Learning Bitcoin With Charts: How Are Hash Payment, Difficulty And Charges Related?

Bitcoin’s danger adjustment mechanism is idea to be one of its most valuable facets, but discovering out the perfect plot it in actuality works on the complete is a daunting task. This text leverages on-chain info to visualise how this mechanism works and the perfect plot it relates to hash payment, block intervals, transaction costs, and the mempool. After discovering out this text, you luxuriate in a greater working out of why at particular cases utilizing Bitcoin may perhaps perhaps additionally seem like barely gradual and pricey, but also how Bitcoin fixes this and why this job is so significant to make certain Bitcoin’s monetary properties.

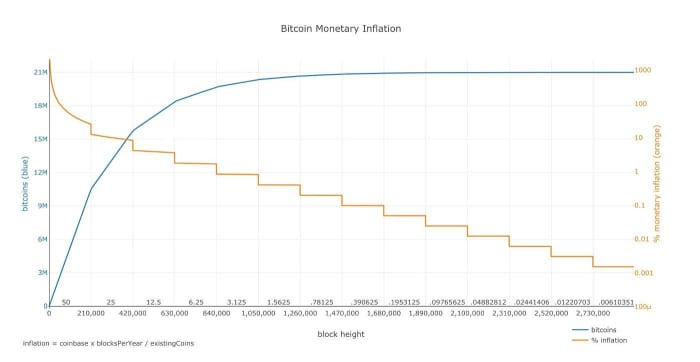

Bitcoin’s Supply Issuance Schedule

In case you luxuriate in gotten heard of Bitcoin, you luxuriate in gotten potentially heard that its provide is exhausting capped at 21 million items (BTC), making it a completely scarce asset and thus the final “exhausting money.”

When Bitcoin turned into created, miners received 50 BTC for every fresh block as a reward for their work. The software program has a constructed-in rule that after every 210,000 blocks which shall be mined (approximately every 4 years, if the block interval is 10 minutes), this “block subsidy” is in the low cost of in half for the length of an occasion called “the halving.” During this first “reward generation”’ which ended November 28, 2012, 10.5 million BTC were mined — half of its most provide. Throughout the second reward generation, half of that quantity (10.5 million / 2 = 5.25 million) turned into issued, followed by half of that (5.25 million / 2 = 2.625 million) for the length of the third reward generation — and quite lots of others. After 32 halvings, the block subsidy equals the smallest unit in Bitcoin (0.00000001 BTC = 1 sat) and can’t be split after, meaning the block subsidy falls away entirely after that (believed to be in the twelve months 2140, if block intervals were 10 minutes for the length of its complete existence). The well-known 14 reward eras of Bitcoin’s issuance agenda are visualized in resolve one.

The careful reader can luxuriate in seen that in the earlier paragraph, we mentioned twice that the exact calendar dates on which these halving occasions occur depend on the block intervals and that we assumed 10 minutes right here. Why is it valuable that this provide issuance agenda is predictable in fashionable calendar-cases in the well-known situation?

The Significance Of Pretty Stable Block Intervals

Let’s take into myth what it would glance fancy if Bitcoin didn’t luxuriate in a constructed-in danger adjustment mechanism, but simply had a mounted mining danger.

If that mounted danger had been house barely excessive, early mining would had been very pricey and blocks would luxuriate in reach in at a extraordinarily gradual wobble early on. Clearly, that wouldn’t had been very glorious to bootstrap a brand fresh community and can luxuriate in intended that it by no advance succeeded in the well-known situation.

On the different coarse, if the danger would had been house barely low to incentivize early community participants to affix, block intervals would luxuriate in shriveled as extra miners joined the community, and blocks would luxuriate in reach in at an increasingly extra faster wobble. It would luxuriate in hasty bound thru its complete provide issuance agenda. Had this took situation, the Bitcoin community likely wouldn’t luxuriate in had passable time to fetch the block situation market significant to sufficiently incentivize miners to take mining blocks in bellow to job transactions and stable the community after the block subsidy had bound out.

To summarize, barely genuine block intervals are significant to unfolded Bitcoin’s provide issuance over time, which in turn is significant to incentivize miners to take joining the community over a barely long bootstrapping interval, to boot to to steadily fetch a block situation market that shall be ready to take the lights on after the block subsidy reward runs out.

