Cake DeFi is a Singapore-based mostly staking, lending, and liquidity pool platform, enabling users to deposit and produce yield on a range of tokens.

With out reference to the “DeFi” nametag, Cake DeFi is a custodial platform that offers a suite of aspects constructed spherical a bunch of DeFi products.

Cake DeFi offers three necessary products: Lending, Liquidity Mining, and Staking– every generates varied charges of yield and has varied requirements. Customers can produce spherical 6.5% lending digital belongings adore BTC, USDC, and ETH, or upwards of 80% by Liquidity Mining.

About Cake DeFi

Cake DeFi changed into founded in 2019 by Dr. Julian Hosp (CEO) and U-Zyn Chua (CTO).

The firm is based mostly in Singapore.

Julian Hosp M.D., has a extensive sort of experiences, ranging from being a Trauma Surgeon in Discipline to a Skilled Kite Surfer. In 2015, Hosp Cofounded TenX, a cryptocurrency-enabled Visa card, and mobile pockets.

Hosp and Chua labored together on the TenX token sale, helping the mission elevate $80M in June 2017; it changed into one amongst the ultimate ICOs on the time. The mission, on the different hand, confronted fat mission within the trials and tribulations of the 2018 cryptocurrency market crash.

Hosp parted ways with the mission in 2019 raising a bunch of controversies– addressed in his blog put up here.

TenX rebranded to Mimo, which seemed to be a staking and liquidity pool platform for a EUR precise token called Parallel, earlier than shutting down entirely in 2021.

U-Zyn Chua has been a Chief Researcher for the DeFiChain mission since January 2019, which performs an integral role within the Cake DeFi ecosystem.

The DeFiChain DFI Token

Cake DeFi constructed a bunch of its companies and products spherical the DeFiChain (DFI) token.

DeFiChain is a non-Turing entire blockchain that aims to enable decentralized finance on Bitcoin. DeFiChain runs on a PoS consensus mechanism, and it anchors its most expose Merkle root to the BTC blockchain.

DFI went stay in August 2020; its worth peaked with a market cap of $2.34B in April 2022.

The mission is operated by the Singapore-based mostly DeFi Foundation, and the muse is led by Cake Founders Dr. Julian Hosp (chairman), and U-zyn Chua (CTO).

Cake DeFi Lending

Cake DeFi’s charges for lending are aggressive with their staunch DeFi counterparts. It advertises a “guaranteed” Incorrect APY– with bonus returns if the cost of the native coin goes up one day of the lending interval.

