Here is an conception editorial by Kudzai Kutukwa, a passionate financial inclusion recommend who used to be known by Snappy Firm magazine as one of South Africa’s high-20 younger entrepreneurs below 30.

The United Fruit Firm (AKA El Pulpo meaning “the octopus”) used to be an American firm that had an overarching presence in Latin American international locations. They grew and traded every form of fruits, however they had been a huge monopoly in the banana procuring and selling commercial. El Pulpo’s dominance extended past Central The United States, stretching as a ways as the West Indies which saw the firm preserve a watch on 603,111 acres of land by 1954. Guatemala, Panama, Costa Rica and Honduras had been carefully dependent on the export of bananas, which accounted for a necessary fragment of their total exports — ensuing from this truth these international locations earned the nickname, banana republics. Which implies that the firm had big preserve a watch on over the economies of those nations and had been infamous for bribing local politicians to acquire their system, as well to ousting leaders that would not play ball.

Jacobo Arbenz, a democratically elected president of Guatemala, used to be made an instance of by El Pulpo when the firm had him ousted by the U.S. authorities in 1954 for expropriating one of the necessary most firm’s land and redistributing it. The seeds for instability had been sown in the Central American nation which eventually culminated in a 36 year long civil conflict between 1960 and 1996. El Pulpo left in the abet of a legacy of destruction and death, not loyal in Guatemala however all the strategy in which by Central The United States.

The United Fruit Firm grew to change into the embodiment of neocolonialism in the feature largely ensuing from the impact of the U.S. authorities and the vitality of the almighty buck. Whereas El Salvador wasn’t a command victim of El Pulpo, loyal handle its Central American neighbors it used to be not proof in opposition to U.S. intervention in the feature, largely evident all the strategy in which by the 12 year Salvadoran Civil War that left 75,000 other americans dull, the broad majority of that had been civilians. This day El Salvador faces a queer model of El Pulpo in the contain of the international fiat financial plan represented by the IMF.

On September 7 2021 El Salvador made history by becoming the necessary nation on this planet to formally adopt Bitcoin as loyal gentle. Nearly without lengthen the IMF and the World Financial institution had been rapid to remark stern warnings to El Salavador’s authorities about this policy decision, urging them to reverse it. In spite of the entirety they’re “guardians of the international financial plan,” handle Agent Smith in the movie The Matrix. What started out as an experiment in El Zonte (popularly frequently referred to as Bitcoin seaside) in 2019, thanks to an anonymous donor and the tireless efforts of surfer Michael Peterson, has now morphed into a modern movement that impressed Bitcoin Metropolis, Bitcoin-backed bonds (aka Volcano Bonds) and financial inclusion for 70% of the inhabitants that had been beforehand unbanked. 12 years after Bitcoin came into existence, it’s a ways now being gentle as loyal gentle in a nation. El Salvador could also had been the necessary to adopt Bitcoin, however it no doubt won’t be the closing.

Acceptable handle how the United Fruit Firm had Latin The United States in its grip, the IMF wields a worthy quantity of vitality over the international financial system. Established in 1944 on the Bretton Woods convention, the IMF’s preliminary feature used to be to stable international monetary cooperation, to fabricate obvious stability of currency change charges and to elongate international liquidity. After President Nixon closed the gold window in 1971, it misplaced its authority to preserve a watch on change charges and the IMF pivoted to being a lender of closing resort to distressed nations — a mission that has done lackluster results to this point. As an illustration, a Heritage Basis belief reveals that IMF loans to surroundings up international locations had been largely ineffective and one of the necessary most international locations that acquired these loans had been worse off economically afterwards:

- Of the 89 much less developed international locations that acquired IMF loans between 1965 and 1995, 48 need to not any higher off economically nowadays than they had been earlier than receiving IMF loans.

- Of these 48 international locations, 32 are poorer than they had been earlier than receiving IMF loans.

- Of these 32 international locations, 14 grasp economies which could effectively be on the least 15 percent smaller than after they acquired their first IMF loans.

With these ends up in thoughts let’s flip our consideration abet to El Salvador to rob a belief at and determine why the IMF is vehemently in opposition to Bitcoin’s loyal gentle dwelling. In spite of the entirety, El Salvador is a diminutive nation with a inhabitants of loyal ~6.5 million other americans and a GDP of $25 billion — why then does the IMF peruse Bitcoin adoption by El Salvador as “posing risks to financial stability, financial integrity and particular person safety?” The straightforward reply is that the IMF is one of the necessary enforcers of the buck hegemony on this planet and the winning adoption of Bitcoin by any nation converse poses a necessary threat to the “solutions-based mostly mostly stutter.” The U.S. has de facto veto vitality over all necessary decisions made by the organization and has the largest vote casting vitality of any nation on earth.

