Nexo is a cryptocurrency curiosity narrative and lending platform that provides between 6% and 12% APY for more than a few digital resources, collectively with BTC, ETH, LTC, BCH, EOS, XLM, TRX, and XRP. It’s a diversified cryptocurrency curiosity narrative offering because it offers day-to-day payouts, as neatly as upwards of 12% for neatly-liked fiat currencies cherish USD, EUR, and GBP for world customers.

Nexo’s dwelling page boasts $12 billion Sources Under Administration for over one million customers, making it one of the most largest crypto curiosity narrative platforms on market.

The next Nexo overview will explore its company historical previous, curiosity narrative, security precautions, and an overall prognosis of the company’s feature in the cryptocurrency alternate.

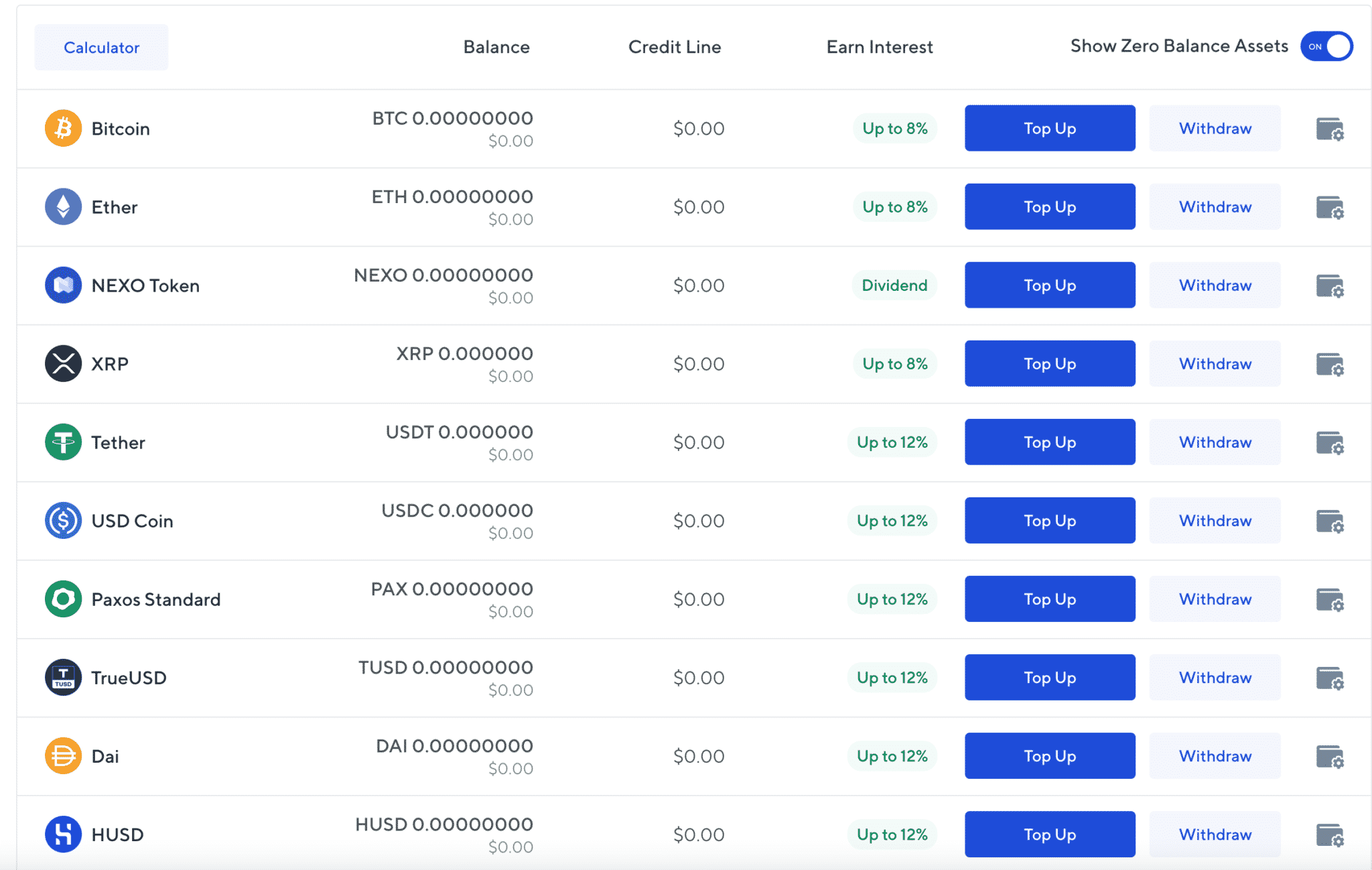

The Nexo Cryptocurrency Interest Chronicle

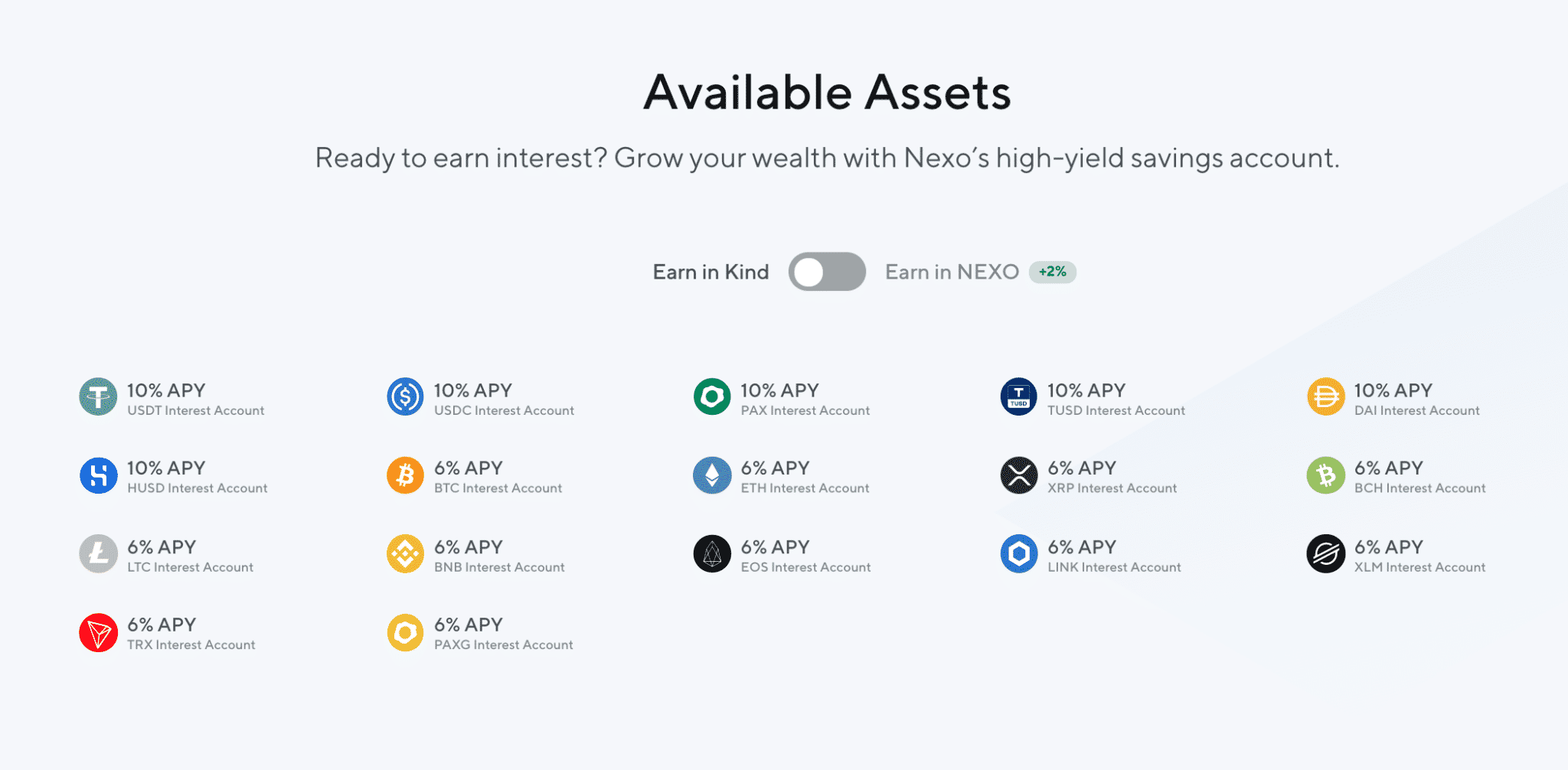

Customers can produce 10% on stablecoins cherish USDT, USDC, PAX, TUSD, DAI, HUSD, and 6% on BTC, BNB, ETH, XRP, LINK, BCH, LTC, TRX, PAXG, and XLM in the event that they elect the “Produce in Kind” choice. Incomes in Kind plot that customers will produce their curiosity in the incorrect forex; BTC deposits will produce in BTC.

- NEXO APY when Produce in Kind choice is chosen.

If customers elect to Produce in NEXO, Nexo’s native token, their curiosity rates lengthen by 2% one day of the board.

