Bitcoin Attacks The Final Ponzi Plot

Who Is Working The Final Ponzi Plot, And How Attain We Conclude It?

The Ponzi contrivance is a easy contrivance.

“A Ponzi contrivance is an investment fraud that pays novel investors with funds still from novel investors. Ponzi contrivance organizers on the general promise to make investments you money and generate high returns with little or no likelihood. But in loads of Ponzi schemes, the fraudsters carry out no longer make investments the money. As a substitute, they expend it to pay of us that invested earlier and could perhaps well encourage some for themselves.

“With little or no legitimate earnings, Ponzi schemes require a fixed trot along with the movement of newest money to continue to exist. When it turns into laborious to recruit novel investors, or when easy numbers of novel investors money out, these schemes are inclined to give contrivance.”

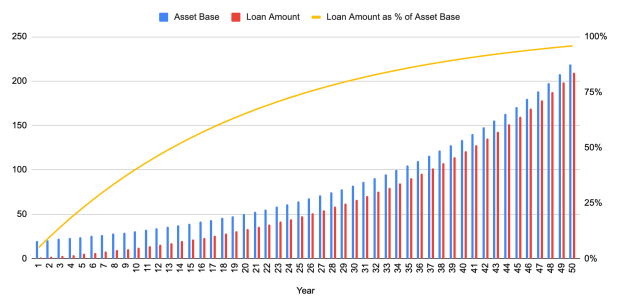

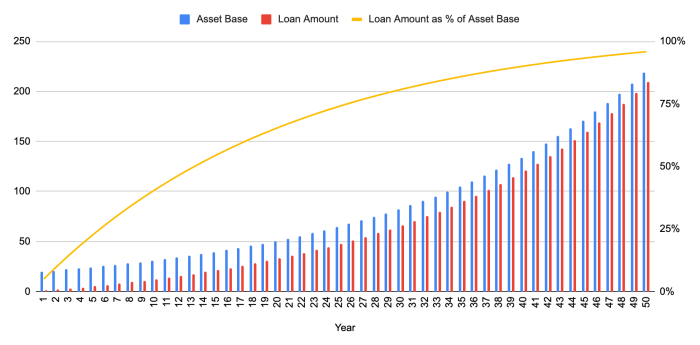

If we substitute investors with lenders, we are capable of survey at a a linked invent of Ponzi. Let’s survey at an instance: Let’s relate Acme Corp takes out a $1 million loan for twelve months against their $10 million in assets. They spend that $1 million, but they tranquil should pay help the bank $1 million plus 5% interest. So, Acme takes out one other loan for $2 million plus, pays help the precious loan, and retains one other $1 million to spend in the 2d year. In the third year, Acme owes that $2 million plus with interest, so that they expend out $3 million, plus adequate to cloak final year’s loan fee, with $1 million to spend in the third year.

As lengthy as a lender is tranquil intriguing to lend to Acme, this would possibly technically trot on as lengthy as Acme’s rate of interest is lower than the growth rate of their assets. Acme could perhaps expend borrowed money to raise more assets, extra fueling this machine.

As you would possibly well presumably see from the chart, the downside is that every time Acme takes out a novel loan, their total debt load grows and approaches the general value of their assets. If Acme’s debt load ever exceeds the value of Acme’s assets, Acme’s creditors will quiz their money help and Acme’s value — their total existence and all investments in them — will trot to zero overnight. This would possibly happen on story of rates of interest rising or asset values falling, even though the latter is over a short time for the length of some calamity.

For Acme’s countless money machine to encourage operating gradually, the rate of interest on loans should tranquil be lower than the increase rate of assets. If this continues, frail money owed could perhaps well be paid with novel loans. The general whereas, on the opposite hand, Acme faces likelihood from a downturn. If asset values trot under Acme’s debt burden, creditors will device calling — and Acme greater receive a slightly good explanation to encourage creditors from pulling out and leaving Acme penniless.

The longer Acme is in a position to speed the countless money machine, the bigger the nominal value of Acme and its assets goes, and the more difficult they and their investors fall when a unexpected drawdown triggers a margin name from creditors. For a valid world instance, see with out a doubt one of China’s greatest corporations, Evergrande:

From the article in the Financial Instances: “‘There is now not any contrivance we are capable of repay so many creditors with our restricted sources,’ said an Evergrande executive, who requested no longer to be acknowledged. ‘We are capable of let judges resolve who gets paid and the contrivance in which mighty.’”

