One in all the cleaner tells in crypto is when the frail provide decides it’s time. Now not “made a handy book a rough 20% and clipped it” time — years frail.

That’s in overall what Glassnode researcher CryptoVizArt flagged after an XRP wallet mature roughly 5–7 years (with a payment basis around $0.40) realized more than $721.5 million in income on Dec. 11.

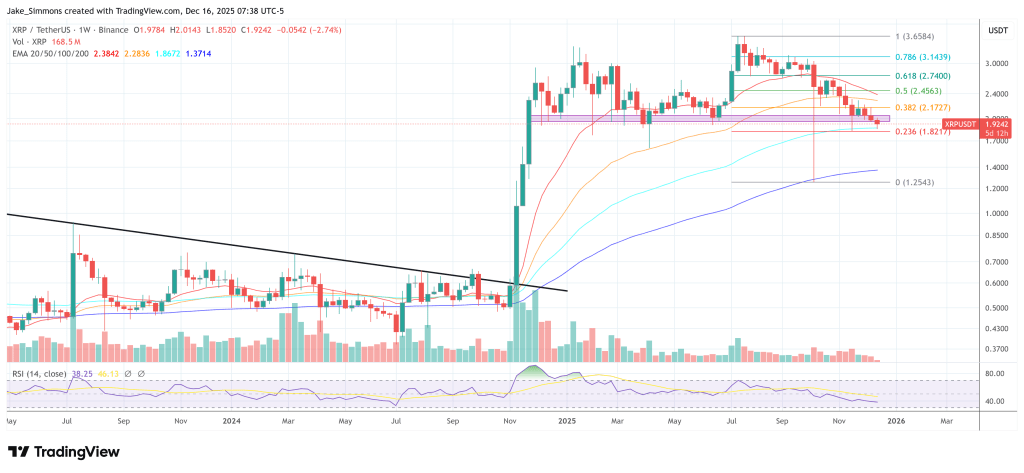

A single wallet doesn’t “shatter” a market by itself. But the timing is the purpose: this wasn’t income-taking valid into a rip. It landed whereas XRP was exhibiting weak point factual at the $2.0 key stage.

CryptoVizArt wrote by scheme of X: “On December 11th, a 5-7 365 days frail XRP wallet address (with a payment basis of $0.4) realized over $721.5M in income! A uncommon mountainous income-taking whereas the payment exhibits weak point factual at the $2.0 key stage.”

What This Manner For XRP Effect

That $2 contend with issues for the conventional causes — spherical quantity, evident chart magnet, psychological line in the sand — however additionally since the market’s been treating it admire a are dwelling wire lately. Since early December last 365 days, the pork up zone between $2 and $1.90 has been examined never-ending cases. XRP bulls repeatedly managed to conclude above the zone on the weekly timeframe.

So what does the $721M print mean? It’s a reminder that provide overhang isn’t theoretical. A 5–7 365 days wallet taking earnings can be be taught as “de-risking,” sure. But in tape phrases, it’s additionally distribution that the market has to absorb whereas ticket is already leaning. If bids are deep, it’s a shrug. If bids are skinny, it turns $2 valid into a trapdoor.

And factual now, “skinny” is trend of the vibe right by scheme of crypto, no longer correct XRP.

CryptoVizArt’s broader framing from Dec. 13 is that the $80K–$90K Bitcoin consolidation is producing stress “same to gradual Jan 2022.” Through X, he wrote: “The present $80K–$90K consolidation fluctuate is generating a magnitude of stress same to gradual January 2022, with Relative Unrealized Loss drawing conclude ~10% of market cap. This places the market in a regime where liquidity is constrained, and sensitivity to macro shocks is elevated, but still beneath the degrees typically connected to paunchy undergo-market capitulation.”

That backdrop issues on sage of alts don’t switch in a vacuum. When the final advanced is afraid, wide sell events at key levels comprise more punch. Now not on sage of every XRP holder by surprise panics, however on sage of market-makers and discretionary traders tend to drag risk at the identical time. Spreads widen, depth thins, and “one-off” flows delivery to circulate ticket more than they need to still.

Collected, it cuts every ways. A single, fat realization can additionally be the market clearing a subject — frail provide exiting, new ask stepping in, the trend of switch that (in the slay) makes a monstrous sturdier. The trick is whether or no longer $2 holds whereas that handoff occurs.

At press time, XRP was procuring and selling at $1.89, which could well well originate Sunday’s weekly conclude one other extremely indispensable match.

Featured listing created with DALL.E, chart from TradingView.com