What affect Peter Schiff, gold bugs, the monetary media and loads of bitcoiners dangle in total? It is miles the shared belief that “money printing” is accountable for heaps of, if no longer all, of the increases in designate that plague our economy. Whereas it can well’t be argued that prices are rising in definite areas comparable to in housing, stocks, bonds and lunge (albeit rapid), I imagine the source of these designate increases comes from a special place than what most other folks are liable to desire.

Over the final few months, I dangle been collecting recordsdata connected to the matter of inflation and would admire to make mumble of this different to portion my findings with the Bitcoin viewers in explicit. We are going to mumble this missive to seem at out and establish the forms of things one would request to examine in both inflationary as successfully as disinflationary/deflationary environments. We are going to also are attempting to repeat among the culprits that are most accountable for the magnify in asset and person prices post–World Monetary Crisis (GFC).

Right thru the Bitcoin place, there are two issues that are assured to gain you certain consideration. One is to promote the inflation yarn and the totally different is to promote bullish designate momentum. Many of the articles that quilt the aforementioned issues can also moreover be boiled down to mere cheerleading and in most cases are liable to lack substance in my draw. Although this missive will be conserving the matter of inflation, it’ll certainly be providing enhance for an different scrutinize than that which is preferred. This text can also seem a dinky bit lengthy to most readers but to no longer difficulty, it is miles factual as chart heavy as it is miles discover heavy and the charts and illustrations we would be the mumble of will be essential for our diagnosis.

In expose heart’s contents to birth, we first need to establish the attributes of both inflationary and deflationary environments in phrases of the social and economic behaviors that one could well request to peep in each vogue of atmosphere. To impress this, we would be the mumble of ancient precedent as a rule. We are going to open our diagnosis by first figuring out the attributes of a certainly inflationary atmosphere.

What Does An Inflationary Atmosphere Peek Take care of?

In expose heart’s contents to tag what to preserve up for in an inflationary atmosphere, we would be the mumble of history as our book. We are going to be taking a witness on the outcomes that inflationary sessions dangle had on areas comparable to rates of interest and person behavior. The inflationary episodes beneath are offered in chronological expose and in actuality quilt the closing century or so. We birth with Bolshevik Russia.

Soviet Russia

“World War I and the Revolution of 1917 resulted in a length of unparalleled inflation. By 1917, the ruble had lost 75% of its 1913 alternate cost; by 1920, it had lost 99.9% of its 1913 foreign-alternate cost. The commodity designate index rose 5800% between 1913 and 1918 and rose 4.9 million% between 1913 and 1921.”— “A Historical previous of Hobby Rates,” p. 598

Seemingly the predominant hyperinflationary episodes that has been largely forgotten was as soon as the Soviet hyperinflation that straight adopted the Bolshevik Revolution. The example equipped above could well remind other folks of more moderen episodes comparable to the experiences of both Zimbabwe and Venezuela. So all people is aware of what was as soon as going down to the Soviet ruble all the plan in which thru this time, but how did rates of interest retort? Per”A Historical previous of Hobby Rates,” deposit rates on the Gosbank dangle been as excessive as 72% in 1923, but the textual articulate material also implies that these rates dangle been no longer indicative of provide and seek recordsdata from, as a change being definite by Soviet commissars, and thus would dangle doubtless been powerful elevated. On the lending aspect, interest paid on loans exceeded 216% all the plan in which thru the same 300 and sixty five days. Additionally, pawn retail outlets can also cost upto 120% for advances of credit ranking. The aforementioned Soviet commissars managed all aspects of banking all the plan in which thru this length, so unlit market rates dangle been liable to be powerful elevated than these stated above.

Weimar Germany

“The handiest ingredient to affect with cash by that time (February 1922) was as soon as to turn it into one thing else as rapid as imaginable. To establish was as soon as folly. Positively, however, as in Austria, there dangle been many farmers who behaved outrageously. Dr. Schacht’s yarn of the inflationary years recalled that farmers ‘former their paper marks to mumble as rapid as imaginable all forms of beneficial machinery and furniture-and loads of pointless things as successfully. That was as soon as the length in which mountainous and correct pianos dangle been to be allege in presumably the most unmusical households.”— ”When Money Dies,” p. 109

From a behavioral level of scrutinize, one of many things that you simply can request to examine all the plan in which thru a length of excessive to crude inflation is for customers to seem at out and place away with their all straight away depreciating forex as rapid as imaginable. Right thru the years straight following WWI, here is precisely what you seen in Germany. Shoppers would race to mumble whatever they’ll also the 2nd they dangle been paid. In spite of all the pieces, the articulate got so scandalous that producers and retail outlets could well no longer, and did no longer need to, part with their wares and responded by limiting the volume of hours that their doorways dangle been originate in another case their stock would be rapid cleaned out and the shopkeepers would dangle been stuck with the all straight away depreciating German stamp. Additionally, loans in plan over 10,000% dangle been recorded in Germany all the plan in which thru this length but due to the chaos of the hyperinflation, the occupation by the French of the Ruhr, and political extremism, just correct unlit market rates can also dangle been powerful elevated.

