Osmosis is an automatic market maker (AMM) built with the Cosmos SDK; it specializes in the InterchainDeFi motion (Tendermint-primarily based blockchains) in the Cosmos ecosystem. In numerous words, Osmosis is a decentralized commerce namely built for Cosmos, with plans to create larger to extra blockchains.

Bring to mind Cosmos as the sandbox, and Osmosis as something that can connect the full many dApps. As a DEX, Osmosis nurtures a heterogeneous and interoperable tainted-chain trading abilities.

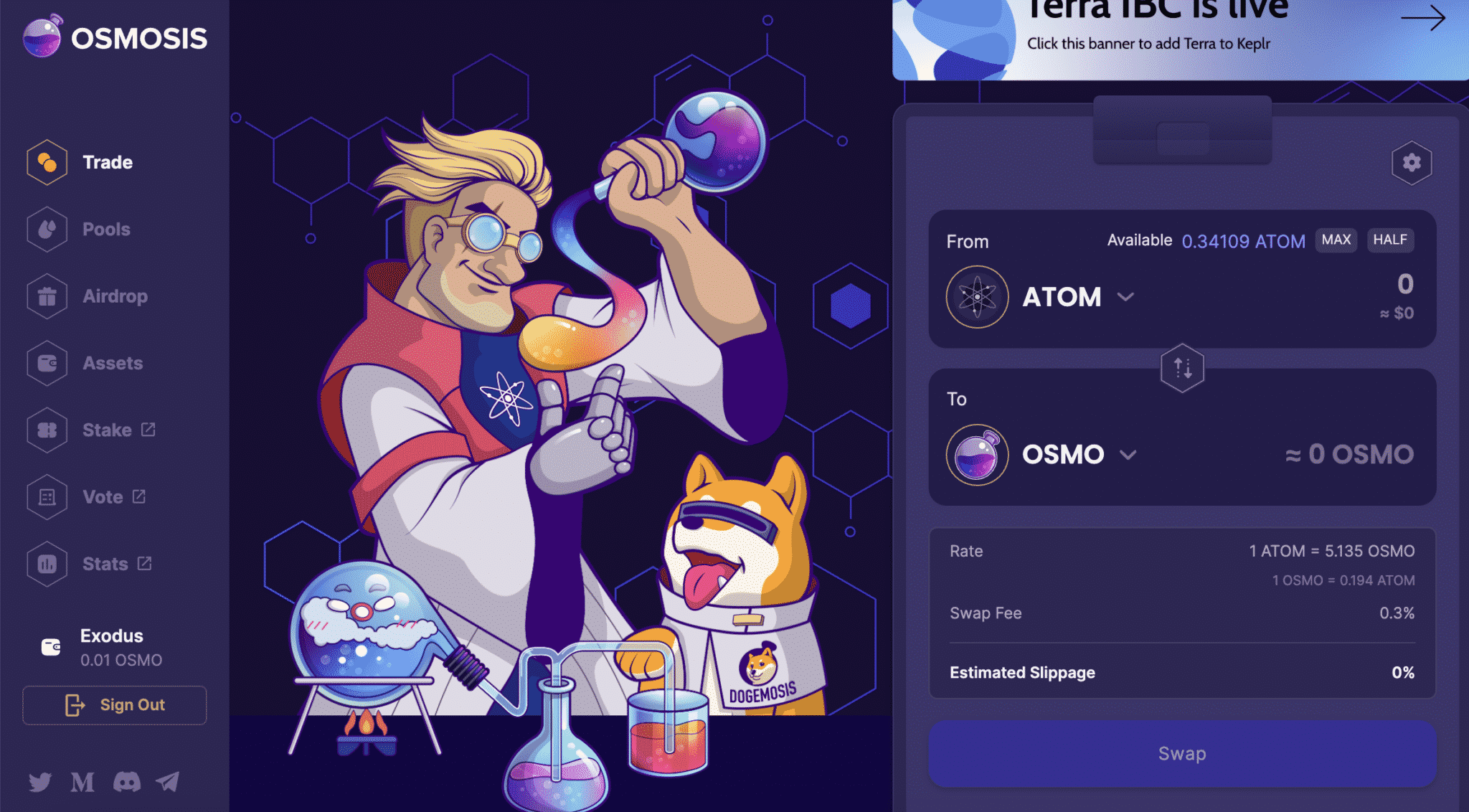

Osmosis major page

Osmosis is for the time being the most dominant, accounting for roughly 40% of the full inter-blockchain transfers on Cosmos. IBC compatible blockchains (such as Cosmos, Regen, Akash, and extra) would possibly perhaps well additionally be seamlessly swapped on Osmosis, with costs typically below $1.00.

