The Bitcoin market has long been outlined by its seemingly immutable four-year cycle, a sample of three years of surging costs followed by a piquant correction. Nevertheless, a seismic shift in policy from Washington, led by pale President Donald Trump, would per chance presumably additionally shatter this cycle and bring in a recent technology of prolonged affirm for the cryptocurrency industry.

Matt Hougan, Chief Funding Officer at Bitwise Asset Management, recently posed an though-provoking set apart a question to: Can Trump’s Govt Utter damage crypto’s four-year cycle? His answer, though nuanced, leans in opposition to an emphatic yes.

The Four-Year Cycle: A Recap

Hougan clarifies his deepest perception that the four-year Bitcoin market cycle is now not driven by Bitcoin’s halving events. He states, “Other folks strive to link it to bitcoin’s quadrennial ‘halving,’ however those halvings are misaligned with the cycle, having occurred in 2016, 2020, and 2024.”

Bitcoin’s four-year cycle has been historically driven by a mixture of investor sentiment, technological breakthroughs, and market dynamics. On the complete, a bull speed emerges following a main catalyst—be it infrastructure enhancements or institutional adoption—which attracts recent capital and fuels hypothesis. Over time, leverage accumulates, excesses emerge, and a main tournament—equivalent to regulatory crackdowns or financial fraud—triggers a brutal correction.

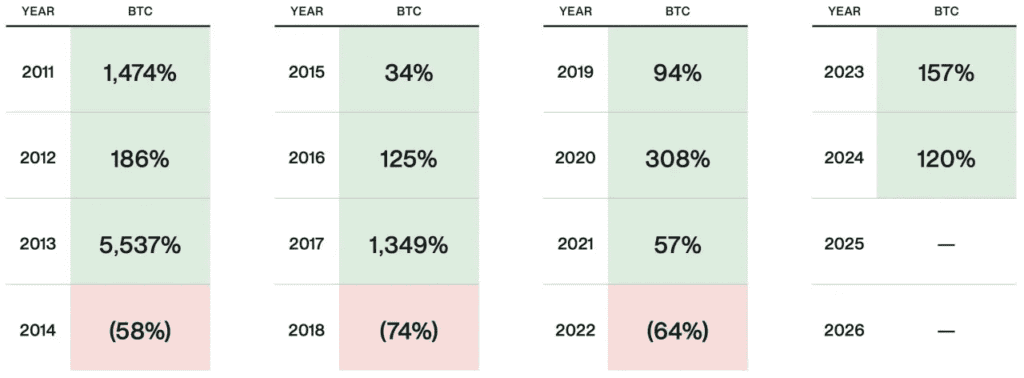

This sample has played out many cases: from the early days of Mt. Gox’s implosion in 2014 to the ICO enhance and bust of 2017-2018, and most recently, the deleveraging crisis of 2022 with the crumple of FTX and Three Arrows Capital. But, every cool weather has been followed by an even stronger resurgence, culminating in Bitcoin’s newest bull speed spurred by the mainstream adoption of Bitcoin ETFs in 2024.

The Govt Utter: A Sport Changer

The fundamental set apart a question to Hougan explores is whether or now not Trump’s newest Govt Utter, which prioritizes the event of the digital asset ecosystem within the U.S., will disrupt the established cycle. The repeat, which outlines a clear regulatory framework and even envisions a national digital asset stockpile, represents essentially the most bullish stance on Bitcoin from any sitting or pale U.S. president.

The implications are profound:

- Regulatory Readability: By taking away merely uncertainty, the EO paves the model for institutional capital to head with the circulation into Bitcoin at an unparalleled scale.

- Wall Aspect dual carriageway Integration: With the SEC and financial regulators now pro-crypto, major banks can enter the position, offering Bitcoin custody, lending, and structured merchandise to their purchasers.

- Govt Adoption: The thought that of a national digital asset stockpile hints at a future the keep the U.S. Treasury would per chance presumably relieve Bitcoin as a reserve asset, solidifying its position as digital gold.

These tendencies is now not going to play out overnight, however their cumulative create would per chance presumably fundamentally alter Bitcoin’s market dynamics. Unlike outdated cycles that had been driven by speculative retail euphoria, this shift is underpinned by institutional adoption and regulatory endorsement—a miles extra stable foundation.

The Raze of Crypto Winters?

If historic previous had been to repeat itself, Bitcoin would proceed its ascent thru 2025 forward of going thru a main pullback in 2026. Nevertheless, Hougan suggests this time would be assorted. While he acknowledges the threat of speculative excess and leverage-driven bubbles, he argues that the sheer scale of institutional adoption will prevent the form of prolonged endure markets seen within the previous.

Right here is a main distinction. In outdated cycles, Bitcoin lacked a solid sinister of charge-oriented investors. At the present time, with ETFs making it more uncomplicated for pensions, hedge funds, and sovereign wealth funds to allocate to Bitcoin, the asset is now not any longer fully dependent on retail enthusiasm. The consequence? Corrections would per chance presumably additionally amassed amassed happen, however they is incessantly shallower and shorter-lived.

What Comes Next?

Bitcoin has already crossed the $100,000 mark, and projections from industry leaders, in conjunction with BlackRock CEO Larry Fink, imply it would per chance presumably attain $700,000 within the coming years. If Trump’s insurance policies trail up institutional adoption, the normal-or-backyard four-year sample would per chance presumably additionally get replaced by a extra veteran asset-class affirm trajectory—equivalent to how gold replied to the quit of the gold normal within the Seventies.

While dangers remain—in conjunction with unforeseen regulatory reversals and excessive leverage—the direction of commute is evident: Bitcoin is turning correct into a mainstream financial asset. If the four-year cycle became driven by Bitcoin’s infancy and speculative nature, its maturation would per chance presumably additionally render such cycles traditional.

Conclusion

For over a decade, investors like extinct the four-year cycle as a roadmap for Bitcoin’s market movements. However Trump’s Govt Utter would per chance presumably additionally be the defining moment that disrupts this sample, replacing it with a extra sustained and institutionally-driven affirm piece. As Wall Aspect dual carriageway, firms, and even governments increasingly extra embrace Bitcoin, the set apart a question to is now not any longer if crypto cool weather will near in 2026—however somewhat if this can near at all.

Disclaimer: This text is meant for informational purposes finest and does now not constitute financial advice. Readers are encouraged to conduct thorough just compare forward of making funding choices.