The below is from a most neatly-liked edition of Bitcoin Magazine Pro, Bitcoin Magazine’s top rate markets e-newsletter. To be among the many valuable to receive these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

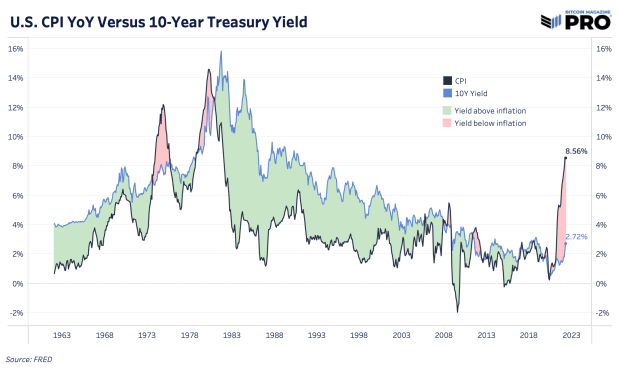

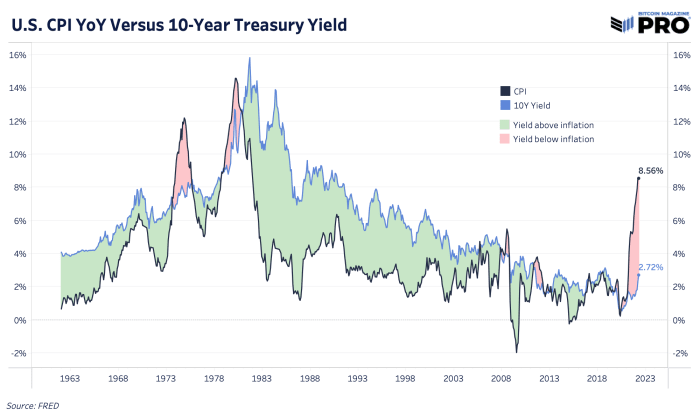

Inflation Versus 10-three hundred and sixty five days Treasury Yields

We now not too long previously got the US Bureau of Labor Statistics inflation knowledge for the month of March, which came in at a crimson sizzling 8.56% three hundred and sixty five days-over-three hundred and sixty five days (marginally above the 8.4% consensus). As what looks to be in direct response to increased inflation and detrimental right yields, treasury markets continue to unload with the 10-three hundred and sixty five days rising to over 2.7%, up from 1.5% firstly of the three hundred and sixty five days.

Collectively, the rising inflation rate and the 10-three hundred and sixty five days treasury yields accomplish what we judge is the greatest macroeconomic chart honest now. We continue to appear for a length of monetary repression play out as inflation is magnitudes above bond yields, which produces guaranteed losses for investors who depend on these threat-free charges.

Even though we were to appear for CPI top this month or in the upcoming months, we peaceable interrogate an elevated level of inflation for all of 2022 and into 2023, effectively above the 2% inflation blueprint and above the 10-three hundred and sixty five days treasury yield.

CPI is effectively above the 2% inflation blueprint and above the 10-three hundred and sixty five days treasury yield.

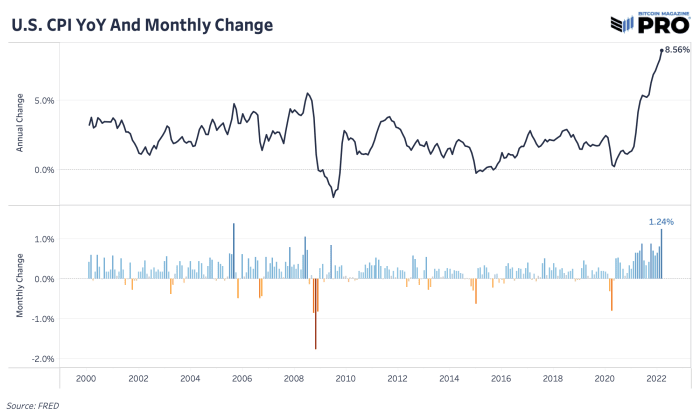

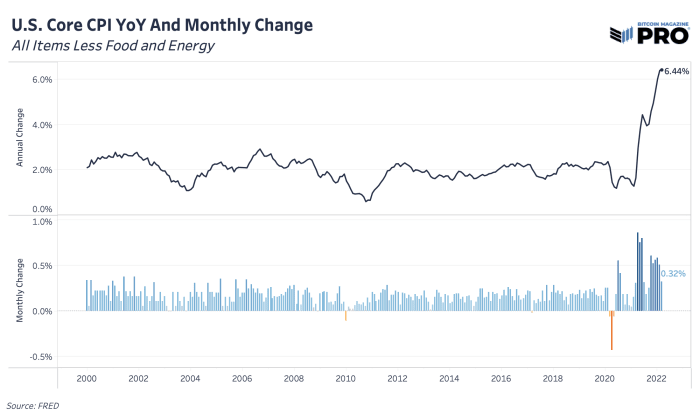

On a month-over-month foundation, total CPI reached its most sensible acceleration since 2005. Core CPI, which removes strength and meals and is extra carefully watched by the Federal Reserve and markets, displays a month-over-month deceleration indicating that some inflation substances would possibly perhaps very effectively be turning over. With Core CPI coming in at 0.32% month-over-month, below the consensus of 0.5%, the bond market saw a little rally.

Sooner or later, the cure to increased prices is increased prices. At final chronic inflation overwhelms shoppers and their wallets which will lead to a noteworthy stronger deflationary impact taking part in out.

CPI three hundred and sixty five days-over-three hundred and sixty five days and month-to-month rate of commerce

CPI three hundred and sixty five days-over-three hundred and sixty five days and month-to-month rate of commerce without meals and strength calculated

Actionable Files

Whereas right here is now not a review product that offers order shopping and selling signals, we fabricate commonly contemporary our knowledge-driven outlook across timeframes. Over the upcoming quarters, the possibilities of a recession in the U.S. as well to different areas of the globe scrutinize an increasing number of seemingly.

The Following Statements Are No longer Investment Advice

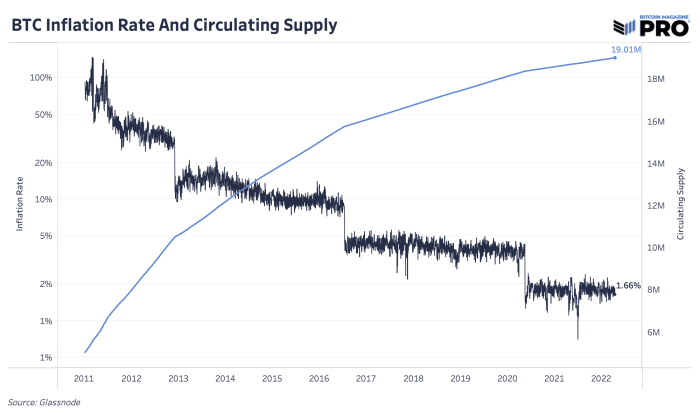

The field is in dire need of neutral, apolitical, programmatic money. The detrimental right-yield atmosphere the industrial system finds itself in today is an inescapable actuality that comes in the late stages of a protracted-length of time debt cycle. Monetary repression (detrimental right yields) is one contrivance to (are attempting to) erode the right impress of the money owed, at creditors’ (bond holders’) expense.

Right here is among the many greatest causes for our chronic uber-bullishness on bitcoin. The total addressable market for one thing indulge in bitcoin (of which bitcoin is the single viable chance attributable to node decentralization, immutability, appealing-capped supply, immaculate belief and proof-of-work mining) is above $100 trillion ($100,000,000,000,000).