Key Takeaways

- Bitcoin dropped below $28,000 within the direction of the final 12 hours.

- Meanwhile, Ethereum lost the $1,800 level as make stronger.

- Extra losses also can additionally be expected as promoting rigidity mounts.

The crypto market sentiment went into “indecent misfortune” all every other time after Bitcoin and Ethereum lost worth make stronger within the direction of the final 24 hours. On-chain records presentations increasing promoting rigidity, which could maybe well per chance result in extra vital losses.

Bitcoin and Ethereum Spell Pain

Bitcoin and Ethereum stumble on sure for vital losses after losing necessary make stronger areas.

Almost $300 million worth of lengthy and immediate positions had been liquidated across the cryptocurrency market within the direction of the final 24 hours. Records from analytics platform Coinglass presentations that the losses accelerated at this time after Bitcoin dipped below $28,000 and Ethereum lost $1,800 as make stronger.

Now, evidently market participants are dashing to exchanges to sell some of their tokens.

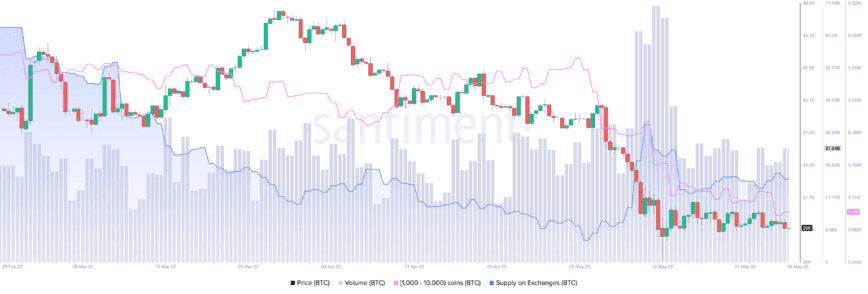

On-chain records exhibits that whales keeping 1,000 to 10,000 BTC enjoy offloaded or redistributed bigger than 30,000 BTC, worth roughly $870 million, within the direction of the final 24 hours. The spike in network exercise coincides with a vital amplify within the replacement of tokens flowing into identified cryptocurrency alternate wallets. Greater than 10,000 BTC had been sent to trading platforms within the identical period, including rigidity to the flagship cryptocurrency.

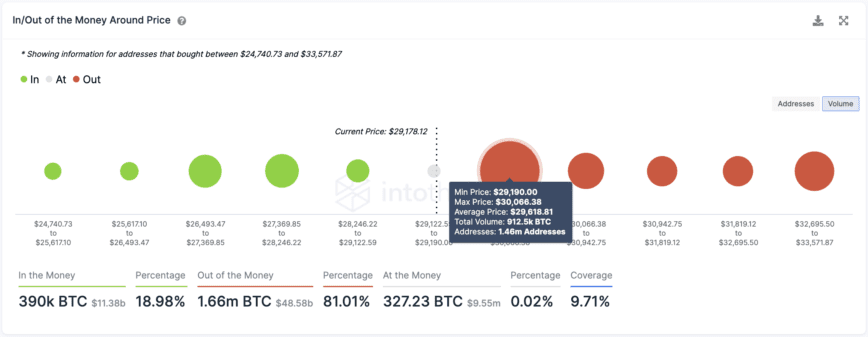

Whereas sell orders pile up across cryptocurrency exchanges, Bitcoin’s make stronger looks old-long-established.

IntoTheBlock’s In/Out of the Money Around Price mannequin presentations no necessary quiz wall below Bitcoin that can per chance well well terminate it from incurring extra losses. What also can additionally be considered is a big present barrier between $29,190 and $30,070, where 1.46 million addresses bought over 900,000 BTC.

Bitcoin must reclaim this serious save as make stronger very rapid in declare in self assurance to enjoy a first charge likelihood of rebounding. Failing to enact so could maybe well per chance generate pain amongst these addresses which also can very neatly be underwater, which could maybe well per chance trigger a sell-off that sends BTC toward Can also 12’s low at $25,370 and even $21,000.

