Explaining the elements at the relieve of bitcoin’s rate plunge this twelve months and exploring essentially the most as much as the moment in central bank news.

Survey This Episode On YouTube

Hear To This Episode:

On this episode of Bitcoin Journal’s “Fed Survey” podcast, hosts Christian Keroles and I, Ansel Lindner, reviewed my most as much as the moment article “What Caused the Mid-Cycle Bitcoin Tag Correction” after which did a tour of most as much as the moment central bank news from around the area. We also hit on the formulation ahead for China, North America and the Fourth Turning.

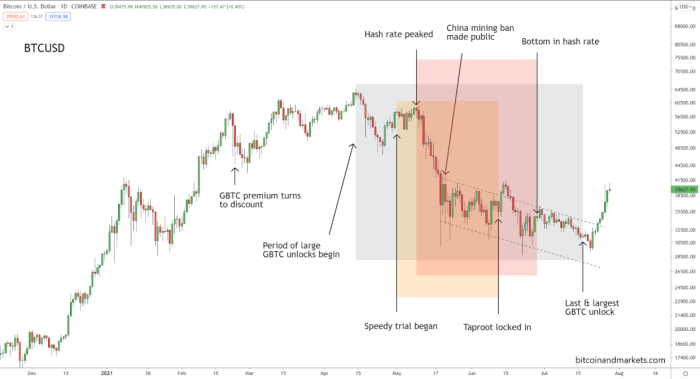

My most as much as the moment article became once about an main narratives from the second quarter of the twelve months, that after plotted on a chart, all overlap correct because the bitcoin rate fell within the second week of Would possibly possibly well 2021.

Grayscale’s Bitcoin Belief (GBTC) unlocks were so correlated to fee that it’s hideous that they performed a chief just in rate all over this period. Within the article you are going to be ready to gather an introduction to the GBTC product, nonetheless for these rate notes this can suffice to repeat that the substantial sequence of unlocks while at a good deal started the precise day of essentially the most as much as the moment high, and persisted unless July 17, exquisite earlier than the bottom.

The next account became once the Bitcoin mining ban in China. We breezed via this one, nonetheless identified an spell binding connection between the Bitcoin ban and assorted communist authoritarian crackdowns happening correct now in China.

The leisure major account all around the substantial rate plunge became once the Taproot upgrade. This flew below the radar for the casual observer of the plot, nonetheless it became once of excessive pastime to the hardcore bitcoiners who lived via the remaining very contentious SegWit upgrade in 2017.

Our dialog then became to central bank news. The major news titillating the Federal Reserve is the explosion in reverse repo (RRP) and the current standing repo facility about to launch. We covered this in some depth, and I attempted to connect some dots. Backside line: As RRP rises over $1 trillion, the Fed refuses to chat taper and it’s environment up an offsetting repo facility. We are succesful of claim the fragility of the system is increasing. Per chance, the Fed is looking out at for fireworks later within the twelve months?

The topic establishing in China is extremely referring to. First, it banned bitcoin mining, then it banned U.S. IPOs. It has been cracking down on technology firms, effectively nationalizing them, and essentially the most as much as the moment news is the crackdown on video games as “non secular opium.” Within the occasion you plot this within the context of the recession, the aggressive facing Hong Kong and the Uyghurs, and deglobalization, it would possibly well be the origin of the high for the CCP. It’s well-known to be aware the plod with which the Soviet Union collapsed. One twelve months, educational experts were tranquil claiming the Soviets were about to take over the area, the next they fell apart. The identical also can happen to the CCP.

We on the entire plunge accurate into a geopolitical discussion, and this episode isn’t any assorted in that regard. We wrapped up the pricetag by speaking about what the lengthy flee holds for the U.S., China and the realm financial system.

As soon as once more, this became once a extremely titillating rate. You gather a dose of central bank news in an ideal world context, which this present day ought to embrace a heavy field for bitcoin.