- Ruble-denominated Bitcoin volumes reached a 9-month excessive as investors fled to build up-haven sources.

- Many of the trading is on cryptocurrency substitute Binance, in accordance with little print cited by CoinDesk.

An increasing selection of folks contain regarded to place shut Bitcoin and different cryptocurrencies across Russia and Ukraine amid the affect of war on native currencies, knowledge reveals.

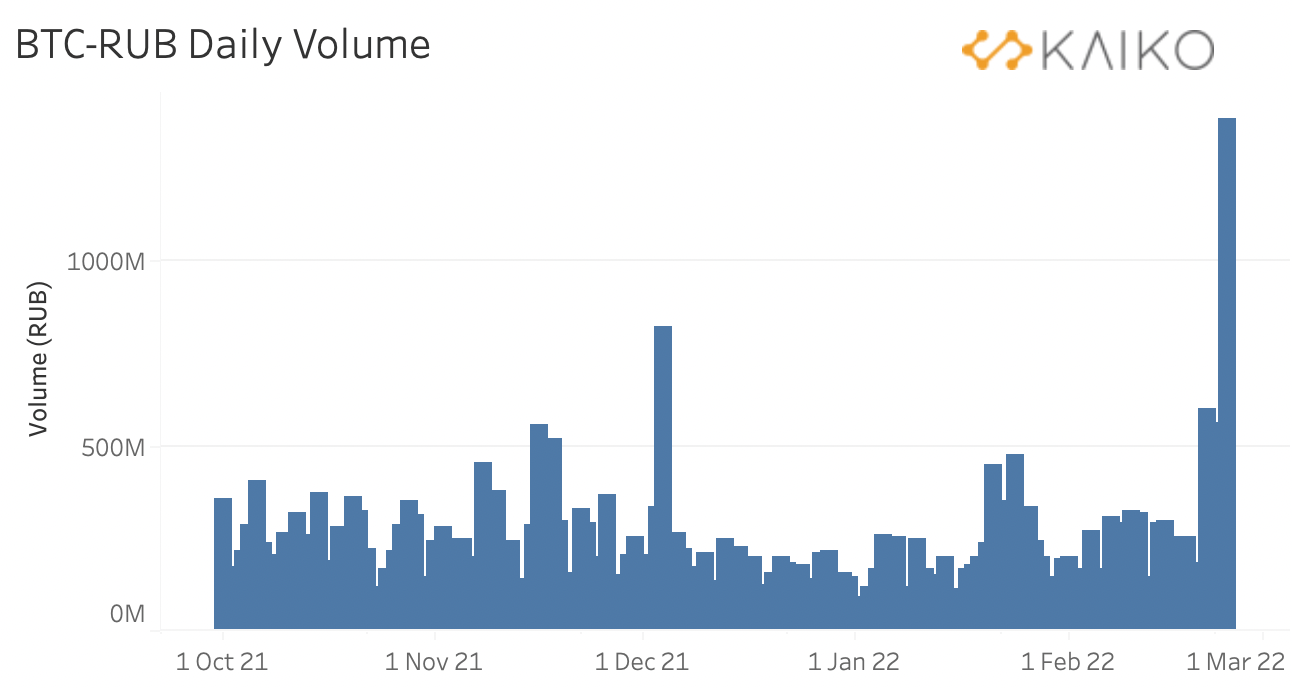

In accordance with knowledge from crypto monitoring build Kaiko, ruble and Ukrainian hryvnia-to-crypto volumes contain shot up previously week to multi-month highs.

Per the guidelines, trading volumes denominated in the ruble-bitcoin (BTC-RUB) pair elevated sharply to hit ranges last viewed in April-Would possibly possibly possibly well possibly 2021.

Ruble-denominated BTC volume soared by 1.5 billion RUB on 24 February, in accordance with Kaiko, just correct earlier than the weekend’s stiffer sanctions that noticed Russian banks minimize off from the SWIFT machine.

Ruble-denominated BTC volume. Source: Kaiko

Ruble-denominated BTC volume. Source: Kaiko

Ukraine’s hryvnia-BTC volume additionally surge

Whereas the ruble noticed the most trading volume amid the frenzy to hedge against the affect of sanctions, investors in Ukraine had been equally worried. Kaiko’s Medalie talked about that even though quiet low, the bitcoin-Ukrainian hryvnia (BTC-UAH) pair spiked over the week.

Tether-ruble (RUB-USDT) and tether-hryvnia (UAH-USDT) trading volumes contain additionally elevated in respect of the invasion, the guidelines confirmed.

Many of the rising volumes had been on Binance- and LocalBitcoins- which enables for seek-to-seek Bitcoin substitute.

Falling ruble

The rising volumes are majorly pushed by a race to build up-haven sources by investors spooked by the sanctions and the doable ramifications for the ruble.

Gold, US Treasuries, USD, and the Swiss franc are amongst the sources to seek an uptick in place shut-aspect stress all by means of the last few days. Bitcoin additionally soared to highs near $40k over the weekend however continues to face stress alongside shares.

Already, sanctions contain viewed Russia’s ruble drop to contemporary lows of 119 against the buck, with the Central monetary institution of Russia transferring to adopt measures supposed to shield the fiat forex from extra depreciation and inflation hits.

Amongst these measures is Monday’s transfer to raise key interest charges from 9.5% to 20%, and an repeat to native brokers prohibiting them from offering providers and products to foreigners making an attempt for to promote securities.