The arena’s most efficient cryptocurrency ardour accounts provide any place between 10x to up to 64x extra APY than realistic ardour-bearing accounts, making a solid case for the vogue the cryptocurrency replace can disrupt the venerable financial products and companies sector.

For instance, BlockFi and Celsius provide around 8.6% to 11% APY on stablecoins, which digital sources pegged to the worth of a greenback. Stablecoins devour USDC and GUSD are designed to continuously (in idea) be $1 (despite a ~$0.02 fluctuation in both route).

Ally Bank, as an instance, has on the total described itself as providing “replace-main” rates, and currently provides 0.2% on financial savings deposits. In idea, one would occupy extra ardour in barely one month on BlockFi or Celsius (8.6%/12 = 0.71% monthly) with a stablecoin than a total yr on Ally.

Further, cryptocurrency ardour accounts moreover topic other venerable investment autos. For instance, the S&P 500 averages around 10%–11% per yr (since 1926), and staunch property averages around 9.4%.

So, if stablecoins can occupy 43x to 55x bigger than their fiat counterparts in “high-yield” financial savings accounts, and digital sources on cryptocurrency ardour accounts provide the identical rates as other investment autos, what’s the exercise? Are cryptocurrency ardour accounts legit? Are they critical of your sources?

We’re honored to be fraction of your due diligence on the prime cryptocurrency ardour myth. While better ardour rates are though-provoking, don’t be rapid to leap the gun. A cryptocurrency ardour myth is contrivance riskier than fiat financial savings myth for causes we’ll fetch below.

Learn along as we unpack the nitty-gritty upsetting and furry questions about cryptocurrency ardour accounts, the studs and duds, top doubtless APY cryptocurrency ardour accounts, and the top doubtless trace-up (and most accessible) bonuses on platforms devour:

Why is that this the most efficient darn cryptocurrency ardour myth overview on the Web? We’ve interviewed the founding and management teams of many of these corporations ourselves (Alex Mashinsky, Celsius Founder in 2018 and 2020, BlockFi thru a handbook in 2019.)

Our community of CoinCentral Insiders own used or steadily use these platforms themselves, so we’re coming at this overview from the point of peep of customers ourselves. To that pause, someone within the CoinCentral community is welcome to electronic mail us or attain out on social if their experiences are opposite to what we’ve written.

So, what makes a prime cryptocurrency ardour myth? We peep at about a main criteria:

-

- Necessary investors and advisors. An organization’s investors and partnerships will assist navigate regulatory complexities and handbook replace thunder.

- Leadership team. Long past are the ICO days the get a cryptocurrency mission’s success is indifferent from its management team. As the cryptocurrency ecosystem grows, so originate the reputational stakes. Every platform ought to own the human firepower to elevate out its ambitious mission.

- Security measures. How get is your money in a cryptocurrency ardour myth? What precautions originate they eradicate to purchase your funds get?

Earlier than we dive into the thick of all of it, let’s realize how cryptocurrency ardour accounts are somewhat about a from long-established financial savings accounts.

Crypto “Savings” Accounts Vs. Popular Savings Accounts: What You Have to Know

Earlier than you pass a single Satoshi or stablecoin out of your other wallets and exchanges, you ought to make certain on about a factors of cryptocurrency ardour accounts.

Is a cryptocurrency ardour myth awful? Are cryptocurrency ardour accounts FDIC insured?

Cryptocurrency ardour accounts aren’t basically high-risk for those with realistic risk tolerance, but they’re no longer risk-free. Even supposing the platforms lined listed here fight thru intensive security protocols and own yet to skills a hack, we’d be doing our readers a disservice by no longer mentioning the dangers, alternatively minimal, enthusiastic with entrusting your cryptocurrency with a third-birthday party supplier.

A cryptocurrency ardour myth need to be viewed as an investment and no longer a financial savings myth. While the overwhelming majority of financial institution accounts in america are lined up to $250,000 by FDIC (Federal Deposit Insurance protection Company) insurance protection, cryptocurrency accounts are no longer. Digital sources akin to Bitcoin, Ethereum, and even fiat-pegged stablecoin deposits akin to USDC, GUSD, and USDT aren’t lined by FDIC insurance protection.