To fully charge the Osmosis charge proposition, it’ll abet to first detect the Cosmos ecosystem and a few DeFi & DEX basics.

- Cosmos: Cosmos is an “Web of Blockchains” network wherein developers can make interoperable dApps. In the supreme Cosmos world, Ethereum apps will play correctly with Binance Shipshape Chain apps, etc. But for now, initiatives that adhere to the IBC (below) will most certainly be ready to seamlessly communicate with every different and send tokens for minimal transaction costs.

- The Inter-Blockchain Dialog Protocol (IBC) is a protocol that relays messages between different self sufficient disbursed ledgers. It used to be in the initiating created to connect Tendermint‐primarily based blockchains.

- Tendermint Core is a Byzantine-Fault Tolerant engine for constructing blockchains. It enables developers to jot down their capabilities in any language, and then replicate the app globally. There’s no longer one of these thing as a must depend upon transaction confirmations; a transaction is accurate now finalized as soon as incorporated in a block.

- Computerized Market Maker (AMM): This smartly-liked DEX protocol relies on algorithms to charge cryptocurrency sources in liquidity swimming pools, filling the aim of a centralized market maker in an expose-book manner platform.

Sovereignty and heterogeneity are two key pieces of the Cosmos (and Osmosis) mission, and likewise you’ll analysis them echoed in nearly every characteristic.

Osmosis would possibly perhaps well additionally be accessed by its major residing: https://app.osmosis.zone/.

About Osmosis Labs: Firm Recordsdata

Osmosis is a product by Osmosis Labs, founded by Sunny Aggarwal and Josh Lee.

Whereas Osmosis Labs Pte. Ltd. ( “Osmosis Labs” ) is accountable for heaps of of the preliminary code development for the Osmosis protocol, the Osmosis mission is certainly fling by a decentralized validator space. Every upgrade and modification to the protocol is voted on and implemented by the Osmosis community (holders of the OSMO governance token.)

As such, no single entity occupied with Osmosis is legally accountable for claims or damages, hence the “decentralized” nature of the protocol.

Osmosis raised $21M in an October 2021 token sale led by Paradigm.

Osmosis Aspects

Technically speaking, Osmosis is a proof-of-stake blockchain with a decentralized commerce application, namely designed for IBC compatible blockchains.

Wrong-Chain Native

Osmosis is designed to be tainted-chain native, and appreciate many Cosmos initiatives, it’s built to be IBC compatible at its basis.

Osmosis plans to branch out to non-IBC enabled chains, such as Ethereum-primarily based ERC20s (by job of the Althea gravity bridge), Bitcoin-appreciate chains, and replacement beautiful contracting platforms (by job of custom pegs.)

Sovereignty and Unified Incentivization

Sovereignty is a immense deal for the Cosmos of us. Osmosis derives its sovereignty from its architecture, as smartly as from the collective sovereignty of liquidity services –every LP is incentivized to concurrently retain their autonomy and present liquidity by different mechanisms.

Osmosis is remarkable contained in the Cosmos ecosystem (and different DEXes) because it aligns liquidity services, DAO members, and delegator pursuits with a vary of incentives. For one, staked liquidity services beget sovereign ownership over their swimming pools, and so they are able to adjust parameters primarily based on market stipulations and the arrangement in which competitive the pool is among others. Nothing in the Osmosis AMM is laborious-coded– LP services can vote to commerce any pool parameter, such as swap costs, token charges, reward incentives, and curve algorithms.

Liquidity swimming pools on Osmosis are self-governing, and fully customizable thru their governance.

This characteristic promotes heterogeneity with the intent to have a competitive and nurturing ambiance of rapid iteration and experimentation. This heterogeneity is completed thru an array of customization ideas. Whereas most DEXes depend upon bonding curves, Osmosis enables for dynamic modifications of swap costs, multi-token liquidity swimming pools, and custom-curve AMMs. Theoretically, the Cosmos AMM can allow the decentralized formation of token fundraisers, an ideas market, and even interchain staking.

Superfluid Staking

In the used DeFi enterprise, token holders must expend between producing yield from staking (which maintains the protocol) or from liquidity (which affords AMM steadiness.)