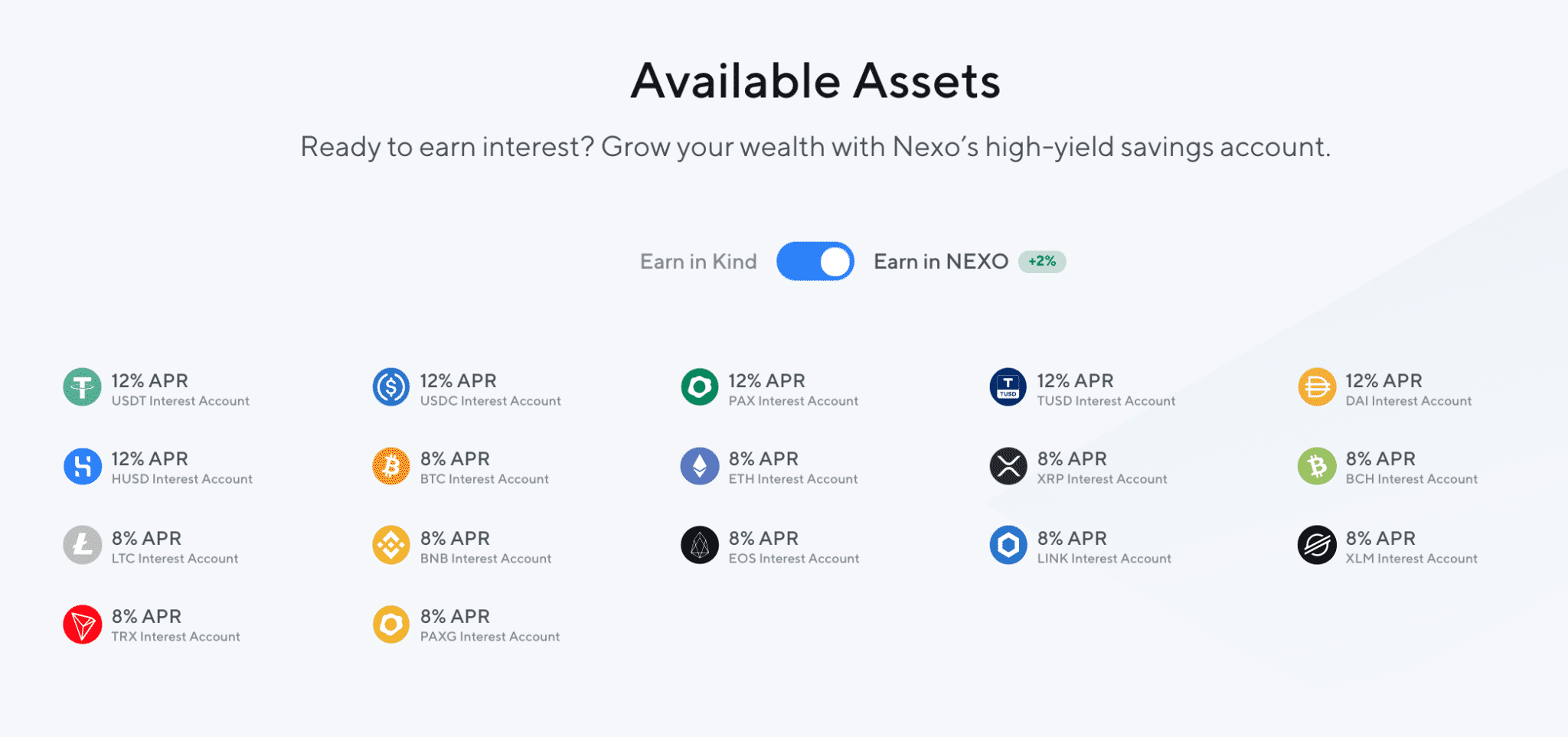

- NEXO APY when Produce in Nexo choice is chosen

What Does the NEXO Token End?