Any loss of funds attributable to theft wouldn’t be lined by federal insurance protection. Calling them cryptocurrency financial savings accounts is a misnomer– they’re investments and desires to be handled as such. Further, cryptocurrency ardour accounts are rather unusual enhancements, and don’t own the predictability of the contemporary banking contrivance, which has a history spanning over 500 years.

Nonetheless, some cryptocurrency ardour myth platforms akin to BlockFi are secured by private insurance protection; in BlockFi’s case, since it uses cryptocurrency commerce Gemini as its custodial provider (BlockFi relies on Gemini to withhold and get its deposits), it is lined by Gemini’s private insurance protection pioneered to present protection to digital sources on Gemini’s platform. Celsius moreover has insurance protection from its custodial BitGo– it is moreover working to launch private insurance protection inside of its platform.

Nonetheless, don’t financial institution on this insurance protection. It’s sufficient to cowl some losses, but completely no longer some catastrophic loss of funds.

Are cryptocurrency ardour rates guaranteed?

In idea, no, but bitcoin ardour rates own stayed rather get between 6-12%.

Keep I want to most efficient use one cryptocurrency ardour myth?

No. Many of these accounts provide related rates, some users might well well possibly discover worth in spreading their cryptocurrency eggs over about a baskets. This diversification moreover helps mitigate one of the major crucial dangers if an individual platform loses funds.

Many accounts moreover own “caps” on better portions of cryptocurrency, so using multiple platforms is a yield maximization strategy.

Further, many of these accounts are competing to contrivance users, so there are many rather high trace-up bonuses obtainable.

How is paying high ardour on cryptocurrency deposits sustainable? How originate cryptocurrency ardour myth corporations occupy money?

Cryptocurrency ardour myth suppliers devour BlockFi and Celsius occupy their money by lending particular person deposits, mighty devour a venerable financial institution. That you simply would be able to also moreover fetch a cryptocurrency loan from any of these suppliers, but our main focal point here is the ardour myth.

Other folk borrow crypto for multiple causes: fetch extra leverage on their trades, the simplicity of a one-quit crypto loan versus the venerable loan direction, and no longer desirous to liquidate their cryptocurrency sources, seemingly for tax functions.

Can I believe a cryptocurrency ardour myth?

Now we own deemed the total cryptocurrency ardour accounts on this checklist as faithful, but again, don’t make investments one thing else you can no longer own the funds for to lose.

The Top Cryptocurrency Hobby Accounts

There are about a considerable leaders within the cryptocurrency ardour myth space.

BlockFi– The Challenge Capital Darling

BlockFi – The NYC-based mostly BlockFi used to be based mostly in 2017 by Zac Prince and Flori Marquez. The corporate has attracted a huge title-studded line of mission capital investments, elevating over $508M from Valar Ventures (Peter Thiel-backed), Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Morgan Creek Digital, and extra.

