Is bitcoin diverging from oldschool markets? Are folks initiating to ranking up to the fact that the fiat system will no longer set up them in times of disaster?

Is bitcoin diverging from oldschool markets? Are folks initiating to ranking up to the fact that the fiat system will no longer set up them in times of disaster?

The below is a disclose excerpt of Marty’s Twisted Subject #1269: “Sharp response out of the U.Okay.” Register for the e-newsletter right here.

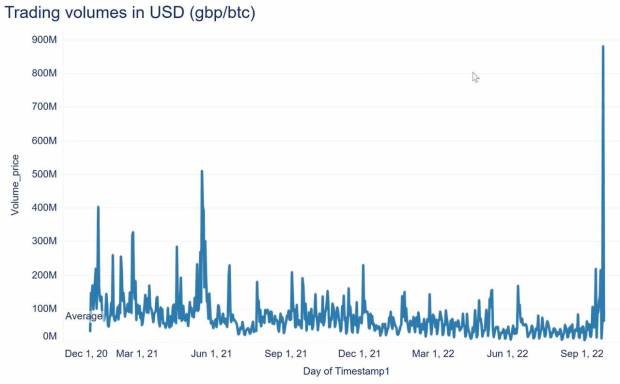

That is a chart that has been lingering in my thoughts all likely the most top ways throughout the week. It was as soon as shared by the team from Coinshares and highlights bitcoin trading volume in the U.Okay. earlier this week while the British pound was as soon as in free tumble. As you have to well maybe presumably presumably also see, volumes exploded to factual beneath $900 million, reaching their absolute top stage in bigger than two years. It is arduous to discern the intent of oldsters that were trading bitcoin in size over in the U.Okay. It could perchance maybe presumably also were folks taking a look to take grasp of succor of swiftly developing arbitrage alternatives, folks taking a look to sell bitcoin to ranking liquidity to carrier failing trades or folks taking a look to get rid of bitcoin as a hedge against instant currency debasement.

We can not reveal for determined, but if the volumes were pushed by those searching for safety in bitcoin, it would listing a really racy turning level for the nascent digital monetary factual and likely the most top ways it is miles being seen by the broader market. One has to accept as true with that there are foreign change traders surveying the panorama of without discover debasing fiat currencies the world over who are initiating to fright, in particular when currencies fancy the pound and the yen are faltering in likely the most top ways they’ve been over the closing couple of weeks. Even supposing the buck is ripping, it is miles the most polished share of shit on the pile. Its relative power doesn’t seem so real can procure to you deem the complications that exist all likely the most top ways throughout the U.S. economy: inflation is high, power policy is suicidal and rising rates are initiating to put a huge beat down on U.S. buyers — in particular dwelling owners and folks with valuable amounts of credit.

With all of that belief to be, it is no longer arduous to deem that more and more folks are initiating to ranking up to the fact that bitcoin is a really beautiful asset to leverage as a hedge in contrast insanity. The network is distributed, its present is finite and it is miles discreet to like without taking on any counterparty difficulty. When in comparison with utterly different currencies, bonds and stocks in an global on fireplace, bitcoin’s superior properties standout fancy a sore thumb. Who knows whether or no longer the change volume out of the U.Okay. is indicative of a rising acknowledgement of bitcoin’s payment proposition, but you are going to procure to indubitably procure this potential pattern for your radar, in particular pondering how noteworthy wealth has been destroyed to this level this year.