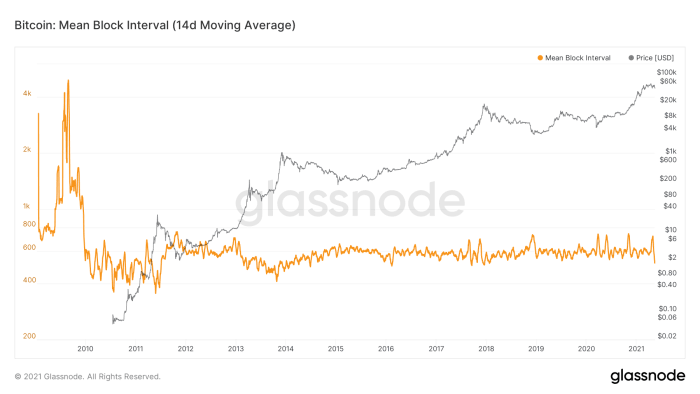

To guarantee that block intervals will remain barely genuine over a multi decade interval, Bitcoin has a danger adjustment mechanism. As shall be considered in resolve 2, even with this constructed-in danger mechanism, its block intervals weren’t very genuine, averaging for far longer than 10 minutes per block for the length of its first twelve months of existence. The block intervals grew to change into extra genuine after Bitcoin house its first market label in July, 2010, and had been barely genuine at proper below 10 minutes for over 5 years now (no structural up or down traits in the orange line in resolve 2) – works fancy a charm.

Bitcoin’s Difficulty Adjustment Mechanism

To mine bitcoin, miners exercise extremely in actuality expert computers to on the complete wager a particular number (a tiny simplified explanation). When a miner finds the number that the community is presently having a see for, that miner earns the finest to carry out a brand fresh block on the Bitcoin blockchain, pick its block subsidy, pick which transactions to incorporate in that block, and derive the costs of these transactions. At the time of writing, all miners which shall be active on the Bitcoin community are estimated to luxuriate in a complete capability (hash payment) of 170 exahashes per second (EH/s), which is 170,000,000,000,000,000,000 hashes per second.

In Bitcoin’s first twelve months of existence (2009), it turned into silent conceivable to mine Bitcoin on the Central Processing Unit (CPU; which is in actuality the central chip in a laptop that takes care of hundreds things) of a median particular person laptop, as the community’s hash payment turned into proper a couple of million hashes per second. Over time, extra computers joined the community and at final chips that were better at heavy number crunching via their Graphics Processing Unit (GPU), the chip in a laptop that’s utilized for graphical tasks and linear algebra) and even hardware personalized made for Bitcoin mining (an ASIC, or Software program Particular Built-in Circuit) turned into weak.

As it is seemingly you’ll perhaps accept as true with, as the community’s hash payment increased by a multi-trillion-fold from that first twelve months till now, it turned into significant to fetch it significant extra difficult to wager that particular number to make certain barely genuine block intervals of approximately 10 minutes each

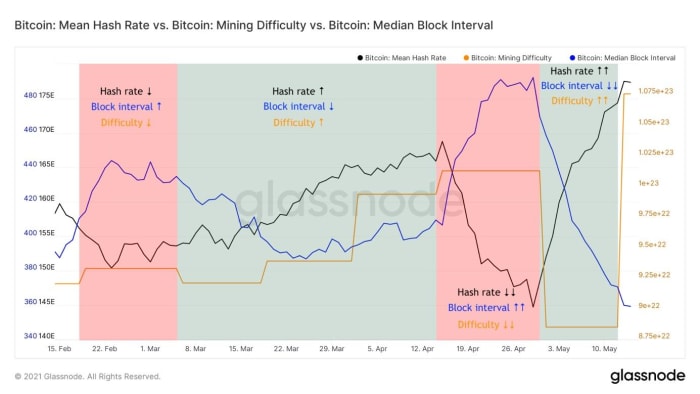

In Bitcoin, “danger” is the measure for the advance exhausting it is to hunt down that number that the community is having a see for. Every 2,016 blocks (14 days if block intervals are 10 minutes), the Bitcoin software program on the complete calculates the block intervals for the length of that interval and adjusts the danger so that right this moment capability, the common block interval shall be roughly 10 minutes over again.

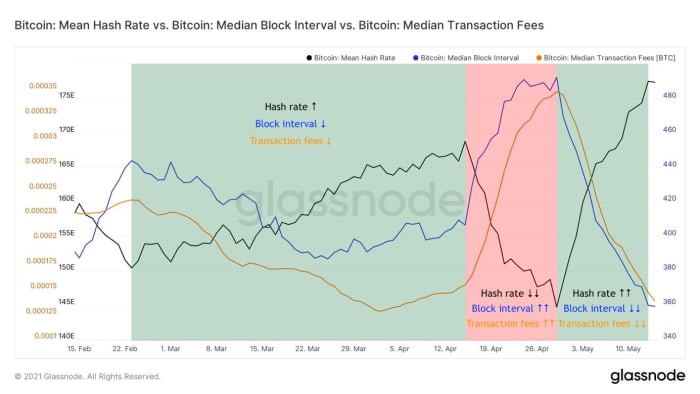

The interplay between Bitcoin’s danger (the 14-day tantalizing common of the) hash payment and block intervals over the final three months is visualized in resolve 3. Throughout the well-known visualized danger adjustment interval (the crimson column on the left), the hash payment turned into declining (downtrend in dark line). As community capability diminished, block intervals increased (uptrend in blue line), making it significant to diminish the danger (tiny tumble in orange line after this interval).