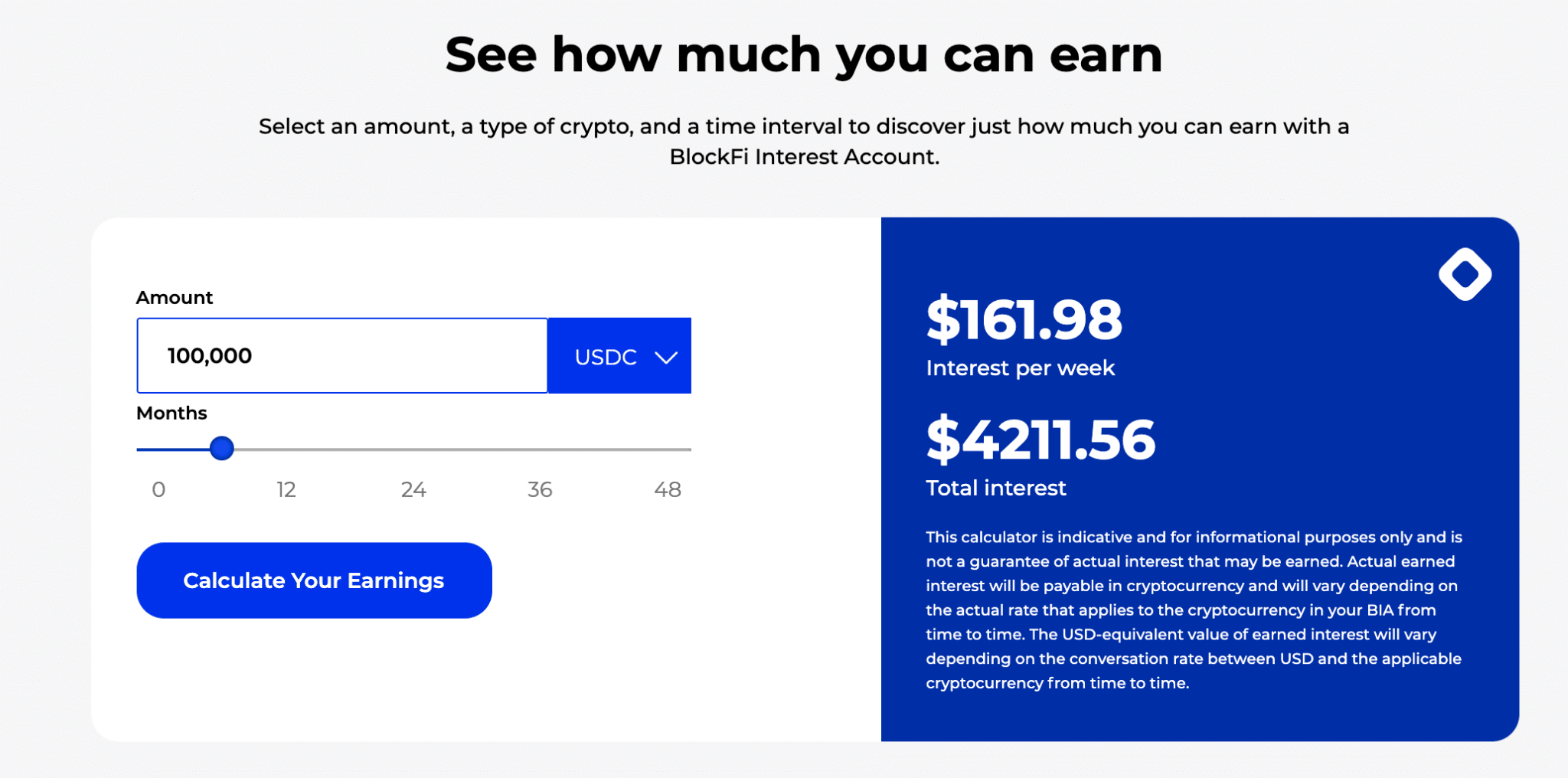

BlockFi provides 8.6% on stablecoins, paid monthly with out a lock-up period or token requirement.

That you simply would be able to also be taught our fats BlockFi overview here.

That you simply would be able to also fetch up to $250 (beginning at $25) in USDC at the same time as you occur to start a brand unusual BlockFi myth with on the least $500.

Celsius – The “Vitality to the Other folk” Grassroot Powerhouse

Celsius – Celsius used to be based mostly in 2017 by Alex Mashinsky (CEO), an NYC-based mostly entrepreneur with accolades akin to over $3 billion in exits and two of NYC’s prime mission-backed exits since 2000. Mashinsky notes Celsius used to be based totally on the premise of bringing 7.5B of us from the venerable world of finance into the cryptocurrency sphere.

Celsius provides 10.5% APY on stablecoins, paid weekly, with out a lock-up period or token requirement.

The Celsius team boasts a return of 80% of company income to users.

That you simply would be able to also be taught our fats Celsius overview here.

Abra– The Each day Compounder

Abra – Abra permits users to occupy around 10% and 4.5% ardour on stablecoins and Bitcoin respectively, with as cramped as $5.

Simplest of all, it’s compounded each day.

That you simply would be able to also be taught our fats Abra overview here.

Crypto.com– The Complicated One (But Can Be Worth It)

Crypto.com – The Hong Kong-based mostly Crypto.com used to be based mostly in 2016, and lists four co-founders: CEO Kris Marszalek, CFO Rafael Melo, CTO Gary Or, and Head of Company Construction Bobby Bao.

The corporate provides a Visa debit card, an app commerce, an immediate loan product, and cryptocurrency “crypto occupy” product.

Crypto.com provides the top doubtless rates of all cryptocurrency ardour accounts– 12% APY on stablecoins IF you lock your deposit up for three months, capture and stake (lock-up) 25,000 CRO (about $2,000). It’s a solid option, but we found the Crypto.com skills excessively sophisticated. When you wished to pass “all in” on the Crypto.com ecosystem, you might well well possibly possibly skills one of the major crucial top doubtless rates, but there are many extra hoops to leap thru than its opponents.

