In times of horrid horror, uncertainty and doubt (FUD), Bitcoiners want FUD-busting.

In 1710, nearly a decade sooner than the South Sea Bubble in England and the Mississippi Bubble in France, the essayist and author Jonathan Swift wrote the following iconic traces, echoed by many of history’s most celebrated writers, about truth and lies and their effects:

“… it veritably occurs, that if a lie be believed most efficient for an hour, it has done its work, and there might perhaps be not this kind of thing as a extra occasion for it. Falsehood flies, and truth comes limping after it; in protest that as soon as males advance to be undeceived, it’s miles too gradual, the jest is over, and the yarn has had its live.”

Little did Swift know that falsehoods paying homage to his hold generation’s financial manias would reemerge many times larger than three centuries later, wielded by economists who don’t know the first factor about the financial and cryptographic invention they’re larger than joyful to attack.

These critics of Bitcoin veritably level out the South Sea Bubble, Tulip mania or the Mississippi Bubble, thinking that they put the definitive trump card. And Bitcoiners, as soon as quickly odd with mighty of financial history, object that bitcoin is now not in a bubble, main to the traditional impasse that we can’t readily identify a bubble unless after it has burst.

Since my academic coaching is in financial history, I hold the least bit times chanced on one more avenue to be more fruitful: object to the analogy altogether. I know a factor or two about the episodes that Paul Krugman, Nouriel Roubini and others mechanically invoke — and I don’t deem they know what they’re speaking about.

So let’s FUD-bust the bubble analogies and educate bitcoiners in these financial-history matters.

Newest to the celebration of equating Bitcoin to the iconic bubbles of the past is the European Central Financial institution (ECB). In its Financial Stability Overview closing month, it acknowledged matter-of-factly that:

“Indicators of exuberance hold also been seen within the renewed hobby in crypto-sources, even supposing financial balance dangers appear restricted. The surge in bitcoin costs has eclipsed outdated financial bubbles relish the ‘tulip mania’ and the South Sea Bubble within the 1600s and 1700s.”

The footnote enhance for this dreary direct was as soon as a reference to that same issue from 2018 (as if nothing has happened in Bitcoin within the closing three years) where we procure:

“Bitcoin’s growth surpassed that of diversified historical bubbles sooner than it crashed in early 2018, losing 65% of its value. [the] Market capitalisation of crypto-sources stays modest no matter label developments that are more horrid than those of historical bubbles.”

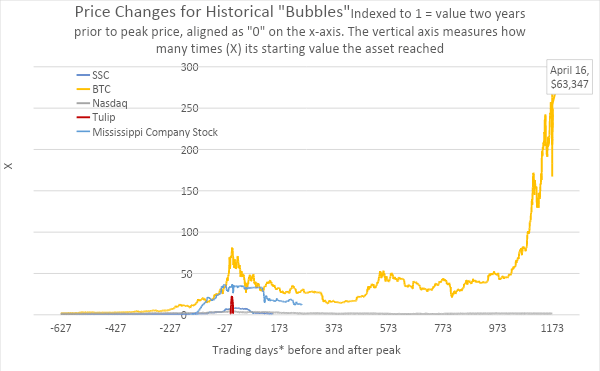

That is adopted by an it sounds as if incriminating graph that I re-make beneath. For positive, if the criteria for qualifying for the bubble corridor of reputation are nothing but substantial and rapid will enhance in asset costs, hundreds of candidates exist,from the most up-to-date history of about a of at this time’s dominant tech firms to your life like red sheet listed mission.

Graphically, it appears relish the ECB issue in 2018 had a degree: Bitcoin’s upward thrust was as soon as meteoric, rapid and towered over the historic bubbles to which it was as soon as when in contrast. The South Sea Bubble appears very modest, now not even achieving a 10x compose from the £100 it had hovered round since its advent in 1711. The series for Nasdaq appears wholly out of location, barely tripling over the 2 years earlier than its peak. By picking more concentrated indices, portfolios or individual tech stocks, lets make a larger spike, for instance by utilizing returns of the list of the 400 or so cyber internet firms that was as soon as printed by Morgan Stanley abet then (collectively with Pets.com, eToys and Eggheads as successfully as more successful ones relish Amazon, eBay and Qualcomm). Even then, we barely search for firms surpassing 10x returns.

Tulips

Labeling an asset “tulips” appears relish the very best argument: tulips are adornments, with established markets, that are somewhat unnecessary and are with out drawback mass produced. No sane individual would engage them at extremely excessive and accelerating costs, which makes any tulip label expand the final proof of irrational financial markets and the delusions of greedy capitalists.As a result of this tulips has change into a “byword for madness within the markets,” in step with Anne Goldgar, the student who has done most to expose the steady history of the 1637 “Tulipmania.”

