As soon as I found bitcoin some years within the past, I believed I changed into woefully behind to the celebration. Looking back it’s glaring how hilariously substandard I changed into. Indulge in Jon Snow, I knew nothing. Most of the cost action, technological construction, geopolitical penalties —all this changed into silent ahead of me. And as years trudge by, I deem this to be great extra right as of late. Whenever you’re reading this, you are not too behind. Right here’s silent the origin.

One thing turns into determined after years of researching Bitcoin and its enact on the enviornment: Bitcoin can not succeed merely partially. It received’t play 2d fiddle. Indulge in Satoshi foresaw, it’s all or nothing. World monetary evolution or irrelevance.

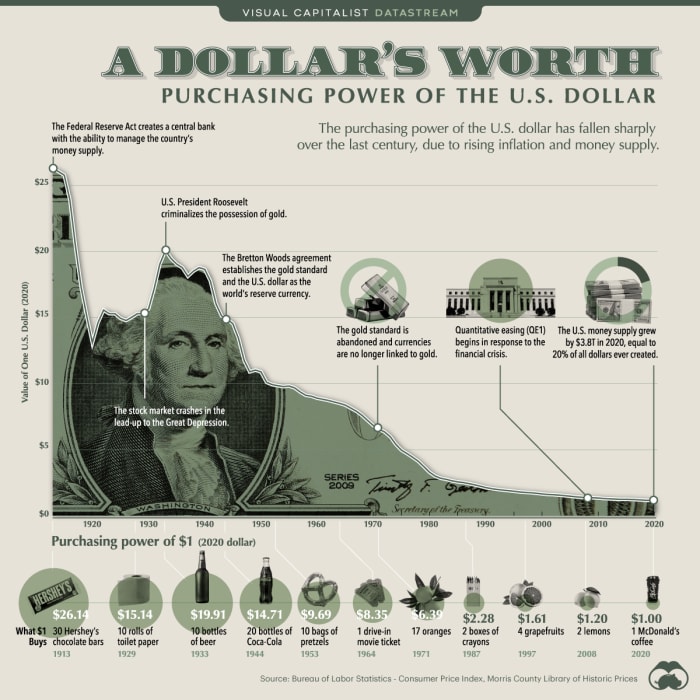

Why is that this the case? Bitcoin is money, rising in a bottom-up vogue, competing with top-down fiat money. Society needs money to without problems replace items & companies and to withhold the charge generated for future exhaust. In economic terms, money serves the role of being a medium of replace and a store of charge. Now fiat money works moderately wonderful as a medium of replace (particularly within the Western world), nonetheless it no doubt’s been getting increasingly extra worse as a store of charge over the a few years.

To make amends for this failure of fiat money, folks glimpse to assorted devices to exhaust as a store of charge, comparable to securities or right property. Bitcoin thus competes with such devices as neatly. When put next with assorted stores of charge, bitcoin doesn’t descend under a order jurisdiction (comparable to stocks, bonds, derivatives or right property) and doesn’t require a third celebration for safekeeping (comparable to gold, diamonds or expensive artwork). These two qualities are on occasion overpassed even within the occasion that they are as necessary (if not extra) because the legit monetary protection ensuing within the 21 million final present.

The case for storing charge within the jurisdictional walled gardens with third-celebration dangers might possibly be more durable to take as bitcoin turns into perceived as a mature asset with diminishing dangers over time.

The devices at this time unparalleled as a provisionary store of charge received’t proceed, they will merely lose their “monetary top class” —which, because the time-frame implies, will opt as a lot as silent accrue to functioning money. When the misfortune of money is mounted through powerful bitcoin adoption, the provisionary devices might possibly be repriced to a pure market charge and utilized where it makes most sense: homes for living, bonds for predictable money trudge alongside with the circulate, stocks for capital allocation. These devices are really helpful for society, nonetheless they’ve no spot serving as a store of charge. Right here’s a job for sound money.

The Bitcoin Skills

Let’s opt up in mind things within the very long time-frame. I’m not talking about a Bitcoin Astronomy variety of timeframe now, extra of a “grandpa, what did you enact within the 20s?” variety of thing. If bitcoin succeeds and turns into the area sound money that the enviornment so direly needs, we are going to be is named the major bitcoin expertise. And it received’t matter whether or not you gambled on Mt. Gox, witnessed the blocksize wars or lived during the mountainous Chinese language hashrate migration. It is likely you’ll presumably perchance be thought about an OG merely since you had been there sooner than bitcoin mounted the enviornment.

Now this might possibly presumably perchance also sound like I merely smoked a large bowl of hopium, nonetheless keep on with me for a minute. Bitcoin as of late is nowhere come its capability. Take into account: it’s an all or nothing variety of thing.