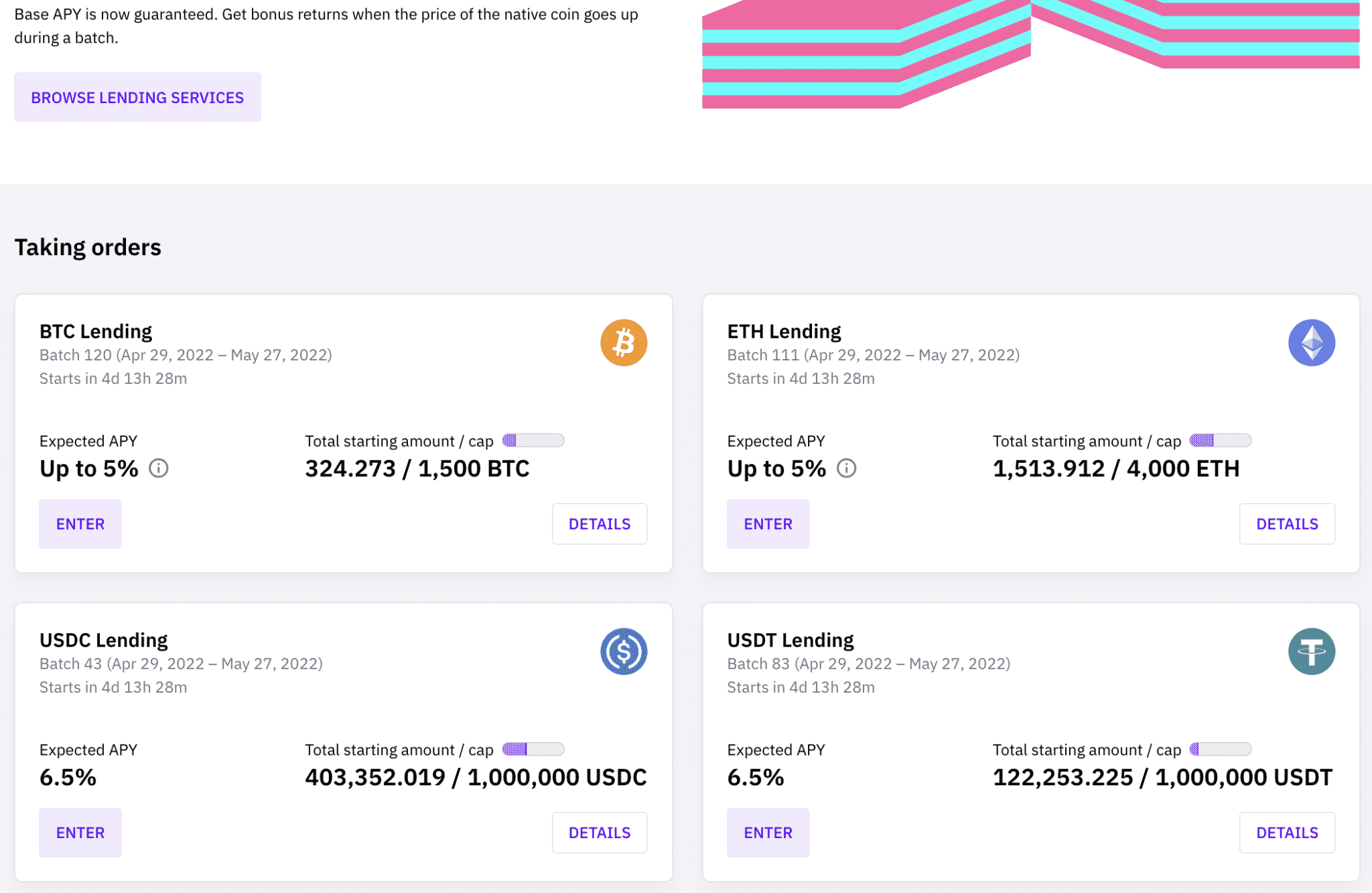

Deposits are lent in “batches” the place users deposit digital belongings (BTC, ETH, USDC, or USDT) and the money are locked in choices contracts for four weeks. The batch lasts for 28 days, and starting and ending on a Friday.

After the four-week interval, users can robotically roll over into the next batch, withdraw their entire main and return to their Cake Pockets, or withdraw greatest the proceeds.

Cake DeFi lending

Cake doesn’t price its users funds; it receives commissions straight from its companions.

Bonuses occur if the field worth of the asset ends in a particular vary. As an illustration, let’s grab the next:

- BTC’s field worth on the originate up date is $10,000.

- A Lending Batch offers 5% APY on BTC, and a bonus BTC return of 2.5% APY if BTC’s field worth is as a minimum $12,500 on the quit of the 28-day interval.

- We enter the Batch with 10 BTC.

Enlighten #1: BTC’s field worth at expiration is $10,500.

We would rep 5% APY on our 10 BTC, or 0.0375 BTC– 5% APY for the 28 days of the batch. We would maintain about 10.0375 BTC in our story, which we are in a position to elect to roll over into the next batch or withdraw entirely.

Enlighten #2: BTC’s worth at expiration is $2,500. (ouch)

We would unruffled rep our 5% APY. Identical as the instance above, we’d receive about 10.0375 BTC in return.

Enlighten #3: BTC’s worth at expiration is $13,000.

We would rep our 5% APY, and an further 2.5% APY bonus, placing our complete APY at 7.5%. On the quit of the batch, we would rep a entire 10.0565 BTC :

- Our main (10 BTC)

- Our 5% APY (0.0375 BTC)

- Our Bonus 2.5% APY (0.01896)

Though Cake claims that the main and returns are each and every fully guaranteed and likelihood-free with “seemingly bonuses,” they don’t in actuality point to how– their team did no longer present a comment when contacted.