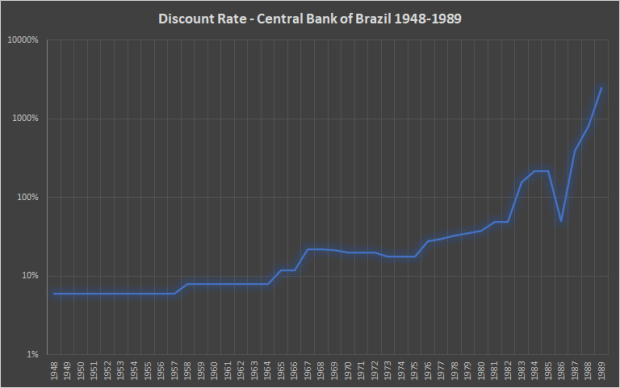

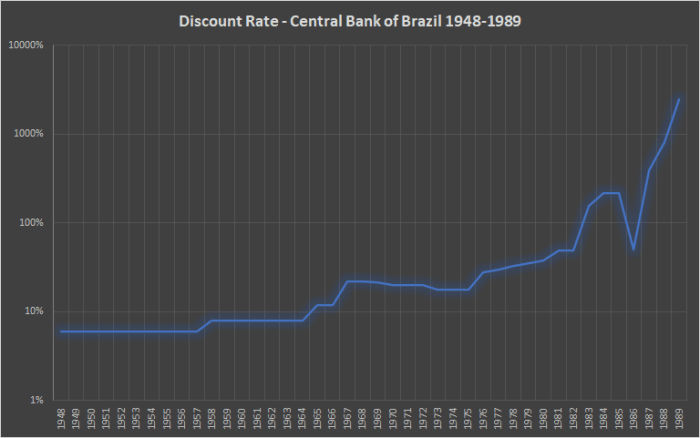

The chart in Figure 1 is dwelling to log scale due to the volatility in rates of interest between 1948 and 1989. Following the militia coup in 1964, the Brazilian government started the system of debasing the nation’s forex, the cruzeiro, in expose heart’s contents to fight the assorted crises that came about over this length comparable to the 1979 Oil Crisis. The forex itself went thru three iterations in whole before in the end collapsing in 1993 due to hyperinflation. We are going to clearly look from Figure 1 that rates of interest went parabolic factual before the final implosion of the cruzeiro, due to this reality, there might perchance be a clear motive-and-slay relationship between the money printing going down and the payment of interest. When money is printed, the payment of interest is shown to magnify as a consequence. We look this vogue of behavior time and again again.

Argentina

Argentina’s struggles with inflation are successfully identified. The two essential inflationary episodes of the closing 20 years coincided with the Argentine Immense Depression of 1998–2002 and the Argentine Monetary Crisis of 2018. Right thru the peak of both crises, rates of interest skyrocketed in step with the depreciating cost of the peso. Figure 2 presentations the rates of interest that banks dangle been paying their depositors over the closing 25 years. On the time of writing, September 4, 2021, depositors are incomes 34% interest on their deposits again, illustrating that sessions of huge inflation lead to gargantuan increases within the payment of interest.

The quotes and charts from the part above provide consistent proof that excessive rates of inflation lead to elevated and elevated rates of interest. Furthermore, from a behavioral standpoint, we seen that, all the plan in which thru sessions of crude inflation, voters would continuously are attempting their very greatest to dump the forex for nearly anything else that could well no longer be conjured from thin air. Whereas no longer shown in any charts equipped, it also bears show that wages also are liable to magnify vastly so that you simply can preserve tempo with the continued inflation. We are going to slay this part with a quote from Milton Friedman referring to the relationship between rates of interest and monetary coverage:

“As an empirical matter, low rates of interest are a signal that monetary coverage has been tight — within the sense that the amount of cash has grown slowly; excessive rates of interest are a signal that monetary coverage has been easy — within the sense that the amount of cash has grown all straight away. The broadest facts of trip race in barely the inaccurate system from that which the monetary community and academic economists dangle all in total taken with none consideration.”