As a change monetary plan Bitcoin used to be designed to weak the feature of trusted third occasions handle central banks and by extension organizations handle the IMF. Given the truth that El Salvador is a dollarized financial system, the circulation of a U.S, buck various handle Bitcoin, could also eventually decrease the feature of the buck in transacting, not loyal in El Salvador however all the strategy in which by Central The United States and the comfort of the international south. This could slowly herald a multi-polar world and could presumably consequence in bitcoin changing the buck as the international reserve currency. In any such international, there could be if fact be told no need for organizations handle the IMF.

The bitcoin-backed bonds grasp also ruffled the feathers of the IMF with some directors “expressing enviornment over the risks associated with issuing bitcoin-backed bonds.” The brainchild of Samson Mow, the $1 billion of Volcano Bonds will be gentle to purchase $500 million value of Bitcoin and $500 million will hump against infrastructure, including infrastructure to harness volcanic energy to mine bitcoin. The international bond market is value $100 trillion and a winning bond remark just is not going to handiest be transformative for the market however will help as a proof of belief for a quantity of international locations searching for an exit out of the IMF’s plan of fiat-based mostly mostly ponzi plot debts. Here’s a viewpoint that eminent investor Simon Dixon echoed in a present interview the set he said,

“If [El Salvador] succeeds, that is a big danger for the commercial mannequin of the IMF. They’re not a bailout firm, they’re not a mechanism for surroundings up the field…They’re a mechanism for dollarizing the field and implementing a international central bank digital currency on high of their particular drawing rights, so they can retain preserve a watch on of their mechanisms.”

As the brand new day El Pulpo, the IMF is hell bent on asserting their dominant plot in the international financial system and despite your entire certain tendencies that could accrue to El Salvador thanks to the Bitcoin Law, they will continue to vehemently oppose it. They are going to converse every tool at their disposal to not handiest be obvious the reversal of Bitcoin’s loyal gentle dwelling in El Salvador however to cease a quantity of fiat-enslaved international locations from following a the same path to debt freedom. A present instance of this frequently is the $45 billion bailout bundle they popular for Argentina in March which incorporated a provision that forces the Argentinian authorities to crack down on cryptocurrencies and discourage their converse as a condition for the bailout. The clause detailed Argentina’s efforts “to discourage the utilization of cryptocurrencies with a witness to fighting money laundering, informality, and disintermediation” in assert to “to further safeguard financial stability.” Argentina’s central bank subsequently banned financial establishments in the nation from offering any Bitcoin or cryptocurrency connected products and providers to their customers. Here is loyal the beginning and it wouldn’t be ghastly to belief this clause being incorporated in every bailout bundle going forward.

With the Bitcoin tag at ~$20,000 as of time of writing, roughly 56% decrease than it used to be all the strategy in which by El Salvador’s adoption closing year, mainstream media pundits are rapid to indicate El Salvador’s paper losses, which could be estimated to be anyplace between $40 million and $60 million on the Bitcoin that the authorities equipped, as evidence of the shadowy failure of the “Bitcoin policy.” This analysis is misleading in that it equates a drop in portfolio payment to exact realized losses, which aren’t appropriate in this case as El Salvador hasn’t equipped a single bitcoin. Secondly it’s also myopic due to by exchanging bucks with a limiteless provide, for bitcoin, a scarce digital bearer-asset, President Bukele’s transfer insured El Salvador in opposition to buck debasement. Interestingly ample earlier than the Bitcoin Law, El Salvador used to be rarely ever mentioned in the Western mainstream media as an alternative of relating to gang violence. Nonetheless, ever since the Bitcoin Law came into cease, President Nayib Bukele has been accused of playing the nation’s resources on bitcoin, with the policy being deemed a failure.

