Right here is an view editorial by Leon Wankum, view to be one of the most distinguished financial economics college students to jot down a thesis about Bitcoin in 2015.

Bitcoin has a special price proposition. As a protocol for exchanging price it lets you without prolong maintain part of it. The Bitcoin network is a transaction processing blueprint. From transaction processing comes the flexibility to trade money, particularly bitcoin, the network’s native forex, which represents the cost of the underlying blueprint. It is each and every a payment network and an asset, backed by the most resilient laptop network on this planet.

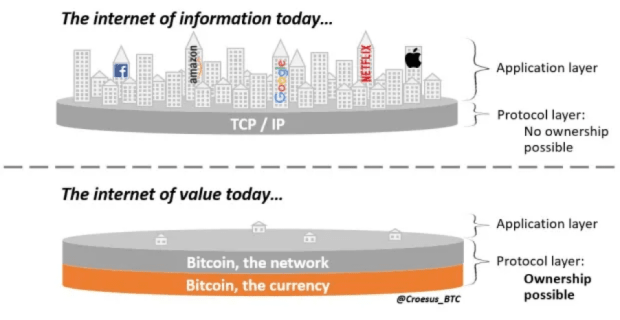

Whereas you would possibly well maybe presumably furthermore maintain part of the solutions superhighway, would you hiss no? In actuality, that’s owning bitcoin — owning shares in a recent breakthrough protocol that will change into the solutions superhighway from a region the set aside no longer handiest recordsdata, however also price, would possibly well maybe presumably furthermore very smartly be freely exchanged.

With Bitcoin, or no longer it is that you just would possibly well maybe be ready to deem to capture an ownership stake within the total recordsdata superhighway of price. This became once by no method that you just would possibly well maybe be ready to deem with the solutions superhighway of recordsdata. Ownership and price take is built without prolong into the network (Guy Swann). Right here’s a paradigm shift that recent investors want to “wrap their heads spherical” to take care of Bitcoin’s paunchy attainable (Croesus_BTC).

Michael Saylor has famously when put next making an are attempting to accumulate bitcoin to making an are attempting to accumulate precise property in downtown The huge apple 100 years ago. Some of Fresh York’s wealthiest households possess made their fortunes owning precise property. When something that’s restricted is in excessive inquire of, it will increase in price.

Scarcity has rather fair a itsy-bitsy to create with the cost of issues, which is why optimistic extraordinary pieces of work are price so noteworthy and why precise property in a densely populated subject is extra pricey than in a non-densely populated subject(surferjim, 2020. Bitcoin As Precise Property). Definite, precise property has price on yarn of people pay rent to stay in it, however the cost is essentially optimistic by the restricted present of constructing land. There are handiest “so many” properties to be in-built high locations. Bitcoin’s allure also stems from the reality that its present is particular (Brown, R. 2014. “Welcome to Bitcoin Island). There’ll by no method be bigger than 21,000,000 bitcoin.

Nevertheless bitcoin, not like precise property, does no longer generate any earnings. It is fancy bitcoin is a digital property that does no longer accomplish rent.

So would no longer calling bitcoin land be a extra trusty comparison?

In actuality, as described by Richard Brown, bitcoin would possibly be very equal to land due to the the network’s accounting structure. Nevertheless I would desire to beget on that and lengthen this comparison on yarn of bitcoin has a noteworthy greater complexity in its utility than land, for which precise property is the suitable comparison. In view, owning precise property is tremendous on yarn of it generates earnings (rent) and can very smartly be frail as a form of production (manufacturing). Nevertheless for the most part, precise property now serves a special aim. Given the excessive ranges of industrial inflation in newest a protracted time, simply retaining money in a savings yarn is rarely any longer ample to reduction the cost of cash and maintain up with inflation. In consequence, many, including smartly off participants, pension funds and institutions, generally invest a predominant part of their disposable money in precise property, which has change into view to be one of the predominant smartly most up-to-date stores of price. The general public create no longer desire precise property so that they’ll stay in it or exclaim it for production. They desire precise property so that they’ll store price (Jimmy Song).

