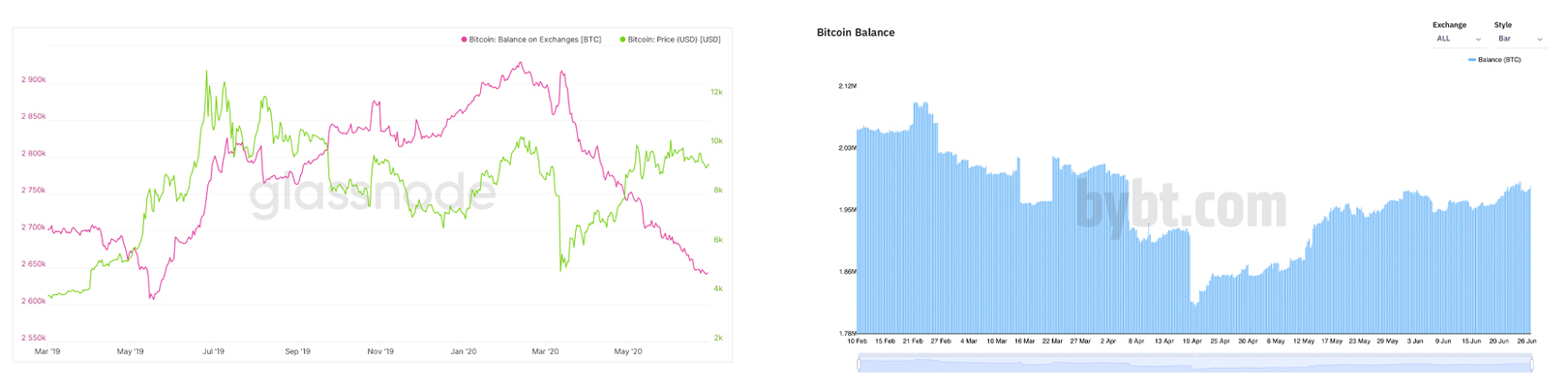

While the cost of bitcoin is larger than 40% decrease than it became 90 days prior to now on March 29, the preference of bitcoin held on exchanges has furthermore been lowered. Closing year on the identical day in June, 2.79 million bitcoin became retained on crypto trading platforms and a year later roughly 28.67% of the bitcoin held left crypto exchanges. The lowering quantity of bitcoin kept on centralized exchanges suggests the money are being held in lengthy-term storage rather than being involving for trading.

Files Suggests Bitcoins Are Being Removed From Exchanges and Into Noncustodial Wallets for Long Timeframe Storage

On March 29, 2021, the cost became 42.93% larger nonetheless there became furthermore 9.54% extra bitcoin (BTC) held on centralized exchanges. Moreover, the cost of BTC became $9,165 per unit, and this day as BTC hovers above $33K per unit the cost is 262% larger than remaining year.

Curiously, there became hundreds extra bitcoin on exchanges on June 26, 2020, with statistics showing 2.79 million bitcoin became held in substitute reserves. At this time, bitcoin held on exchanges is 28% decrease with recordsdata showing 1.99 million bitcoin on centralized trading platforms.

Closing year, Bitcoin.com News reported on substitute balances shedding a month in a while July 30, 2020. At that time restrict, there became 2.6 million bitcoin on world exchanges and that metric became a 12 month low which fueled bullish optimism.

When bitcoin balances are lowered on centralized exchanges, market participants obtain these money are being held in lengthy-term storage rather than waiting to be sold. Analysts presume that decrease selling rigidity stems from bitcoin customers storing funds in noncustodial inner most wallets.