Liquidity Swimming pools

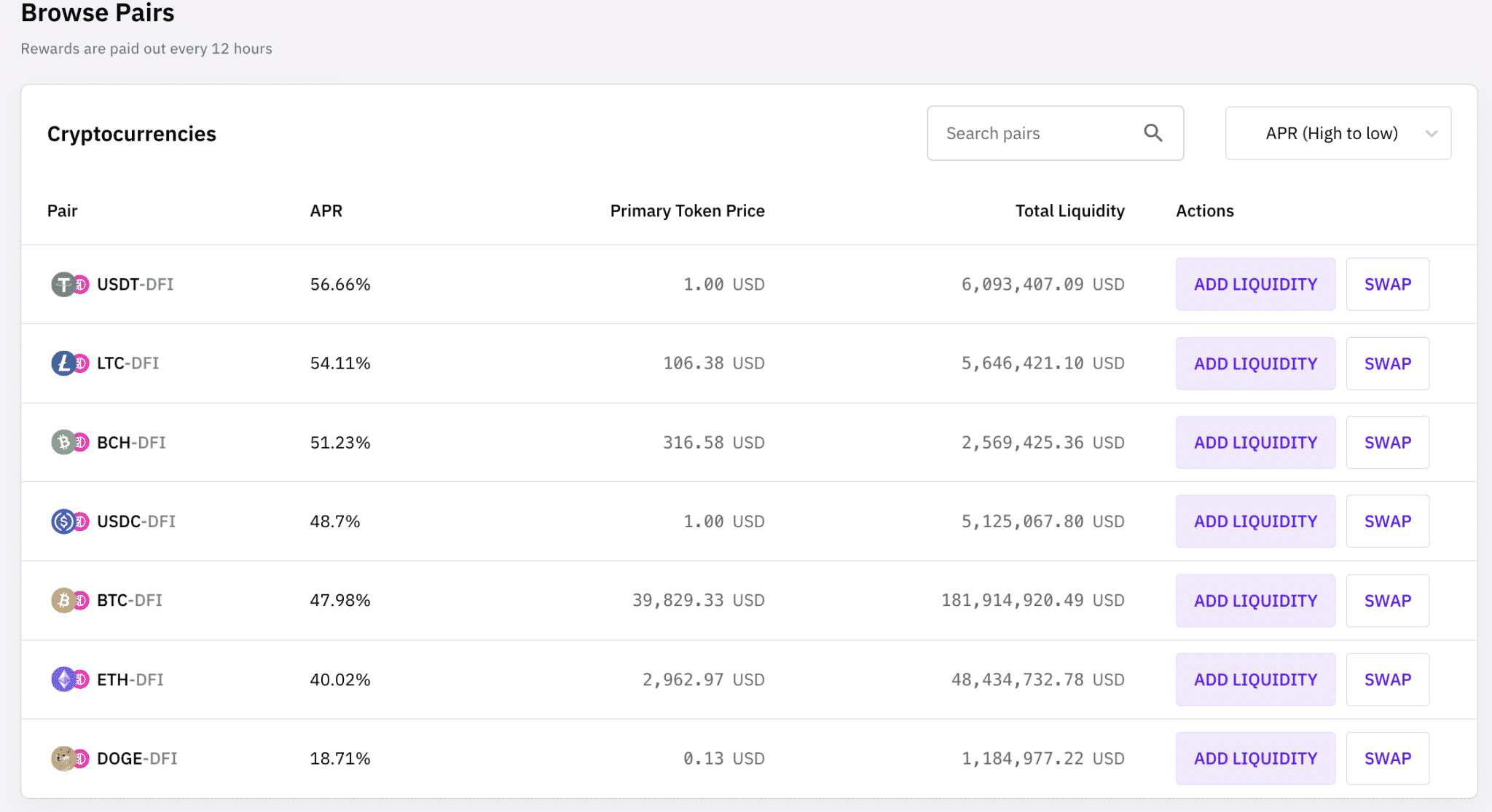

Cake DeFi offers shared liquidity mining pools the place users can produce yield in pairs between smartly-liked money and the DFI token.

These liquidity pools pay a yield upwards of 68% (self-discipline to commerce). Cake takes 15% as a fee on all rewards.

Rewards are paid out every 12 hours straight into your pockets on the Cake platform; it could perhaps well perhaps additionally grab in to 24 hours for the first rewards.

A snapshot of the Cake DeFi liquidity mining pools

These rewards are paid in each and every pairs, so whereas you happen to could perhaps well perhaps additionally perhaps be including liquidity to a BTC-DFI pool, you’ll be paid in equal amounts BTC and DFI.

Customers can grab their money out of liquidity mining pools at any time.

