- What’s Yield Farming?

- How Yield Farming Works

- The Perfect DeFi Aggregators

- 1inch

- Zapper

- Zerion

- Plasma.Finance

- Matcha

- Expend DeFi for Free

- Final Tips: The Evolving DEX Aggregator Role

A DeFi aggregator is a platform that leverages loads of more than a few DEX and implements various buying and promoting solutions to motivate users maximize earnings, moreover to mitigate high gas costs and DEX trading commissions.

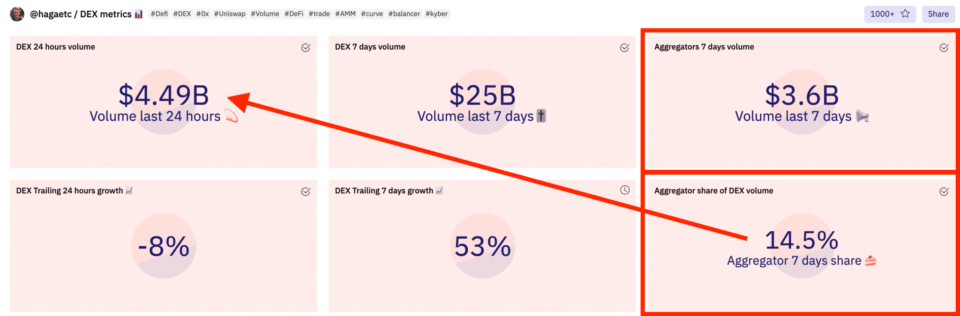

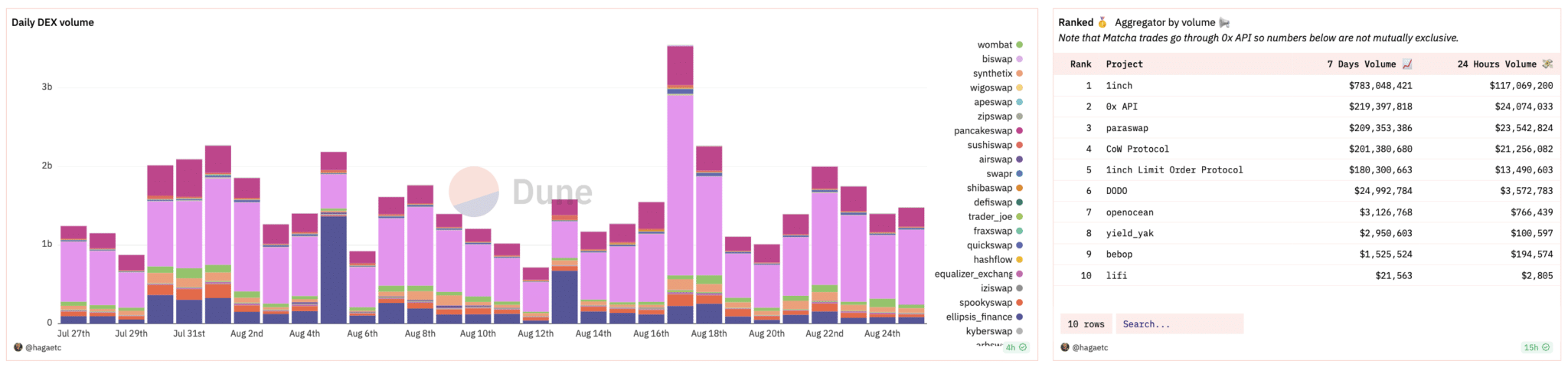

Widespread DeFi aggregators 1inch, 0x, and Paraswap facilitate about $1.2 billion of volume weekly.