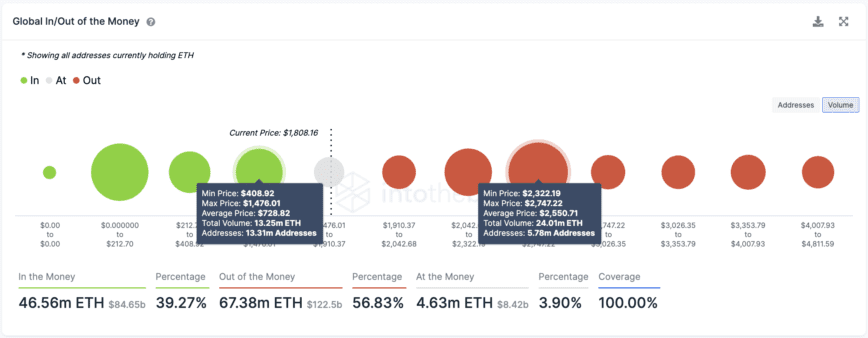

Though on-chain metrics enact no longer display cowl a the same amplify within the replacement of ETH flowing into identified cryptocurrency alternate wallets, the World In/Out of the Money mannequin does display cowl an absence of quiz walls. The biggest make stronger level for Ethereum sits round $730, where bigger than 13.31 million addresses bought over 13.25 million ETH.

Per transaction history, Ethereum would be no longer inclined to get better and enter a brand contemporary uptrend till it kinds a market bottom round $730 or climbs above $2,550.

The most contemporary prerequisites counsel that there could be extra room to head down prior to the kill of the crypto iciness. Happily, there are a pair of on-chain metrics that enjoy accurately anticipated outdated market bottoms and could maybe well present guidance a pair of doable pattern reversal within the lengthy bustle.

Disclosure: On the time of writing, the creator of this portion owned BTC and ETH.

For extra key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

The guidelines on or accessed through this web web online page online is obtained from just sources we are expecting to be splendid and legitimate, however Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any info on or accessed through this web web online page online. Decentral Media, Inc. is no longer an funding manual. We enact no longer give personalized funding suggestion or diversified monetary suggestion. The guidelines on this web web online page online is field to interchange without behold. Some or the total easy job on this web web online page online also can change into out of date, or it’ll be or change into incomplete or improper. We also can, however are possible to be no longer obligated to, replace any out of date, incomplete, or improper info.

You need to always nonetheless by no technique set aside an funding decision on an ICO, IEO, or diversified funding basically based totally on the easy job on this web web online page online, and you have to nonetheless by no technique elaborate or in every other case depend on any of the easy job on this web web online page online as funding suggestion. We strongly recommend that you consult a licensed funding manual or diversified qualified monetary skilled if you should maybe well per chance presumably also very neatly be in search of funding suggestion on an ICO, IEO, or diversified funding. We enact no longer accept compensation in any produce for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Panic Prevails in Crypto Market as Bitcoin Tumbles

After Terra’s implosion, the cryptocurrency substitute has reached a serious point in its history. Market participants remain sidelined whereas uncertainty reigns. Crypto Investors in “Vulgar Panic” Panic, uncertainty, and doubt…

CFTC Chair Considers Bitcoin and Ethereum to Be Commodities

Commodity Futures Buying and selling Price (CFTC) Chair Rostin Behnam has expressed his perception that Bitcoin and Ethereum are commodities, although the digital asset market contains commodities and securities alike. He subsequently…

Because the Market Bleeds, Bitcoin Dominance Hits Seven-Month Excessive

Bitcoin has historically dominated the cryptocurrency market for the period of downturns. Bitcoin Dominance Rallies Though the crypto market looks to be old-long-established, Bitcoin is proving that it’s nonetheless “the King.” The #1 cryptocurrency…