Looks love a hazardous sport to play, but Acme is factual one firm. Attain we survey at this invent of Ponzi behavior at some level of a full financial system?

The World Limitless Money Machine

The Acme instance illustrates how the countless money machine Ponzi works and presents us one contrivance to predicament it from the starting up air: debt-to-equity ratios.

Let’s survey at your total equity market in america to see whether or no longer this invent of exercise is playing out broadly in our world.

Upright love Acme, the debt to equity ratio of US corporations presentations evidence of impolite leverage, practically touching 100%. This means your total US financial system is exposed to big systemic likelihood, and the problem is simplest getting worse.

Why are we seeing systemic likelihood increasing, and what can we provide out about it?

To respond to these questions, we should open up with rates of interest.

The Curiosity Fee Gods

An rate of interest could perhaps well be conception of because the time value of money — the quantity a borrower pays to borrow money for a contrivance length of time. That has similarities to any utterly different rental provider, love a vehicle rental; the general loaned quantity is the vehicle, and the rate of interest is one contrivance to impart the quantity you pay to rent the vehicle. Upright love every utterly different good or provider, the competition of provider suppliers over customers and repeated transactions could perhaps well lead to a “market value” for a loan, factual love costs for a linked companies and products at some level of utterly different vehicle rental corporations are inclined to converge.

In our contemporary financial system, on the opposite hand, we receive endowed rates of interest with a divine position, allowing central bankers to contrivance these rates quite than contributors in a free market. Central banks love the Federal Reserve alternate rates the utilization of their monopoly on the introduction and destruction of reserve money, which they expend to raise and promote assets internal the business banking system. These actions are convoluted, but their acknowledged intent is to impress all utterly different rates of interest in the financial system to transfer up or down.

Central banks thus encourage watch over a key lever of the countless money machine Ponzi: rates of interest.

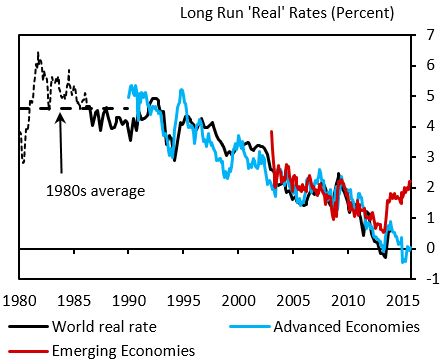

What are they doing with this lever? Reducing rates of interest gradually.

Provide: VoxEU.

As we be aware from the Acme instance, lower rates of interest makes countless money machine Ponzis more uncomplicated to speed, that technique more corporations and your total global financial system face systemic likelihood. On the opposite hand, an infinite money machine moreover requires asset values to gradually upward push faster than rates of interest with simplest contained downturns.

What’s going on with assets?

The The total lot Rally

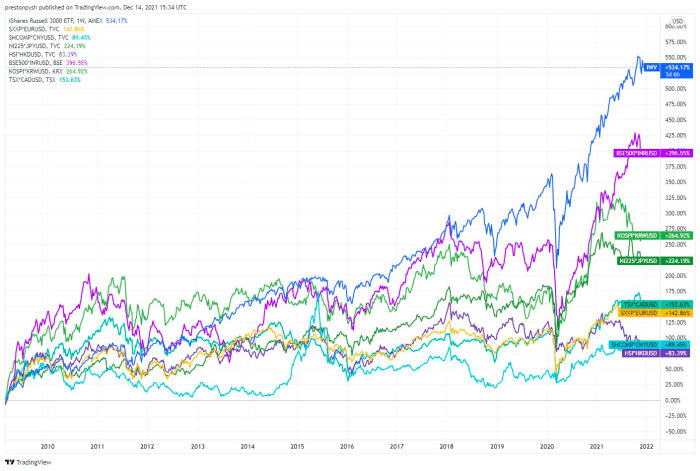

Asset values, on paper, are skyrocketing. Looks good, till you expend into story that this means heaps of room for countless money machine Ponzis and the systemic likelihood that includes them.

Main stock indices in buck terms (Provide: Preston Pysh).

The story in the help of asset values unearths the muse of this meteoric upward push. As central bankers and governments work together to lower rates of interest and contrivance credit ranking more accessible, they’re incentivizing savers to transfer their savings out of low-likelihood assets — love savings accounts — and into bigger likelihood assets — love shares of corporations.

