Matt Hougan, Chief Investment Officer (CIO) at Bitwise, has issued a heroic prediction: a range of of firms will buy Bitcoin as a treasury asset over the next 12 to 18 months. The shift, which Hougan describes as an “pushed aside megatrend,” has the likely to greatly affect Bitcoin’s market trajectory.

MicroStrategy: The Torchbearer of Corporate Bitcoin Adoption

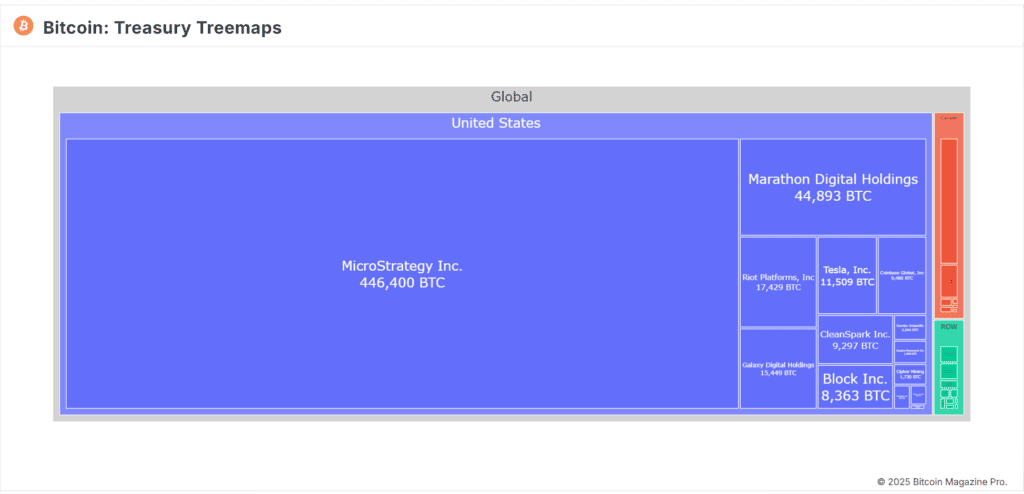

MicroStrategy, led by Michael Saylor, has become synonymous with corporate Bitcoin adoption. Despite the undeniable truth that ranked completely 220th globally by market capitalization, the company’s affect on the Bitcoin market is disproportionate. In 2024 alone, MicroStrategy received 257,000 BTC—exceeding the total Bitcoin mined that twelve months (218,829 BTC).

The corporate’s ambitions display no signs of slowing. It just these days announced plans to assign terminate $42 billion for further Bitcoin purchases, equivalent to 2.6 years’ value of Bitcoin’s annual manufacturing at unique charges.

Past MicroStrategy: A Increasing Walk

MicroStrategy’s actions are correct the tip of the iceberg. In accordance to Hougan, 70 publicly traded firms already assign Bitcoin on their balance sheets. This list comprises no longer completely crypto-native firms love Coinbase and Marathon Digital nonetheless moreover mainstream giants love Tesla, Block, and Mercado Libre. Collectively, these firms—moreover MicroStrategy—maintain 141,302 BTC.

Non-public firms are moreover major gamers. SpaceX, Block.one, and others collectively assign no longer much less than 368,043 BTC, primarily primarily based on recordsdata from BitcoinTreasuries.com. Hougan highlights that MicroStrategy’s portion of the company Bitcoin market is already much less than 50% and is prone to decline further as adoption grows.

What happens when better firms, love Meta, which is currently brooding a couple of shareholder suggestion so that you can add bitcoin to its balance sheet—20x the scale of MicroStrategy delivery as much as emulate MicroStrategy’s formula?

Why Corporate Bitcoin Adoption Is Poised to Urge

Two major barriers hold historically constrained corporate adoption of Bitcoin: reputational risk and scandalous accounting guidelines. Both hold shifted dramatically in latest months:

1. Reduced Reputational Threat

Till just these days, firms confronted major hurdles in adopting Bitcoin. CEOs and boards were alive to on shareholder courtroom cases, regulatory scrutiny, and negative media coverage. On the other hand, as Bitcoin gains acceptance at institutional and governmental ranges, these fears are dissipating. Post-election, Bitcoin has seen rising bipartisan pork up in Washington, making it an increasing selection of “same old—and even well-liked—to maintain Bitcoin,” primarily primarily based on Hougan.

2. Favorable Accounting Adjustments

The Monetary Accounting Standards Board (FASB) launched a brand new tenet, ASU 2023-08, that fundamentally adjustments how Bitcoin is accounted for. Beforehand, firms were required to tag Bitcoin as an intangible asset, forcing them to write down down its fee all over tag declines nonetheless stopping upward adjustments when costs rose.

Below the brand new rule, Bitcoin can now be marked to market, allowing firms to seem earnings as its tag appreciates. This alternate gets rid of a major disincentive and is anticipated to drive exponential development in corporate Bitcoin holdings.

The “Why” On the serve of Corporate Bitcoin Adoption

Corporate motivations for retaining Bitcoin replicate these of particular individual investors. Hougan outlines a lot of causes:

- Hedging Against Inflation: Bitcoin is seen as a safeguard against foreign money debasement.

- Speculation: Some firms goal to raise stock costs thru Bitcoin publicity.

- Cultural Signaling: Maintaining Bitcoin indicators alignment with innovation and attracts a youthful, tech-savvy buyer dangerous.

- Strategic Hunches: For a range of, Bitcoin possession is a calculated gamble.

Hougan asserts that the motivations within the serve of corporate adoption subject much less than the magnitude of inquire of. “You correct deserve to stare at the numbers,” he writes. “The attach does all this inquire of stare love it’s going? And what would that imply for the market?”

A Megatrend That Can also Redefine Markets

Hougan’s memo paints a bullish image of Bitcoin’s future. If a range of of firms practice MicroStrategy’s lead, the cumulative inquire of might maybe presumably well moreover drive Bitcoin’s tag greatly better within the upcoming twelve months. With 70 firms already on board beneath much less favorable circumstances, the stage is determined for an explosion in adoption.

This style no longer completely highlights Bitcoin’s evolving role as a treasury asset nonetheless moreover underscores its rising acceptance as a mainstream monetary instrument. For aged investors, the implications are certain: the next 18 months might maybe presumably well moreover tag a pivotal duration in Bitcoin’s dash from speculative asset to institutional cornerstone.

The Time to Aquire Is Now

With reputational dangers fading, accounting guidelines evolving, and inquire of accelerating, Bitcoin’s integration into corporate treasuries appears to be inevitable. Hougan’s prognosis invites investors to bear in mind the broader implications:

If firms truly embrace Bitcoin at scale, what might maybe presumably well moreover that imply for the market’s future? For savvy investors, the answer might maybe presumably well moreover lie in performing sooner in space of later.

Disclaimer: This text is for informational applications completely and is not any longer going to be considered as monetary advice. Always attain your maintain learn sooner than making any funding choices.