There’s been masses of jibber-command about how a lot the United States stands to help from the gigantic hash rate migration from China, nonetheless what about the U.S.’s continental cousin, Canada?

Just a few months previously, a records describe surfaced that mentioned Bitfarms, one among Canada’s biggest bitcoin miners, used to be quitting Quebec on sage of rising energy prices and stringent regulations. Genuinely that is no longer lawful; Bitfarms is expanding in Quebec, nonetheless it’s upright transferring transferring portion of its lickety-split to South The United States in a present to diversify its operations.

Gathered, the records peg painted Canada as a unfortunate jurisdiction for miners to location up shop, nonetheless lest we paint your complete nation with gargantuan strokes, we could per chance additionally mild buy a ogle at other jurisdictions to get the fleshy image, besides ogle Quebec’s natty hash rate footprint despite the industry being tied up by purple tape.

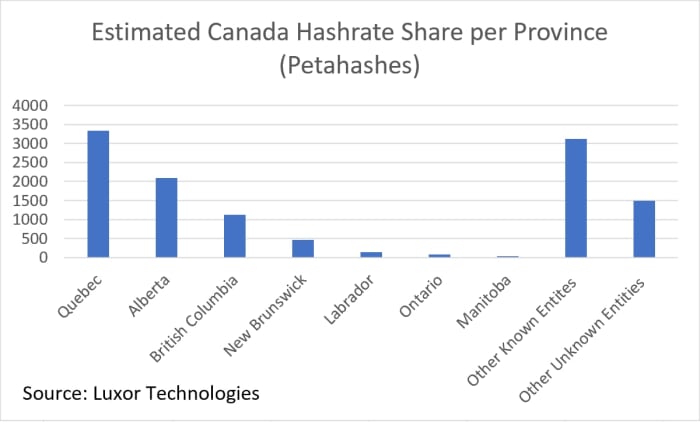

Figures from the College of Cambridge’s most up-to-date mining describe part that Canada in the in the intervening time represents 3% of the network’s hash rate. Right here’s skewed on account of the truth that the describe relied on IP login records to pinpoint mining operations (so if a firm operates machines in Canada nonetheless it managed its machines from the U.Okay., then its hash rate could per chance per chance be registered in the U.Okay.). Luxor Applied sciences estimates that a more lawful figure is 7.8%, in line with the dimension of the ASIC fleets of key gamers in the role and the recent network hash rate.

2018 figures from Cambridge pinned Canada’s hashrate portion at 13% — why the giant discrepancy between then and now? May per chance well additionally the mining panorama bask in modified that a lot?

Canada Is Extra Than Quebec

When observers review Canada to other mining hotspots, the nation’s ostensibly stringent regulatory atmosphere — particularly with regard to energy regulation — is most incessantly one among the first hassle points of their opinions. Even so, the role has the biggest focus of miners in the nation, with over 3 exahashes of hash rate in the in the intervening time in operation.

Each and each Canadian province isn’t the the same, although, and they each goal their bask in regulators and strength authorities.

Quebec’s sole public strength utility, Hydro-Quebec, as an illustration, positioned a strength moratorium on Bitcoin mining in the spring of 2018, and a few actors on this province, love Blockstream’s mining arm, bask in stop the role, citing narrate with working with the strength provider.

After the moratorium, Hydro-Quebec location up a program for miners to put together for as a lot as 50 megawatts (MW) by an RFP. The flexibility provider sectioned off 300 MW of capability for public comfy by this program, nonetheless the utility route of used to be so lengthy and strenuous that only 20 MW to 30 MW ended up being gotten smaller. Apart from language barriers (the utility used to be in French), Hydro-Quebec requested proof that the miners had procured ethical infrastructure (transformers, warehouse disclose), so miners who had connections in the disclose and could per chance per chance stable infrastructure earlier than time had a leg up over outsiders. Furthermore, the agreements had been strict about electrical scheme: in the occasion you signed up for five MW, you needed to bask in that a lot otherwise that it’s likely you’ll bask in your charges jacked to a degree that could per chance per chance develop your operation uncompetitive.

As a result of this program, those miners who had been already working in the disclose or knew the panorama secured agreements, whereas others both didn’t meet requirements or gave in entirely.

Gathered others, love Bitfarms, bask in no plans to head away the role anytime soon. The challenge operates 5 companies and products in the role and plans to double its capability in Quebec in the long term, in accordance with comments from chief mining officer Ben Gagnon on a most up-to-date Compass are residing circulation.

The matter for would-be miners in Quebec, although, is that Hydro-Quebec is limiting the amount of strength they are prepared to sell to Bitcoin miners. So, incumbents love Bitfarms, which bask in already established rapports with the energy producer, can bask in a leg up when trying to stable strength buying agreements (certainly, Gagnon claimed in the Compass are residing circulation that, for the length of the 2018 endure market, Bitfarms used to be ready to stable 50% of the energy allotted to miners by Hydro-Quebec for a given strength buying settlement block).

