Here is an idea editorial by Mickey Koss, a West Level graduate with a level in economics. He spent four years in the infantry earlier than transitioning to the Finance Corps.

Continuously up, regularly having to add extra lest you plunge in the help of. I could well presumably feel the American dream slowly slipping away yearly. We dutifully paid our funds, contributed to retirement accounts, invested prudently and yet it felt love yearly things bought a small tighter. Rather extra difficult to make a contribution what we wished to. As soon as we learned Bitcoin, it gave us hope.

“Inserting is mutual suffering. A game of chicken. Bitcoin modified the sport. It made striking precious to the striker.”

–Matt Hill on “Bitcoin Audible,” episode 75

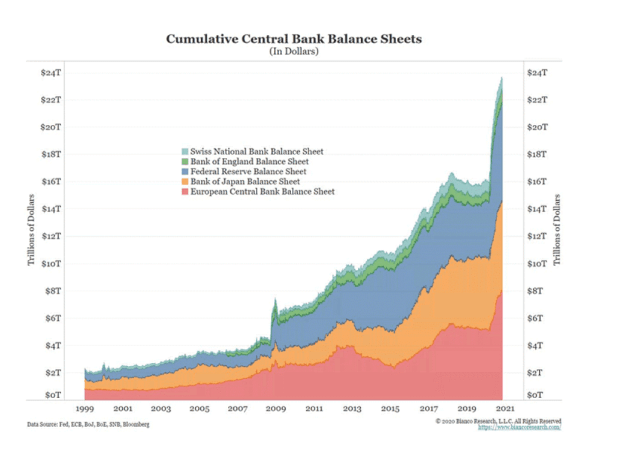

Now my wife and I are on strike, love loads of you reading this text doubtlessly are. As soon as the money printers started roaring after the COVID-19 lockdowns started in 2020, I felt a sinking feeling that the arena would never be the same yet again. Ungodly sums of money were talked about on records stations with such causal indifference. In the end, the outcomes keep up a correspondence for themselves:

We Need Better Critics

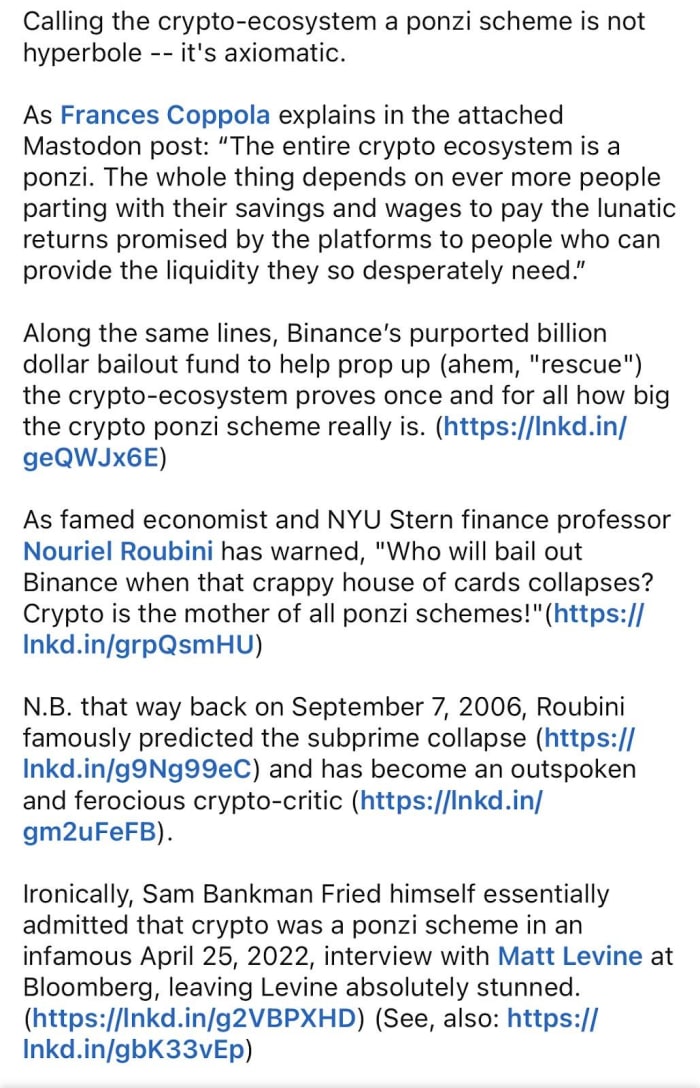

One in every of the most assuredly-cited evaluations I hear from seemingly-sophisticated investors and financial PhDs alike is that Bitcoin is a Ponzi plan: a game of the better fool making an are trying to secure from the scammy huckster as the earlier investors dump their baggage on the fresh.