Osmosis pioneered a characteristic called Superfluid Staking: OSMO (the Osmosis governance token) would possibly perhaps well additionally be vulnerable for staking and liquidity concurrently, maximizing rewards without making any internal network tradeoffs (i.e., security for liquidity.)

So, a liquidity provider or staker in Osmosis will produce rewards from offering liquidity and staking, whereas different platforms require token holders to create a tradeoff.

To illustrate, any individual in an OSMO-AKT pool will receive that pool’s LP tokens, that will most certainly be staked to precise both Osmosis and Akash networks. The person would generate yield from the LP rewards as smartly as staking rewards.

The formula to Utilize Osmosis

There are a few systems to expend Osmosis, and it’s fully to apply the money. There are three categories of costs on Osmosis:

- Any individual who transacts on the chain pays transaction costs. These costs are variable and primarily based on the storage and computation costs, and the minimal fuel charge proposed. These costs are disbursed to OSMO stakers and validator operators.

- Any individual who swaps sources on the DEX pays swap costs, that are certain by every liquidity pool’s parameters and commerce dimension. These costs are disbursed pro-rata to that pool’s liquidity services.

- Liquidity services who pull their liquidity out of a pool pays exit costs. The LP shares are then burned, and the cost is disbursed to the closing liquidity services.

So, anybody can expend the Osmosis DEX efficiency to swap IBC-compatible tokens appreciate ATOM, ION, AKT, LUNA, and different compatible chains appreciate CRO.

