DeFi, a shortened model of the mouthful “decentralized finance”, is a hot buzzword in the intervening time. The term is continuously related with crypto tokens and networks, as successfully as the applications constructed on high of them for lending, borrowing, asset shopping and selling and totally different financial contracts to be completed without intermediaries.

Most of as of late’s financial contracts require central intermediaries that are arguably opaque by indulge in and desires to be relied on by both parties to glean contracts rather. In most cases that belief is damaged, enjoy when the largest international switch (Forex) brokers colluded for as a minimum a decade to rip-off their customers — costing companies, pensioners, investors and savers a but unknown figure that would without complications quantity to over $1 trillion. Most productive one particular person used to be arrested and the banks alive to had been fined a whole of $1.7B — round 0.2% of their whole earnings from the rip-off. The explanations we distrust banks, and the governments and central banks standing on the help of them, are plentiful — I’m clear you would possibly need got your have.

DeFi guarantees to be a extra real platform, serene of launch-offer code that’s auditable and transparent. Furthermore, DeFi opens the floodgates for modern tips. Licensing requirements are replaced with code audits, permitting efficiency to replace accreditation and opening the financial world to unusual tips.

In truth decentralized finance — your total plot down to the settlement layer — also guarantees to be a extra sane monetary gadget. Money is an integral fragment of civilization, permitting societies to grow and scale without everyone having to belief one one other for my fragment. A decentralized financial gadget can fix the deeply-ingrained complications of our monetary gadget as of late.

A financial gadget free from many of the burdens and pitfalls created by relied on intermediaries and important masters sounds enjoy a snug future lets silent all want to bring in.

What stands in our plot?

The Belief Dealers And Their Top class

Great of the aim banks and financial intermediaries exist as of late is to glean belief between parties: they are “belief dealers”.

Escrow services and products are a in point of fact scream example of this: a financial institution with a status to uphold will act as middleman to an switch of resources, guaranteeing that both parties follow their discontinuance of the deal. An escrow service would be entirely automated in a DeFi gadget, ensuing in decrease charges and extra predictable execution.

Belief dealers carry out a “belief top rate” for their services and products, which makes them replacement cash. DeFi takes that belief top rate away, and belief dealers obtained’t let run of that income and not using a combat.

Even many solutions of fresh governments exist to glean belief between parties who want to make and build in force contracts with each totally different. The Securities and Alternate Commission (SEC), to illustrate, is partly a belief dealer with a 3-section mission:

- Supply protection to investors.

- Protect magnificent, neat and ambiance friendly markets.

- Facilitate capital formation.

A swish section of this comprises guaranteeing that “those that sell and alternate securities — brokers, dealers and exchanges — must treat investors rather and if truth be told” (SEC). Today time, the SEC and its enforcement equipment want to transfer round disturbing data from non-public companies to verify that they are acting rather and if truth be told.

In a world the assign brokers and exchanges are automated pieces of code, launch offer and auditable by somebody, the need for all those resources required for investigations is greatly diminished. In the SEC’s case, the belief top rate is extra abstract: now not income, however energy.

Central banks and governments also carry out an enormous belief top rate: we belief them to manipulate cash affords with the supreme pursuits of the public in mind.

Today time’s governments and financial corporations are therefore cautious about, if now not openly opposed to, if truth be told decentralized financial programs. These programs threaten their belief top rate — whether or now not that’s earned in the invent of income or energy over the financial gadget.

Belief Dealers Are Extremely efficient

Right here is now not a petite neighborhood of rogue states or enviornment of interest asset managers however the core of the mainstream financial gadget: the wealthiest and strongest individuals and organizations on the earth as of late.

These teams and other folks defend their role as relied on intermediaries in the financial gadget — and therefore the belief top rate they carry out in cash or energy — in a diversity of methods. What we imagine as excessive-functioning, magnificent governments exclaim they need this energy over the financial gadget to combat cash laundering and terrorist financing — nevermind the fact that anti-cash laundering (AML) policies indulge in decrease than 0.1% affect on legal budget (which is decrease than the “tax” on the Forex scammers!).

When governments flip extra openly oppressive they resort to raw energy over simply reasoning, and enforcement starts to search out extra authoritarian: blacklisting other folks from the economy or simply confiscating cash from voters.

The incumbent belief dealers are attacking decentralized programs from all angles, claiming they are too unstable, they facilitate legal activity and they eat too unprecedented energy. Nonetheless, they know they obtained’t be ready to succeed simply by slamming unusual skills — they want to give but every other or co-decide a brand unusual skills to swimsuit their purposes.

Sooner than we glean into how belief dealers are confronting the specter of DeFi, we now indulge in got to focus on regarding the alternate-offs inherent to any decentralized gadget. This might per chance shed gentle on how a DeFi platform might evade destruction.

Replace-Offs Of A Decentralized System

Among the founders of the Ethereum protocol, Vitalik Buterin, coined a “trilemma” about networks that helps us better understand the alternate-offs compulsory to realizing a decentralized financial gadget.