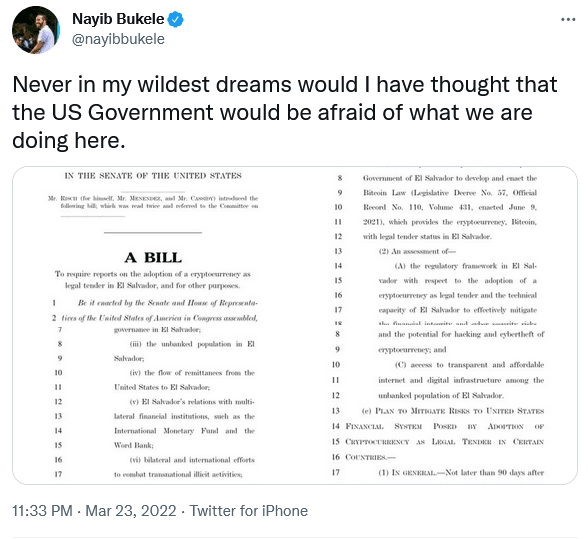

Moreover, El Salvador’s sovereign debt score has been downgraded by Fitch, Changeable’s and S&P to junk dwelling, with all three score companies citing the sovereign’s adoption of Bitcoin as a threat to securing IMF financial give a boost to as one of the necessary explanations for the downgrade. In step with S&P “The risks associated with the adoption of bitcoin as loyal gentle in El Salvador appear to outweigh its in all probability advantages. There are instantaneous negative implications for the credit score.” On February 16, U.S. Senators, James Risch (R-Idaho), Bob Menendez (D-N.J.) and Invoice Cassidy (R-La.) introduced the “Accountability for Cryptocurrency in El Salvador (ACES) Act,” which is guidelines that compels the Articulate Division to write down a myth on El Salvador’s adoption of Bitcoin as loyal gentle and a belief of action to mitigate risks arising from this. To set “risks” in viewpoint, El Salvador’s GDP ($25 billion) is 840 occasions smaller than the U.S.’s GDP ($21 trillion). Commenting on the invoice in a press unlock Dr. Cassidy said, “El Salvador recognizing Bitcoin as reliable currency opens the door for money laundering cartels and undermines U.S. interests … If the US desires to fight money laundering and retain the feature of the buck as a reserve currency of the field, we should always handle this remark head on.” It’s straightforward that that is a tactic straight out of El Pulpo’s playbook whose map is to stymie El Salvador’s Bitcoin adoption.

Despite your entire challenges and attacks there could be a silver lining in the clouds. From the time the Bitcoin Law came into cease a year ago El Salvador has seen a 30% lengthen in tourism based mostly mostly on Salvadoran Tourism Minister, Morena Valdez. This year by myself El Salvador has welcomed 2.2 million vacationers and in a present tweet President Bukele noted that tourism in the nation had recovered to pre-pandemic ranges, citing “Bitcoin and surf” coupled with the ongoing crackdown on gangs, as the major reasons for the recovery. Moreover to this, the seaside city of El Zonte is made up our minds to receive over $200 million value of infrastructure upgrades. Given the uptick of tourism ensuing from El Zonte’s iconic dwelling from Bitcoin Seaside, the money is being gentle to finance the come of new facilities to cater to the vacationers flocking to the city. With tourism in the meanwhile contributing 9.3% to El Salvador’s total GDP these are all very necessary certain tendencies.

El Salvador’s GDP grew by 10.3% in 2021 and it’s value noting that earlier than 2021 El Salvador had never had double digit GDP boost. Exports for 2021 also grew by a further 13%. Annual remittances to El Salvador fable for 24% of its GDP (roughly $6 billion) with 70% of Salvadorans reliant on them for survival. On fable of of Bitcoin they’d set at least $400 million in money transfer charges yearly which equates to 1.5% of El Salvador’s GDP. Moreover since there are now extra Salvadorans with Bitcoin wallets than those with bank accounts these payment financial savings are without lengthen being realized by the broad majority of the populace. The media very simply ignores pointing out these and loads of a quantity of instantaneous advantages that grasp materialized put up Bitcoin adoption.

In 1958 Guinea attempted to claim its monetary sovereignty from the French by leaving the CFA franc zone. Over a 2 month duration the French pulled out of Guinea taking the entirety with them from gentle bulbs to sewage pipe plans, and they even went as a ways as burning necessary medicines. The next step used to be to destabilize Guinea and undermine any efforts of business prosperity by a covert operation that grew to change into frequently referred to as “Operation Persil,” the set they counterfeited Guinean bank notes and flooded them into the nation. The map of the operation used to be to engineer financial give method by technique of hyperinflation. The French produced banknotes that proved to be extra proof in opposition to the humidity of the Guinean local weather higher than the reliable bank notes, thus financial instability in the nation used to be successfully precipitated and the Guinean financial system collapsed. For the El Pulpos of the field handle the IMF, destroying Bitcoin is an absolute necessity due to failure to carry out so would consequence in their extinction. It would be naive to preserve that these organizations will let El Salvador stroll out of their fiat ponzi-plot plan without placing up a fight.

As the cracks in the fiat monetary plan dispute in confidence to seem, Bitcoin is a defense plan in opposition to financial censorship, buck debasement and seizure handle in the case of the confiscation of Russia’s foreign reserve; it peaceable achieves international consensus in an adversarial surroundings. Bitcoin is a tool for resisting all kinds of monetary repression and El Salvador’s adoption of it’s a declaration of monetary independence from the buck imperialism that grips the field. As geopolitical tensions upward push and the slack de-dollarization of the field occurs, the alternatives for nation states will be a buck same outdated vs a BRICS same outdated or a Bitcoin same outdated. Having chosen the latter, El Salvador is the new Camelot.

Here’s a customer put up by Kudzai Kutukwa. Opinions expressed are exclusively their accept as true with and carry out not necessarily mirror those of BTC Inc. or Bitcoin Journal.