For the period of the last 24 hours, the market witnessed a well-known rally in the Bitcoin mark, which soared by 10% from a day-to-day low of $60,805 to a top of $68,250. This excellent mark circulation would possibly per chance per chance per chance furthermore be attributed to loads of key components, along side yesterday’s Federal Initiate Market Committee (FOMC) assembly, a distinguished swap in the Coinbase Top price, and Bitcoin’s technical breakout from a downtrend channel.

#1 FOMC Assembly: Dovish Remarks By Jerome Powell Gasoline Optimism

As reported yesterday, the macro ambiance came support into focus for Bitcoin and crypto following the warmer than anticipated Client Keep Index (CPI) and Producer Keep Index (PPI) inflation recordsdata in the US. Investors gave the influence to own de-risked their positions sooner than the FOMC occasion. On the opposite hand, traders bought a favorable waste result.

The pivot point for Bitcoin’s rally would possibly per chance per chance per chance furthermore be traced support to the Federal Reserve’s latest FOMC assembly, where Chairman Jerome Powell delivered a speech that the market interpreted as dovish. The Fed’s stance, specifically in gentle of latest inflation recordsdata, has reassured traders.

Crypto analyst Furkan Yildirim supplied a summary of the FOMC’s key capabilities: “The ‘Dot Dilemma’ projections advise that the median first price expects three quarter-percent cuts in 2024 […] The FOMC voted unanimously to fade the federal funds price unchanged […] The median forecast for PCE inflation stays unchanged at 2.4% for 2024 […] Officials own furthermore raised forecasts for where they ogle hobby rates in the long term.”

The reaction to those announcements modified into once instantly bullish in the regular finance markets moreover to Bitcoin and crypto. QCP Capital, a Singapore-based mostly crypto asset procuring and selling firm, highlighted the dovish nature of the FOMC’s stance: “1. In Powell’s press convention speech, he modified into once no longer inquisitive about the excessive inflation numbers in Jan and Feb. 2. Within the dot set, more contributors shifted their projection to three cuts in 2024 (9 contributors vs 6 in Dec).”

Analyst Ted (@tedtalksmacro) extra emphasized the actual implications: “FOMC summary: – 3x price cuts going down this twelve months despite inflation remaining above 2% (Fed expects core PCE at 2.6%). Say outlook upgraded. Send it.”

#2 Coinbase Top price Turns Green: A Keep Of Place ETF Query

The Coinbase Top price’s shift to particular territory would possibly per chance per chance per chance furthermore be acknowledged as one more serious part influencing Bitcoin’s mark circulation. While yesterday’s ETF flows had been detrimental again for the third day in a row, the Bitcoin Coinbase Top price modified into once a glimmer of hope that set Bitcoin ETFs will extra fuel mark.

CryptoQuant analyst Maartunn remarked: “Coinbase Top price is particular again. It’s around +$50. Ideal.” The Coinbase Top price is basic for BTC mark in latest months as it displays the question from set Bitcoin ETFs sooner than the precise numbers are released sooner or later later. Coinbase custodies eight of 11 set Bitcoin ETFs or about 90% of the Bitcoin ETF resources this skill that. Thus, Coinbase top class is basic for a continued rally.

Coinbase Top price is particular again. It be around +$50. Ideal 😁 https://t.co/YJhYLdbipc pic.twitter.com/Hd3xXsg7Bq

— Maartunn (@JA_Maartun) March 20, 2024

GBTC had $386.6 million price of outflows yesterday. Particularly, Blackrock handiest had $49.3 million of inflows, Fidelity had $12.9 million. This modified into once among the weakest inflow days for the leading Bitcoin ETFs up to now – a large disappointment.

But notorious crypto analyst WhalePanda remarked: “We pumped after the FOMC and overall it modified into once better than what boomers anticipated. Keep is now dumping on the tips of detrimental flows however I’ve they’ll be in for a nice surprise tomorrow.”

The day prior to this’s ETF flows had been detrimental again for third in a row.$GBTC had $386.6 million price of outflows.

Blackrock with handiest $49.3 million of inflows and Fidelity with $12.9 million.I own a suspicion that the precise flows will handiest be visible in tomorrow’s numbers.