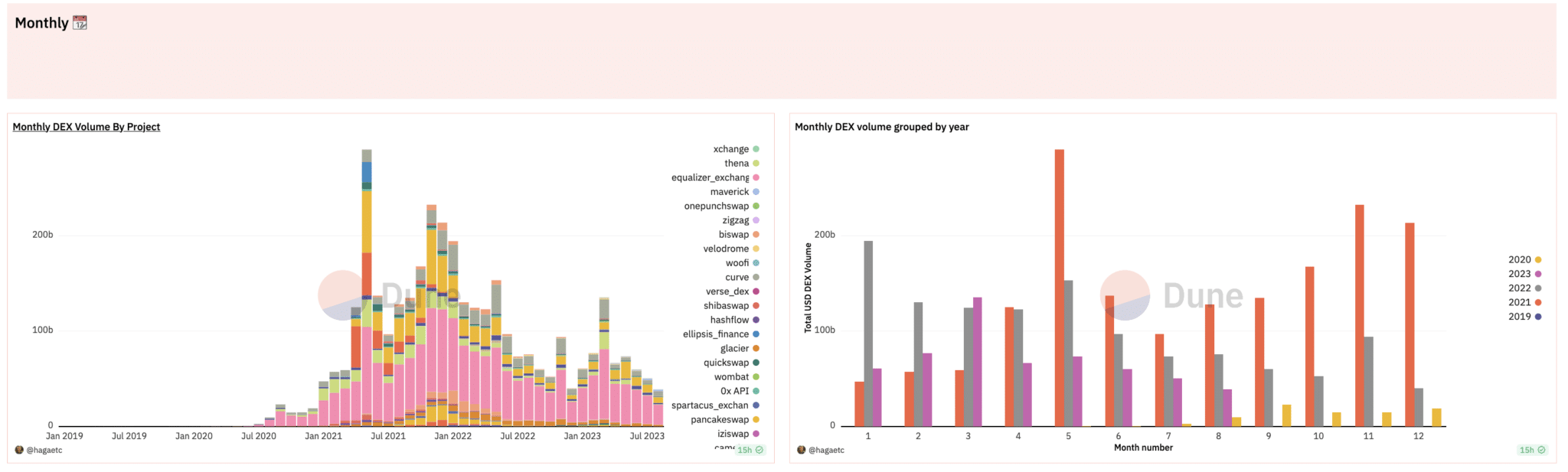

In retaining with Dune Analytics Knowledge, the need of unique users, each day transactions, and each day volumes occupy surged in 2023, doing about $10 billion in volume weekly, dominated by Ethereum-primarily primarily based DEX aggregators.

What’s Yield Farming?

To greater imprint the utility of a DeFi aggregator, it’s priceless to gloss over the concept of Yield Farming.

Yield farming (noun): a methodical plot to lending and staking cryptocurrency sources on the places that yield the very best returns and rewards. Yield farming requires a cryptocurrency holder to lock up their funds in a supreme contract, which specifies how important and how in general a lender receives their rewards.

With out a DeFi aggregator, a yield farmer would click around loads of more than a few lending pools and decentralized exchanges such as Aave and Compound, manually evaluating the very best charges, and cryptocurrency token solutions available, and migrating the funds themselves.

The attach carry out DeFi yields come from? In thought, the opposite facet of the decentralized finance equation has a borrower eliminating a loan the employ of their get hold of cryptocurrency as collateral. Extra in general than no longer these borrowers need funds for liquidity on decentralized exchanges.

These rewards are inclined to be important greater on reasonable than extra feeble investments nonetheless occupy important greater risks linked.

How Yield Farming Works

Most yield farming is in general completed by lending ETH or an ERC-20 token on a decentralized, non-custodial cash market protocol.

Yield farming and the tokens they generate is steadily a unstable endeavor, here’s the design it works:

Step 1: Add funds to a liquidity pool. These are supreme contracts that hold the funds themselves, and the pools energy a market where users occupy the skill to interchange, borrow or lend tokens.

Step 2: If you may occupy added your funds to a pool, you develop into a “liquidity provider” and originate to originate producing hobby by costs.

Step 3: Subsequent you’ll occupy the likelihood to complete a leveraged yield farming plot. To carry out this, connect with your wallet, and plot certain that that your community is made up our minds to the chain in quiz. You’re going to gaze your energetic positions within the “Your Positions” part, and you may need to make a need a plot that it is advisable complete and click on “Shut Location”. Await the transaction to be processed, and you needs in an effort to gaze the tokens serve on your wallet.

DeFi aggregator definition: In plot of having to manually sift by loads of pools, DeFi users can employ a DeFi aggregator to get hold of entry to a massive differ of decentralized exchanges and trading pools on a single dashboard, which attracts recordsdata from a massive quantity of exchanges and automatic market makers.