Over time, this makes the S&P 500 and a linked indices into the novel savings accounts. Youthful generations know this, and in consequence, we see document-high participation in the stock market thru apps love Robinhood. Passive investing methods — love ETFs — see document reputation as successfully.

Savers who fetch a firm stock on the novel time are widening the divide between rates of interest and asset value increase for that firm, making it more uncomplicated for them to open up and withhold an infinite money machine. If we survey on the total American financial system, we are capable of see how rates of interest and asset values are diverging, opening the assorted for folk and corporations to infinitely borrow against their assets.

So rates of interest are held low, and in consequence, asset values are pushed bigger, solving two of the three pieces of our countless money machine. On the opposite hand, volatility tranquil represents a sturdy take a look at on the countless money machine, on condition that a adequate drawdown can stop the total ruse in an quick. How device the celebration isn’t over but?

Eliminating Downturns

A downturn in asset values endangers the debt-fueled celebration of countless money machines. This makes downturns a deterrent to even embarking on an infinite money machine Ponzi. Unfortunately, that deterrent is now but a relic of historical past as a result of the readiness of central banks and governments to intervene in downturns.

When downturns arrive, central banks and governments work together to make expend of authorities debt and newly printed money to encourage asset values afloat. “Making sure solvency” of a bank, as an illustration, technique defending its debt burden from exceeding its asset value — defending its countless money machine in operation.

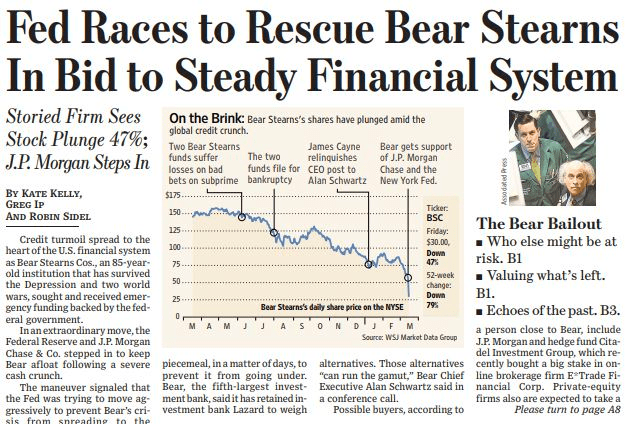

When money owed exceed asset values for a firm, that firm’s value quick goes to zero – except they fetch a bailout (Provide: Wall Boulevard Journal).

Banks are on the general the precious beneficiaries of authorities bailouts but no longer the final. With every crisis, central banks and governments are injecting more money even extra at some level of the financial system.

So, low rates of interest power high increase in asset costs, widening the fertile ground on which countless money machine Ponzis develop and fetch. Downturns on the general minimize these Ponzis down, but we see governments stepping in to bail them out with but more credit ranking. This, in flip, feeds asset costs, and on and on the cycle goes.

Attain we quiz our elected officers to merely stop pushing down rates of interest, bailing out of us that took on too mighty debt, and in its put let downturns speed their route?

Let’s Upright Conclude

If central banks and governments stopped making credit ranking more uncomplicated and more uncomplicated to fetch thru lower rates of interest and debt monetization, we could perhaps well set an stop to this Ponzi contrivance behavior and fetch help to an financial system where we promote priceless goods and companies and products to every utterly different.

The put’s the field?

Central banks and governments can’t stop taking on debt and printing money, because our currencies themselves are a key fragment of a big countless money machine Ponzi.

The U.S. buck and all utterly different valuable currencies in circulation on the novel time are fiat currencies, with central banks and governments in a position to work together to systematically lengthen the currency provide the utilization of debt. Commercial banks manufacture loads of the currency in circulation thru lending. The central bank pushes business banks to lend more by adjusting the interest on reserves paid to member banks and by seeking assets love authorities debt after which along with to bank reserves from their currency printer. This means the currencies we expend each day are essentially debt held by contributors, corporations, and governments.

The provide of this countless money machine is central banking. A firm or particular person must designate a lender that they’re creditworthy, but the central bank is a sure invent of lender. This lender bears no value to lend their currency, to permit them to lend to somebody, anytime, at any rate. Governments contrivance essentially the most of this special lender as their literal countless money machine. And to boot they even admit it’s an infinite money machine!

Central banks and their money printers enable the appearance of every lower rates of interest and asset increase. When central banks push rates of interest down, they contrivance credit ranking more cost effective.. This lets in more currency to device help in to the financial system via loans, which circulates and pushes costs for all the pieces up, all at utterly different rates and cases. As a result, asset costs and GDP float upward.