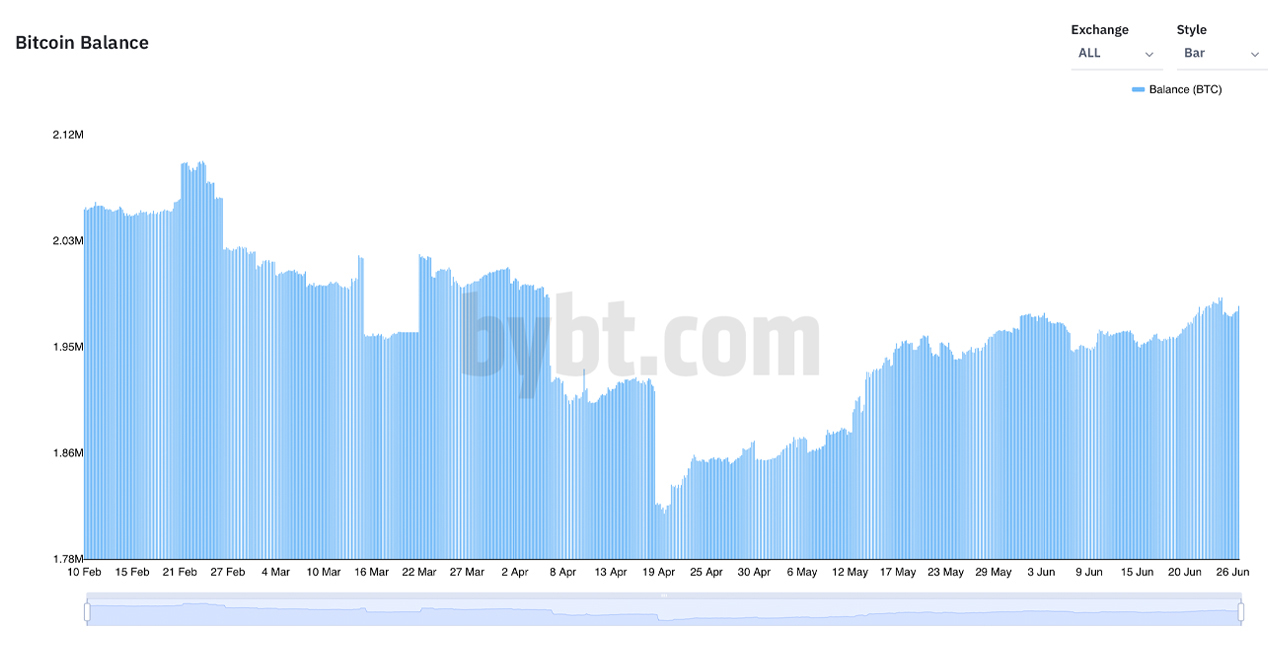

Bitcoin balances on exchanges from February 2021 to June 27, 2021.

Bitcoin balances on exchanges from February 2021 to June 27, 2021.On the other hand, since April 2021, there’s been an construct larger in bitcoin held on exchanges as April 20 became the lowest level of the year. On that day, recordsdata reveals that 1.82 million became held on exchanges and since then balances all over the board private spiked by 9.34% to 1.99 million BTC or $62 billion rate the exhaust of this day’s substitute charges.

In affirm the cost has dropped decrease in present times, there’s been a runt bump up in substitute deposits, which balances the 90-day drop from March 29 to now. In March 2020, when ‘Dim Thursday’ took residing there private been larger than 3 million BTC held on exchanges.

Coinbase Holds the Ideal Crypto Reserve Steadiness With $35 Billion

Statistics level to the tip substitute with basically the most bitcoin (BTC) on June 27, 2021, is Coinbase with 636,835 BTC or larger than $21 billion in bitcoin reserves. 3,550 BTC or over $117 million left Coinbase all over the remainder 30 days basically based on bybt.com/steadiness stats.

Coinbase is followed by Binance (341,722), Okex (323,552), Bitfinex(187,728), Huobi (156,277), Kraken (144,499), and Bitflyer (61,185). Despite the proven truth that Coinbase saw over 3K in BTC dart away the bogus, Huobi saw 23,335 BTC or $774 million exit the trading platform all over the remainder month.

Alongside with stablecoins and ethereum (ETH) into the combo and recordsdata from Bituniverse, Peckshield, Chain.recordsdata, and Etherscan reveals that Coinbase has larger than $35 billion in reserves between stables, ETH, and BTC.

With those three metrics mixed, the reserve positions by substitute recordsdata adjustments, with Binance ($14.9 billion), Huobi ($12.8 billion), Kraken ($8.64 billion), and Okex ($6.33 billion) following respectively. Closing year, those crypto balances held in USD price private been remarkable decrease than this day.

Shall we embrace, Coinbase’s reserve price became 61% decrease in July 2020 and held around $13.6 billion in price with its stablecoin, ETH, and BTC reserves. Binance’s price of the identical aggregate of reserves became 71.40% decrease in USD price. Without reference to the upward thrust in price, at that time remaining year, each and each exchanges had extra cryptocurrencies held in reserve.