The recent tally goes like this:

- Bitcoin stands at 7% of gold’s market cap. Whereas gold has a sturdy Lindy enact going for it, you completely can’t teleport it to the plenty of facet of the planet within the blink of an uncover about comparable to you will doubtless be ready to enact with sats over the Lightning Network. Gold needs relied on intermediaries to feature properly. Bitcoin wins over gold within the long journey.

- Just one nation so some distance has adopted bitcoin as its right gentle. The game conception here is evident: the 20th century changed into the age of dollarization; the 21st might possibly presumably perchance presumably be the age of bitcoinization.

- The total geopolitical video games interesting bitcoin are silent ahead of us. In the words of the legendary Jack Mallers: “There’s no fucking methodology you are tantalizing” for what we’ll uncover about within the impending years. Grab your crimson meat jerky and stash your sats within the coldest of storage. History is upon us.

- Most folk aren’t conscious about the Lightning Network. How on the total enact you hear the “Bitcoin can’t scale past four transactions per 2d” FUD? Lightning is working, here and now.

- Many silent aren’t conscious about bitcoin’s divisibility into 100,000,000 gadgets, aka satoshis or sats. The unit bias lures many into shitcoins, naively believing they stumbled on cheap selections to bitcoin. It is likely you’ll presumably perchance presumably also silent acquire hundreds of sats for one greenback — that is hilariously cheap.

- Smaller central banks aren’t even gathering bitcoin so some distance, although bitcoin on the balance sheet affords a excessive likelihood of saving minor nationwide currencies (within the duration in-between not not as a lot as, sooner than they change into unparalleled as hyperbitcoinization happens).

- Tremendous investors are most practical likely slowly waking as a lot as the reality that there might possibly be one thing terribly substandard with bonds, equities and even money itself.

- Just one corporation is conducting a speculative assault on the US greenback, so some distance. When others observe strategies to leverage fiat’s monetary protection in opposition to itself, this might possibly presumably perchance also change precise into a crowded replace.

The traits above, whereas not all measurable, direct us extra about bitcoin than the temporary effect efficiency (temporary being not as a lot as yearly candles). Brief-time-frame effect action is liable to be seductive to gamblers, nonetheless it no doubt’s moderately irrelevant within the broad scheme of things. It primarily doesn’t matter whether or not the cost is $3,000, $30,000 or $300,000. No fiat effect effect primarily matters because fiat money itself will not matter within the long journey. So long as we denominate bitcoin in fiat terms it silent is too early because that suggests that bitcoin hasn’t change into the universal unit of sage yet.

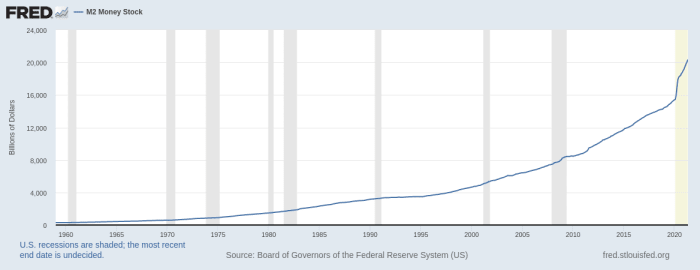

Fiat is popping into ever extra nugatory with every passing yr. That’s merely how the recent debt-based mostly fully system works. Ever extra monetary gadgets will opt as a lot as silent be created to forestall the total thing from collapsing:

Every fiat forex in existence is undergoing hyperinflation. The order distinction among them is the time scale on which it happens.

The exhaust of bitcoin for stacking extra fiat is a signal of fundamentally misunderstanding what’s occurring on this planet as of late. Fiat will not be a sustainable variety of money, as many opt up pointed out. Stacking fiat is a idiot’s game. There is an infinite quantity of fiat. No matter how great you purchase, you can acquire diluted to zero, given sufficient time.

Number Gallop Up Turns Into Number Gallop Down

Pricing bitcoin in fiat doesn’t acquire sense within the long journey, so then what does?

Pricing all the pieces else in bitcoin.

Admittedly this feels a diminutive bit absurd for now, when most of us silent opt up fiat-denominated wages, charges and money owed. Yes, we are silent on the fiat neatly-liked. But as bitcoin step by step takes over, making mental calculations in bitcoin will change into recurring.

This stamp day, we don’t judge regarding the “effect” of the greenback, nonetheless barely what the greenback buys. And that’s liable to be the the same with bitcoin because the enviornment step by step adopts it as money. Of us will mentally shift from bitcoin’s effect to bitcoin’s purchasing energy.

