Public bitcoin mining companies had been an unusually mighty fixture of the crypto marketplace for the past couple of years as traders, media and regulators peek their financial development and operational expansions. Whereas half prices for nearly all of these companies critically outperformed bitcoin for the length of the most customary bullish market pattern, the reverse elevate out is clearly in play now as public miners strive and weather the on-going absorb cycle. In point of fact, none of these companies absorb managed to outperform bitcoin to this level in 2022.

This text explores a bunch of files relevant to the performance of public mining companies, different strategies from these companies in fresh market prerequisites, and why the public mining market matters to the broader bitcoin financial system.

Public Bitcoin Mining Firm Data Overview

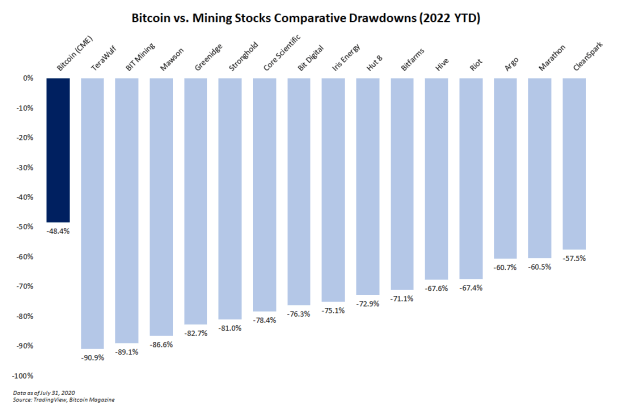

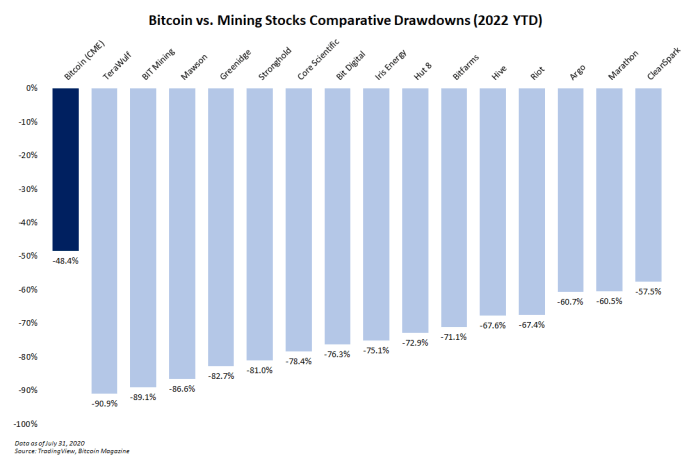

Bitcoin has had a no longer easy one year to this level. However public mining companies absorb had an even more challenging one year. The bar chart below visualizes the brutality with bitcoin’s one year-to-date drawdown alongside drawdowns for 15 leading public mining companies over the same time duration.

Bitcoin’s one year-to-date drawdown alongside the drawdowns of the leading public bitcoin mining companies demonstrates the brutality of this absorb market.

There’s no productive cause of overemphasizing the drawdowns. The numbers focus on for themselves.

The 5 worst performers to this level this one year that trade on the Nasdaq are:

- TeraWulf (-90.9%)

- BIT Mining (-89.1%)

- Mawson (-86.6%)

- Greenidge (82.7%)

- Stronghold (-81%)

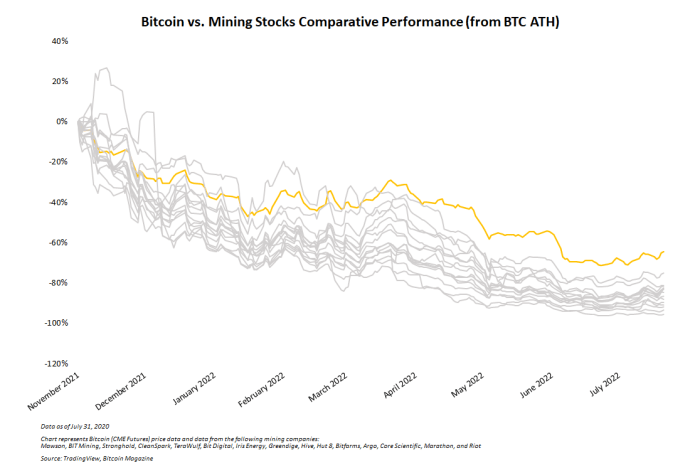

Unnecessary to issue, this invent of performance is now not any longer sudden taking into account the hot market atmosphere. A more complete picture of the comparative performance from bitcoin and mining companies is proven in the freeway chart below that entails designate files from bitcoin’s all-time excessive in late 2021 to the time of writing (the tip of July 2022). Bitcoin and all mining companies naturally trended down collectively, however no longer a single mining company outperformed (or had a drawdown less than) bitcoin.

Or no longer it’s rate noting that even over this 9-month duration, the tightened correlation between all mining stocks is obvious after May per chance moreover simply 2022, when compared with the aloof-close-however-noticeably-weaker correlations in the previous months.

The stock performance for public bitcoin mining companies is changing into more and more correlated.