The trilemma goes enjoy this: a database (or a “blockchain”) must sacrifice in one of those areas in clarify to glean in one other:

- Security

- Decentralization

- Scalability

Security

Security plot the community is resistant to assaults meant to disrupt its normal operation of validating and finalizing transactions. For a financial gadget, safety is paramount. Without it, the gadget loyal obtained’t work.

How unprecedented safety is “enough” safety? Right here is a tempting demand to query, however a harmful one to acknowledge to or put into effect. This demand assumes we can understand all doubtless futures and device out their dangers. Right by time immemorial, individuals indulge in many cases underestimated the aptitude for future occasions to exceed the bounds of imagination and engineering. Thinking that we know what “enough” safety appears to be like enjoy, and stopping there, is continuously a recipe for failure.

Decentralization

Decentralization in our context boils down to the ease with which somebody can validate transactions on the community. If it’s very easy for unusual validators to affix, it’s doubtless that a swish quandary of nodes will glean to validate transactions, limiting the energy of any single entity to replace the principles of the gadget.

Decentralization — enjoy safety — is obtainable in levels. The extra difficult it is for unusual validators to affix the community, the extra doubtless it is that a centralized entity evolves to specialise in validating transactions. Finally, this entity can birth influencing the principles of the community or wait on as a straightforward target for extra important forces to purchase over in clarify to co-decide the gadget.

Scalability

Scalability plot the rate with which the community can route of data. For a decentralized financial gadget with lending, escrows and extra overall financial services and products, scalability lets in for extra complexity and faster experimentation.

Centralized programs — enjoy the laborious power to your computer or the Visa payment community — glean a excessive level of scalability by fully forgoing decentralization. Some blockchain networks, enjoy Ethereum, are ready to glean extra scalability by sacrificing safety and decentralization.

Tricky Alternatives

To imagine the supreme route forward for a DeFi gadget, we must purchase into consideration these alternate-offs against the methods incumbent belief dealers might exhaust to topple or co-decide the gadget. We will now not naively imagine that existing institutions will simply roll over and accept the inability of their belief top rate and not using a combat.

Elizabeth Warren, to illustrate, is positively preparing for battle.

The Belief Seller’s Assault Sorts

Sooner than we purchase into consideration balance decentralization, safety and scalability, let’s purchase into consideration how incumbent belief dealers might imagine attacking decentralized programs.

Most assaults are inclined to compare into three categories:

- Brute Force

- Self assurance Erosion

- Co-Opting

Brute Force Assault

The first plot is blunt — they would possibly be able to exhaust emotional appeals and, in the raze, brute force to discourage or block you and I from interacting with decentralized programs. They are doing this as of late — the utilization of all styles of misdirection to position down DeFi programs. Some countries indulge in even utilized bans — though none were of unprecedented exhaust, with decentralized programs growing despite the bans.

The brute force attack isn’t working — so that they would possibly be able to add on unusual assaults.

Self assurance Erosion Assault

The 2nd incorporates a bit subterfuge ˆ with the intent being to disrupt the gadget in such a system as to harm individuals’s belief in it. This might per chance come in the invent of a hack orchestrated by rogue agents and per chance demonstrating the energy of the authorities to fix it. Extremely efficient financial entities might even exhaust their existing energy to glean cash in clarify to manipulate prices, destroying self perception in the operation of the markets for resources in the unusual financial gadget.

Co-opting Assault

The third attack incorporates a poke of diplomacy — they might are attempting to co-decide a gadget with meager decentralization, working carefully with blockchain builders to lend a hand them enhance safety and scalability. Finally, the gadget then steers away from decentralization and finally ends up taking a look exactly enjoy the centralized financial gadget it used to be meant to replace!

Central financial institution digital currencies (CBDCs) are one other example of a co-opting attack. Governments are building programs they take care of a watch on via the flexibility to replace present and block transactions, however they are offering them as better choices to genuinely decentralized networks. Elizabeth Warren does exactly this — bashing Bitcoin then praising CBDCs as a greater respond to the identical distress.

Nonetheless, CBDCs are now not decentralized – the settlement layers of every CBDC will almost definitely be fully owned and operated by their respective central financial institution, the largest belief dealers of all of them.

Getting Priorities Straight: Decentralization And Security

All three assaults exploit weak decentralization and miserable safety. None of the assaults purchase good thing about any lack of scalability.

Decentralization and safety are clearly extra fundamental than scalability to the safety, let alone exclaim, of a DeFi gadget. It bears repeating that the incumbents in our centralized financial gadget are the strongest, successfully-connected and resource-rich entities on this planet as of late. Any compromise in decentralization or safety in clarify to give a boost to elevated scalability is a harmful alternate-off, opening doors for a diversity of assaults.

While decentralized programs continue to endure assaults from incumbents, those building the programs must glean in layers. Esteem erecting a skyscraper, first a deep foundation needs to be poured, then the steel goes up, then your total internal facets that make it a livable residence. You can’t birth by stacking glass 10 floors excessive on an empty lot.

