This is an idea editorial by Alex, a bitcoin miner with Kaboomracks.

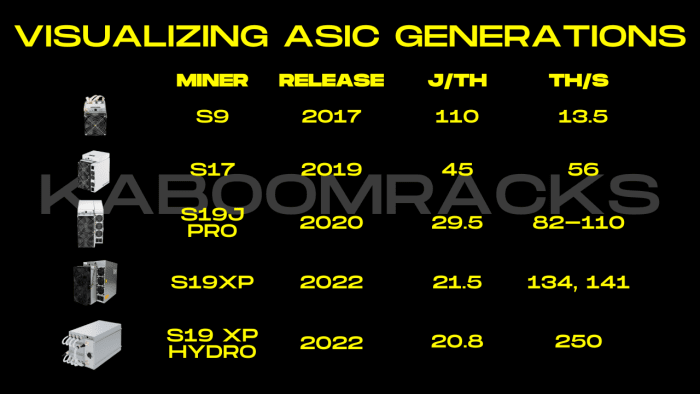

It’s a ways severe for folk taking a have a examine bitcoin mining for the principle time to attain the importance of Bitcoin’s scenario adjustment as successfully the influence this has on mining profitability. Many inexperienced persons to bitcoin mining will search the advice of the profitability of an ASIC on a mining calculator, awaiting that that profitability will pause quite the same going forwards in due direction. It’s a ways a misunderstanding because the profitability of any given machine, dispositions downwards over time. Increases in scenario has to be understood sooner than shopping an ASIC.

A straightforward come of thought here is evaluating an ASIC to a different electronic tool. The longer the tool is in use, the less connected it is as novel instrument requires more computing vitality. If you had been to use an iPhone from 6 years ago, its performance will more than likely be extremely frustrating. The older the phone will get, the less utility it has.

A in point of fact identical job occurs in mining. If you happen to would possibly maybe perchance be mining, you will more than likely be competing with the complete other miners at some level of the area. As more miners flip on machines, it will get more complex to compete. Having newer and more efficient hardware makes you more competitive, but that hardware is at as soon as transferring towards being less competitive.

Bitcoin Articulate Adjustment

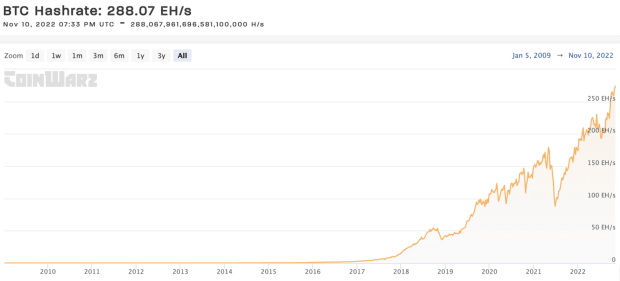

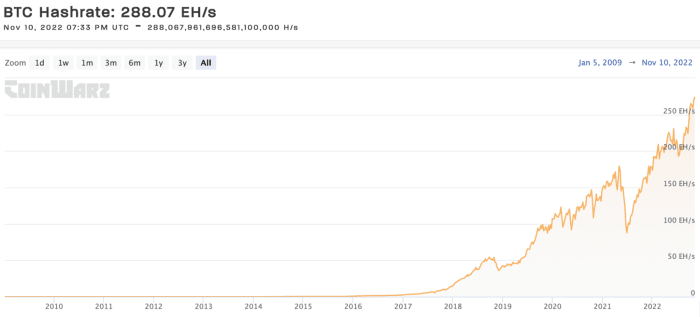

Bitcoin’s scenario adjustment is one thing constructed into the Bitcoin protocol in allege to ascertain Bitcoin has a stable and predictable present schedule. If there became as soon as no scenario adjustment, the total bitcoin likely would’ve already been mined and there’ll more than likely be puny to no incentive for miners to acquire the network. When more miners be a a part of the network, blocks are minted at a faster rate because a hash rate magnify. The network responds by adjusting the scenario greater to ascertain that blocks reach in around 10 minutes. For miners, elevated scenario adjustments indicate less earnings. For the everyday Bitcoin individual, it come more safety for the monetary network they’re utilizing.

Downwards scenario adjustments indicate that miners will likely be incomes more earnings as these are a result of hash rate coming offline. The noted example of this taking place is when China banned Bitcoin mining and a immense a part of the network hash rate went offline for a time duration. Downwards scenario adjustments are no longer the norm as mining hardware is repeatedly getting more highly efficient and efficient. Despite the incontrovertible truth that there became as soon as a stagnation of machine effectivity and hash rate increases, more machines will more than likely be produced and plugged in. The Bitcoin mining commerce is amazingly immature and there would possibly maybe be a dapper quantity of room for articulate going forward that come that hash rate is virtually indubitably going to magnify at fleet charges going forward over the longer term.

