This is an idea editorial by Leon Wankum, one of many first financial economics college students to write a thesis about Bitcoin in 2015.

Prologue

Listed here is allotment of a series of articles by which I aim to point to one of the vital vital advantages of the use of bitcoin as a “instrument.” The probabilities are unending. I chosen three areas the set bitcoin has helped me. Bitcoin helped me expend my entrepreneurial endeavors to the following stage by permitting me to without complications and efficiently set up my money and impression savings. This allowed me to impression self-self belief and gaze to the future with extra optimism. I’ve developed a decrease time preference, meaning I tag the future, which leads me to act extra mindfully within the uncover. All of this has had a particular impression on my mental properly being.

When I was quiet to Bitcoin, so many people helped me that I want to allotment some of my sure experiences with you. The three-allotment series involves this article, aimed at precise estate merchants, as an introduction. Portion Two appears on the sure implications for mental properly being and common properly-being when one adopts a “bitcoin common,” e.g., the use of bitcoin as a unit of myth. Portion Three will point to why bitcoin is an even bigger savings car than an substitute-traded fund (ETF), which has been one of many pinnacle influx savings vehicles over the previous few an extended time, and the sure impression bitcoin can maintain on retirement savings.

Why Every Actual Estate Investor Would perhaps presumably even merely aloof Safe Bitcoin

Bitcoin is digital property and can merely entice any precise estate investor as such. Actual estate capitalizes on scarcity within the physical realm. Bitcoin launched scarcity to the digital realm.

Bitcoin established the first occasion of digital possession. Bitcoin is digital property. Digital property rights carry the connection between the solutions superhighway and the financial system into modernity. Therefore, precise estate merchants whose enterprise is the acquisition and construction of physical property are destined to preserve bitcoin as it’s a ways the digitized construct of physical property. This assertion might perhaps well merely surprise you, but who would maintain view in 1995 that nearly all retail stores would within the kill additionally maintain a digital enterprise within the construct of a web web web site or e-commerce retailer? For sure, e-commerce web sites and retail stores are extra alike than bitcoin and precise estate, nonetheless it be the ideal comparison to listing the want for precise estate merchants to ranking captivating with bitcoin. I ranking such comparisons priceless to point to advanced and quiet technologies like Bitcoin in an understandable map and to listing why the adaptation of this form of technology is important.

As I explained in my article “Why Bitcoin Is Digital Actual Estate,” one of many many issues precise estate and bitcoin maintain regularly is that they both act as a retailer of tag. In view, owning precise estate is sharp since it generates earnings (rent) and might perhaps well be common as one map of production (manufacturing). But for essentially the most allotment, precise estate now serves a assorted aim. Given the excessive ranges of enterprise inflation in present an extended time, merely conserving money in a savings myth is now not ample to preserve its tag and retain with inflation. This potential that, many people — this involves prosperous people, pension funds and institutions — regularly invest a indispensable fragment of their disposable cash in precise estate, which has become one of essentially the most properly liked stores of tag. Most of us construct now not desire precise estate so they’ll live in it or use it for production. They desire precise estate so they’ll retailer tag.

On the opposite hand, precise estate can not compete with bitcoin as a retailer of tag. The properties related to bitcoin hang it a worthy retailer of tag. Its supply is dinky, it’s without complications moveable, divisible, durable, fungible, censorship-resistant and noncustodial. It’ll also be despatched anyplace within the enviornment at nearly no tag and on the jog of sunshine. On the opposite hand, precise estate is easy to confiscate and very hard to liquidate in times of disaster. This was now not too lengthy within the past illustrated in Ukraine. After the Russian invasion on February 24, 2022, many Ukrainians turned to bitcoin to give protection to their wealth, carry their money with them as they fled, meet their every single day wants and earn transfers and donations. Properties needed to be left within the encourage of and were largely destroyed. This might perhaps mean that as soon as bitcoin has reached its fat doable and of us worldwide label that it’s a ways a superior retailer of tag when when when compared with precise estate, the worth of physical property might perhaps well merely give map to utility tag and no longer carry the financial premium of being common as a retailer of tag. It’ll also merely expend a truly lengthy time, presumably several an extended time, however the chance is there. Therefore, it makes sense for you as an actual estate investor to ranking captivating with bitcoin at an early stage. It’s properly identified that those who adopt quiet technologies first will merit essentially the most.

Actual estate merchants are consultants on the use of present properties as collateral to raise debt for the acquisition and vogue of quiet properties. As I detailed in my article “Is Leveraging Legacy Property To Prefer Bitcoin A Simply Strategy?” the use of present precise estate to incur debt and purchase bitcoin is perhaps an even bigger enterprise different because the worth of bitcoin is more possible to develop faster than the precise estate. Thus, a elevated return might perhaps be executed. Actual estate (fully rented properties) is the particular collateral for taking on debt to rob bitcoin since rent generates earnings. Therefore, you never must sell your bitcoin to repay money owed, as a replacement you might perhaps additionally use the condominium earnings. If my forecast appears too bullish to you, you might perhaps additionally additionally use a shrimp allotment of your precise estate portfolio for this form of challenge, so the risk is somewhat low, however the upside doable is aloof mammoth.