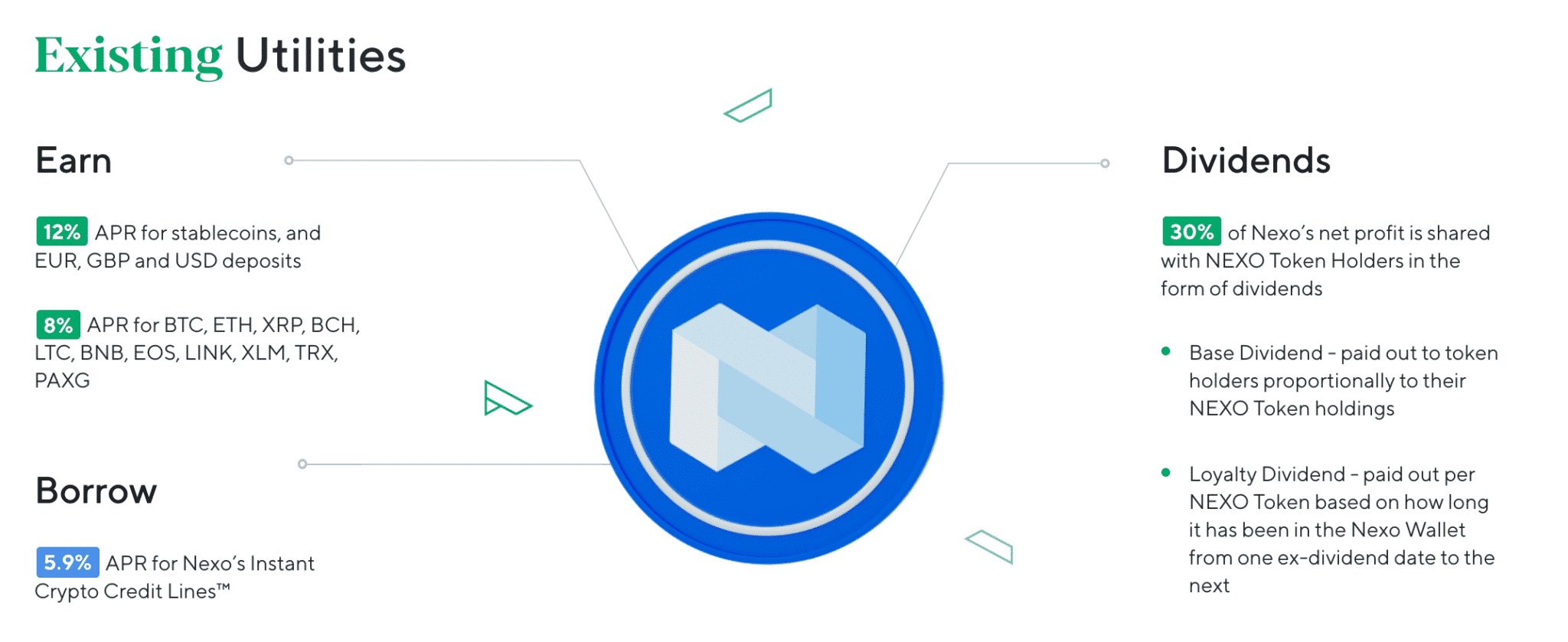

NEXO was created one day of the ICO, and distributed to the team and early adopters. The company shares up to 30% of its profits with NEXO holders.

The NEXO token underpins the loan and deposit ecosystem; maintaining the token entitles investors to a 30% portion of company profits, cherish a dividend. Nexo claims it has paid over $9 million to tokenholders since 2018.

- Nexo token performance.

The token moreover has just a few benefits for cryptocurrency curiosity narrative customers. If maintaining NEXO, customers can:

- Produce an extra 2% APY on their deposits, bringing stablecoins up to 12% and other cryptocurrencies to 8%.

- Borrow 5.9% for Nexo’s Instantaneous Crypto Credit Lines.

Utterly different cryptocurrency curiosity narrative platforms absorb same tokens: Celsius has CEL, Crypto.com has CRO. They are a technique to anchor and incentivize early adopters to make drawl of the platform and take away the token.

Is the NEXO Token a Excellent Exercise?

NEXO’s complete present is pegged to 1 billion tokens, currently, 560 million are in circulation. The token assign bounced round $0.09 and $0.50 for the important thing three years of its existence nevertheless exploded to $3.60+ in 2021.

This Nexo overview won’t present funding advice, nevertheless it completely’s charge thinking in regards to the volatility of the token when in contrast with the longevity of the company. The NEXO token launched merely after the 2017 bull market, nevertheless noticed its sharpest produce in 2021, alongside the 2021 bull speed.