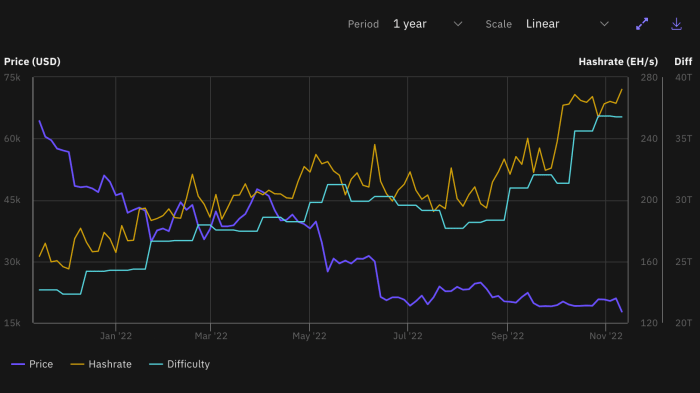

We’re currently seeing a bull market in vitality prices with a suppressed bitcoin assign that come that miners are experiencing quite a puny of anguish. There would possibly maybe be a possibility that there’ll likely be a series of downward scenario adjustments as hash rate comes offline, but here isn’t any longer one thing that miners ought to position in their objects. It’s a ways severe to put collectively for the worst case anguish which is what now we have viewed the closing few months.

Original Machines Coming To Market

Every couple years, ASIC producers initiating a brand novel machine with predominant improvements on the self-discipline of hash rate and effectivity. Present network hash rate increases are largely due to seeing Bitmain’s S19 XP and S19 Hydro being deployed. One other part is that a immense quantity of older expertise machines are lastly being grew to became on because infrastructure being constructed out.

If you happen to need an ASIC, its worth will likely be consistently depreciating as both network hash rate increases and novel machines reach onto the market. The worth will fluctuate reckoning on the Bitcoin assign, but it for jog’s obtain to claim the machine loses worth over time. That’s why it is amazingly crucial to have the machine working ought to you have it. Buying it to dawdle in later come you will more than likely be throwing money away unnecessarily.

Bitcoin Buying Vitality

Bitcoin mining is fancy taking a long space on Bitcoin, but with a range of headaches and execution risk. If performed wisely, it will likely be extremely lucrative. If performed incorrectly, it is a extra special come to receive sad lickety-split. The earnings the machine makes is quite consistent, but the shopping vitality of that earnings varies enormously. Vitality prices would possibly maybe perchance be stable priced in bucks, but are very unstable when priced within the earnings you will more than likely be making from that machine. A S19j Pro would possibly maybe perchance assemble 38,000-40,000 sats a day in earnings, but whenever you will more than likely be mining on $0.10 a kWh, your vitality expenses will likely be 41,263 sats with bitcoin trading at $17,461.

For this reason it is amazingly crucial to amass a survey at and receive the bottom that you would possibly perchance perchance maybe bear in mind electrical energy prices in allege to be profitable and ROI to your instruments. Finding cheap electrical energy is neither uncomplicated nor uncomplicated. Oftentimes there are hidden prices or issues that area off miners to fail. All miners no topic how mountainous or tiny are subjected to those economics of variable shopping vitality, network hash rate increases, and machine devaluation/obsoletion.

ASIC Pricing

There would possibly maybe be a inferior worth for the producers to create novel instruments. We’re currently at or reaching that flooring for assign novel instruments coming from the manufacturer. As a result, they’re either slowing down or halting manufacturing of obvious objects. Contributors expend to pay a premium for assign novel instruments because they reach with warranties. Used instruments on the different hand in general does no longer reach with a guaranty, and additionally uncertainty of stipulations that it became as soon as escape in. For this cause, aged instruments is typically sold at a giant discount.

ASIC pricing is variable appropriate fancy each and every other commerce. Provide and search recordsdata from are the predominant factors that pick assign. Contributors shopping for ASICs have 1,000,000 diversified the reasons why they would possibly be able to are attempting at shopping at a obvious time, but Bitcoin assign and scenario are predominant influences. If the shopping vitality of the earnings being earned by an ASIC is low, there’ll likely be less search recordsdata from and the ASIC assign will drop. Own markets are in general pretty occasions to need since the search recordsdata from drops significantly.

Moore’s Regulations And The Future Of ASICs

“Moore’s Regulations: an axiom of microprocessor pattern typically maintaining that processing vitality doubles about each and every 18 months especially relative to worth or dimension.” — Merriam Webster

We’re coming to the tip of the pc chip revolution as chip makers are pushing the boundaries of physics. In no come is this the tip of broad increases in Bitcoin’s network hash rate. The mining commerce is extremely tough at some level of the perimeters on the self-discipline of very long-established solutions akin to warmth dissipation, instrument implementations, and relationships with vitality producers. Computer chips would possibly maybe perchance have slower leaps thus a ways as increases in computing vitality, but now we have barely scratched the flooring on the self-discipline of other technological leaps forward that can within the damage lead to more vitality being consumed and more computing vitality expended in allege to acquire the Bitcoin Community.

As bitcoin becomes more widely adopted, and its worth understood, the search recordsdata from for mining is sure to magnify globally. The tip result will naturally be an magnify in Community hash rate. As a miner, here’s a painful actuality because it come the profitability of my hardware will decrease over time. As a Bitcoiner, it provides me self belief within the monetary network that I use day-to-day.

It’s a ways a guest post by Kaboomracks Alex. Opinions expressed are fully their very salvage and make no longer necessarily replicate these of BTC Inc. or Bitcoin Journal.