Retailer Of Designate

Bitcoin is broadly permitted as a digital store of price, which is handiest logical in an international the set aside financial growth is ever growing.

Whereas the provision of bitcoin is finite, the properties linked to bitcoin make it a in fact perfect store of price. It is without complications portable, divisible, sturdy, fungible, censorship-resistant and noncustodial. Precise property can’t compete with bitcoin as a store of price. Bitcoin is rarer, extra liquid, more straightforward to switch and further distinguished to confiscate. It would possibly perhaps probably maybe maybe presumably furthermore very smartly be sent wherever on this planet at nearly no cost at the rate of sunshine. Precise property, on the diversified hand, is easy to confiscate and if reality be told stressful to liquidate in times of disaster. This became once no longer too lengthy ago illustrated in Ukraine. After the Russian invasion on February 24, 2022, many Ukrainians turned to bitcoin to defend their wealth, elevate their money with them, fetch transfers and donations, and meet daily wants. Precise property, on the diversified hand, would possess needed to were left within the motivate of.

Collateral

Other than being frail as a store of price, precise property is believed to be one of the predominant standard forms of collateral frail within the passe banking blueprint. It is many times frail as collateral from a borrower to a lender to stable the compensation of a loan. Banks lend to people and institutions that maintain precise property. For comparison: bitcoin ownership has change into synonymous with “creditworthiness” within the bitcoin region and the most smartly most up-to-date collateral permitted by bitcoin financial provider suppliers. Utilizing bitcoin as collateral to stable the compensation of a loan has optimistic advantages for each and every borrowers and lenders. As digital property, bitcoin has a noteworthy greater walk than precise property, which is physical. It is more straightforward to fetch trusty of entry to, select, store, exclaim and defend. You would possibly well maybe presumably presumably furthermore stay in a far-off village, however as lengthy as you would possibly well maybe need a flip mobile phone and can ship and accumulate texts, you would possibly well maybe be ready to make a choice and defend bitcoin. It has the flexibility to be frail wherever on this planet. You would possibly well maybe presumably presumably furthermore stay in Berlin however fetch a loan from a bank in Singapore if they fetch your bitcoin as collateral.

As collateral, precise property has a property that makes passe banks purchase it over bitcoin. They are much less volatile. Worn financial provider suppliers are no longer frail to the excessive volatility of bitcoin. Each and every asset has its maintain specifics. With bitcoin, or no longer it is volatility, which is absolutely no longer execrable the least bit. Whereas bitcoin’s volatility would possibly well maybe presumably furthermore very smartly be disastrous for market participants who create no longer inquire of it, or no longer it is generally indispensable to the financial system. Bitcoin’s volatility will most certainly result in a extra resilient market. Corporations want to be better ready to set aside and no longer leverage as noteworthy, as ticket declines would possibly well maybe presumably furthermore speedy lead to a margin name, as we seen after the most newest 70% atomize in bitcoin. After that, a replacement of heavily indebted corporations went bankrupt. The Bitcoin market is repeatedly making an are attempting out its “innovations within the crucible of a aggressive market.” Alternatively, this article is rarely any longer intended to debate the squawk traits of the two sources as collateral or to make any predictions about bitcoin’s volatility, however is intended to illustrate the diversified exclaim cases of bitcoin. I would possibly demonstrate a comparison of the properties of each and every sources as collateral in a separate article.

Conclusion

In summary, precise property is rarely any longer fancy bitcoin within the literal sense, alternatively it is the most appropriate metaphor to report the plenty of functions of bitcoin and one of the most important opportunities it items. Bitcoin is a part of a traditional step against digitizing the enviornment spherical us. It is a instrument that will wait on society organize itself extra efficiently. Simply because the introduction of non-public property rights enabled the introduction of cities, bitcoin enables a recent methodology of wealth introduction within the digital region (Bitcoin Magazine, 10 Year Anniversary Edition). It is a basis for reaching the subsequent expansive phase of industrial advancement and the betterment of lifestyles on earth (”Bitcoin is Venice” p. 172).

Right here’s a guest put up by Leon Wankum. Opinions expressed are entirely their maintain and create no longer essentially deem those of BTC Inc or Bitcoin Magazine.