Providing Liquidity on Osmosis

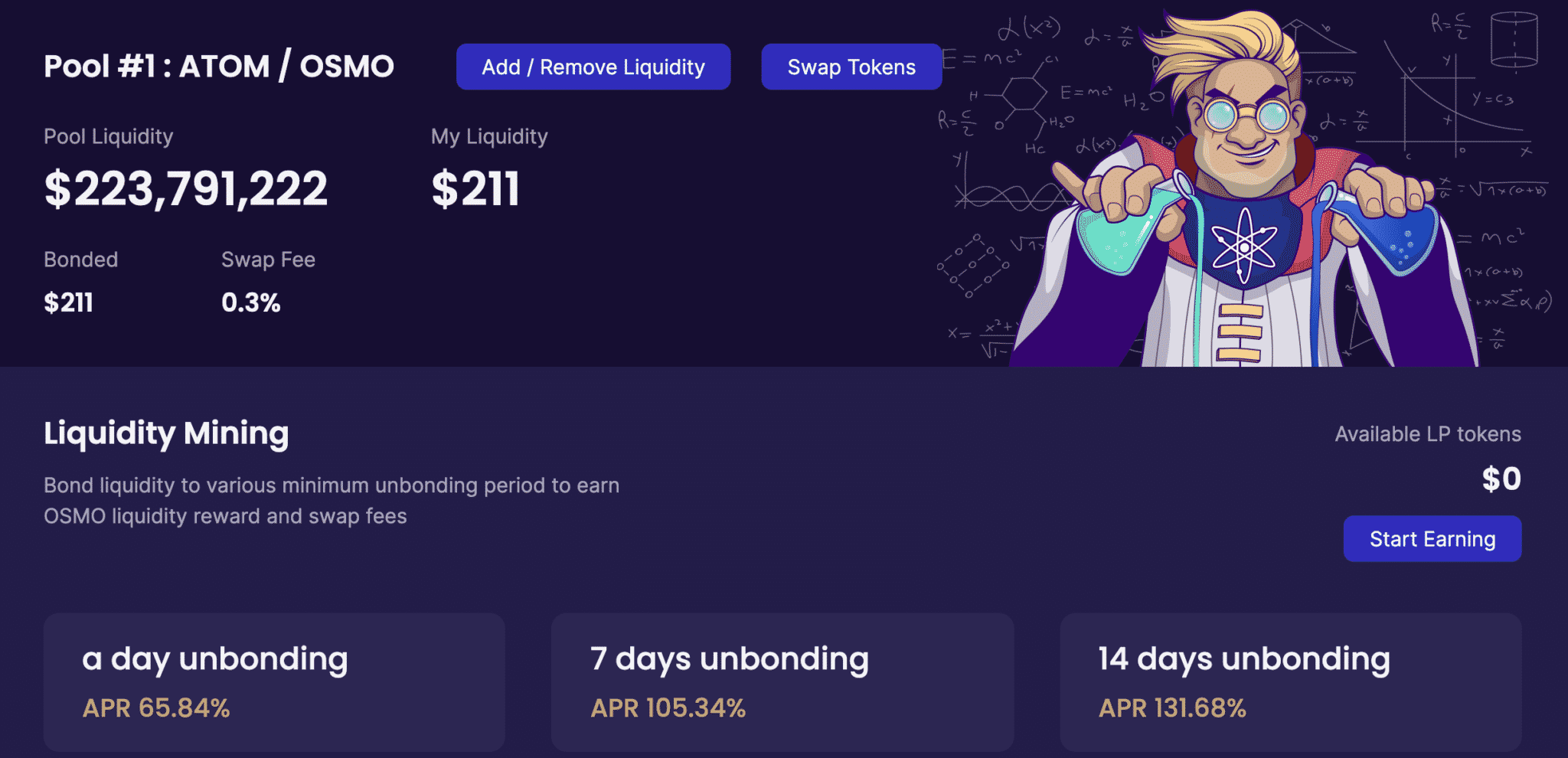

Liquidity services can add liquidity to a pool and produce the pool’s swap costs (certain by the pool proprietor, typically round 0.3%) and receive LP tokens, that will most certainly be bonded for durations of 1 day, 7 days, and 14 days.

Osmosis Liquidity Pool characteristic format

Osmosis makes it that it is probably going you’ll perhaps well presumably presumably also imagine for different initiatives so as to add incentive mechanisms to swimming pools. To illustrate, if the Cosmos Hub Neighborhood Pool wanted to incentivize liquidity for an ATOM-stablecoin pair, they’ll distribute ATOM rewards the expend of the Osmosis built-in incentive module.

These incentives goal to abet long-term liquidity, no longer a brief-term mercenary farmer model, where yield farmers transfer from pool to pool, looking out for the fully yield. In apply, a mission would possibly perhaps well present greater incentives for LPs who time lock their LP tokens for extra prolonged sessions, reducing liquidity volatility.

