XRP is now trading at $0.55, following weeks of speculation and pleasure from investors who expected a pointy trace upward push. Nonetheless, trouble and uncertainty power the market, with Bitcoin and most altcoins trading at lower levels. This downturn has impacted investor sentiment at some level of the board.

Wanted records from Santiment displays a noticeable alternate within the outlook of XRP holders. The optimism that once drove self assurance is now fading, as most investors are sitting on unrealized losses. This shift in sentiment underscores the growing issues surrounding XRP’s future, in particular within the context of broader market challenges. With the market under strain, XRP’s potentialities appear more and more unsafe.

XRP Holders Facing Unrealized Losses

XRP has demonstrated relative strength when compared with other altcoins, shedding 13% from its August 24 high of $0.631. Nonetheless, this decline has created substantial damage amongst investors, mirroring the broader market’s uncertainty.

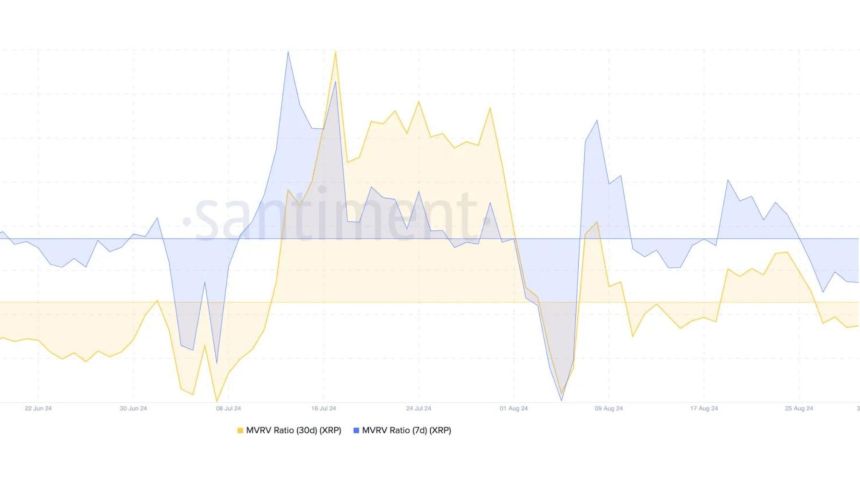

Wanted records from Santiment sheds light on the trouble, revealing that both the 30-day and 7-day Market Value to Realized Value (MVRV) ratios for XRP have grew to turn into damaging. A damaging MVRV ratio signifies that XRP is on the moment undervalued, which plot that, on common, if all money were supplied on the present trace, most merchants would incur a loss.

This shift in MVRV ratios is main, because it suggests that most of XRP holders are truly liable to realizing damaging returns on their investments. The records reflects a broader pattern of investor caution, in particular in light of the ongoing market volatility. Whereas XRP’s performance has been slightly better than many other altcoins, the damaging MVRV ratios highlight the growing issues interior the investor community.

The declining MVRV ratios succor because the largest indicator of market sentiment, suggesting that the optimism surrounding XRP shall be waning. Merchants are more and more cautious of the aptitude for further declines, which would possibly per chance per chance exacerbate losses. Whereas XRP has shown resilience, the present market conditions and damaging MVRV ratios counsel that caution is warranted. The arriving days shall be fundamental for XRP holders as they navigate this keen market atmosphere, weighing the aptitude risks and rewards of preserving or selling their property.

$0.55 Key Enhance Must Retain For Consolidation

XRP is on the moment trading at $0.559, preserving impartial above a fundamental enhance stage, the day after day 200 appealing common (MA), which sits at $0.5509. This stage is fundamental for affirming bullish momentum, because it has acted as a solid enhance, giving hope to investors ready for a trace restoration.

If the price can sustain above this MA, it would possibly per chance per chance signal a attainable continuation of the uptrend, reassuring bulls. Nonetheless, if the price drops under this key indicator, it would possibly per chance per chance trigger a further decline, pushing the price toward lower question levels.

The next main enhance to search around would be around $0.Forty eight, a fundamental stage for bulls to protect. Retaining above the 200 MA is fundamental for affirming a obvious outlook, whereas a damage under would possibly per chance per chance point out elevated selling strain. As XRP navigates via this pivotal share, merchants and investors are carefully monitoring these levels to evaluate the market’s subsequent course.

Disclaimer: The conception came at some level of on NewsBTC is for academic applications

most productive. It does no longer signify the opinions of NewsBTC on whether or to no longer aquire, sell or lend a hand any

investments and naturally investing carries risks. You are suggested to behavior your hang

study ahead of building any funding choices. Exercise info supplied on this online page

fully at your hang risk.