In three danger adjustment classes after (first green column in resolve 3), the hashrate turned into growing over again, blocks came in faster than deliberate and danger adjusted upwards three cases. Mid-April, 2021 (appropriate crimson column), there turned into a trim energy outage in China that led to a big tumble in Bitcoin’s hash payment, slowing down blocks plenty and making a gigantic downwards danger adjustment significant after the interval. After this took situation (appropriate green column), the energy outage itself turned into solved and the downwards danger adjustment made it significant more straightforward for miners to carry out blocks over again. Consequently, some miners with much less efficient hardware and/or extra pricey energy may perhaps perhaps impact a profit mining over again, truly overcompensating the earlier lack of hash payment, truly sending it to fresh all-time highs.

This most modern hash payment tumble and recovery is a proper example of why miners leaving the community does no longer luxuriate in a cascading discontinue of extra miners leaving the community (typically called the “mining death spiral” by critics), however the software program simply will increase the closing miners’ profit margins, incentivizing different miners to (re)be a part of the community.

Transaction Charges

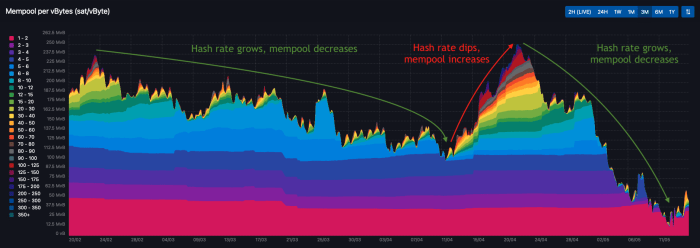

An aspect discontinue of this mechanism that all of us feel is its impact on transaction costs. During cases when the hash payment will increase and blocks are coming in faster than deliberate (green columns in resolve 4), transactions can barely without problems be included in blocks. Since this implies that there are much less transactions queued up in line (in Bitcoin called the “mempool”) to be included in upcoming blocks, transaction costs shall be barely low.

The reverse is proper for the length of classes the keep hash payment drops and block intervals elevate (crimson column in resolve 4). When blocks are coming in slowly, the queue of transactions ready to fetch included will get crowded, and folks luxuriate in to enlighten up their transaction costs to on the complete bounce the line. As such, transaction costs spike especially when the community capability decreases (hash payment drops) and is able to be bailed out by the following danger adjustment.

ned the costs of transactions that were included in blocks. For these having a see to transact on the Bitcoin community, it is significant extra linked to fetch a feel for the advance significant the total transactions which shall be silent ready in line to be included in future blocks are bidding for their significant block situation.

Mempool

As briefly mentioned above, the Bitcoin mempool shall be interpreted as the total of all transactions which had been broadcast on the community but are silent ready in line to be included in a future block. Technically, each of the hundreds of Bitcoin nodes on the community has its have mempool, but since they are mostly successfully interconnected, visualizing them as a single ready line is alright for total explanatory capabilities.

Mempool.situation is an industry-standard internet sites that affords someone no longer running their very have node or simply having a see to fetch a like a flash glance on the mempool your complete linked info. Examples are the total measurement of the ready line (mempool measurement), what number of transactions are joining the queue (incoming transactions), if blocks are coming in faster or slower than expected (estimated danger adjustment) and estimations of how excessive the transaction price of a brand fresh transaction must be to be included at low, medium, or excessive priority.

Resolve 5 visualizes the mempool of the final three months. As it is seemingly you’ll perhaps seek info from, the patterns described in resolve 4 shall be considered right here. Between behind February and early April 2021, when the amount of hash payment on the Bitcoin community increased and extra blocks than deliberate were created, the mempool measurement (the scale of the ready line) diminished and transaction costs diminished correspondingly. After the mid-April hash payment tumble, the mempool hasty increased and transaction costs skyrocketed, but both declined rather hasty after the April 30th danger adjustment, and subsequent hash payment development to all-time highs.

The Future Block Put Market

As briefly mentioned at an earlier point listed right here, Bitcoin’s block subsidy is designed to decay over time, and the pattern of a healthy block situation market the keep transaction costs change into the well-known provide of income for miners is significant to incentivize miners to take processing transactions and securing the community in the long-bound.

Right here’s maybe a really grand test that awaits Bitcoin in some unspecified time in the future, and is the matter of my earlier Bitcoin Magazine article titled “An Ode And Coming near near Obituary To Bitcoin’s Four-twelve months Cycle,” which is a suggested educate-up read. At final, whenever you occur to’ve got gotten any questions about the topics mentioned listed right here, be at liberty to ship me a message on Twitter.