The above post beautifully illustrated the general lack of records, let by myself excessive pondering, surrounding this explicit line of FUD. The abject lack of psychological curiosity is astonishing, yet one way or the opposite unsurprising given my fresh stint in academia:

“The general factor relies on even extra folks parting with their financial savings…”

Is this no longer factual for the stock market? The housing market? The commodities market? By that good judgment, every market with fluidity of pricing constant with provide and depend upon is a Ponzi plan. I wager it’s time to head help to the barter financial system? Or does the stock market crawl up on earnings by myself with none investors or depend upon?

Genuinely, It appears to be like to me that costs bask in been going up faster than earnings since about 1980, even when taking inflation into story:

The above image depicts the Shiller PE ratio for the S&P 500. It’s far the worth-to-earnings ratio for the stock market, but adjusted for inflation. Can any individual negate “Cantillon carry out”?

Fiat Is The Ponzi

Crypto is a symptom, no longer the underlying discipline. Years of pent up nihilism unleashed into secure-prosperous-hasty pump and dumps as the arena seemingly falls apart around us. It’s no longer laborious to glance why. But Bitcoin is no longer crypto, and crypto is no longer Bitcoin.

In what now feels love the blink of an seek, trillions of bucks were created to stop the diagram from imploding. Today, the stock market was once booming while it seemed love all the pieces was once crumbling. I don’t even blame the central bankers. They responded to their incentives and did what they’d to, however the effects were dire. While you happen to weren’t already invested, you lost sizable, making it factual that unprecedented extra difficult to secure your dollars to give you the results you want, to shatter out inflation and finally shatter out the rat bustle.

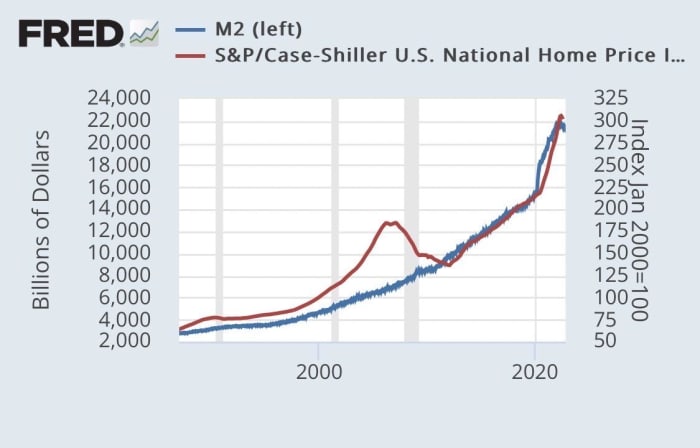

One in every of the most salient illustrations to me is the under graph. It demonstrates that you just need to always secure a home, any dwelling, it doesn’t matter. On story of while you don’t already private a home, while you resolve to assign as a replace, that it is possible you’ll never truly be ready to afford one. It doesn’t secure loads of empathy to treasure the monetary desperation many are feeling on the present time.

Federal Reserve financial records: M2 money provide vs. housing label index

Now, I admit that I’m no longer a reliable statistician, however the charts appear to bask in some indispensable correlation. Per chance CPI inflation may well presumably no longer be the fitting discipline. Per chance asset label inflation may well presumably be forcing savers to turn out to be share-time investors. Provide and depend upon has a label affect on bitcoin, certain, but does the stock market no longer require fresh money to make stronger costs as effectively?

Bitcoin Is Financial savings

Financial savings: Money effect by the extra of profits over expenditures.

So, why can’t we factual assign money anymore? The FRED graphs incorporated right here repeat all of it. While you happen to don’t turn out to be an investor, it is possible you’ll never deal with. That’s, until now.

Bitcoin is our financial savings in a world bereft of things noteworthy of funding. Even though it hits $1 million tomorrow to come, we’re no longer promoting. What would we even put up for sale for? To diversify? Into what? A stock market entirely dependent upon money printing? An funding property the build our tenants won’t bask in to pay rent following the stroke of a politician’s pen? A intellectual rock with “intrinsic worth”?

You glance, how may well presumably Bitcoin be a Ponzi when Bitcoiners don’t even prefer your dollars? What you don’t sign is that we’re taking part in a uncommon game now. What you don’t sign is that we’re looking to invent one thing fresh; the next future for our teenagers and grandchildren.

So, while you deem bitcoin is doomed to shatter and burn then short it. Try to revenue off our death, although I don’t deem it is possible you’ll.

We are in a position to factual deal with making an are trying to secure and preserving, continuing to entrance-traipse you and Wall Toll road, and everyone else who refuses to even strive and treasure Bitcoin. We help no enrage or resentment in direction of you. We don’t must eat the prosperous, or to burn the diagram down; we factual don’t must play by your principles anymore. And if we crawl down with the ship, no no longer up to we lost all of it combating for one thing we believed in.

Here is a guest post by Mickey Koss. Opinions expressed are fully their very private and construct no longer necessarily mediate those of BTC Inc or Bitcoin Magazine.