Whether or no longer NEXO is a factual salvage could presumably perchance come the final model down as to if or no longer or no longer you indicate to eradicate the token to receive company profits or lengthen your APY in the curiosity narrative– outside of pure speculation, unnecessary to claim.

- Nexo token perks

How Does Nexo Bewitch Its Funds Safe?

Nexo acts as the custodian for all deposits, which plot that the company retail outlets your digital resources. It does so via a partnership with cryptocurrency custodial answer BitGo.

Per Nexo’s Terms and Stipulations, Nexo’s pockets services and products are supplied “as is,” and the company’s authorized responsibility boundaries defend it from hacks, tampering, or trojan horse transmissions.

These authorized responsibility boundaries are lovely commonplace amongst cryptocurrency curiosity narrative platforms, as many of them are custodian platforms. That being stated, these companies on the complete accomplice with a right custodian answer particularly designed for conserving consumer funds safe.

For instance, BlockFi uses cryptocurrency alternate Gemini as its custodian.

Nexo’s resources are kept in frigid wallets secured with multi-signatures, and the inner most keys are kept offline (via BitGo) locked in Class III financial institution vaults for bodily security. These protections given the protection of the platform some weight in our Nexo overview.

By its partnerships with BitGo and Ledger Vault, Nexo’s deposits are coated by $375 million in insurance security.

Earlier than respiratory a affirm of aid, do no longer omit that Nexo claims $12B in resources below administration. It’s unclear what proportion is saved in frigid storage and insured, nevertheless mathematically Nexo’s insurance would duvet about 3% of funds if the complete lot had been lost in some doomsday-esque put of dwelling.

