Dwelling » Bitcoin » Wisconsin doubles down on BlackRock’s Bitcoin ETF with $321 million investment

Feb. 14, 2025

Wisconsin pivots from Grayscale’s GBTC to embody IBIT amid surging question for digital property.

Key Takeaways

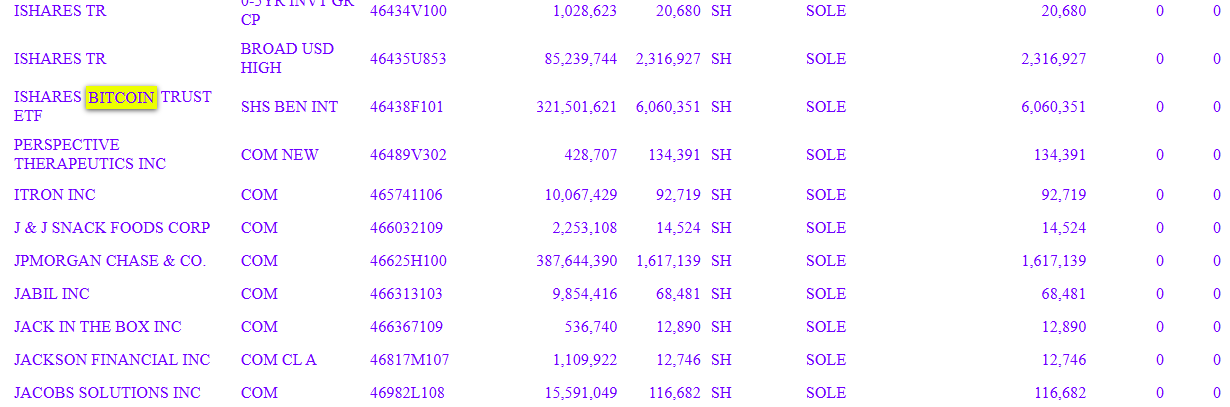

- The Wisconsin Investment Board doubled its holdings in BlackRock’s iShares Bitcoin Believe to 6,060,351 shares valued at $321.5 million.

- Wisconsin’s board has moreover rather loads of investments in crypto-linked companies love Coinbase and Marathon Digital.

Portion this text

The Verbalize of Wisconsin Investment Board (SWIB) has doubled its holdings in BlackRock’s iShares Bitcoin Believe (IBIT), including over 3 million shares to attain 6 million shares valued at over $321 million as of December 31, 2024, in line with a recent SEC filing.

The lengthen marks a extraordinary growth from around 2,8 million shares the articulate pension fund held on the tip of September 2024. The board divested its space of 1,013,000 shares in the Grayscale Bitcoin Believe (GBTC) for the length of the second quarter of 2024, ahead of expanding its IBIT investment.

IBIT has emerged because the fastest-increasing articulate Bitcoin fund, gathering approximately $41 billion in win inflows since its launch. The fund’s property under management reached $56 billion as of Feb. 14.

The Wisconsin board has rather loads of its crypto-linked investments past IBIT, with stakes in Coinbase, MARA Holdings, Robinhood, and Block Inc.

Earlier this week, Goldman Sachs disclosed its holdings of over $1.5 billion in US articulate Bitcoin alternate-traded funds (ETFs), including around $1.2 billion in IBIT and $288 million in Constancy’s Bitcoin fund (FBTC).

Portion this text