- Staking 101: A Transient Recap

- Lido as a Plan to Staking Illiquidity

- Lido’s Staking Solution

- How Does Lido Work?

- Guidelines on how to Stake on Lido: A Quick Recordsdata

- Lido Competitors

- Ideal Ideas

Within the persistently evolving cryptocurrency world, staking has turn out to be celebrated for crypto holders to generate passive earnings through staking rewards.

But, musty staking has fundamental obstacles, cherish locking up sources for prolonged classes. This capital inefficiency leaves patrons trapped by pursuing yield in preference to being ready to make disclose of their capital to stimulate increase in diversified parts of the ecosystem and compose yield in other locations.

Enter Lido, a decentralized self reliant organization (DAO) that revolutionized staking by providing a liquid staking service for Ethereum 2.0. Lido’s liquid staking service enables stakers to compose staking rewards while soundless retaining liquidity.

It’s a revolutionary notion, but forward of we discuss about how Lido capabilities, let’s evaluate how staking basically works.

Staking 101: A Transient Recap

Staking is a direction of that enables cryptocurrency holders to take half in network security and compose rewards by locking up their sources for Proof-of-Stake (PoS) chains.

Ethereum (ETH), Cardano (ADA), Polkadot (DOT), Tezos (XTZ), Cosmos (ATOM), Algorand (ALGO), Avalanche (AVAX), Solana (SOL), and Binance Coin (BNB) are all Proof of Stake.

First, the user transfers their coins into a pockets that supports staking functionalities. Next, the user locks (stakes) these coins, most regularly deciding on a validator node to delegate their stake to. Alternatively, you would possibly perhaps scamper a paunchy node and stake that plot, but it certainly’s some distance more model-intensive.

From an outsider’s perspective, staking would possibly perhaps seem advanced, critically alongside side your whole unique diversifications emerging as we bid time. The direction of is every so most regularly barely straightforward– about a clicks and also you’re staking.

Cryptocurrencies cherish ETH in general provide between 3% to 5% APY, whereas others cherish Polkadot provide up to fifteen%.

While staking affords a accurate (but no longer threat-free) yield lumber, it also poses just a few challenges.

Feeble staking requires customers to lock up their sources for a mounted interval, making them inaccessible for procuring and selling or diversified purposes. This in general is a effort for patrons who are making an are attempting to protect flexibility with their funds.

Some staking alternatives supplied by exchanges or third-event services reach with custodial dangers, meaning customers must belief these entities with their sources.

However, we’ll explore some non-custodial ability of staking and generating the accurate yield– sans the custody threat.

Lido as a Plan to Staking Illiquidity

Lido modified into once founded in December 2020 by Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish, identified as Cobie. Lido has been successfully-obtained within the crypto neighborhood for its ability to liquidity for staked sources.

Early supporters and patrons incorporated prominent organizations cherish Paradigm, Coinbase Ventures, and Andreessen Horowitz (a16z).

Before every little thing pondering about the Ethereum ecosystem, Lido expanded its help beyond Ethereum to incorporate diversified fundamental blockchains cherish Solana, Terra (RIP), and Polygon.

It sunset its Solana staking service in February 2024.

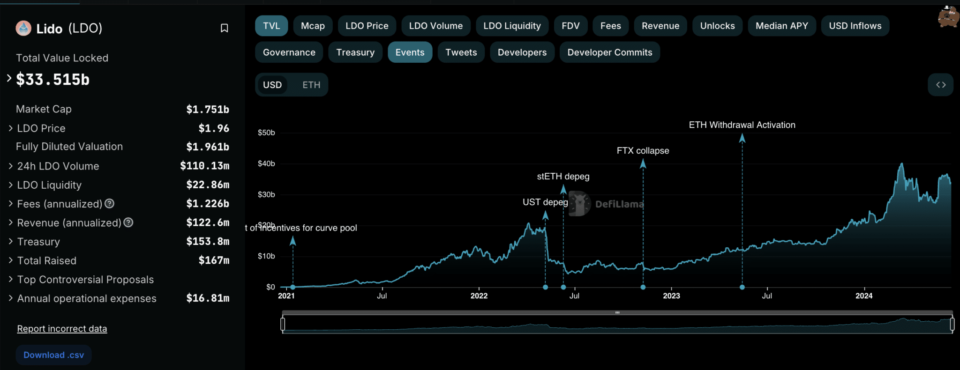

As of 2024, Lido has over $33 billion in TVL and has issued millions of stETH tokens.