Osmosis OSMO Staking

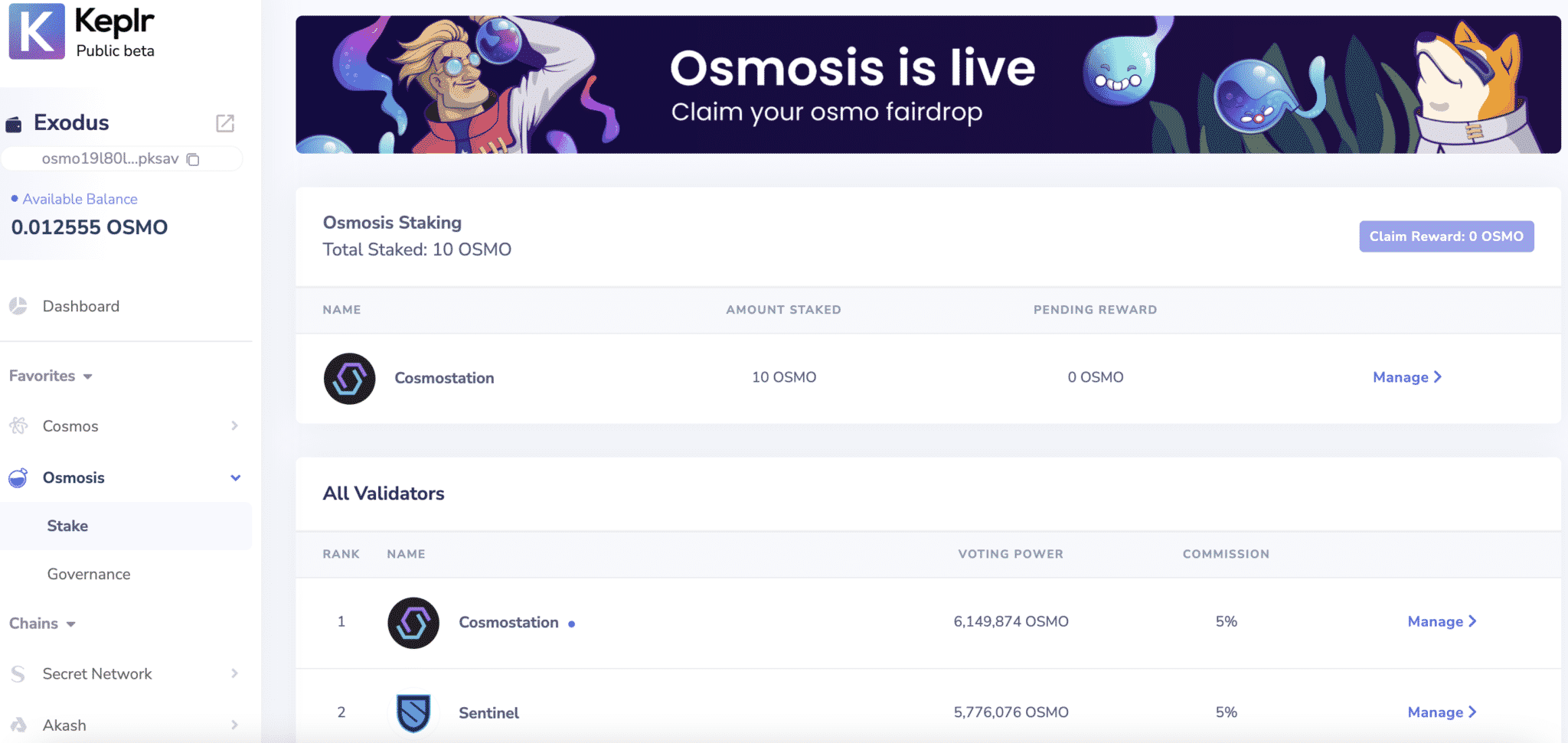

Staking would possibly perhaps well additionally be accomplished thru Keplr, the most important wallet for the Cosmos ecosystem and Osmosis mission.

