With El Salvador turning into the fundamental nation to present proper gentle space to bitcoin, it begs the demand: must aloof African nations note suit?

After June 8, we can insist that the sector entered the “nation instruct game thought” portion of Bitcoin adoption. Latin American neighbors to El Salvador, reminiscent of Panama, rep started mulling over the possibilities of passing the same legislation, as they don’t need their nations to be left late. Latin American nations must now not the absolute top nations feeling stress to transfer forward with bitcoin-pleasant legislation. Kal Kassa wrote a elegant portion about Ethiopia and bitcoin. As well to, American soccer player of Nigerian descent, Russell Okung, wrote a compelling inaugurate letter to the president of Nigeria imploring him to embrace a bitcoin customary.

Now, I by no arrangement rep the identical level of clout as Mr. Okung, but I am of Ghanaian descent, as my family immigrated to the U.S. in hopes of a bigger lifestyles, and I’d select to originate the case for an African nation to embrace bitcoin by the extinguish of the three hundred and sixty five days.

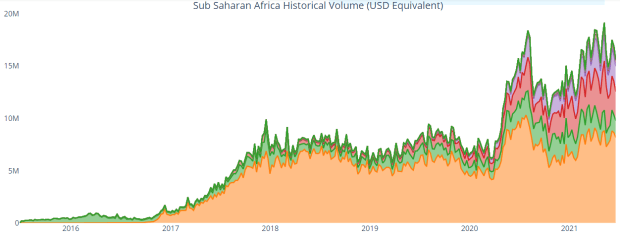

In accordance to records from usefultulips.org, sub-Saharan Africa leads the sector in take a look at-to-take a look at bitcoin transactions in 2021.

Sub-Saharan Africa additionally has a history that one could per chance per chance mediate would lead to favorable stipulations for a non-world-vitality-aligned monetary possibility.

Attributable to the lasting legacy of imperialism and colonialism in Africa, the French-backed and controlled CFA Franc, created in 1945, is a colonial relic in 15 African nations. One CFA Franc used to be equal to 1.70 Francs in 1945. Over half a century later the CFA Franc used to be equal to 0.01 Francs in 2002 as France ditched the Franc for the Euro. How did this happen? Devaluation of the CFA Franc by the French executive. The CFA Franc lost 17,000% of its price in the span of 52 years.

Bitcoin, created in 2009, solves this bellow of preserve watch over and manipulation of cash from the skin.

There are roughly 40 varied currencies all via the continent of Africa by myself. Here’s a headache pondering the geography of the continent. Boarding a flight from Accra to Lagos is referring to the identical distance as from New York to Philadelphia, yet the barriers and hurdles you’ll face earlier than, all the arrangement via and after touring, reminiscent of with visas and foreign alternate, are frustrating. This has introduced challenges in sinful-border funds, industry and economic development, currency instability, devaluation and inflation for lots of many years.

Bitcoin arrangement varied things to varied other folks. I insist this to point out that as soon as looking out for to point out the “store of price” ingredient of bitcoin to American citizens and Europeans, it on the total falls on deaf ears due the usual of lifestyles that most had been accustomed to. You have not grown up in an emerging market. You have not lived under authoritarian regimes who can restrict how and what you quit with your money. You have not experienced inflation wiping out your savings, killing your currency. Treasure the aged announcing goes, “I create now not realize how right here’s helpful to me resulting from this truth, it be pointless.”

The listing of countries racing to adopt bitcoin as proper gentle is increasing and it’s absolute top a subject of time earlier than one more nation turns into the 2nd to quit so after El Salvador. I am hoping this can be an African nation even supposing it’s more likely that a Latin American nation does, given their proximity to El Salvador.

It is in the suitable hobby now not simply for Bitcoin entrepreneurs, industry kinds and governments, but for the conventional other folks of the continent. Bitcoin’s outlandish properties originate it a digital store of price, a savings abilities, a quasi monetary institution fable for the unbanked, a monetary institution fable in cyberspace and an different to Western Union for remittance funds to family and chums all the arrangement via the sector (Sub-Saharan Africa stays the most costly space to ship money to, the save sending $200 bills an average of 8.2% p.c as of the fourth quarter of 2020).