If truth be told, to occupy shut to the identical rates as BlockFi or Celsius, you’d need to capture some of Crypto.com’s uncertain tokens (our dropped by 50% whereas writing this text, don’t notify we by no approach did nothin’ for you guys) and lock them up to occupy the top doubtless tier of earnings.

Crypto.com’s platform might well also be so complicated that we’d be doing our readers a disservice by explaining it in aspect listed here. That you simply would be able to also be taught extra about it in our crypto.com handbook, coming soon 🙂

That you simply would be able to also fetch $25 USD as a signup bonus on Crypto.com

Nexo– The One You’ve Potentially Considered Adverts For

nexo ardour myth

Nexo – Nexo provides high-yield financial savings myth for cryptocurrency holders, and looks to cater its products and companies to a European heinous of customers bigger than its opponents. Nexo uses BitGo as its custodian, an organization backed by Goldman Sachs and is CCSS Stage 3 and SOC 2 compliant. Nexo’s token, NEXO, provides holders a a part of 30% of the corporate’s income.

CoinCentral readers can fetch $10 when signing up and depositing $100 or extra on Nexo.

Nexo used to be based mostly in 2018 and is led by CEO Antoni Trenchev.

The positioning’s communications lean closely on its lending model; expectantly, this factors to the corporate constructing a sustainable replace model fueled by lending.

It has an “Impact in Nexo” option akin to Celsius’s (Impact in CEL), from which users fetch about a 2% increase per asset. Without the “Impact in Nexo” option, Nexo customers can occupy around 10% APY on stablecoins, which is the next return than BlockFi but decrease than Celsius. Nexo moreover provides an XRP ardour myth.

The platform looks to cater its products and companies to an global crowd, and it’ll even be an ravishing option for our readers in Europe.

That you simply would be able to also be taught our Nexo overview here.

Linus– Half of the Anguish, Half of the Charges

Linus – Linus comes in solid with a “what has your financial institution executed for you no longer too long ago” tagline.

Linus’s ardour myth product is unheard of in that it most efficient accepts and permits withdrawals in USD, obfuscating the cryptocurrency layer for the tip-particular person.

Right here is an ravishing option for folk that simply correct to fetch better ardour and dip their toes into the cryptocurrency ardour waters, but don’t desire the concerns of sending and preserving crypto.

The parable pays out 4% to 4.5% on USD deposits, which is aloof an marketed 64x that of venerable USD financial savings accounts.

Despite being fiat, deposits are no longer FDIC-insured,

Deposit $100 or extra on Linus and fetch $20.

What’s the Simplest Cryptocurrency Hobby Myth Platform?

We’ve used quite a bit of the products and companies above for over two years, opened somewhat about a buyer pork up queries to gauge response, and interviewed founding teams. We’ve determined it’s a portray originate shut tie between BlockFi and Celsius, with BlockFi correct a hair earlier than Celsius. Every BlockFi and Celsius are ravishing decisions for a cryptocurrency ardour myth, and it’s no longer queer for folk to own each.

Celsius provides about a factors that BlockFi doesn’t.

Celsius provides weekly payouts; BlockFi most efficient pays once monthly.

Celsius is extra of a grassroots endeavor: Whereas BlockFi leans closely on its mission capital financing, Celsius raised the massive majority of its capital thru ICO (life like one of many few corporations that ICO’d that in point of fact went on to elevate out huge things.) It has an active Telegram community of over 17,000 of us

Alex Mashinsky, Founding father of Celsius, has multiple successful startup exits. Right here is the eighth Alex has based mostly, and two prior ventures, Arbinet and Transit Wireless are two of New York’s largest mission-backed exits ever–$750M and $1.2B respectively.

A comparability between BlockFi and Celsius can jog on for hundreds of words, which it does on our BlockFi vs. Celsius handbook.

Right here’s why we mediate BlockFi has the brink.

Fund security: BlockFi uses cryptocurrency commerce Gemini as its custodian. In other words, BlockFi relies on accomplice Gemini to purchase its funds get. Gemini has labored widely with nationwide regulating authorities and the extra complicated NYC financial regulators. Gemini’s Digital Asset Insurance protection uses third-birthday party underwriters to cowl any losses attributable to theft or faux transfers.