Sooner than we pays for espresso with bitcoin or make on-chain credit default swaps, we now indulge in got to make clear the blockchain is as accurate and decentralized as doubtless. The foundation can’t be compromised in the name of scalability. Correct enjoy a building, the layers on high of the root can alternate away some energy for magnificence, usability and extra.

Which blockchain as of late is making the magnificent alternate-offs to give us the supreme shot at constructing DeFi?

Bitcoin Is DeFi, Altcoins Are No longer

While the press and YouTube shill artists can indulge in you think that DeFi is the one real possession of non-Bitcoin networks, these protocols are severely lacking in safety and decentralization when put next to the sluggish, frail, “outdated-accepted” Bitcoin.

The Sagging Cathedral Of Altcoins

Esteem a snug cathedral constructed on a marsh, these projects stumble on sharp and promising as of late however lack the solid foundation to be round tomorrow as the root of a DeFi gadget. These networks sacrifice safety and decentralization in the name of programmability and transaction throughput. This supplies us issues to focus on — a whole bunch developer activity, unusual tokens, protocols — however it and not using a doubt hides an absence of supporting energy.

Mediate Ethereum to illustrate, prolonged the frontrunner of the DeFi world.

Ethereum suffers from:

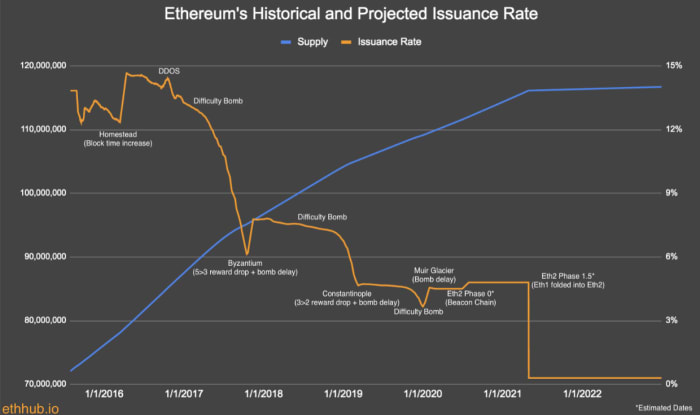

- A monetary coverage that is unpredictable and openly targets “minimum issuance to accurate the community.” As stated previously, attempting to “optimize” safety is harmful.

- An unclear roadmap for a switch to the chain’s consensus mechanism, with frequent delays. Right here is related to attempting to replace the engine of a plane all the plot by a flight.

- Project in developing and syncing paunchy nodes, that are serious to decentralization of the community. A single company, Infura, affords paunchy nodes as a service which many key applications (“DApps”) rely on at their very have anxiousness.

This makes Ethereum launch to all styles of assaults, from co-opting by governments to scream assaults on chain safety. The Ethereum chain used to be even publicly attacked, with its have founder main the payment, in clarify to rewrite the chain history after a hack exploited a neat contract on the platform. No wonder the Federal Reserve — the very bastion of as of late’s centralized financial gadget — is waxing poetic regarding the wonders of DeFi on Ethereum!

DeFi on Ethereum and others would possibly be the controversy of the city as of late, however the brightest flames most continuously burn out first. Bitcoin might now not be as flashy, however accurate foundations never are — as but every other they are enduring.

The Humble Fortress Of Bitcoin

Bitcoin optimizes for safety and decentralization over scalability. While complex financial contracts are difficult to glean on Bitcoin’s blockchain, Bitcoin beats all totally different blockchains on safety and decentralization.

It is serious that we glean financial infrastructure on high of essentially the most decentralized protocol with the supreme safety while silent permitting totally different layers to resolve into the protocol. Bitcoin does this better than any totally different protocol, and with essentially the most history. Now that incumbent belief dealers are attentive to the existence of cryptocurrencies, unusual protocols don’t stand of mission against co-opting assaults.

Bitcoin nodes are low-value and straightforward to bustle, ensuing in a swish quandary of geographically dispersed validators. A predictable proof-of-work consensus mechanism has led investors to indulge in enough conviction to make investments billions in aim-constructed bitcoin mining machines, that are plugged in at each corner of the globe. The Bitcoin chain has never suffered a extreme reorganization or a success attack on its foundational ruleset.

Bitcoin forms the settlement layer upon which totally different layers can glean. Applied sciences enjoy the Lightning Community will enable extra scalable payments and ease of programmability — bringing unusual financial primitives rooted in Bitcoin’s decentralized settlement layer. Upgrades to Bitcoin enjoy Taproot and BIP 300 will enable totally different layers and applications to root firmly to Bitcoin’s uncomplicated however predictable operation.

Making DeFi Work

Bewitching regarding the armada of belief dealers who will face down any DeFi gadget, handiest the platform that leans most heavily toward safety and decentralization as of late has of mission of emerging from the onslaught intact.

One after the other, platforms that are less accurate or decentralized will succumb to the assaults of important institutions. A mode of the guidelines build into observe on those less accurate platforms will are residing on, however constructed as but every other on high of the supreme platform that survives.

And that platform, the supreme likelihood we now indulge in got at DeFi, is Bitcoin.