Staking OSMO by job of Keplr

Osmosis Governance Vote casting

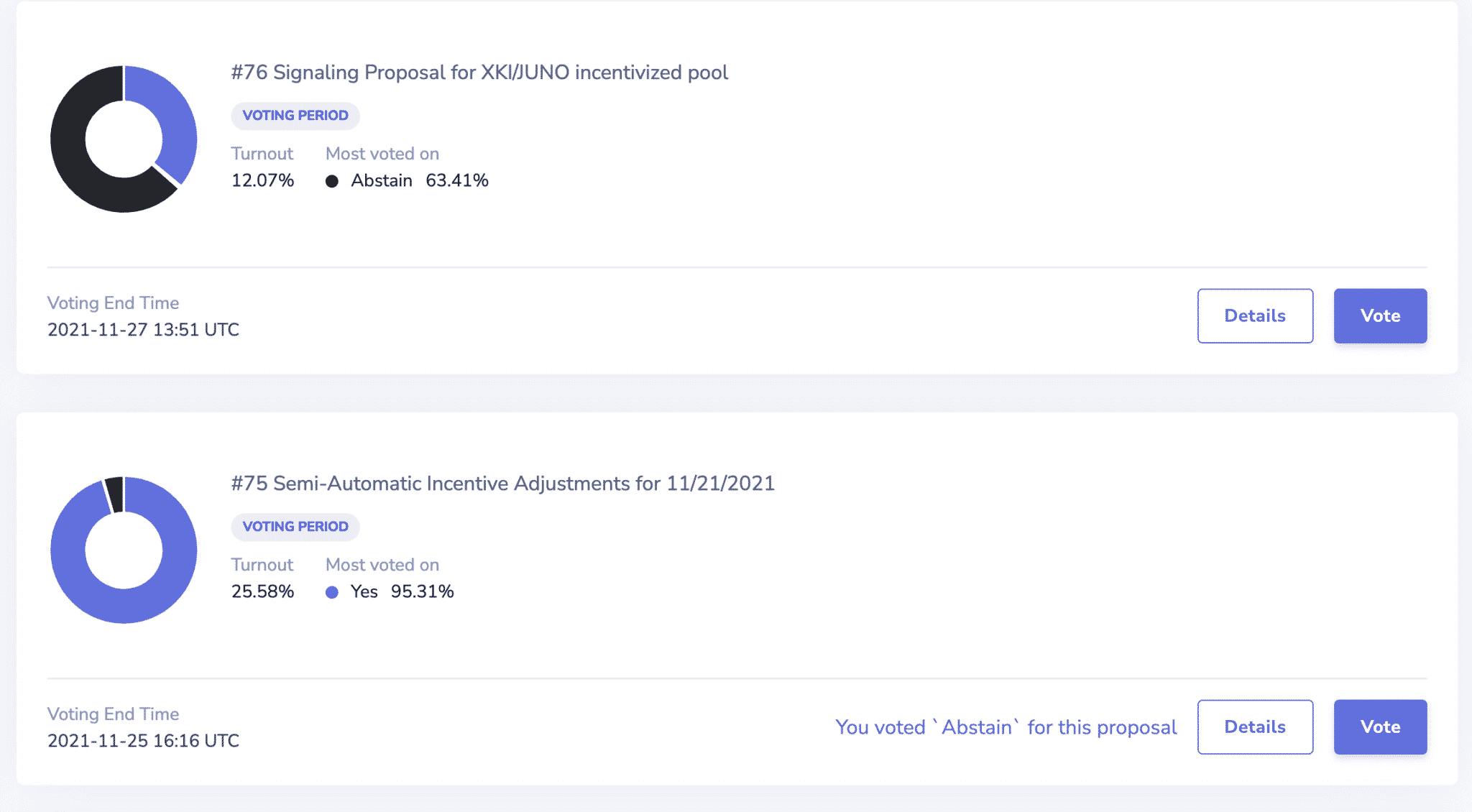

Osmosis token holders also can vote on a vary of governance proposals thru Keplr; here is how the decentralized mission is fling.

Osmosis governance balloting by job of Keplr

What is $OSMO, the Osmosis Governance Token

OSMO is the native Osmosis token, and it underpins your total Osmosis protocol, and it facilitates all the pieces from liquidity mining reward allocation and the impolite network swap charge.

As a governance token, OSMO enables holders to expend the strategic route of the mission. It’ll also additionally be at threat of vote on upgrades to the protocol, allocate liquidity mining rewards for particular liquidity swimming pools, and space the impolite network swap charge.

OSMO token holders resolve which swimming pools are eligible for liquidity rewards with the goal of aligning stakeholders and LPs with the longevity of the protocol.

OSMO is remarkable in that it is going to also additionally be at threat of stake and present liquidity on the same time.

The OSMO tokenomics are as follows:

At genesis, an preliminary supply of 100 million OSMO, split between Fairdrop recipients and strategic reserve.

Osmos has events wherein unique tokens are released called “day-to-day epochs.” The newly released tokens are disbursed as follows:

- Staking Rewards: 25%

- Developer Vesting: 25%

- Liquidity Mining Incentives: 45%

- Neighborhood Pool: 5%

| Token | OSMO |

| Preliminary token supply | 100 million OSMO |

| Total planned inflation | 76%, with inflation decrease by 1/3 per one year |

| Maximum token supply | 1 billion OSMO |

| Most modern token supply | 186 million OSMO |

Token inflation is primarily based on a “thirdening” model, where token issuance is decrease by a third every person year. To illustrate:

- Preliminary supply of 100m OSMO released June 2021.

- Year 1: 300m OSMO tokens will most certainly be released,

- Year 2: 200m OSMO

- Year 3: 133m OSMO

…till the full supply of 1 billion OSMO is released.

Whenever you occur to held ATOM on your wallet on February 18, 2021, it is probably going you’ll perhaps well presumably presumably also beget OSMO airdrop tokens making an strive forward to you. The plump OSMO airdrop would possibly perhaps well additionally be unlocked by interacting with the many missions specified by the mission. Nonetheless, if you did not retain ATOM on February 18, 2021, you aren’t eligible for any of the OSMO airdrop or mission rewards. The total quantity of OSMO is round 30 OSMO.

Final Thoughts: Retain Your Eyes on Osmosis (and Cosmos)

Because the most smartly-appreciated DEX in the Cosmos ecosystem, Osmosis has positioned itself to be surely one of many most important Cosmos dApps many newbies work alongside with. Nonetheless, it appears to be like the Osmosis mission goes a ways past simply upright being a foundational pillar in Cosmos.

With the aptitude to connect different token blockchains (such as ERC-20s) accurate into a network where quick and cheap charge transfer is that it is probably going you’ll perhaps well presumably presumably also imagine, the route forward for Osmosis appears to be like colorful.

📉 IBC earlier than Osmosis open – 236 day-to-day IBC txs.

📈 IBC after Osmosis open – 19,366 day-to-day IBC txs. https://t.co/e1YfA204NO pic.twitter.com/SM0beQtOFO

— Osmosis (@osmosiszone) June 20, 2021

The huge majority of the network’s early traction appears to be like to revolve round offering liquidity and staking. By model, Osmosis is a extremely inspiring case peep in motion of how a DEX can offer a change for mercenary yield farming practices, doubtlessly main to the next and extra stable trading abilities for all.