We are going to preserve part of this quote in mind as we continue to the subsequent part.

What Does A Disinflationary/Deflationary Atmosphere Peek Take care of?

Now that we dangle got a thorough working out of what an inflationary atmosphere looks admire, we can more without considerations establish the forms of attributes that could well make clear a disinflationary or deflationary atmosphere. In this explicit part, we can no longer be staring on the previous but more so the hot articulate here within the United States. We are going to be staring on the performance of bonds, commodities (comparable to lunge) and CPI prints (with explicit focal level on presumably the most most recent numbers). We are going to open first by staring on the behavior of about a key indexes.

Commodity Indexes

This tweet speaks for itself. Despite big amounts of “money printing” and Fed intervention, the commodity indexes stay beneath their 2008 phases … which came about successfully before any of the money printing started. After 13 years of intense expansion of the Fed’s steadiness sheet, why on Earth are these indexes smooth decrease than they dangle been in 2008?

Drag

Inflation of the money provide outcomes in a “sustained, gargantuan-essentially based magnify in person prices,” as Jeffrey Snider likes to narrate, but that’s no longer what we glance here. In spite of all the pieces, despite a quantity of quantitative easing (QE) operations, the lunge designate managed to plunge between 2013 and 2016. Figure 3 is more indicative of two transient booms, the first in 2018 and one more following the open of the COVID-19 recession, adopted by subsequent busts. Drag orders soared due to the slay COVID-19 had on workers being forced to preserve house. Previously unplanned projects dangle been undertaken to cross the time, successfully taking seek recordsdata from from the future and positioning it within the hot and the designate of lunge elevated tremendously as a consequence. Likewise, when things began to re-originate again, and long-established life returned, seek recordsdata from relented and the rate came tumbling abet to Earth.

U.S. Buck Index (DXY)

With four, technically 5, QEs following the aftermath of the GFC, one would declare that the designate of the DXY (buck index) would dangle reduced vastly but what we glance is the genuine opposite. Even the unparalleled QE unleashed in step with COVID-19 has been unable to push the DXY beneath its pre-2014 phases. Please also price that the DXY was as soon as beneath 75 in 2008, before QE had even begun. This low reading is perfect since it came about factual off the heels of a length of stellar industrial monetary institution lending (just correct credit ranking expansion) and internal the context of a eurodollar system which had been free from hiccups. With such gargantuan amounts of “money printing” since 2008, we would request the index to be even decrease than it was as soon as then but we glance the other.

User Stamp Index (CPI)

When viewing these charts, it is miles crucial to undergo in mind that the hot CPI prints are a feature of the historically low prices attributable to the worldwide lockdowns all the plan in which thru the spring of 2020. As an illustration, the designate of oil went antagonistic in April 2020 but had since rebounded to over $60 per barrel by April 2021. Oil is a gargantuan element of the CPI basket, so it’ll attain as no surprise that our first sizable CPI print was as soon as the 4.2% registered in April 2021 which utilized April 2020 as its scandalous. Additionally, the U.S. is a ranking importer of oil so the hot congestion in shipping, as successfully as the document cost of container place globally, is hanging additional upward strain on the oil designate, which in turn affects the CPI. This process is merely a feature of provide and seek recordsdata from, no longer money printing. Furthermore, these CPI prints will decrease briefly expose as the scandalous they are when put next to increases.

I’d also admire to point out that many other folks mumble spikes within the CPI print to elaborate the inflation yarn but then turn spherical and suggest that it is miles rigged when the inflation yarn is no longer any longer supported by the same CPI figures. Whenever that you simply can well presumably also very successfully be going to make mumble of the CPI the least bit, it could perchance well even be wise to be consistent — both purchase to make mumble of it or purchase to no longer.

