The below is from a new model of the Deep Dive, Bitcoin Magazine’s top class markets publication. To be among the many essential to bag these insights and a good deal of on-chain bitcoin market analysis straight to your inbox, subscribe now.

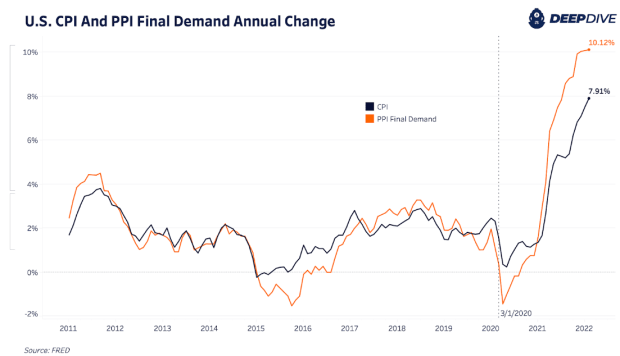

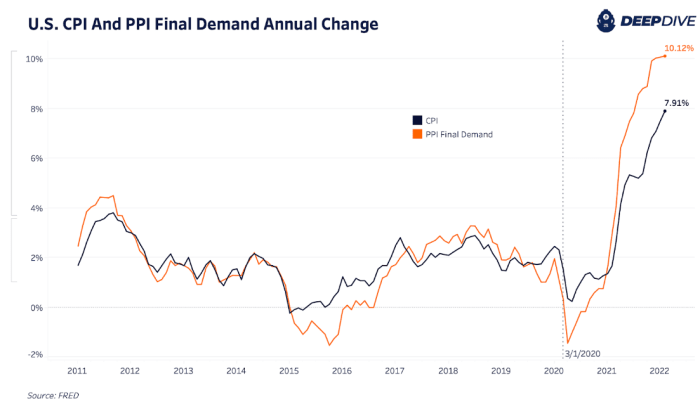

The most up-to-date United States producer designate index (PPI) figures had been released the day gone by morning showing a 10% annual index alternate. The PPI tracks designate changes bought for goods and products and services across domestic producers and can very smartly be a truly crucial key enter within the Federal Reserve Board’s probability to tighten monetary policy the next day to come within the face of surging inflation.

The US PPI development is aloof smartly below what we’ve seen across the European Union and might well doubtless continue better within the coming months as producer enter costs toddle the upward thrust in commodities and power costs. Below we peek a lunge pattern of acceleration in User Label Index and PPI put up the COVID-19 response, which came armed with unprecedented fiscal and fiscal stimulus.

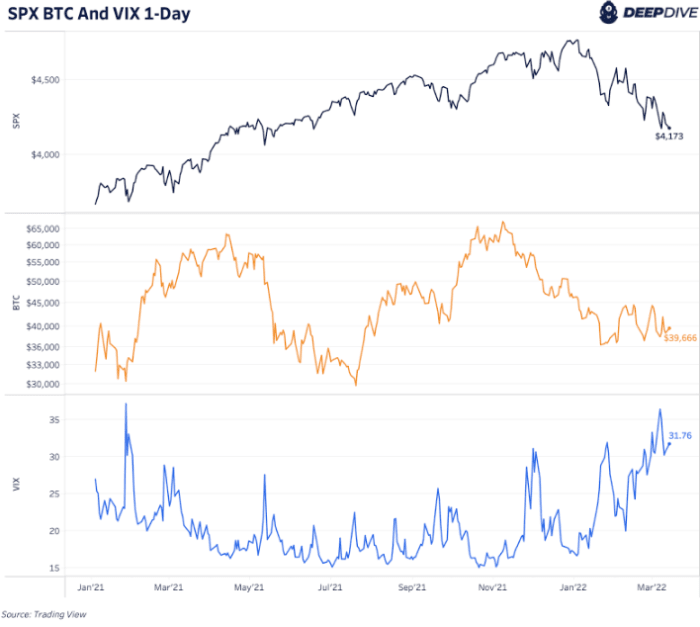

Volatility within the system stays elevated with the VIX over 31. The preliminary volatility spikes support in Q4 2021 coincided with the market promote-off in bitcoin and the S&P 500 Index. Based fully on its historical moves and relationship to the VIX, it’s laborious to assume bitcoin making a bigger upwards transfer with overall equity market volatility so excessive within the short timeframe. We would want to thought a foremost, essential shift (decoupling) or catalyst on the market to alternate our gape.

Our unhealthy case is that we’re due for one other explosive volatility shock and that the VIX has no longer made its yearly excessive but. We also gape the probability of a recession within the U.S. as a shut to straightforward activity over the coming four quarters, as true development doubtless reverses within the face of soaring power costs and rising yields.

With a U.S. recession a shut to straightforward activity, the bitcoin designate is no longer going to surge upwards

For bitcoin bulls, the encouraging signal is that beneath the outside, accumulation is going down, with free-float provide continuing to diminish, as quantified by a fluctuate of on-chain metrics.

Nonetheless, on account of the accelerating readings of inflation across the global financial sector, credit markets are promoting off, and thus broader market liquidity is reducing as volatility continues to raise.

In our gape, the market will bear its agonize point tested within the make of better yields one day of 2022, and it is no longer a matter of if nonetheless pretty when the Fed decides to intervene to quell credit market prerequisites.