Lido’s Staking Solution

Customers who stake their Ether with Lido salvage stETH tokens in return and would possibly perhaps presumably continue to compose staking rewards while the disclose of the stETH as they wish.

stETH tokens symbolize their staked Ether plus any rewards earned and would possibly perhaps presumably be traded, held, or aged in diversified DeFi purposes.

stETH and ETH exchange across the an analogous model, but stETH’s model is most regularly a hair bigger attributable to the rewards factoring into its model at issuance. Every stETH token is a divulge to the staked amount of Ethereum.

How Does Lido Work?

Lido comprises serious components: the stETH token, good contracts for deposits and minting stETH, a node operator registry, and beacon chain oracles for updating stETH balances.

Customers must deposit Ether into Lido’s good contracts to salvage stETH tokens representing their staked Ether, including rewards minus any slashing penalties.

From a technical POV, Lido in general works cherish this:

- Customers ship Ether to the Lido good contract.

- The sensible contract mints an analogous amount of stETH tokens.

- Node operators validate the staked Ether.

- Oracles ceaselessly video show the beacon chain and exchange stETH balances.

- Customers can exchange, protect, or carry out basically the most of stETH in DeFi purposes.

- Lido DAO actively manages governance, including upgrades and emergency responses.

From a layman’s POV, Lido is some distance more straightforward:

- Space up your pockets of various (MetaMask, Ledger, etc.)

- Join pockets to Lido platform: the legitimate hyperlink is https://lido.fi/.

- Deposit ETH on Lido and salvage stETH tokens.

- Alternate or disclose the stETH in DeFi. Right here is known as liquid staking.

Guidelines on how to Stake on Lido: A Quick Recordsdata

Many centralized exchanges, comparable to Coinbase, make it more straightforward to stake ETH through the platform, but these are barely self-explanatory. To boot they reach with custodial dangers.

We’ll streak over a laborious pockets and a gentle pockets to get a technique to carry out it.

Setting Up a Wallet

Sooner than you would possibly perhaps stake with Lido, you will want a cherish minded cryptocurrency pockets. MetaMask and Ledger are celebrated picks.

- MetaMask: A browser extension and mobile app that serves as a pockets for Ethereum and diversified ERC-20 tokens.

- Ledger: A hardware pockets that affords enhanced security by retaining your non-public keys offline. Ledger devices are cherish minded with Lido through integrations with software program wallets cherish MetaMask.

While each routes disclose MetaMask, the Ledger is safer, and your non-public is saved to your bodily hardware software program.

Connecting to Lido

- Accept admission to the Lido Platform: Consult with Lido’s legitimate website and navigate the staking share.

- Join Your Wallet: Click on the “Join Wallet” button. You are going to be precipitated to establish your pockets kind. Whilst you’re the disclose of MetaMask, decide out it and put together the on-show directions to join. For Ledger, you’ll desire to make disclose of MetaMask as a bridge:

- Commence MetaMask and narrate your Ledger software program is hooked up and unlocked.

- Opt the Ledger myth from MetaMask to join it to the Lido platform.

Staking Your Ether (ETH)

Once your pockets is hooked up, you would possibly perhaps stake your Ether:

- Deposit ETH: Enter the amount of Ether you settle on to stake. The platform will philosophize the identical amount of stETH you would possibly perhaps salvage.

- Verify Transaction: Approve the transaction for your pockets (MetaMask or Ledger through MetaMask). This would possibly perhaps occasionally involve signing the transaction and paying a itsy-bitsy gasoline price.