It’s charge noting that insurance on cryptocurrency resources is aloof very contemporary, and few platforms provide insurance honest like Nexo, if any. Here’s why most of these accounts are known as cryptocurrency curiosity accounts and no longer cryptocurrency financial savings accounts– neither your main nor your curiosity is guaranteed.

So, are your funds safe on Nexo?

Nexo’s security infrastructure is ISO/IEC 27001: 2013 licensed. So, your funds are potentially safe on Nexo; deposits are likely as safe on Nexo as competitors cherish BlockFi and Celsius. Alternatively, cryptocurrency curiosity accounts provide a diversified situation of dangers that shouldn’t be disregarded. End your analysis, discuss alongside with your licensed financial consultant.

About Nexo: Company Profile

Nexo was basically based in 2017 by Antoni Trenchev, Georgi Shulev, and Kosta Kantchev, three Bulgarian founders with trip with varied financial institutions round Europe. The company is registered in London, England.

Nexo raised $52.5 million in two funding rounds, counting two investors: Arrington XRP Capital and Erhan Bilici. The platform is on hand in 200 jurisdictions, claiming over 1 million customers and $12B AUM.

- Nexo on Crunchbase

Nexo’s roots are intertwined with one other Bulgarian Fintech startup, Credissimo, a swiftly-loan company that basically operates in Europe. The company previously IPO’d on the Bulgarian Inventory Alternate, nevertheless was delisted for unconfirmed reasons. A Reddit submit speculates the founding team came one day of being a public company was “too burdensome” and sold out the final public shareholders to purchase the company inner most again.

An early version of Nexo whitepaper aspects to its Credissimo connection, nevertheless it completely has since eradicated state:

“Nexo is powered by Credissimo, a number one FinTech Neighborhood serving hundreds of hundreds of people one day of Europe for over 10 years. Credissimo has for all time operated below the very finest regulatory requirements and strictest supervision by just a few European Banking and Financial Companies Regulators. Now, the same Team and its Board of Advisors, empowered by the ever-growing personnel of Nexo supporters and big quiz for the Instantaneous Crypto-backed Loans, are unlocking the associated rate of digital resources in a all in an instant rising token financial system that can alter the very fabric of a $5 trillion dollar market.”

Kosta Kantchev is aloof listed as a Board Member for the project.

Is Nexo Legit?

Nexo’s longevity in the put of dwelling has earned it some credit in opposition to being a sound cryptocurrency curiosity narrative pioneer.

Nexo’s cryptocurrency curiosity narrative rates are aggressive with BlockFi, Celsius, and Crypto.com.

Alternatively, Nexo has a stride of unfortunate customer provider; several Reddit threads and Twitter posts quiz more transparency or involvement from the company’s leadership groups in addressing customer concerns.

The elephant in the room for Nexo (and to be gorgeous, a factual chunk of cryptocurrency companies) is that it hasn’t published an audited financial assertion to enhance its claims. Dun & Bradstreet claims Nexo makes $417,555 in income per three hundred and sixty five days, nevertheless this quantity appears to be like very low when in contrast with unofficial Nexo statistics, which speculate that alternate is booming for Nexo.

As some distance as this Nexo overview goes, this doesn’t seem cherish neglect or malice on Nexo’s segment– a third celebration auditing Nexo’s deposits and profits would likely need partial discover-most efficient access to BitGo’s vault wallets, which likely aren’t publicized for routine audits for security reasons.

Nexo’s security infrastructure is ISO/IEC 27001: 2013 licensed, which plot the platform has been successfully audited by CISQ, the realm’s largest supplier of administration system certification, and RINA. This audit basically specializes in security, which is a small associated to the alternate metrics Nexo discloses.

Per our Nexo overview, outside of some peculiarities in reporting, Nexo appears to be like to be a sound platform.

Is Nexo Safe?

Nexo faces a mess of dangers extraordinary to cryptocurrency-basically based totally mostly initiatives.

For starters,

- Interest loss in lending in case of a have market.

