The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s top price markets newsletter. To be among the first to fetch these insights and various on-chain bitcoin market prognosis straight to your inbox, subscribe now.

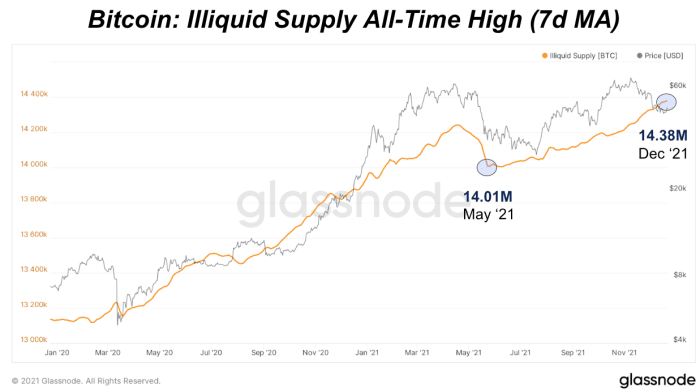

Illiquid provide continues to hit multi-year highs, adding virtually 371,000 bitcoin for the explanation that deceleration in May perchance perchance well merely. Even with the unique trace drawdowns sparked from prolonged liquidations and market sell-offs, illiquid provide continues to make bigger signaling that more prolonged-term holders are adding bitcoin over the last few months.

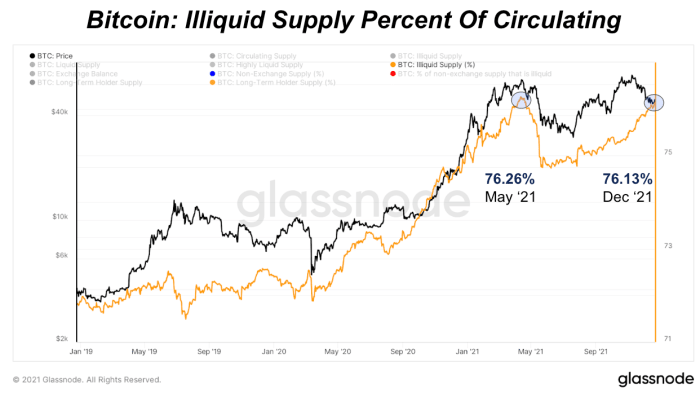

As a share of circulating provide, illiquid provide is 76.13% and proper below the all-time high of 76.26% also seen support in May perchance perchance well merely. Illiquid provide share of circulating provide has been a strongly correlated relationship with trace over the closing year.

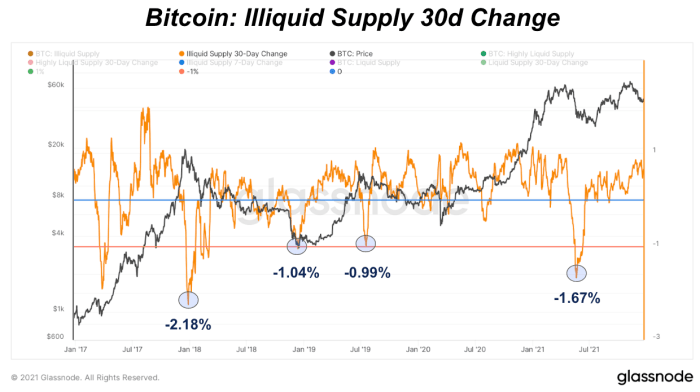

The illiquid provide traits also demonstrate that the most up-to-date drawdowns had been largely pushed by the derivatives market and no longer so mighty the place market. With each and each fundamental bitcoin correction, there became once a fundamental deceleration in illiquid provide taking a see on the illiquid provide 30-day trade. Generally here is a 30-day trade in illiquid provide at or below -1%.

A 1% trade of illiquid provide on the present time would possibly well well be 143,942 bitcoin rate correct over $7 billion at a $49,000 trace. We would quiz a more most necessary, place-pushed bitcoin correction to come support with a decelerating illiquid provide, which hasn’t been seen over the last few months.