What every person is aware of about the tulip mania is amazingly restricted, most of which was as soon as popularized by Charles Mackay over two centuries later, nearly all of it counting on rumour, chosen extracts from moralizing pamphlets on the time and echoed credulously in our time by the likes of John Kenneth Galbraith and Charles Kindleberger. All had substantial axes to grind towards the madness of financial markets.

As presented by Goldgar, now we hold traces of scant trading by merchants and among the gentry of snatch bulb promissory notes: futures contracts that entitled the proprietor to a obvious bulb as soon as sprouted later that spring. Now we hold got archival proof of a hundred or so diversified costs for these contracts, with few place transactions taking location between November 1636 and March 1637, as the bulbs hold been planted within the bottom staunch thru the iciness months. Goldgar never chanced on larger than about a dozen purchases of bulbs at costs exceeding a grasp craftsman’s wages, and all these hold been by successfully-off merchants who decorated their homes with one-of-a-form bulbs space subsequent to portraits or diversified decorations.

A serious drawback faces the building of the bubble-relish time series that the ECB so carelessly feeble: bulbs are now not same. Individual kinds hold been valued for odd patterns that arose with a mosaic virus that made them “rupture” — they hold been non-fashioned products, the majority of which never fetched any unparalleled costs. Peter Garber identifies 16 diversified styles of bulbs with a handful of label quotes for each and each. According to a pamphlet retold by Dutch historian N.W. Posthumus within the 1920s, Earl Thomson recreated a high quality-adjusted label index utilizing a as a lot as the moment reference ebook for tulips. We pause up with a dozen recordsdata facets on a unconditionally unreliable index over the associated few months.

Since no place transactions took location within the serious weeks of early 1637, Goldgar writes that “of us who misplaced money within the February fracture did so most efficient notionally… I chanced on now not a single bankrupt in these years who might perhaps well perhaps presumably also very successfully be is named somebody dealt the fatal financial blow by tulip mania.”

The scant quantitative proof on hand doesn’t level to a frequent tulip craze, and neither does the qualitative proof surrounding the Dutch bulb alternate within the 1630s.

The Mississippi and South Sea Bubbles

When put next to the shortage of quantitative observations for the Dutch Tulip Bubble, we are awash in them for John Legislation’s Mississippi diagram of 1719-1720 in France and the South Sea Company Bubble in England the following year. Each of these schemes tried to lower govt debt burdens by changing costly annuity liabilities into fairness in these trading enterprises — geared toward French The US for the Mississippi company and Spanish The US for the South Sea Company. What tiny such global alternate took location was as soon as puny-scale, unreliable, veritably unprofitable and instead the respective schemes became autos for financial engineering.

Legislation’s financial takeover of the French teach began along with his establishing a present-issuing bank, Banque Générale, that issued inventory in alternate for govt bonds that traded beneath face value. It also promised its depositors to advance abet the same amount of coins deposited, no matter any devaluation of the forex which might perhaps well perhaps presumably also occur, a treasured insurance coverage proposition towards monarchs inclined to misusing their financial prerogative. In 1717 the teach began accepting the bank’s notes as payment of taxes, firmly establishing Legislation’s advent within the banking and financial sphere.

Legislation organized what became is named the Mississippi Company, owning the monopoly rights to alternate on the French lands along the Mississippi River. The company expanded gradually to protect the rights to most of France’s global alternate. In January 1719 Legislation’s bank, now retaining hundreds govt bonds and having issued paper (notes and fairness) to fund itself, was as soon as taken over by the govt. and renamed Banque Royale. Later that year, Legislation merged the financial empire along with his trading empire after which successfully became finance minister: he controlled international alternate, held many of the govt.’s debt and was as soon as in possession of the money printer.

He expanded the bank’s existing issuance by 5x within the latter half of 1719, coinciding with a 10x of the associated payment of Mississippi Company inventory, which topped out in January 1720. After a heavy promote-off Legislation restricted gold withdrawals from the Banque, made its paper notes correct subtle and promised to alternate these notes for company inventory the least bit-time highs, sooner than many times devaluing the shares within the following month. By the head of the year, costs of fashioned goods had jumped, the Mississippi company inventory was as soon as abet the total vogue down to where it had been sooner than Legislation’s bubbling and Legislation himself fled the country.

The South Sea Company, which began its upward trajectory roughly when Legislation’s diagram was as soon as collapsing, was as soon as created nearly a decade earlier in a tried and tested system for the British govt to lower its debt costs: by auctioning off the privilege of amassing govt debt. By consolidating many sprawling annuities and diversified financial debt devices into equities in a single, with out drawback tradable asset, the Company made servicing the debt simpler for the govt. and the asset more liquid for the creditor.

