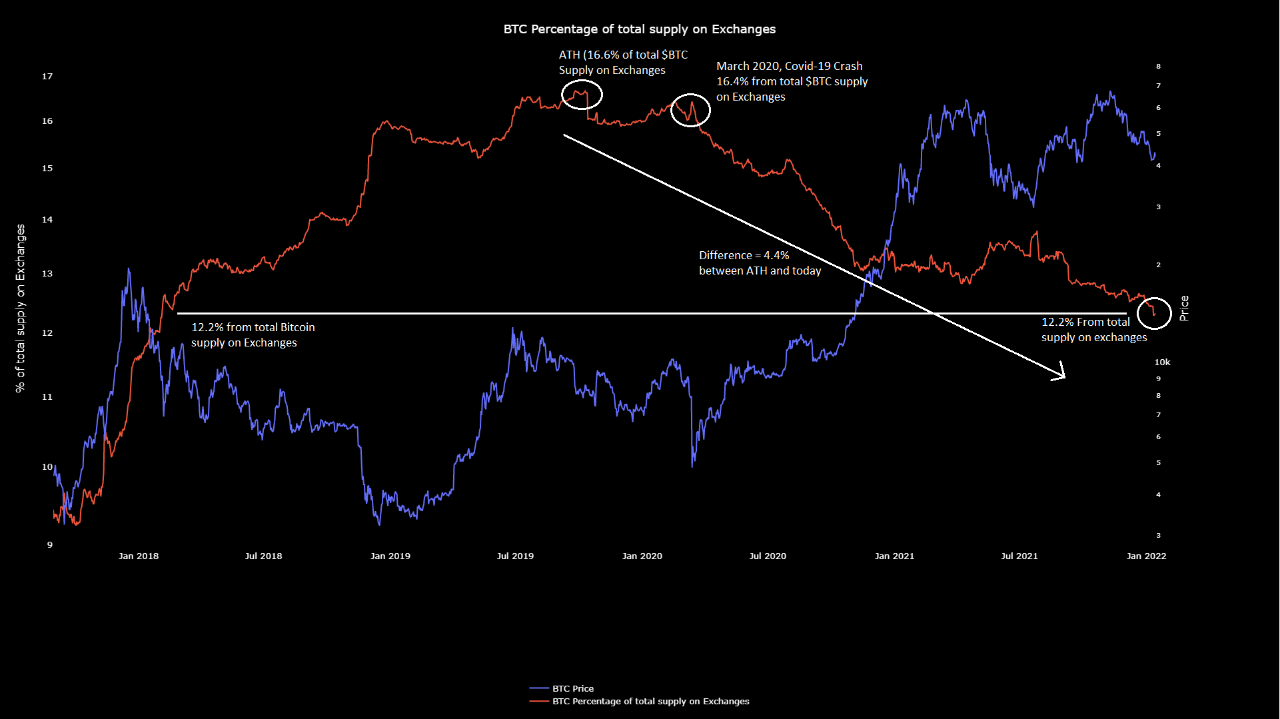

Percentage of the Bitcoin present on exchanges has dipped additional all of the formulation down to 12% nowadays, as the present shock continues to deepen.

Staunch 12% Of Bitcoin Supply Is Now Held By Exchanges

As pointed out by an analyst in a CryptoQuant post, the proportion of BTC present kept on exchanges has now dropped all of the formulation down to actual 12%.

The all exchanges reserve is an on-chain indictor that measures the final quantity of Bitcoin currently held by wallets of all exchanges.

The “percentage of BTC present on exchanges” is a metric that tells us the ratio between the alternate reserve and the final present of the crypto.

When the payment of this indicator strikes up, it formulation alternate wallets are receiving a rep quantity of coins. As merchants normally send their coins to exchanges for selling applications, this present is usually assuredly known as the promote present of the market. Subsequently, an uptrend in it’s some distance prone to be bearish for the payment of the crypto.

On different hand, when the metric’s value strikes down, it formulation holders are withdrawing their Bitcoin from exchanges. Prolonged such model can imply there is accumulation going on within the market, and the readily available present is terrorized. Hence, downwards motion of the indicator is prone to be bullish for BTC.

Linked Discovering out | Bitcoin Miners Point to Stable Accumulation As Their Inventories Spike Up

Now, here is a chart that shows the model within the payment of this metric over the last few years:

Appears to be like cherish the present on exchanges has been heading down since some time now | Supply: CryptoQuant

As it’s seemingly you’ll gaze within the above graph, the proportion of the Bitcoin present on exchanges has contracted all of the formulation down to actual 12% now.

The indicator’s last all-time excessive (ATH) became once made at around 16%. Since then, the metric has been regularly making its diagram down, and has now dropped 4% in value.

Linked Discovering out | Jack Dorsey’s Block To Democratize Bitcoin Mining With Initiating Supply Mining Machine

Some merchants mediate that this decrease within the present on exchanges is prone to be establishing a present shock within the market. This kind of scenario could be bullish for the payment of Bitcoin within the very prolonged timeframe.

On the opposite hand, some contemporary data goes against the account, arguing that the present has merely redistributed itself within the map of investment vehicles cherish ETFs.

BTC Sign

At the time of writing, Bitcoin’s value floats around $42.7k, up 3% within the last seven days. Over the previous month, the crypto has lost 11% in value.

The below chart shows the model within the payment of the coin over the last 5 days.

BTC's value has once again started to skedaddle sideways within the $40alright to $45okay fluctuate over the old couple of days | Supply: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com