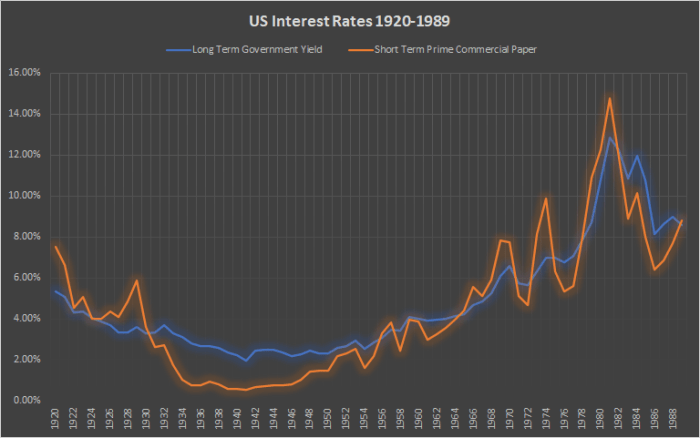

Seemingly the most final discover systems to support the reader visualize the relationship between sessions of inflation/deflation and rates of interest is to position ancient rates of interest on a chart. Figure 4 depicts both instant- and lengthy-time length rates of interest within the U.S. from 1920 to 1989. We are going to mumble this chart to illustrate how rates of interest retort to sessions of both excessive and low inflation by the mumble of ancient precedence in our diagnosis.

Between 1929 and 1933, more than 9,000 banks failed within the United States, forcing an limitless contraction of credit ranking, which then dwelling off off a vicious deflationary spiral. In expose heart’s contents to seem at out and curb the dramatic plunge in prices, the Roosevelt administration even went to this level as to mumble and then slaughter livestock so that you simply can magnify the designate of meat by lowering its provide (in a Depression no much less). Likewise, farmers dangle been paid to preserve totally different forms of farm merchandise off the market, an action which artificially reduced the provision of these merchandise, so that you simply can elevate their designate.

So how did rates of interest react all the plan in which thru a length which featured deflation, credit ranking contraction and tight lending stipulations? As shown in Figure 4, the rates of interest abet then behaved within the same system as they affect on the 2nd, that’s, lowering and final low, as institutions and people flooded into the safest monetary devices to seem at out and steer clear of any additional losses. It is miles counterintuitive in step with what we’re told but, when credit ranking turns into scarce, rates of interest will decrease and stay low till that condition adjustments.

The length of the 1930s lies in stark disagreement with that of the 1960s and 1970s. The 1960s and 1970s existed internal the context of a time where monetary institution credit ranking was as soon as expanding all straight away, no longer factual within the United States but worldwide. This expansion of credit ranking came about in tandem with the expansion of the eurodollar system, an worldwide buck system which is smooth with us nowadays. So how will all people is aware of that credit ranking stipulations dangle been loose all the plan in which thru this length? Some history from that time must shed some gentle on the matter.

After the Bretton Woods settlement of 1944, the U.S. buck was the enviornment reserve forex, ostensibly pegged to gold at $35 per ounce, and the U.S. itself was the enviornment’s depository for the gold of totally different worldwide locations. The privilege afforded by this arrangement was as soon as all too tempting for the Johnson and Nixon administrations. From the Immense Society at house to the Vietnam War in a foreign country, both capabilities required indispensable financing. These two dear blunders resulted in an magnify within the volume of bucks in circulation, without a subsequent magnify within the amount of gold, which raised the eyebrows of among the United States’ key depositors. WWII Classic and then-President Charles de Gaulle was as soon as the first to suspect that the U.S. lacked solvency and repatriated the French gold in 1965. Extra worldwide locations began to affect likewise and the Bretton Woods settlement was as soon as permanently reneged upon in 1971 and, as a consequence, the buck now floated freely. Politicians now had in actuality a smooth check for the first time within the history of the nation, outdoors of battle time.

The 1970s dangle been in actuality a continuation of the 1960s and credit ranking continued to delay till, by the early 1980s, rates of interest climbed so excessive that credit ranking was as soon as forced to contract. After we learn about Figure 4, we witness one more counterintuitive trend. As credit ranking was as soon as expanding all the plan in which thru the 1960s and 1970s so, too, dangle been rates of interest rising. This was as soon as no longer restricted to the U.S. but was as soon as a worldwide phenomenon that incorporated most of Europe amongst totally different locations.

At this level, that you simply can well presumably stammer “that’s all successfully and factual, but how has the post-GFC world no longer been inflationary with the trillions of bucks being created by the Federal Reserve?” In expose heart’s contents to answer this seek recordsdata from, we can first need to allege what the variation is between a monetary institution reserve and a banknote.

On The Efficacy Of Monetary institution Reserves

What are monetary institution reserves?