Since bitcoin is primarily unparalleled as a store of charge first, it’s some distance good that we undertake a addiction of interested in our bitcoin stash in terms of sats in spot of greenbacks. The greenback charge of our bitcoin holdings might possibly presumably perchance also alternate over time, nonetheless most folks sooner or later advance on the conclusion that the most practical likely thing that matters within the tip is to amass extra sats. Many uncover the hard methodology: promoting at a fiat effect they mediate excessive sufficient, most practical likely to scrutinize one other steep upward thrust in effect later. Most speculators gain themselves having much less and much less bitcoin over time. After they observe this, they shift their mental model from greenbacks to sats. Been there, performed that.

The following step is when folks launch as a lot as simply opt up a section of their wage in bitcoin. Right here’s a natural progression for long-time-frame bitcoiners, seeking out jobs where they’ll completely focal point on their passion. Beside the passionate bitcoiners, the solution to invent a section of their wage in sats is coming to workers from assorted paths of lifestyles rapidly. Whereas the wage itself might possibly be denominated in fiat, workers will inevitably peep how many sats they receive every month. As bitcoin rises in terms of fiat effect, workers will also peep that they devise fewer and fewer sats, even supposing these smaller quantities might possibly be charge extra in fiat terms as time goes by. Incidentally, here is how the deflationary exclaim of bitcoin might possibly presumably perchance also change into considered as a natural methodology things are.

A extra step will then be to mentally reprice mountainous purchases in sats. “Three million sats for an iPhone?! Fifty million sats for a automobile?!!” Any long-time-frame hodler knows that these costs will trudge down over time. Bitcoin has a sturdy enact on lowering your time preferences, i.e. valuing future wellbeing over temporary gratification. Mentally denominating things in sats will change into 2d nature.

Right here’s how “Number trudge up” step by step turns into “Number trudge down.” Bitcoin’s effect might possibly presumably perchance also match as a lot as infinity in fiat terms within the raze, nonetheless few will hear because fiat will change into irrelevant at that point. No one cares as of late how great bitcoin is charge in Zimbabwean greenbacks, and no-one will care in a few a few years how great it’s some distance in U.S. greenbacks. Of us on the sats neatly-liked will instead scrutinize constantly falling costs.

But what regarding the volatility? As soon as bitcoin turns into the universally accredited unit of sage, the volatility and the rate of appreciation will diminish vastly. Right here’s because of a couple of components: there received’t be any speculators aiming for fiat positive aspects, all americans will auto-DCA (even supposing that is liable to be known as merely “saving”) and the market capitalization might possibly be so enormous that that is liable to be almost very not going for any single entity to circulation the purchasing energy of bitcoin. There received’t be any dumps, nor will there be pumps. As a replace, the rate of purchasing energy appreciation after hyperbitcoinization will merely correspond to the rate of productivity enhance. This bitcoin neatly-liked is in concord with expertise-induced enhance deflation.

Skills is deflationary. That will not be conjecture. It is some distance the nature of expertise. And since expertise underpins increasingly extra extra of the enviornment around us, it capacity that we are entering into an age of deflation unlike any the enviornment has ever considered. -Jeff Gross sales spot, The Label of The following day: Why Deflation is the Key to an Plentiful Future

Now you might possibly perchance presumably perchance also teach “all here is candy and all, nonetheless it no doubt’s a few years away.” Smartly, that’s variety of the purpose of the total article, isn’t it? You is liable to be not too behind as of late since the major socio-economic penalties are silent ahead of us. Appreciation of the that you just will doubtless be ready to guage of — and in my intention, moderately probable future trends — has a sturdy enact on as of late’s behaviour. Lustrous where all of it leads motivates us to act in a virtuous manner as of late: adopting a low time-preference outlook, patiently stacking whereas accounting your savings in sats in spot of fiat, ignoring the fiat maximalists and shitcoiners (as if there’s a distinction).

No one Is Leisurely, But Not All americans Is Early

No one can ever be behind to bitcoin. When bitcoin turns into world money and its rate of purchasing energy appreciation shows mankind’s productivity enhance, this might possibly presumably perchance also continually acquire sense to store charge in bitcoin. This can merely be the most practical likely savings instrument there might possibly be, constantly appreciating without third-celebration or project-failure dangers.

The long journey isn’t written, even supposing. There are dangers to stacking and holding bitcoin sooner than hyperbitcoinization happens. These kinds of dangers are technical in nature; we silent don’t opt up the safekeeping primarily sorted out for honest, even supposing tools are bettering at a mercurial tempo and are turning into extra intuitive. Assorted dangers are political in nature; the thunder silent has a right monopoly on money and can provide protection to it. Novel bitcoin holders face the likelihood of unfair tax medication, confiscations or assorted kinds of harassment.

That’s the reason it’s some distance feasible to be early, although no person might possibly be ever behind to adopting bitcoin. Early merely capacity being there sooner than hyperbitcoinization happens.

And that will doubtless be one thing to direct our grandchildren about.