1inch

1inch is a notorious DEX aggregator that specializes in thought the very best crypto costs when put next to varied decentralized exchanges. The platform launched with its get hold of governance token is named 1INCH, and the predominant plot all over which you as a consumer can get hold of 1INCH tokens is by providing liquidity to the liquidity platform.

The token is Ethereum-primarily primarily based, and the aggregator works by sourcing liquidity from varied DExs, which plot that you just may presumably get hold of greater token swap charges than you may fin on an particular particular person DEX.

1inch changed into primarily based by Sergej Kunz.

1inch may just even be accessed on https://app.1inch.io/.

Zapper

Zapper capacity that you just can management DeFi sources and liabilities by a straightforward interface, and it’s in general regarded as one in every of the most intuitive DeFi aggregators– users can deploy varied DeFi positions with a single click.

Users can enter and exit DeFi positions by functions known as Zapping In and Zapping Out.

Zapper integrates with loads of DeFi platforms, such as 1inch, Aave, Alchemix, Alpha, and extra, and enables for portfolio rebalancing by shifting capital to other platforms. Portfolio rebalancing supplies advantages when put next to easily retaining crypto, and the approach implemented by Zapper will motivate you to within the discount of risk by rebalancing your portfolio at some level of definite lessons.

Zapper even entails a multi-pooling feature that enables for diversification when it involves asset distribution.

Zapper changed into primarily based by Seb Audet and Nodar Janashia.

Zapper may just even be accessed at Zapper.Fi

Zerion

Zerion enables traders to imagine the ability of every asset within the marketplace and commerce on the very best charges from a single dashboard.

The app tracks over 50 protocols, making it straightforward to get hold of much less standard tokens.

It also sources liquidity from predominant decentralized exchanges, and this affords users single-transaction get hold of entry to to liquidity pools and even automated solutions. This implies that they can replace sources, and ship them to a different wallet interior a single transaction.

Zerion changed into primarily based by Vadim Koleoshkin, Alexey Bashlykov, and Evgeny Yartaev.

Zerio may just even be accessed on https://app.zerion.io/.

Plasma.Finance

With Plasma.Finance, you may presumably tackle your portfolio, Fiat on/off ramp, liquidity pools, DEX and SWAP aggregator, lending and borrowing moreover to unsuitable-chain asset swap from a single interface.

It’s some distance one in every of the very best ways to buy moreover to promote tokens on account of it enables for credit rating card or monetary institution integrations. This is completed by a partnership with plasmapay, ramp, and simplex.

Plasma.Finance changed into primarily based by Ilia Maskimenka.

Plasma.Finance may just even be accessed by visiting Plasma.Finance.

Matcha

Matcha is a DeFi platform that intends to get hold of crypto traders the very best charges on any cryptocurrency replace by the usage of a proprietary 0x API abilities that checks 23 decentralized exchanges (DEXs) on the identical time.

It no doubt works with 0x, Uniswap, SushiSwap, Curve, Kyber, Balancer, Mooniswap, Bancor, mStable, and a few other coins. Users can search 23 exchanges simultaneously, and intelligently route their orders to commerce safely without hidden costs.

No account is required, and there are no trading limits, deposit requirements, or withdrawal costs.

Matcha changed into created by Will Warren.

Matcha may just even be accessed on https://matcha.xyz/

Expend DeFi for Free

That you just must just sight that even precise experimenting with DeFi protocols and aggregators gets pricey swiftly in consequence of the Ethereum community gas costs.

Some aggregators provide DeFi simulators, that plot that you just may presumably play around with the dashboard with unsuitable Ethereum or other tokens generated by the mock simulation.

The Defiant has a immense explainer video on the employ of the DeFi simulator feature on another DeFi aggregator known as InstaDapp :

Final Tips: The Evolving DEX Aggregator Role

An aggregator pulls the very best costs from across varied DEX so that you just don’t must manually test something.

As such, you get hold of the likelihood to plot an informed decision on what to farm next important faster. DeFi aggregators are a most standard innovation that occupy deal simplified the DeFi panorama for rookies and specialists alike.

By no plot Miss One other Opportunity! Salvage hand chosen recordsdata & recordsdata from our Crypto Consultants so that you just may presumably plot educated, told choices that without lengthen occupy an impact for your crypto earnings. Subscribe to CoinCentral free newsletter now.