Reason to trust

Strict editorial policy that specializes in accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The ideal requirements in reporting and publishing

How Our Knowledge is Made

Strict editorial policy that specializes in accuracy, relevance, and impartiality

Advert discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper ecu odio.

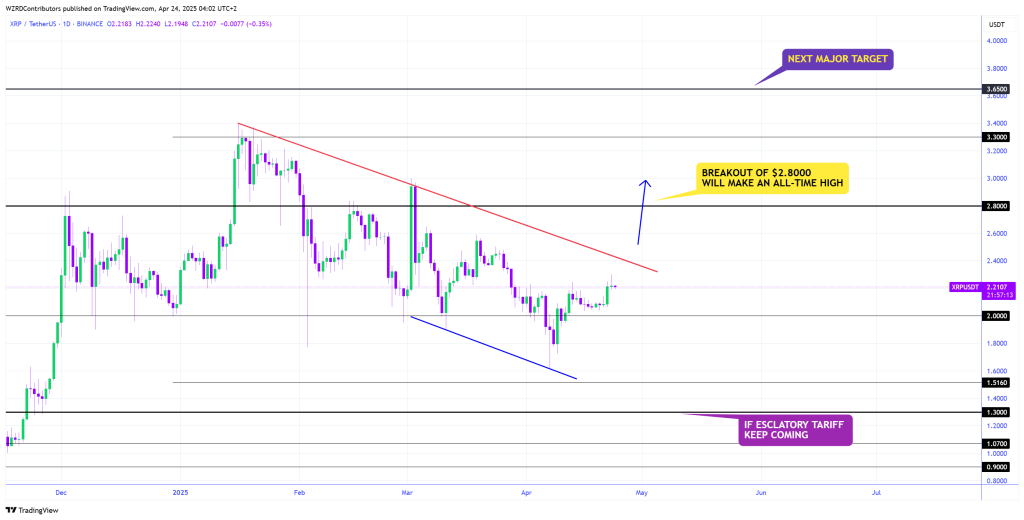

A new day after day chart shared by market technician @cryptoWZRD_ means that XRP is correct one technical save off faraway from stamp discovery. The analyst’s chart—printed early Thursday on TradingView—plots XRP/USDT on Binance and displays the token altering hands at $2.2107 after an indecisive day after day halt on Wednesday.

XRP Targets $3.65

Doubtlessly the most conspicuous characteristic is a descending trend-line (drawn in crimson) stretching from the 3 February swing high at roughly $3.40 down to the most up-to-date decrease-high cluster. That line for the time being intersects stamp marginally above the market and has capped every relief rally since mid-January. Primarily based on WZRD, a day after day candle that breaks by this “decrease-high trend-line” would ignite “a in actual fact rapidly impulsive transfer” in the direction of the next horizontal barrier at $2.80.

Why $2.80 issues is spelled out in a fascinating yellow call-out on the chart: a halt above that level would, in WZRD’s words, “build an all-time high” very likely. Above $2.80 the chart gives little historical construction except the $3.30 – the stamp which marked the weekly high in January.

Next, the analyst targets the $3.65 zone, flagged because the “next predominant target” in crimson. That band is the top doubtless shaded horizontal plotted and represents the analyst’s first plot in stamp discovery territory.

Pork up is clearly outlined as smartly. The thick shaded horizontal at $2.00 is labeled the “predominant day after day enhance target.” Under that, successive cabinets are marked at $1.5160, $1.3000, $1.0700 and $0.9000, with an annotation at $1.30 warning that a damage also can materialise “IF ESCALATORY TARIFF KEEP COMING.” A secondary blue trend-line connects leisurely-March and early-April lows, creating a transient-time-frame falling-wedge construction whose upside resolution has already begun to unwind some bearish momentum.

WZRD’s accompanying commentary stresses the interplay between location XRP and its performance in opposition to Bitcoin. He notes that XRP/BTC is coiling interior a symmetrical triangle that will “ancient” on a transfer elevated in Bitcoin dominance; sure trudge there would add tail-winds to the buck pair.

“XRPBTC wants lend a hand from Bitcoin Dominance. Transferring above from its most up-to-date website can assist the market to win the next impulsive transfer in the direction of its upper decrease high trendline, the save apart this also can ancient the symmetrical triangle and push at ideal elevated. Optimistic stamp trudge from XRPBTC can assist XRP was more bullish from its most up-to-date website,” WZRD adds.

Conversely, a “choppy” Bitcoin also can assist XRP bottled up between $2.2050 and $2.00, a range that outlined much of Tuesday’s intraday commerce. ”The overall sentiment from Bitcoin can hold an impact on XRP tomorrow as smartly, even supposing I demand to behold sure stamp trudge from XRPBTC. My focal level will reside on the decrease time physique chart trend to win the next healthy commerce setup,” the analyst writes.

For now the level of passion, WZRD says, is on decrease-time-physique trend: any decisive day after day settlement above the crimson trend-line would verify trend reversal and save the stage for a jog to $2.80—and, must serene that level tumble, the analyst argues historical previous will likely be within the making.

At press time, XRP traded at $2.13.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The info learned on NewsBTC is for instructional capabilities

ideal. It doesn’t signify the opinions of NewsBTC on whether to aquire, sell or assist any

investments and naturally investing carries dangers. You are told to habits your occupy

research sooner than making any funding selections. Utilize files supplied on this website

fully at your occupy chance.