- Complications and bounds with withdrawals (Nexo has custody of your funds)

- Inherent likelihood with stablecoins and the seemingly loss of their dollar peg, for in spite of reason.

- Hacks or in any other case dishonest drawl.

Alternatively, these are merely blankly stated dangers that every and each cryptocurrency curiosity narrative have to take care of. To glance a fleshy prognosis of dangers, check out our cryptocurrency curiosity narrative records.

So, can you belief Nexo?

This Nexo overview lists the above aspects for folks who’re liable to distrust as a default– skepticism ends in deep analysis. Nexo’s unknown profitability carries implications for depositors and NEXO token holders, nevertheless the platform has but to absorb a major subject.

Nexo appears to be like cherish a honest company, nevertheless it completely would vastly absorb the support of more communications involvement from its leadership.

In distinction, Celsius CEO Alex Mashinsky conducts weekly AMAs, and is effectively inserting on a masterclass in leadership involvement and transparency for cryptocurrency curiosity companies. Signing up for Celsius moreover will get you $40 in BTC alongside with your first transfer of $400 or more.

How Does Nexo Have confidence Money?

Nexo makes cash on the differential between crypto loans and deposits. Here’s lovely standard for cryptocurrency curiosity narrative and lending platforms.

Its cryptocurrency loans could presumably perchance provide rates as low as 5.9%, nevertheless these rates could presumably perchance lengthen in confide in pay better curiosity to depositors.

For instance, dispute we detect a bull market. Hypothetically, shoppers would wish to borrow more to salvage BTC in hopes of benefiting from its rising assign. The quiz fueled by borrowers would lengthen curiosity rates.

