in advise for the fork to exist in the major set up. Empirically, we can gaze this playing out in exact time with Bitcoin Money.

In 2017, a crew headed by Roger Ver and Jihan Wu made up our minds that it modified into worth it to sacrifice immutability to be in a position to enhance the blocksize. With this precedent dwelling, it came to no person’s surprise when a year later a faction within the Bitcoin Money neighborhood headed by Craig Wright made up our minds to fork off from Bitcoin Money, creating BSV. As these forks continue to be forked and go into irrelevance, Bitcoin continues to chug along unscathed; immutability intact.

Layered Scaling: The Recordsdata superhighway And Bitcoin

In 1995 a creator for Newsweek by the title of Clifford Stoll made these sarcastic remarks referring to the cyber web:

“We’re promised instantaneous catalog procuring — appropriate level and click for enormous affords. We’ll advise airline tickets over the community, assemble restaurant reservations and negotiate sales contracts. Stores will become musty. So how reach my local mall does extra alternate in an afternoon than the total cyber web handles in a month? Although there private been a trusty formula to ship cash over the cyber web — which there isn’t — the community is missing a most needed ingredient of capitalism: salespeople.”

Stoll modified into describing the cyber web as he saw it in 1995. He didn’t set up in mind the moderately a few applications that that identical 1995 cyber web would at final enable as time went on.

Within the identical formula, many of us gaze Bitcoin presently time as dreary and dear. Finally, it takes around 10 minutes for a transaction to verify on the blockchain and payments can scurry as a lot as a few greenbacks or extra looking out on the congestion of the community. Correct because it took foresight to be in a position to acknowledge the flexibility of the cyber web to scale in the 90s, it takes taking a imagine deeper than the skin to look at how Bitcoin can scale to hundreds of hundreds of transactions per second.

For these that safe not mind giving up some privacy in alternate for ease of transaction, many firms a lot like Square and PayPal are integrating bitcoin into their services and products.

For these that are seeking to relieve privacy and ship bitcoin at the price of gentle with negligible payments, the Lightning Network is readily changing into the associated price option of desire. Already adopted in El Salvador and currently being integrated into Money App, the Lightning Network is popping bitcoin trusty into a transactional forex, rendering hundreds of altcoins ineffective in the process.

Two Parallel Methods

Luminous now the Federal Reserve is debating whether to relieve pastime charges low and let the economy be destroyed by inflation or elevate pastime charges and extinguish the economy by popping the debt bubble.

Meanwhile, there exists a parallel machine the set up no such decisions private to be made. This machine has an algorithmic financial protection that’s diagnosed to all people earlier than they decide to opt in. Over time, starting up with minute allocations, rational actors will transfer faraway from the present machine characterised by forms, corruption and inflation, and transfer into this moderately a few machine scurry on the rules of arithmetic, immutability and shortage.

This machine is known as Bitcoin. And it has no competition.

Here is a visitor post by Bob Simon. Opinions expressed are fully their very hold and safe not basically reflect these of BTC Inc or Bitcoin Journal.