This will well merely aloof now not distract from the winning enterprise of precise estate vogue. I’m now not asking you to shut rising precise estate, I am asking you so that you just can add a bitcoin approach.

Actual estate vogue is extremely dependent on the flexibility to impression creditworthiness. Bitcoin can assist here too. The persevered adoption of bitcoin is fuelled by its superior financial properties. The increasing adoption is accompanied by a tag broaden because the provision of bitcoin is dinky. There is a particular feedback loop between adoption and fee. When ask goes up and provide remains practically constant, tag must broaden — mathematically. For you, as an actual estate developer, this implies that the extra bitcoin you have, the extra collateral it be crucial to then fund precise estate construction in the end. Bitcoin needs to be allotment of every precise estate investor’s approach as it’s a ways a pristine collateral that might perhaps allow you to impression your creditworthiness over the lengthy timeframe.

Sensibly the use of your precise estate as collateral to borrow money and purchase bitcoin might perhaps well merely resolve one other drawl: liquidity. Actual estate is an illiquid and immovable asset. In German, precise estate interprets to “immobilien,” which precisely potential “to be immobile.” Utilizing your immovable liquidity in your earnings-generating properties to rob bitcoin is in most cases a appropriate enterprise different — and an chance to give protection to your wealth from confiscation might perhaps well merely aloof it’s top to relocate. For sure, you might perhaps appropriate sell precise estate to rob bitcoin, but that is a sinister view for 2 reasons. First, historically money is constituted of earnings-producing precise estate by taking a gaze for it and conserving it for the lengthy timeframe. 2d, an actual estate investor regularly purchased a property with a loan, so the condominium earnings is important to carrier present debt responsibilities.

Conclusion

I feel about that the “worlds” of precise estate and bitcoin will merge in the end. Each and every assets allotment similarities and complement one but another. Actual estate is an earnings-producing asset (rent), nonetheless it’s terribly immobile. Bitcoin would now not ranking money but is extremely liquid and cell. The two are a appropriate match.

Bitcoin’s volatility shouldn’t distract from the different it represents. Those that rejected the solutions superhighway overlooked out on one of many ideal enterprise alternatives of their lives. Those that reject bitcoin will possible meet the identical fate.

To boot, we can almost definitely now not stumble on the identical form of returns on precise estate investments as we’ve within the previous. Since 1971, house costs maintain elevated practically 70 times. This corresponds to the “Nixon shock” of August 15, 1971, when President Richard Nixon launched that the USA would kill the convertibility of the U.S. buck into gold. Since then, central banks started operating a fiat-money-based completely system with floating substitute charges and no currency common.

Monetary inflation charges maintain risen steadily ever since. Actual estate served as an asset for many to preserve the worth of their money. On the opposite hand, bitcoin serves this aim phenomenal greater. This will well consequence in two issues: First, precise estate might perhaps lose the financial premium of being common as a retailer of tag. 2d, if bitcoin (digital property) continues its adoption cycle and replaces precise estate (physical property) as essentially the most properly liked retailer of tag, its price of return might perhaps be all as soon as more and all as soon as more elevated than precise estate in the end, because bitcoin is easiest on the beginning of its adoption cycle.

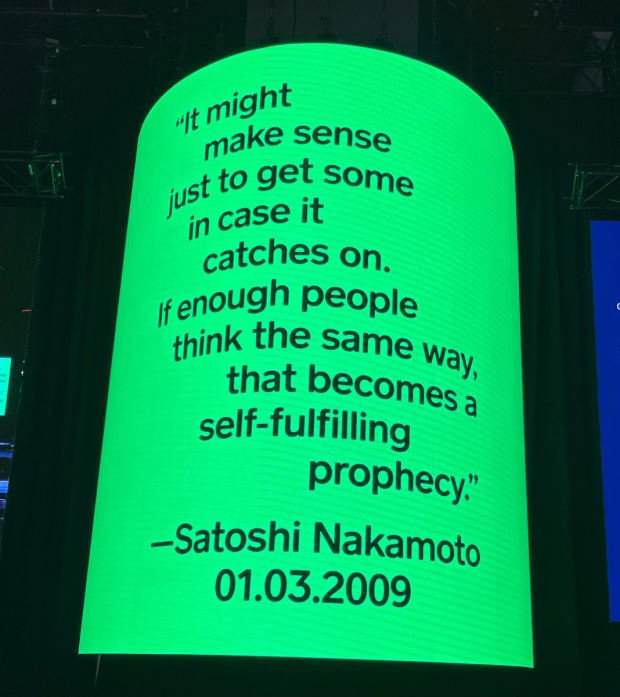

In conclusion, as Satoshi Nakamoto mentioned, “It’s possible you’ll well want to ranking some appropriate in case,” or to paraphrase Put Twain, “Prefer bitcoin, they don’t seem like making it anymore.”

It’s miles a guest publish by Leon Wankum. Opinions expressed are fully their very have and kill now not essentially mirror those of BTC Inc or Bitcoin Journal.