Buck-fee averaging (DCA) is defined as buying at definite intervals regardless of designate, and has confirmed to be one among the finest and safest ways to get bitcoin. It enables the actual person to mitigate bitcoin’s wild volatility, and possess peace of mind in their saving approach.

DCA is also not most intelligent right to your fetch worth, but it no doubt’s also right for Bitcoin. As Hass McCook explains in “How The DCA Military Will Power A $1 Million Bitcoin Designate,” Bitcoin advantages in quite so a lot of ways if there are sufficient other folks doing auto-DCA, thus casually racy away on the total bitcoin provide.

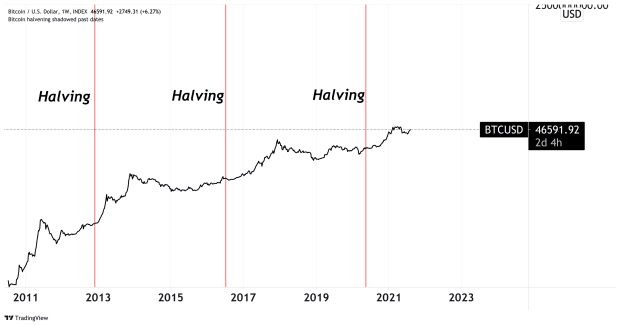

Whilst you DCA on a protracted sufficient time horizon, you may well perhaps earnings so a lot — especially after every halving, which ends in the novel provide of bitcoin created on daily basis getting cut in half every four years. Historically, bitcoin’s designate has always seen a meteoric upward thrust and a novel all-time excessive in the course of every person year following every halving so far.

The bull flee in 2017 made bitcoin creep mainstream, with many leaping in on the hype. Let’s flee the numbers and explore where you would be in case you began DCAing into bitcoin inspire then.

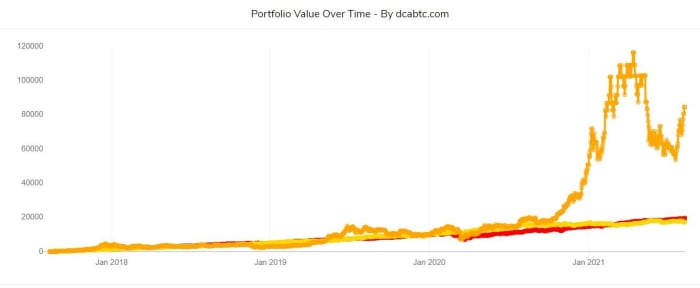

Every single day Buys

Whilst you were to possess began on daily basis DCAing $10 into bitcoin every single day since August 12, 2017, you can possess invested a total of $14,610 dollars on the time of writing. That cash saved in bitcoin would be worth a total amount of $84,506, approximately 1.82 BTC. That’s a total return of 478.41%.

Now what if we were to possess taken that same cash but in its effect invested it in what many claim to be a competitor to Bitcoin: gold?

Whilst you can possess invested that same cash into gold reasonably than bitcoin, this day you can possess a total of $17,177. A total expand of most intelligent 17.57%. This makes for a in point of fact pathetic comparison and it has to create you deem, in case you held gold over bitcoin in some unspecified time in the future of this time then you definately misplaced out on 460.84%. Gold all of a surprising doesn’t appear to be too right a store of fee, huh?

Weekly Buys

Whilst you were to possess DCAed $100 a week from August 12, 2017, you can possess invested a total of $20,900. This present day that cash would be worth a tall total of $115,718, approximately 2.49 BTC. That’s a total expand of 453.68%.

Bitcoin fully crushes its competition, gold. Whilst you can possess invested that $20,900 into gold over that same, then this day you can most intelligent possess $25,075 — a total expand of 19.98%.

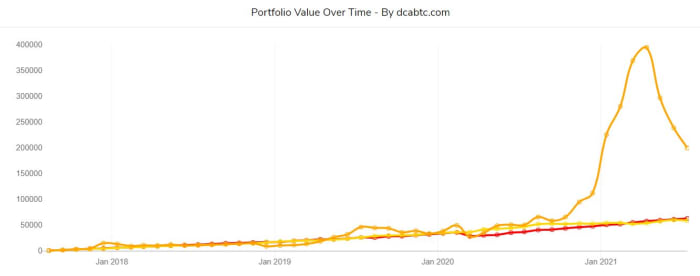

Month-to-month Buys

Whilst you were to possess executed a $1,000 per 30 days DCA into Bitcoin, you can possess invested a total amount of $48,000. That cash this day would be worth $200,066, or approximately 4.31 BTC. That is a total expand of 316.81%.

Appropriate take care of the on daily basis and weekly buys, gold has fully been steamrolled by bitcoin. Your investment of $48,000 into gold would now be worth $59,191. An expand of most intelligent 23.32%.

This 2021 bull flee isn’t over but, as lawful about all americans who is knowledgeable in the trade is awaiting a 2d leg up to happen in the final half of this one year. Many are making enormous designate predictions reminiscent of $100,000, $250,000, and even over $500,000.

Let’s advise the fee rises to $250,000 later this one year. That 1.82 BTC from on daily basis taking a seek for can be worth $455,000. That 2.49 BTC from weekly taking a seek for can be worth $622,500. And that 4.31 BTC from monthly taking a seek for can be worth $1,077,500.

Whilst you were to possess began DCAing even earlier than four years prior to now, then you definately would possess accumulated more bitcoin and change into even wealthier. Bitcoin was the finest-performing asset of the closing decade, and is taken into fable by many to be not astray to turning into the finest performing asset of this decade as wisely. When picking to store wealth, it’s principal to gain properly. Protect bitcoin, or lose fee retaining other sources.

“History reveals it’s far not imaginable to insulate yourself from the penalties of others retaining cash that’s more difficult than yours.” – Saifedean Ammous