Firm funding: BlockFi has attracted investments from quite a bit of the sector’s most efficient investors. As is traditional with VC-backed FinTech corporations, increasing particular person acquisition and cutting again particular person churn might well also be a precedence. In idea, this ought to align BlockFi with providing the next particular person skills (for now) in notify to showcase favorable thunder rates to investors, ought to it think elevating subsequent rounds.

A checklist of BlockFi’s investors, thru screenshot from its web location.

Particular person convenience: BlockFi provides each mobile and desktop apps, which puts it a hair above opponents that don’t yet own one or the other. Celsius, as an instance, doesn’t own a desktop app. BlockFi pays out on a monthly foundation, and our skills with them has been very streamlined.

Hobby calculator from BlockFi

Are Abra, Crypto.com, Nexo, and Linus Mute Lawful Crypto Hobby Alternatives?

The remainder of the lot are aloof first price alternate solutions for a cryptocurrency ardour myth, in every other case, they wouldn’t own made this checklist.

Abra provides each day compounded ardour, which is unheard of within the space. With 10% ardour on stablecoin deposits and a very intuitive interface, it’s a solid option for somebody taking a survey to start up earning ardour on their cryptocurrency.

Linus provides 4% to 4.5% on USD deposits, and most efficient permits the deposit and withdrawal in USD. For our readers which can well well possibly be rather hesitant to enter the cryptocurrency replace but are attempting to reap one of the major crucial wait on, Linus is an ravishing option. Nonetheless, it isn’t risk-free– its deposits are no longer FDIC insured.

The replace model is unheard of: users deposit bucks into Linus, Linus exchanges them for somewhat about a cryptocurrency sources to lend out, and when users are attempting to withdraw, Linus converts crypto assist into fiat. The total pause-particular person sees is USD, whereas Linus takes care of the fiat-crypto exchanges. This convenience comes at about a 4.6% – 6% much less return than other opponents, but might well well even be a match for a selected location of customers that purchase this feature.

What’s the top doubtless APY cryptocurrency ardour myth?

The top doubtless APY cryptocurrency ardour myth is crypto.com… but there’s a exercise, as we’ve outlined above and in aspect in our Crypto.com handbook.

The Top Cryptocurrency Hobby Myth Promotions

The next crypto ardour myth promotions are active, but topic to commerce. We’ll originate our most efficient to purchase these up to this point, but fetch them whereas they’re sizzling in notify for you them.

Celsius: Take a look at in and occupy $40 in BTC along with your first transfer of $400 or extra!

Crypto.com: Take a look at in and fetch $25 USD to set up in for Crypto.com. That you simply would be able to also need to stake 2500 CRO (about $200)– the promotion isn’t certain.

Linus: Signal up and deposit $100 or extra and fetch $20.

Remaining Tips – Are Cryptocurrency Hobby Accounts Worth It?

When you’re someone taking a survey to diversify your portfolio by procuring for and preserving cryptocurrency, we strongly counsel sorting out cryptocurrency ardour accounts to your self.

We waddle our readers to continuously originate their very occupy analysis. Personal this conversation with a financial handbook, and feel free to ship them this text as a foundation for the discussion. Cryptocurrency ardour accounts devour BlockFi and Celsius are in point of fact investments and the returns are no longer guaranteed. Our thunder is only intended to be tutorial and informational. A single greenback or satoshi shouldn’t leave your wallets without skilled advice.

That being stated, we’re a rather paranoid editorial team that acknowledges the “be your occupy financial institution” and “no longer your private keys, no longer your bitcoin” ethos of the cryptocurrency replace.

The arena’s most efficient crypto ardour accounts are attempting to cater to particular person security, but on the tip of the day, any time your funds leave your hardware wallets, you’re within the hands of the digital world. The risk is yours, and yours most efficient, to occupy.

Earlier than we mean you can jog, let’s leave on this idea: if extra digital asset holders are overjoyed holding their funds on a cryptocurrency ardour platform, placated by rather low-risk first price returns, volatility might well well decrease within the slay.

With digital sources devour Bitcoin considered as much less volatile attributable to fewer of us promoting Bitcoin, the case for institutional capital to enter the ecosystem turns into mighty stronger.

We mediate cryptocurrency ardour accounts are a cramped, but obligatory fraction, of maturing cryptocurrency as an asset class.