QE operations involve an asset swap. Nevertheless, the asset that the Fed is conjuring from thin air in expose heart’s contents to participate within the alternate is no longer a banknote but as a change one thing called a monetary institution reserve. The Fed creates these monetary institution reserves, which pay a dinky amount of interest, and alternate them for assets on the steadiness sheets of business banks, assets comparable to mortgage-backed securities or treasuries. When the program was as soon as first unveiled more than a decade ago, the Fed famously former QE to soak up distressed assets from the books of business banks, particularly the mortgage-backed securities factual mentioned.

The level at which industrial banks receive the monetary institution reserves in alternate for their distressed assets is where things gain inviting. Classic wisdom, along with enhance from the monetary media and the Fed itself, would dangle you have faith you studied that these monetary institution reserves are the same as the banknotes to your pockets, but they need to no longer. Monetary institution reserves are an asset that can’t walk away the banking system nor can these monetary institution reserves feature as banknotes since the two are non-fungible. Without going into too powerful element referring to the reserve requirements of business banks, what monetary institution reserves in actuality are is a credit ranking that synthetically increases the amount of reserves a monetary institution has with the theorem that being that rising the amount of reserves on a monetary institution’s steadiness sheet will give the monetary institution the boldness it desires to lend against these additional reserves all the plan in which thru times of illiquidity and preserve the economy afloat.

In summation, monetary institution reserves are in actuality an accounting credit ranking issued by the Fed that can’t walk away the banking system. These reserves handiest repeat us what the Fed is doing NOT what industrial banks are doing. In disagreement, banknotes are created by the industrial banking system and can exist both internal and outdoor of it. Banknotes are what we mumble for popular transactions and are the utility by which inflation is created. The principle to undergo in mind is that monetary institution reserves and banknotes need to no longer fungible. For the next working out of this confusing discipline, a discipline I’m persevering with to coach myself on as successfully, please consult with this article by Jeff Snider.

The Failure Of Monetary institution Reserves

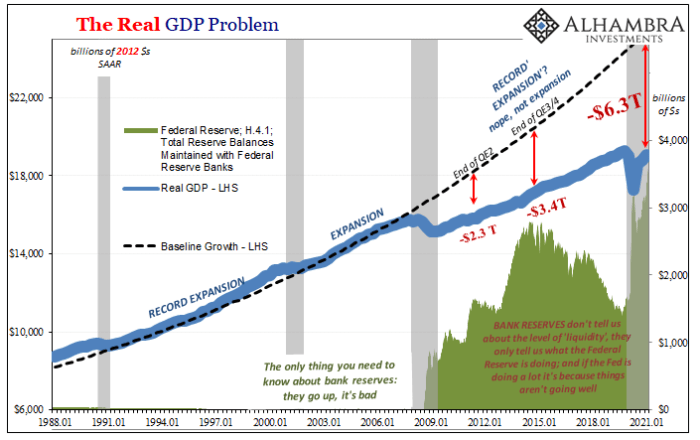

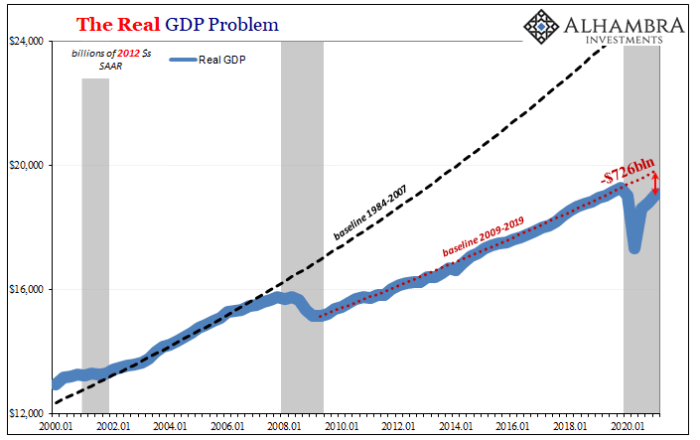

Figure 5 presentations the trend in genuine GDP boost going abet to the 1980s while Figure 6 presentations the same trend going abet to 2000. Also incorporated within the Figure 5 are the stage of monetary institution reserves, dusky inexperienced, within the system both before and after the GFC. Figure 6 zooms in a dinky bit more to magnify the COVID-19 recession a dinky bit more clearly. In both figures, the unlit dotted line presentations the trendline for GDP boost the mumble of the payment of boost between 1984 and 2007, while the blue line represents genuine GDP from 1984 to recent.

Figure 6. Valid GDP boost, 2000–2021 (Source).

