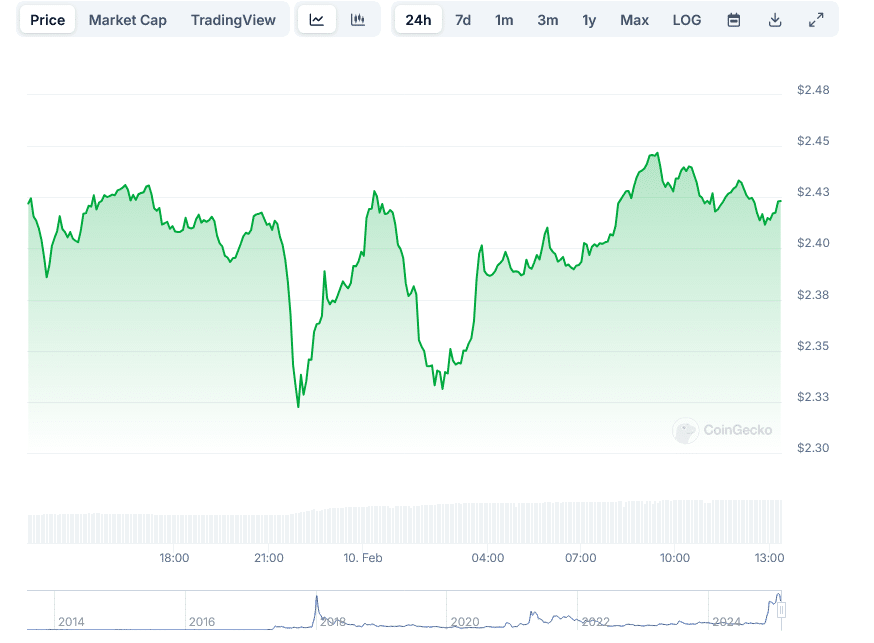

XRP has skilled a pointy decline from its January high, dropping 28.5% from $3.40 to $2.42 as of February 10, 2025. This tag circulation has passed off alongside a dramatic decrease in futures market activity, with delivery hobby falling by 52% from $7.62 billion to $3.52 billion.

The cryptocurrency’s tag decline looks linked to broader market uncertainties, including Donald Trump’s delayed announcement regarding cryptocurrency insurance policies and escalating tensions over China trade tariffs. These factors dangle created a cautious atmosphere for crypto traders.

Market knowledge shows that traders are an increasing sort of taking bearish positions on XRP. The futures market has recorded opposed funding charges, indicating that short-situation holders are paying expenses to those holding lengthy positions. This represents a shift in market sentiment toward a extra pessimistic outlook.

The derivatives market has witnessed a wave of lengthy situation liquidations since XRP’s January 16 high. A considerable liquidation event passed off on February 3, resulting within the fall down of $74.67 million in bullish positions all the device via a market downturn precipitated by Trump-connected news.

Technical diagnosis of XRP’s tag circulation reveals a undergo pennant sample, which on the full suggests persevered downward circulation. This sample features a pointy decline followed by a consolidation allotment. Market analysts counsel that if XRP breaks under essentially the most contemporary sample’s lower trendline, it would possibly perhaps presumably also role off a additional 30% decline toward $1.63 by March 2025.

Several key increase levels are right now being watched by traders. The $2.31 level serves as immediate increase, while $2.40 represents some other fundamental threshold. The Relative Strength Index (RSI) on day to day charts indicates oversold stipulations, which some analysts make clear as a doable mark of an upcoming tag reversal.

Ancient tag patterns dangle caught the consideration of market experts. Prognosis of outdated XRP actions shows that identical market stipulations in July 2023 led to corrections of 54.65% and 59.73%. If these patterns repeat, some analysts venture doable tag targets of $1.54 and $1.37 respectively.

The fall in futures delivery hobby from $7.86 billion in mid-January to $3.5 billion in February reflects reduced market participation and declining self perception amongst traders. This decrease in market activity typically precedes additional tag actions, even though the path remains unsure.

Despite the bearish indicators, some market people be conscious the doable tag decline as a buying replacement. They point to outdated cases the establish identical corrections created favorable entry capabilities for traders.

Buying and selling knowledge shows XRP’s day to day quantity has elevated by 40% to $5.49 billion, with the tag transferring between $2.49 and $2.32 in recent trading classes. The most contemporary RSI reading of 39 suggests the asset is drawing near oversold territory.

Technical indicators point to a few eventualities for XRP’s short-term tag circulation. A restoration above the 50-day straightforward transferring moderate would possibly perhaps perhaps presumably also signal a doable rally, per historic patterns. Earlier cases of XRP reclaiming this transferring moderate preceded tag increases ranging from 29% to 520%.

The undergo flag sample right now visible on tag charts developed after XRP’s decline from $3.13 to $1.76 between January 31 and February 3. The associated price has been trading interior an ascending parallel channel, with increase at the lower boundary round $2.34.

Non eternal tag action shows XRP trading in a consolidation allotment, with the token inserting ahead situation between established increase and resistance levels. The day to day trading range has narrowed, indicating a doable buildup to a more in-depth tag switch.

Market knowledge from February 10 shows persevered rigidity on XRP’s tag, with the token trading at $2.43. The one-day trading quantity stands at $5.49 billion, reflecting provocative market participation no matter the final bearish sentiment.

By no device Omit One other Opportunity! Gain hand chosen news & files from our Crypto Experts so that which you can make educated, told choices that straight dangle an ticket in your crypto earnings. Subscribe to CoinCentral free newsletter now.