“Quebec’s mining gold bustle came and went as soon as the 2018 moratorium used to be assign into originate. On the other hand, from this regulatory hurdle came clarity. Hydro-Quebec and the Régie de l’Énergie established a quiz for proposal route of to award strength take agreements dedicated to cryptocurrency mining,” Mike Cohen, who operates multiple farms in Canada, mentioned in an interview for this text, summing up the disclose of affairs. “While the energy price could per chance per chance no longer be the most realistic in the world at around 0.05 Canadian greenbacks per kilowatt hour (kWh), it’s mild aggressive and the safety and peace of suggestions that comes from a 5-twelve months mounted rate settlement with a authorities-scoot utility company in a jurisdiction the put the climate is cool, the courts work and the energy is almost entirely from renewables has gigantic price in our industry.”

Alberta, Other Jurisdictions May per chance well additionally honest Maintain Extra Room To Grow

Gathered, there are other jurisdictions the put strength isn’t monopolized by the authorities and Just Programs Operators (ISOs) goal as non-public entities. In Alberta, New Brunswick and Ontario, as an illustration, ISOs dominate and provide an abundance of low price energy. Oil-rich Alberta stands out from the leisure right here and has been a boon for companies love Upstream Records, which has been capturing flared gas from this role to mine bitcoin since 2017.

Generally, these oil producers (working as they develop in the course of nowhere) don’t are looking out to switch this pure gas to customers, as they’d lose money with transport price, in reveal that they flare it as a alternative. Bitcoin miners soak up this in every other case wasted energy and provide the drillers with a payday — a snatch-snatch for all involved.

Furthermore, Hut 8, one among the biggest miners globally, operates in Alberta, with its CEO Jaime Leverton noting previously that the more-conservative province has been kinder to Bitcoin miners.

Jurisdiction Hopping

It’s also rate noting that some miners goal multiple farms in utterly different provinces.

This jurisdictional arbitrage is essential desirous about some provinces (love Alberta and Labrador) are far more favorable to Bitcoin miners than a put love Quebec (which, whereas mild viable for folk that know navigate the regulatory panorama, is more difficult to shatter into).

Furthermore, provinces on the East Soar love New Brunswick are ripe for mining and are mild largely unexplored when when put next with Canada’s ancient mining epicenters. These coastal states bask in an abundance of low price hydro and other renewables, nonetheless they lack the inhabitants density to soak up what they believe.

Bitcoin miners, then, could per chance additionally present an economic battery of forms that gives these strength producers with an everyday purchaser of first and closing lodges to balance charges. The mining industry is mild in the fledgling levels in these areas, nonetheless we ask it to buy flight in the approaching years as miners develop headway with suppliers and regulators in these areas and the industry is flush with novel participants.

Advantages Versus The U.S.

Canada’s Bitcoin mining sector is most incessantly when when put next with the United States’ bask in, and no longer with out motive: each portion the the same continent, so each are competing for the the same market to an extent.

Most observers physique the United States as a more aggressive market, nonetheless Canada has its bask in advantages over the U.S.

Theory amongst these, Canada’s import taxes are a lot decrease, roughly 5% for frequent sales tax on imported goods. Trump-era tariffs, in conjunction with the current 2.6% responsibility levied on imported goods, add a 27.6% tax on the ASICs that U.S. companies take from China. That’s a mountainous load so as to add to any operation’s CAPEX.

Furthermore, Canadian companies historically bask in had a higher time list their shares on Canadian stock exchanges. The Toronto Inventory Alternate, as an illustration, hosted Hut 8, Hive and Bitfarms well sooner than any of those shares went are residing on the Nasdaq (which upright took put this twelve months).

North The United States’s only working ASIC manufacturer, ePIC Blockchain, resides in Toronto, as well. The corporate only manufactures Siacoin ASICs in the in the intervening time, nonetheless its CEO has mentioned its intentions to eventually shatter into the Bitcoin ASIC market (Argo, as an illustration, inked a take care of ePIC to get first dibs on its bitcoin miners once they attain production).

If and when this happens, it’ll give miners in Canada (and North The United States more broadly) more uncomplicated get right to use to machines and repairs. Furthermore, British Columbia- and Quebec-essentially based miner Blockstream upright announced its intentions to initiate up manufacturing ASICs, as well.

“Canada has but every other in its hands ethical now to advertise itself as a national host for relied on infrastructure suppliers, love Hut 8,” Hut 8 CEO Jaime Lerverton mentioned in an interview. “The single assignment they must develop to achieve right here’s to verify their dedication to our industry and put determined and favorable insurance policies and programs to fortify our articulate and innovation. There could be design to be won by Canada, and as a proud Canadian company, we hope our authorities will buy the choice to guide globally with us.”

Canadian mining will likely grow slower than in the U.S., the put gun-hoe states love Texas and Wyoming bask in fewer purple tape restrictions, thus allowing accelerated industry operations. Nonetheless grow this could per chance per chance, and we ask Canada to be a high-three mining hub in all over the world the subsequent decade as novel entrants ogle for authentic, abundant strength in nations with robust property rights and true protections.