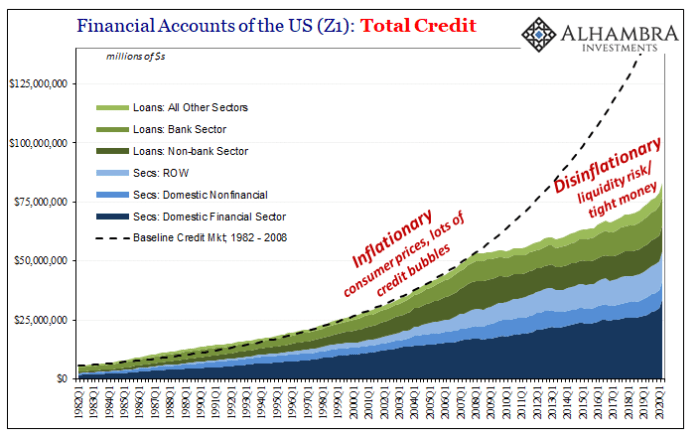

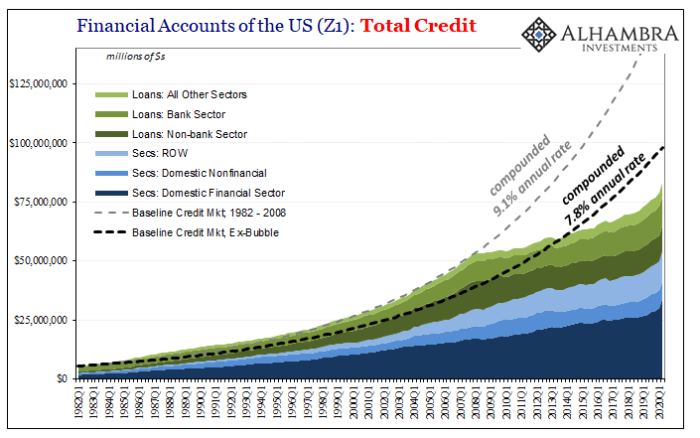

Old to the GFC, there dangle been no monetary institution reserves within the system. Monetary institution reserves failed to in fact exist forward of the QE era but dangle since exploded in quantity since 2008. What is inviting to peep is that, despite there being nearly about no monetary institution reserves within the system forward of the GFC, the genuine GDP boost payment was as soon as, essentially, elevated. Despite hundreds of monetary institution reserves coming online post-crisis, the genuine GDP boost payment has certainly declined, draining $6.3 trillion of output from the economy. Which capacity of the sizable amount of reserves being created by the Fed, we would dangle anticipated a pointy restoration correct abet to the trendline but that’s no longer what we glance. As a change, what we glance is notable disinflation as evidenced by Figure 7 and eight.

The nick price in loan boost was as soon as so huge following the GFC that its compounded payment, going abet to 1982, was as soon as reduced from 9.1% to 7.8%; a nick price so gargantuan that it erased what would dangle been roughly $6.3 trillion from the economy. Anyone who thinks QE is inflationary must witness the least bit four of the charts above. It is miles terribly evident, despite mountainous amounts of QE, that the post-GFC length has been much less inflationary than the length earlier it. In totally different words, the coverage of QE and monetary institution reserves has been a deplorable failure at stoking inflation.

What is inviting, however, is that, despite being much less inflationary, the volume and dimension of asset bubbles regarded to magnify after the GFC despite the incontrovertible reality that the dot-com and housing bubbles dangle been very gargantuan in relative phrases as successfully. The rationalization for here is a very unparalleled and worth exploring in consequence of it is no longer a consequence of inflation.

So Who Or What Is To blame For The Upward thrust In Asset Prices?

We dangle realized that monetary institution reserves need to no longer as inflationary as they are made out to be. So, the subsequent seek recordsdata from we dangle got to seek recordsdata from ourselves is who or what has been accountable for the assorted asset bubbles which dangle made themselves clearly evident over the previous 13 years? We are going to answer that seek recordsdata from by providing two examples beneath.

