The under is from a present version of the Deep Dive, Bitcoin Journal’s top fee markets newsletter. To be amongst the first to ranking these insights and assorted on-chain bitcoin market prognosis straight to your inbox, subscribe now.

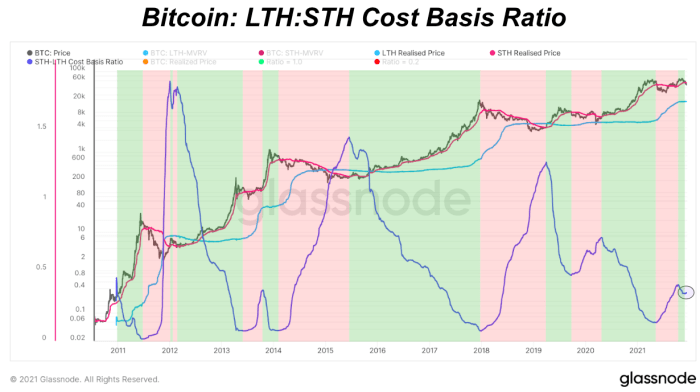

We accept as true with mentioned the mark foundation ratio of bitcoin’s long-timeframe holders (LTH) and momentary holders (STH) a quite heaps of amount of instances in our old prognosis.

For an introduction to the metric, be taught The Each day Dive #070 – Short-Term:Prolonged-Term Impress Foundation Ratio.

A TLDR:

When the STH:LTH realized mark ratio is rising, it formulation that the mark foundation of STHs is rising relative to LTHs, and conversely, when STH:LTH realized mark ratio is reducing, the mark foundation of LTHs is rising relative to the mark foundation of STHs.

That is intensely insightful, because the mark of bitcoin rises when the marginal vendor is exhausted. That’s the reason you see the mark foundation of LTHs stop significantly stagnant all the blueprint by explosive bull markets, whereas the mark foundation of STHs (many of whom are fresh market people) explode upwards — there are simply no longer adequate coins to circulate round to meet newfound interrogate. Thus, “number slither up.”

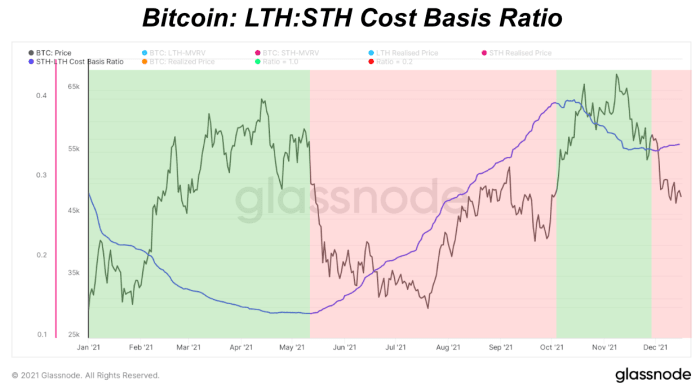

the metric neutral nowadays, with mark neutral nowadays breaking under the mark foundation of momentary holders, their mark foundation is reducing, and thus the metric is precise barely rising.

That is occuring as some present market persons are capitulating and taking on-chain losses. A downtrend will resume once mark has reclaimed the mark foundation of momentary holders, ($52,495), or the increasing old in of coins into the long-timeframe holder cohort causes their respective mark foundation to expand towards that of momentary holders.

Last Display

The secular pattern of international bitcoin adoption will continue. Despite loads of macroeconomic uncertainties heading into 2021, there’s by no formulation a wicked time to expand your piece of the arena’s most sound monetary system. Consolidation to total 2021 is per chance the almost definitely place.

Sat stackers accept as true with fun.