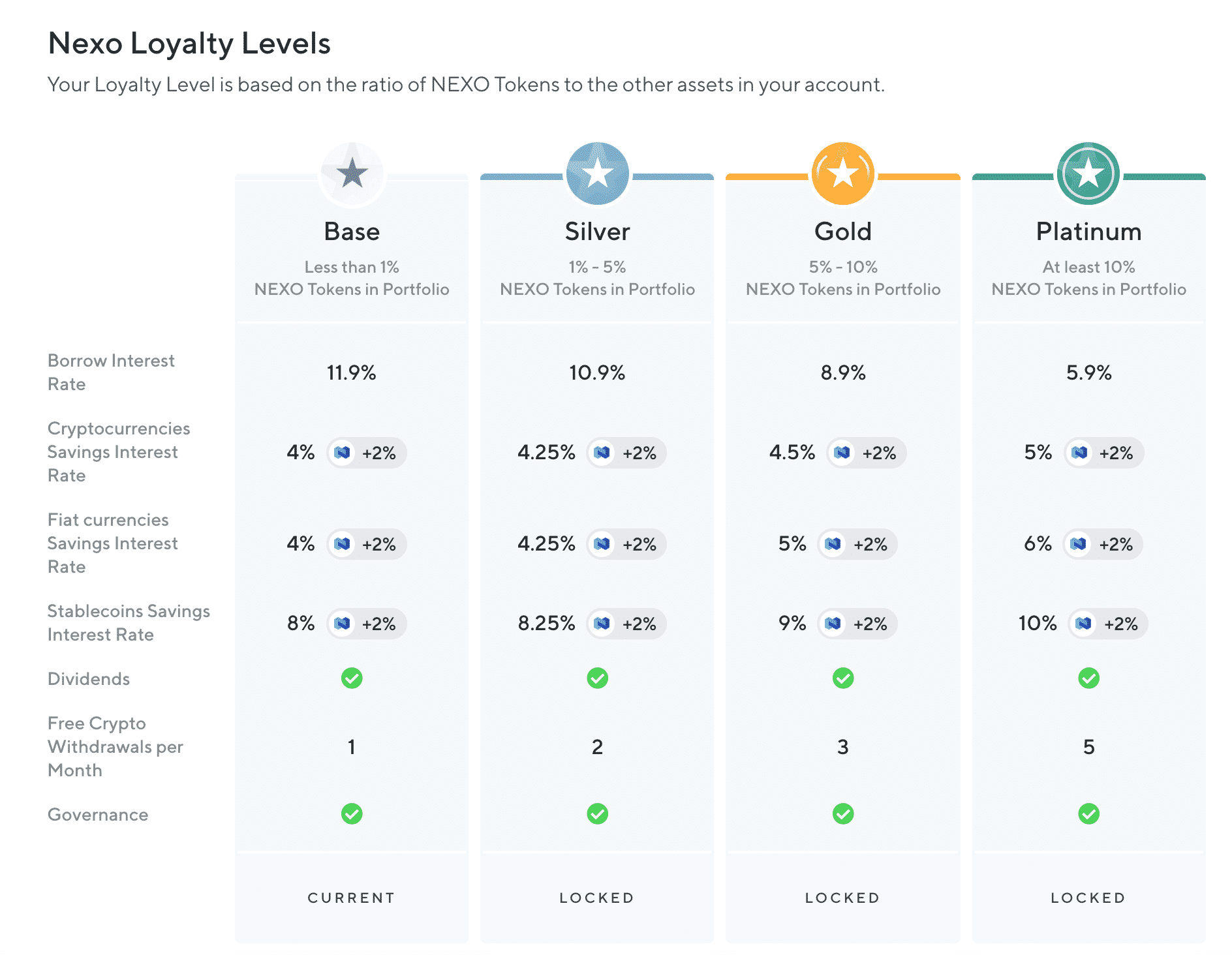

- Nexo curiosity rates

Nexo distributes loans in step with cryptocurrency collateral, allowing customers to purchase out a loan by locking some of their coins as collateral. They can release their coins after they repay their loan. Let’s impart they deposit BTC to purchase a loan out in USDT. If BTC appreciates, the associated rate of the BTC as collateral increases as neatly, which increases the loan restrict, allowing customers to purchase out the next loan.

Is Nexo DeFi?

By definition, Nexo is never any longer a DeFi project– it is a centralized platform that retains custody of your digital resources whereas you drawl it. In theory, Nexo can eradicate deposits and restrict withdrawals.

Nexo Signal Up Bonus

CoinCentral readers can rep $10 when signing up and depositing $100 or more on Nexo.

The next bonuses are moreover on hand from competitors.

Celsius: Produce $40 in BTC alongside with your first transfer of $400 or more.

BlockFi: Stand up to $250 (starting up at $25) in USDC while you birth a contemporary BlockFi narrative with in spite of the complete lot $500.

Crypto.com: Get $25 USD as a signup bonus on Crypto.com.

Supreme Thoughts: Is Nexo Legit and Rate Your Time?

Nexo has a stable presence in the cryptocurrency curiosity narrative put of dwelling. With aggressive curiosity rates for stablecoins, BTC, ETH, other cryptocurrencies, and even fiat, it’s an choice charge exploring for these having a glance to rep paid curiosity on their cryptocurrency. The company has moreover considered great enhance in its userbase, and its token has more than 7xed in assign, likely minting just a few very neatly off and chuffed early adopters.

Nexo is a European-basically based totally mostly company. As such, our European readers could presumably perchance very neatly be more ecstatic with Nexo than a United States-basically based totally mostly platform. In distinction, U.S. readers could presumably perchance capture companies which would be obligated to feature within U.S. rules and jurisdictions cherish BlockFi and Celsius.

Alternatively, there is small need for tribalism by strategy of cryptocurrency curiosity accounts. Readers could presumably absorb the support of signing up for a mess of the prime curiosity narrative services as a technique to diversify away one of the most most platform dangers of using correct one.

Our Nexo overview comes attend optimistic, nevertheless we’d strongly attend the leadership team to be more active in communicating with the model of contemporary communities being shaped round cryptocurrency curiosity accounts.