The first conversion in 1711 swapped new South Sea fairness at par for govt annuities trading at heavy reductions (an quick earnings for the debt holders). Things modified toward the head of the last decade: if one might perhaps well perhaps presumably swap some govt debt, why now not all of it, in particular those parts of the debt that the govt. itself couldn’t redeem? As its shares had sailed above par value of [£]100, any conversion at par would all over again open quick features to those handing in their annuities. In the proposals handed to the govt. in January 1720 the Company diverged from this prepare, which allowed the conversion to take location at market label. This, writes Thomas Levenson in a new ebook on the South Sea diagram, was as soon as “the hinge on which all of what was as soon as to advance abet would turn.”

Squaring off with the diversified moneyed firms — the Financial institution of England and the East India Company — the South Sea Company promised up-front offers to the govt. in alternate for the privilege of changing debt whereas its inventory exploded in secondary markets. The larger the inventory rose, the much less shares the corporate’s directors would must section with to fulfill the annuitants, whereas conserving the final shares for themselves to promote or lend out later. The parliamentary deal allowed them to swap new shares at market costs, but chronicle for them at par: redeeming £100 rate of govt debt with South Sea inventory trading at £100 would require the fats share, but that same share might perhaps well perhaps presumably redeem twice as mighty debt if the South Sea inventory exchanged hands at £200. Peaceful creating and issuing two new shares, but most efficient having to forestall one to fulfill debt holders, the corporate directors had an extra share to live with as they wished. “The more South Sea shares rose,” writes Levenson, “the more the Company might perhaps well perhaps presumably be rate — which would carry out shares in this kind of treasured mission easy simpler.”

Over four fund-raising subscriptions staunch thru the spring and summer of 1720, the Company successfully created leveraged products as most efficient a chunk of the inventory was as soon as paid up front. As the diagram most efficient labored whereas Company stocks soared larger, new considerations weren’t delivered to subscribers unless December 1720, fighting promote-offs (because of a lock-up length). Subscriptions hold been issued at step by step larger costs; The Company lent money to traders with Company inventory as collateral; its directors joyful Parliament to ban diversified joint-inventory firms; it closed its transfer books (successfully turning place trading into futures) for 2 months on the inventory’s label peak, sooner than struggling to pay an outsized dividend. As with many diversified debt and leverage-fueled schemes, eventually the gas runs out, and ideally suited relish leverage elevated the power on the system up, its cascading effects of horror-promoting exacerbated the downfall. Notwithstanding the Company’s many attempts to retain it afloat, the inventory collapsed within the autumn of 1720 abet to round £130, where it had began the year.

Peaceful, it wasn’t worthless: its fundamental value was as soon as now not, wander Roubini, zero. After legal court cases and restructuring by Parliament, it became a govt-bond retaining company operating unless the 1850s.

Retailers, paupers and half the nobility hold been hooked in to South Sea inventory within the spring of 1720, and at some level the market capitalization of the corporate rivaled the associated payment of all land in England. That makes it a mighty more believable candidate for a financial mania, but would by that same metric exempt bitcoin: its total market capitalization is round a trillion bucks whereas the enviornment’s fairness markets, bond markets and properties hold a mixed market value of larger than a hundred times that. If bitcoin is in a South Sea-vogue bubble, it has a lengthy system left to transfer.

If bitcoin had dwindled into obscurity after its December 2017 peak, the arguments by the Krugmans, Roubinis and ECB pundits of the enviornment would carry out some sense: it does certainly rival the substantial bubbles of the past, rising to prominence sooner than collapsing (albeit in label movements, in preference to financial system-wide influence). Of us that known as victory when bitcoin’s dollar label fell from grace in early 2018 must look what happened subsequent with substantial concern. Roubini veritably says that the basic value of bitcoin is zero but the associated payment moves extra and further away from his lengthy-standing prediction. If I lengthen the steady same chart to what happened after the ECB’s 2018 issue, we bag this:

It’s tough to search for this as analogous to Bitcoin. Few bubbles speed up relish bitcoin and collapse most efficient to advance abet stronger than ever about a years later. It took Nasdaq larger than 10 future years abet to its prior excessive, consisting principally of most up-to-date firms as successfully as the successes of the gradual-1990s. Particular tulips of 1637 fell out of fashion; the Mississippi company was as soon as wound down; the South Sea Company returned to its existence as a dreary pass-thru automobile for govt hobby funds. In disagreement, the in actuality flourishing firms to advance abet out of the dot-com generation (Amazon, eBay, Apple) hold made their traders successfully off, even of us who supplied on the peak of the bubble.

The direct of of us who predict a South Sea Company-relish collapse for Bitcoin easy hold time on their aspect, and with most up-to-date events, even gas on their fires. However they don’t hold history. Reviewing the iconic bubbles to which Bitcoin will get when in contrast, it appears mighty much less relish these alleged financial manias and heaps more relish the resilient success experiences that got here out of the dot-com generation.