Attain we no longer alter GDP or asset costs for this inflation? Sadly, no. No economist or supercomputer is capable of parsing the complexity of value actions in markets to assert what percentage of a upward push in value came from trusty productiveness versus merely more currency gadgets floating round, pushing up costs. If any individual could perhaps well, they’d be the richest person in the enviornment overnight by completely trading the monetary markets.

On the opposite hand, a central bank and its fiat currency receive the a linked Achilles heel as a Ponzi contrivance:

“With little or no legitimate earnings, Ponzi schemes require a fixed trot along with the movement of newest money to continue to exist. When it turns into laborious to recruit novel investors, or when easy numbers of novel investors money out, these schemes are inclined to give contrivance.”

If central banks and governments stop printing money, or if quiz for their debt or currency falls, your total ruse will give contrivance.

How does a authorities be sure quiz for their debt or currency?

Dictating Request to Withhold the Ponzi Going

A firm or particular person who lets their money owed surpass their assets should peaceably file for financial anguish and unwind the total folly. A authorities would trot down factual the a linked as soon as contributors began to cherish the inanity of the fiat currency system. On the opposite hand, we receive given governments our blessing to make expend of power, and in loads of cases given up our bear capacity as electorate to face up to that power.

To receive their Ponzi currency going when contributors become aware of it, governments should restrict freedoms or expend violence.

Taxation is a technique in which governments restrict freedoms and spend violence in verbalize to prop up their currency system. By disturbing taxes be paid of their very bear currency, governments are in a position to prop up quiz for electorate to invent their currency after which expend that currency out of circulation. Proponents of contemporary monetary theory are very express about this, believing that the reason of taxation is to encourage watch over inflation by sucking liquidity out of the system. The backstop to ensure these methods work? That authorities’s police will gladly lock you up in the event you carry out no longer comply. Factor in you made the choice no longer to continue lending to a firm since you didn’t reflect they were solvent, and an employee of that firm handcuffed you and threw you in a cell. Who could perhaps well be in the scandalous right here?

Governments could perhaps well spend defense power power on the enviornment stage to take care of threats to its Ponzi contrivance. The U.S. authorities is in particular adept on the utilization of defense power vitality — or merely a projection of it — to protect the U.S. buck system from threats. When utterly different international locations pain quiz for bucks on the enviornment market, relate to be used in oil markets, the missiles open up flying. That is the reality in the help of the meme under.

Because the authorities goes deeper into debt, this can want to expend more drastic measures to be sure the fiat currency Ponzi continues. That can mean more inflation, bigger taxation, stricter controls, and strategic expend of the authorities’s backstop of violence. They’ll develop taxes, remove assets, tighten surveillance and even “debiting FedAccounts” when inflation inevitably quickens. The general whereas, the severity of the eventual give contrivance will develop.

If the authorities obtained’t help us fetch out of a system that is hurting us all, what can we provide out by ourselves?

Ending The Ponzi Ourselves

Fortunately, we, collectively, as electorate of the Earth, can fix this field — no longer thru votes or UN resolutions but thru particular person actions to stop taking half in the machine governments receive built round us.

We’re already bombarded by messages that it is the grasping filthy rich and capitalism itself which is accountable for our societal ills, but now each person is aware of they’re simplest following a playbook and technique enabled and encouraged by a authorities-led Ponzi contrivance.

Provide: CNN.

Mockingly, these messages power contributors to hand more vitality to governments, who’re considered as essentially the most easy respond to controlling the excesses of the deepest sector. The outcome is exacerbation of the field, no longer resolution, as authorities-centric monetary systems are the muse of those complications.

Fortunately, defunding the fiat currency Ponzis and ridding our world of their catastrophic systemic risks is already in growth. Day by day, contributors are opting out of a broken monetary system and proper into a novel one, out of authorities attain and mounted in provide: Bitcoin.

The existence and increase of the Bitcoin network represents a pain to a system which should exert more controls and develop systemic risks in verbalize to continue to exist. That system would receive us work more difficult for less factual to encourage the Ponzi contrivance ticking. Everybody who chooses to carry bitcoin quite than assets which governments can remove or devalue is doing their fragment to dismantle that contrivance.

Will you be with out a doubt one of them?

That is a customer post by Captain Sidd. Opinions expressed are entirely their very bear and carry out no longer essentially reflect those of BTC Inc or Bitcoin Magazine.