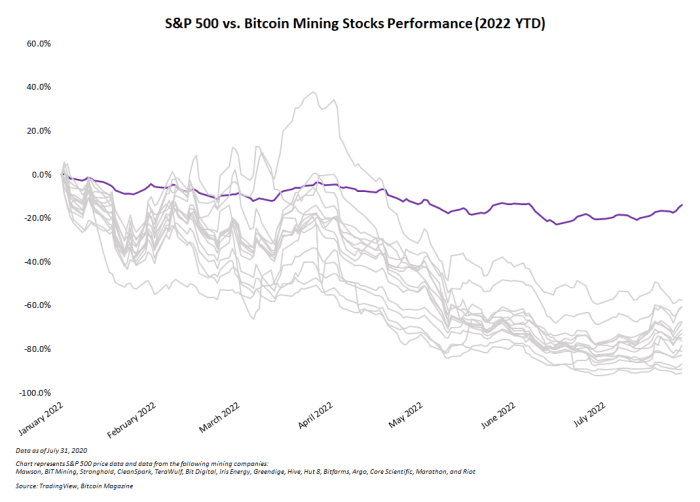

Even worse than comparing mining stocks to bitcoin’s drawdown is comparing them to the Commonplace and Unfortunate’s 500 stock market index. The line chart below reveals this files, and it’s obvious that the S&P 500 has trounced mining stocks to this level in 2022.

Bitcoin mining company stock performance when compared with the S&P 500’s is even worse than it’s when compared with the bitcoin designate.

Is this invent of underperformance irregular? In bearish market traits, no. Mining companies fabricate powerful better than bitcoin when bitcoin goes up. And when bitcoin goes down, mining companies descend even more difficult. It wouldn’t be subtle, however, to peep one or two miners fare a tiny bit better than bitcoin. However the market has been brutal across the board, and none of them absorb outperformed.

Summer Change On The Bitcoin Mining Sector

Environment apart the doom and gloom of the article as much as this level, miners are aloof operating properly despite market prerequisites. In many circumstances, month-to-month bitcoin manufacturing is growing, unique financing is being secured and enlargement plans are persevering with.

Particularly on month-to-month bitcoin manufacturing, for instance, the past few months absorb seen:

- Iris Energy boost manufacturing by 10% in May per chance moreover simply

- Hive mine over 278 BTC in June

- Greenidge boost manufacturing by 18% in June

Some public miners are persevering with to promote greater-than-regular amounts of their regular bitcoin manufacturing to weather the absorb market. Core Scientific and Argo are examples of this. Other miners are persevering with to relief many or the majority of the money they mine, at the side of Hut 8, which is increasing its holdings, and Marathon, which provided no bitcoin in Q2 2022.

And despite the absorb market, many public miners continue planning enlargement projects.

In contrast to six months ago, margins are aloof critically tighter for miners. Hash designate, bitcoin designate, yada yada. However what is arguably undoubtedly one of many perfect sectors in the bitcoin financial system is alive and growing even because the broader market is a tiny bit battered and beaten down. Core Scientific secured $100 million in fresh financing and signed a 75 megawatt (MW) web web hosting deal. CleanSpark continues shopping discounted mining hardware. Compute North and Compass Mining signed a 75 MW enlargement agreement. And Marathon secured a 200 MW web web hosting deal.

Bitcoin’s designate must aloof aloof be properly off its highs, however development in the mining sector is aloof humming along.

Who Cares About Public Miners?

In many Bitcoin circles, tiny-scale and at-dwelling miners are the darlings, no longer institutional mining entities. Even supposing all kinds and sizes of mining objects absorb their situation in Bitcoin, some readers also can surprise why the public mining market matters the least bit?

Part designate performance for mining companies is a reasonably correct gauge for broader investor curiosity in bitcoin, as adversarial to the bitcoin designate itself. As more passe financial analysts are paying consideration to the mining market, it’s more and more beneficial to gauge classic sentiment spherical bitcoin.

Mining companies are also a excessive-beta investment automobile (or leveraged play) for bitcoin traders. So, if a specific investor is bullish on bitcoin and desires to outperform bitcoin itself, they also can set in mind investing in a basket of mining stocks.

The declare of the trade’s greatest miners could per chance moreover be a signal of the bitcoin financial system’s properly being. Miners are repeatedly the bulls of remaining resort for bitcoin. And even if trouble for public miners doesn’t repeatedly indicate trouble for bitcoin, the inverse is incessantly correct. Horny instances for public mining companies typically signal correct instances for bitcoin.

Public Bitcoin Miners Are HODLing On

The unique bitcoin absorb market has been brutal for public mining companies because the charts listed here display conceal. Despite this, most public mining companies continue to relief bitcoin, actual unique web web hosting and financing deals, and prepare for the next bull market and the impending halving match. Whether the market will earn worse earlier than it gets better is an commence question. However the mining sector is removed from boring or beaten down. Bitcoin mining is weathering the absorb market besides to anyone also can question.

Here’s a visitor put up by Zack Voell. Opinions expressed are totally their like and attain no longer essentially middle of attention on these of BTC Inc or Bitcoin Magazine.