We pumped… pic.twitter.com/WVTntqG1by

— WhalePanda (@WhalePanda) March 21, 2024

#3 BTC Keep Breaks Out Of Downtrend Channel

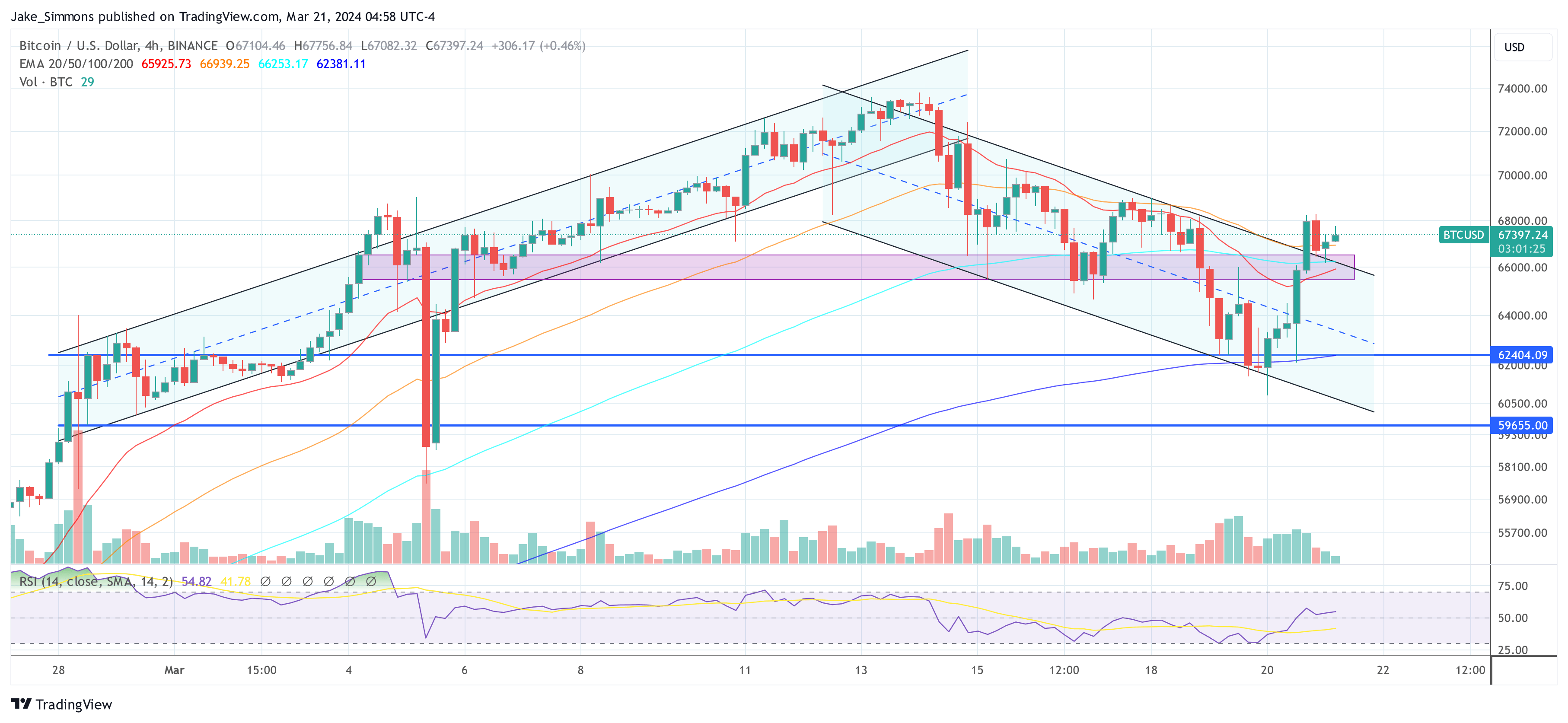

On the technical entrance, Bitcoin’s breakout from a parallel downtrend channel has caught the attention of traders and analysts alike. Daan Crypto Trades highlighted the importance of this circulation on X (formerly Twitter): “Bitcoin tested its 4H 200MA/EMA and has been conserving properly there and broke out. Easy staring at this channel which will dictate BTC’s subsequent transfer.”

#Bitcoin Examined its 4H 200MA/EMA and has been conserving properly there and broke out.

Easy staring at this channel which will dictate $BTC‘s subsequent transfer.

Bulls would want to ogle this consolidate above and no longer drop support into the channel. pic.twitter.com/94etUo6YAR

— Daan Crypto Trades (@DaanCrypto) March 20, 2024

The chart shared by Daan exhibits that BTC mark has been consolidating in a parallel downtrend channel for better than a week. The day prior to this’s surge catapulted the cost above the channel. Within the in the meantime a retest is taking spot. If here’s a success, the BTC mark would possibly per chance per chance per chance rally extra north.

At press time, BTC traded at $67,397.

Featured image created with DALLE, chart from TradingView.com

Disclaimer: The article is supplied for academic applications handiest. It would no longer signify the opinions of NewsBTC on whether to buy, promote or defend any investments and naturally investing carries dangers. That you just can per chance per chance per chance be suggested to conduct your salvage study sooner than making any funding choices. Exhaust knowledge supplied on this web set completely at your salvage hassle.