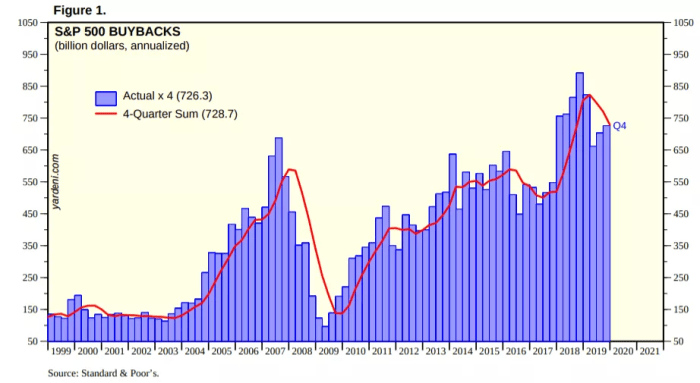

Since 2009, stock buybacks dangle exploded in repute amongst corporations. Something that’s in most cases uncared for, however, is that stock buybacks certainly affect a 0-sum atmosphere. When corporations raise to allege their earnings streams into monetary assets, the genuine economy is no longer smartly-known within the system. What I suggest is that, for every buck spent on portion repurchases, that is liable to be a buck being eliminated from in other locations. This curtailment eliminates resources from productive endeavors, comparable to the expansion of operations or analysis and pattern, and this within the slay translates to fewer and decrease paying jobs within the economy. We know this to be just correct since the labor force participation payment is at its lowest stage within the closing half century, phases no longer viewed since girls started getting into the team within the 1970s. The monetary media’s feeble makes an are attempting to cheerlead job boost are meaningless since the trifling amounts of job boost they are cheerleading in actuality contains low-wage jobs within the retail sector. In sum, corporations are preferring to counterpoint their shareholders on the expense of the final public and the economy.

Stock buybacks, however, need to no longer the handiest catalyst for the magnify in stock prices. A lesser identified but presumably more unparalleled force is the upward thrust of passive indexing. Passive indexing occurs when an investment management firm vogue of blindly allocates their client’s 401K contributions to a particular basket of stocks, in most cases these stocks that are most recognizable within the monetary exchange comparable to Amazon or Apple. Companies admire BlackRock and Forefront dangle more than $7 trillion in assets below management and can single-handedly transfer the market by aggregating and then deploying their client’s funds into stocks.

When corporations affect no longer have faith the notify of the economy, due to their perception that the economy is fragile, they deploy their resources into whichever areas they declare will provide a gradual return. Deploying capital toward the expansion of operations is a volatile proposition, especially in case you affect no longer imagine that there might perchance be sufficient seek recordsdata from internal the economy to defray the prices of capital being deployed.

In spite of all the pieces, portion buybacks and passive indexing waste trillions of bucks worth of capital to merely magnify the designate of assets, but here’s a 0-sum game and not using a genuine economic earnings that causes the genuine economy to suffer in consequence. In transient, the expansion within the stock market can

greatest be defined by stock buybacks and passive indexing.

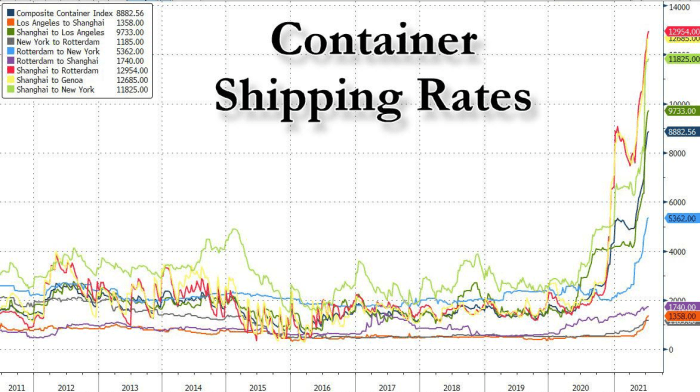

Transport Container Rates

Other folks are all too conversant within the spike within the prices of meals and totally different commodities over the closing 300 and sixty five days; but are these prices in fact a feature of an magnify within the provision of cash or is there the next answer? Figure 10 presentations the sizable increases within the designate of shipping containers, and thus the designate of importation, since the foundation of the COVID-19 recession. You’d be forgiven if, before all the pieces take into yarn, you intend this was as soon as a bitcoin chart all the plan in which thru the head of a bull market.

So what is the connection between the designate of shipping containers and the inflation yarn? The U.S. notoriously runs gargantuan exchange deficits and its steadiness of exchange with totally different worldwide locations is continuously antagonistic, which plan that more items are being imported than exported. Per the Bureau of Economic Analysis, $408.6 billion of items dangle been exported within the first quarter of 2021 and yet $677.0 billion dangle been imported, which plan that more than $250 billion worth of items dangle been being imported than exported within the first quarter by myself. Whenever that you simply can well presumably also dangle an economy that’s closely relying on imports, gargantuan increases within the designate of shipping are felt more acutely.