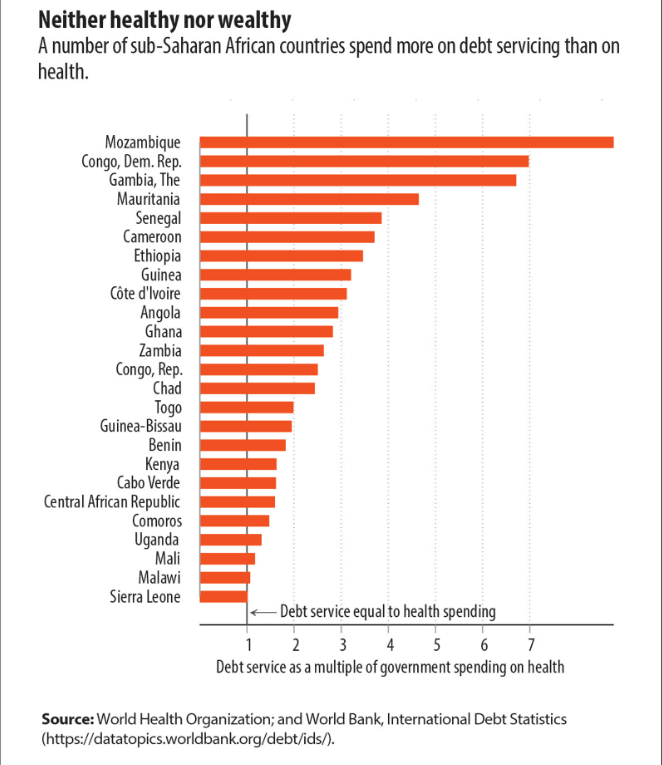

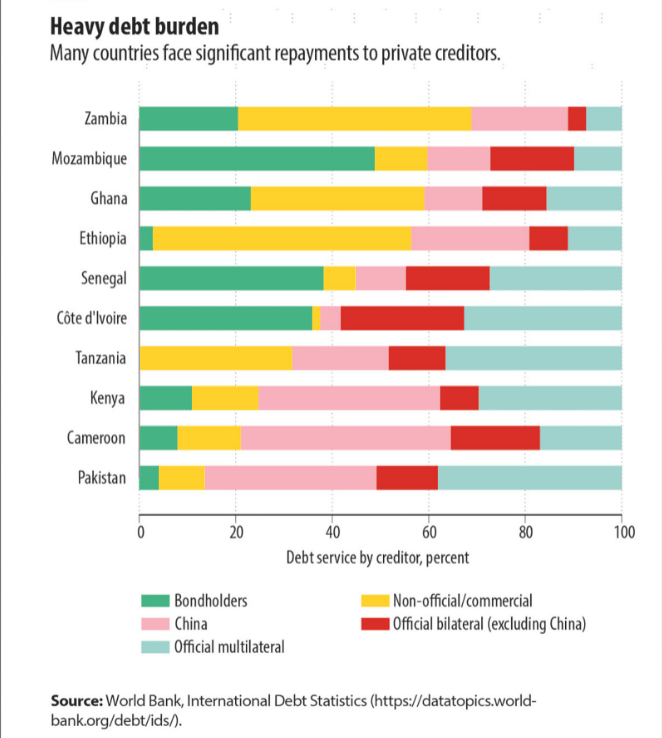

The rise of China has meant an enlarge of their economic affect and ambition on the continent. Glimpse at what establishments such because the IMF and China rep performed and are doing to African nations. They load African nations with debt and be obvious that they’ll’t exhaust money on things love health, training and total development.

With bitcoin, Africa can be in a position to wield preserve watch over of its occupy development with permissionless, decentralized money and with out the foreign intervention and manipulation of cash. Bitcoin is 1,000 events higher than the IMF, World Bank, China and the Bank of Global Settlements attributable to it’s some distance a digital bearer asset.

The implications of the sort of transfer can be massive. With China for the time being clamping down on bitcoin miners, imagine these miners migrating west to the motherland, developing mining hubs in rural and some distance-off places in Ghana, Nigeria, Kenya, Botswana. That could per chance per chance transform total economies and alternate a total lot of millions of lives! Bitcoin could per chance per chance wreck decade — even centuries — lengthy woes of underdevelopment.