- Gather stETH: After confirming the transaction on the Ethereum network, you would possibly perhaps salvage stETH tokens for your pockets. These tokens symbolize your staked Ether and would possibly perhaps presumably be traded or aged in diversified DeFi purposes.

Managing Your stETH

With stETH for your pockets, you would possibly perhaps carry out the next:

- Alternate stETH: Employ decentralized exchanges (DEXs) cherish Uniswap to exchange stETH for diversified cryptocurrencies.

- Form Yield: Take part in DeFi protocols by lending your stETH or providing liquidity in pools to compose extra rewards.

- Show screen Rewards: Your stETH stability will automatically exchange to mediate staking rewards, which would possibly perhaps presumably be earned continuously in step with the performance of the Ethereum 2.0 network.

Liquid staking is a rabbit hole worth exploring, and we recommend setting a while aside to battle through our guide. However, it’s no longer a lot diversified from the staking direction of described above.

Taking part in Governance

Lido is dominated by a DAO, which manages the decentralized protocol. The DAO is to blame for deciding on node operators, managing funds, and making key protocol choices.

Governance is facilitated through Lido’s native token, $LDO, which grants holders the accurate to vote on protocol upgrades and diversified essential matters.

Lido employs a threshold signature plot to help the protection of staked sources. This plot ensures that no single entity controls the funds, reducing the threat of hacking or mismanagement. Furthermore, Lido uses beacon chain oracles to interchange stETH balances and protect transparency.

For more detailed recordsdata, you would possibly perhaps take a look at with the legitimate Lido documentation on their GitBook.

As a stETH holder, you would possibly perhaps take half in Lido’s governance. Vote casting requires LDO tokens.

Lido Competitors

Even despite the incontrovertible fact that Lido is a pioneer in its accessible platform and liquid staking, it’s no longer alone in its offering.

RocketPool is a decentralized staking service for Ethereum 2.0, but it certainly focuses more on providing infrastructure for node operators.

Ankr also staking alternatives with a liquid staking feature comparable to Lido’s stETH, but with a vary of chains.

Section of the Frax Finance ecosystem, Frax Ether affords liquid staking for Ethereum, with a TVL of about $700 million.

Ideal Ideas

An related to how Robinhood democratized stock procuring and selling, Lido democratizes Ethereum staking with a user-pleasant UI and the flexibleness that comes with liquid staking.

Lido has about a dependencies worth noting, comparable to its reliance on Ethereum. To be comely, it launched as an Ethereum staking service, but because it broadens its staking companies and products to diversified chains, it diversifies its enterprise model.

A standout discipline is the threat of stETH tokens dipping below their ETH cost, which is unlikely, but would largely be indicative of some deeper technological discipline or exploit.

Lido has emerged as a prominent player within the DeFi enterprise, setting up itself as a sustainable and passe fragment of infrastructure.

As of writing, the present cryptocurrency environment is marked by vast developments, comparable to the approval of scream Bitcoin ETFs and anticipated Ethereum ETFs, each of which would possibly perhaps presumably be rising institutional ardour in cryptocurrency.

However, unlike Bitcoin, Ethereum affords a mode of generating yield through supporting the network. The introduction of an Ethereum ETF would possibly perhaps presumably carry out staking more accessible for institutional patrons now not as we bid through a regulated funding, all of which helps get the Ethereum network and enlarge the utility of platforms cherish Lido.

The DeFi sector shall be rising very rapidly, driven by advancements in layer-2 scaling alternatives and sector-particular platforms. Ethereum’s dominance in good contracts stays unchallenged, with spherical 57% of the general cost locked within the crypto ecosystem on Ethereum.

Lido has carved out a gap in this rapidly changing environment by addressing the liquidity issues related with musty staking. Furthermore, Lido’s ability and governance structure, managed by a decentralized self reliant organization (DAO), is a neighborhood-driven experiment that can philosophize to be the unique long-established for decentralized companies.

Never Travel out One other Opportunity! Accept hand selected news & recordsdata from our Crypto Consultants so that you just would possibly perhaps carry out professional, told choices that as we bid bear an model to your crypto earnings. Subscribe to CoinCentral free e-newsletter now.