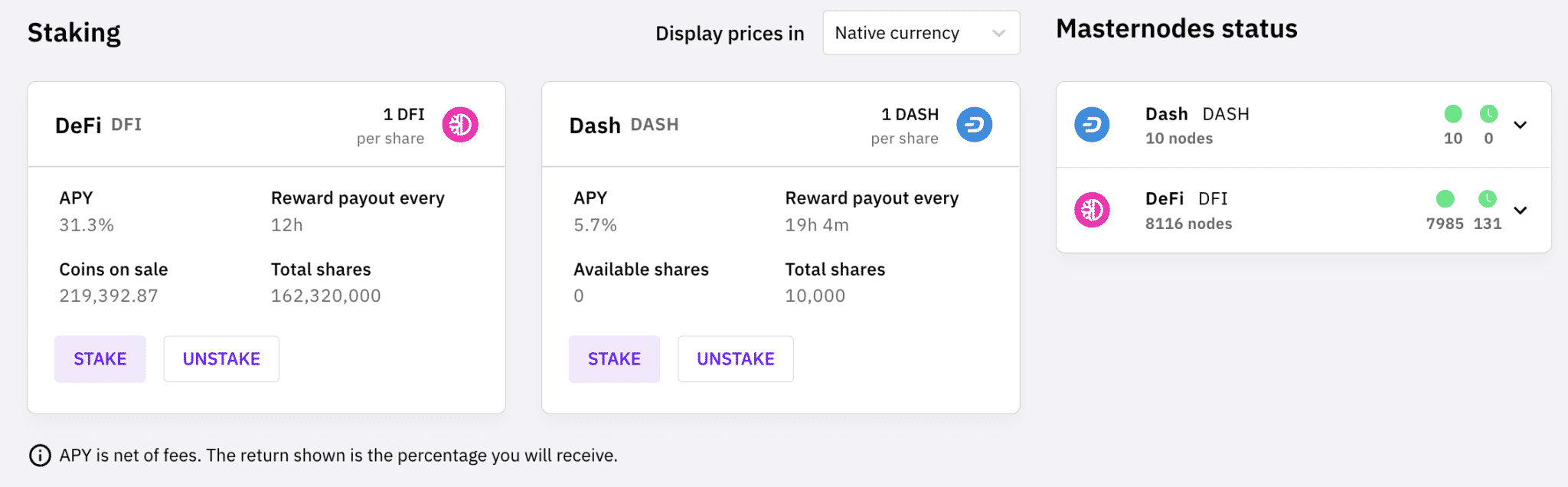

Staking

Customers can stake (“bake” masternodes) and produce staking rewards in proper-time. Cake currently offers two masternodes– DFI (as much as 31.7% APY) and Bound (5.7%).

A snapshot of the Cake DeFi staking choices

The Cake Freezer 🥶

The extra hardcore Cake users can elect to “freeze” or lock up their DFI for as much as ten years. In return, they rep each day money slide along with the stream on their locked-up funds and an 85% rebate on staking funds.

To make exercise of the Cake Freezer, you honest elect to lock up your DFI for at least a month (or a max of a decade). Your funds will likely be robotically allocated to liquidity mining pools; bonuses are staggered in accordance with the interval of your lock-up.

As an illustration, let’s verbalize we freeze 10,000 DFI for 1 month. We’d rep a Incorrect APY of 89%, and our Freezer APY would be about 92%. For the 1 month, we’d receive about 500 DFI in rewards.

Alternatively, let’s assume what occurs if we enact a fleshy ship on our DFI. Let’s grab we’re gigantic bullish on the Cake platform, DFI token, and assume each and every fresh in 10 years.

Over this 10-year interval, our Freezer APY would soar to about 108%. On the quit of this interval, our 10,000 DFI would maintain changed into into about 42,000 DFI.

Final Strategies: Is Cake DeFi Legit?

Cake DeFi is a pretty unprecedented offering compared with its crypto yield family. Cake DeFi is a centralized firm adore BlockFi and Celsius; by the utilization of the carrier, you’re trusting it to abet your funds safe one day of the a bunch of yield-generation actions. It does offer some guarantees, however there could be nothing of substance to support the guarantee, which comes off as advertising and marketing-talk.

Alternatively, it differs within the opportunities accessible. Whereas most crypto ardour accounts greatest offer yield on lending your belongings, Cake lets in users to rep entry to powerful increased returns via liquidity mining and staking– actions in most cases reserved for the DeFi-savvy crowds.

How is Cake ready to present 80% APY? Wisely, adore most varied liquidity mining and staking opportunities, the yield is paid out in DFI that the Cake DeFi team controls. So, the right kind “yield” you rep is dependent on DFI affirming its worth, besides your ability to promote (its most smartly-liked exchanges are on Kucoin and Binance, with tiny abet in different places).

These tokenomics don’t work nicely in DFI’s prolonged-time interval favor, so the “freezer” manufactured from locking DFI up for 10 years appears adore a abominable proposition.

The controversies with TenX shouldn’t be overlooked, however it doesn’t appear that this product changed into created out of malicious intent. The firm itself is based mostly in Singapore, which adheres to varied regulating authorities than U.S-based mostly firms.

Alternatively, despite dubious claims of guaranteed returns and a lack of firm response to elaborate, it doesn’t appear adore the product is illegitimate. The token itself has surprisingly held its cost up nicely in fresh cases.

As always, this handbook isn’t monetary advice or an endorsement. Digital belongings are abominable, and platforms that grab custody of your belongings to introduce but another likelihood.