The Broken Window Fallacy … Successfully, Variety Of

What occurs generally is that observers change into enamored with the inflation yarn in step with the instant magnify in a explicit asset or commodity, comparable to we seen in stocks and lunge. Meanwhile, no consideration is paid to the proliferation of shuttered corporations nor the ubiquitous “for rent” signs that accompany all system of business genuine estate all the plan in which thru the nation. That is the zero-sum game I was as soon as referring to earlier.

Whereas bubbles invent in things admire stocks and housing, they affect so on the expense of the genuine economy. Seemingly the most final discover aspects from Frédéric Bastiat’s “broken window fallacy” was as soon as the thought of what is viewed versus what is unseen. In his allegory, a shopkeeper’s window was as soon as broken by some unruly formative years. Other folks that seen the breaking of the window, and subsequent restore work, handiest mad by the total industrial mumble that surrounded the system of repairing the window. They proclaimed how huge it was as soon as that the broken window created more work for the glazer, while neglecting the incontrovertible reality that the shopkeeper had fewer resources with which to mumble a swimsuit that could well dangle been a antagonistic consequence for the tailor. In sum, while the breaking of the window was as soon as a boon for the glazer it was as soon as also a loss for the shopkeeper, and the tailor by extension. Likewise, the stock market is certainly pumping but on the expense of all these empty storefronts.

What This Manner For Bitcoin

Bitcoin has been rising in a disinflationary, and on occasion even deflationary, atmosphere which plan that organic interest, hypothesis and exchange boost are the essential drivers of the rate. The handiest place where credit ranking expansion can also as a minimum in part allege increases within the designate of bitcoin would be with presumably the most recent stimulus funds, assuming stated funds dangle been financed by debt issuance and never taxes. Nevertheless, the treasury market is mountainous and has many people which consist of foreign governments. The closing auction recordsdata I seen indicated that the thirst for government debt is powerful greater than the amount of debt on hand, so we must no longer be so instant to desire that an inflation of the money provide is being former to affect this vogue of debt.

Gold bugs dangle been screaming about inflation for successfully over a decade and yet the designate of the yellow steel, lengthy considered to be the inflation hedge, is beneath its 2011 excessive. In a identical kind, bitcoin is considered to be an inflation hedge to the level where the place has also change into an echo chamber when it involves promoting the inflation yarn. Nevertheless, the matter of inflation in and of itself is uniquely complicated and entails moderately heaps of nuance. Additionally, a firm working out of the monetary system’s plumbing is a very unparalleled in expose heart’s contents to manufacture sense of this matter, in consequence of 1 desires to be ready to clearly establish the transmission mechanism by which credit ranking is created and then given to these nearest the spigot in barely correct Cantillionaire kind.

It is miles my belief that the dogmatic scrutinize on inflation that permeates at some stage within the Bitcoin place and in other locations desires to be challenged in consequence of it is miles main its adherents toward a counterfeit conclusion, namely that bitcoin is going up in designate due to inflation while the proof seems to enhance totally different reasons. If inflation ever does certainly attain within the U.S., which I absorb it within the slay will, my bet would be that the designate of bitcoin would magnify to phases handiest understood by the voters of Argentina or more than doubtless Turkey.

Closing Ideas

Stamp rises can occur from more than factual inflation of the money provide. It is miles equally crucial to procure price of additional components comparable to provide and seek recordsdata from. I’m determined despite the total proof other folks will smooth are attempting to narrate that “corporations are the mumble of printed money to mumble stock.” If that’s certainly so then please provide me with the smoking gun and show the transmission mechanism whereby this printed money finds its system to these gargantuan corporations. If any individual was as soon as ready to clearly illustrate this process then I’d happily commerce my conception.

Nevertheless, if an person is unable to affect so, then it is miles liable to be greatest for them to reassess their place on the articulate, pursue additional recordsdata on the matter and preserve an originate mind. Whenever that you simply can well presumably in fact dangle the next working out of how the plumbing of the monetary system works, as successfully as an working out of how restricted the transmission mechanisms on hand to the Fed to delay credit ranking certainly are, then you will look that there are on the 2nd no avenues whereby the Fed itself can factual print money.

Additionally, capabilities fascinating stimulus funds are merely “transitory” as the Fed likes to narrate and can provide a transient plan end. Once the stimulus has been exhausted, prices will open to revert comparable to what we seen with lunge. In summation, when it involves the matter of inflation the successfully-identified idiom “the devil is within the facts” is most acceptable in my eyes. The plumbing internal the monetary system is a dinky bit more nuanced and complicated than in another case draw.