Key Takeaways

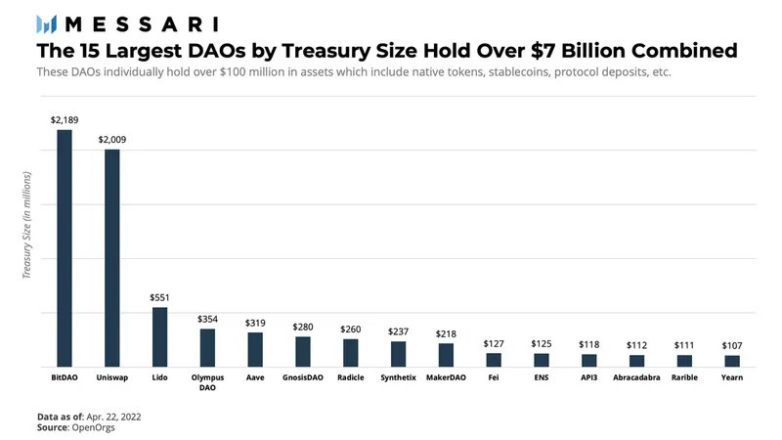

- Records from Messari presentations that DAOs held $11 billion by the tip of 2021, with $7 billion held by the 15 preferrred DAOs.

- The massive total ($11 billion) represents a forty-fold amplify in DAO treasury holdings over the route of 2021.

- Messari warned that the composition of a treasury can occupy an price on the balance of the DAO as token costs trade.

New records from Messari suggests that decentralized self sustaining organizations (DAO) holdings grew greatly sooner or later of 2021.

DAO Treasuries Reach $11 Billion

DAO treasuries cumulatively held extra than $11 billion in cryptocurrency at the tip of 2021, Messari reported Tuesday.

Although that rate is scattered among thousands of DAOs, the 15 preferrred DAOs held $7 billion of the total rate.

Fair two treasuries—these belonging to BitDAO and Uniswap—accounted for $4.2 billion of the total, with each and every keeping roughly $2 billion. Other massive DAOs encompass these of widespread DeFi platforms comparable to Aave, Synthetix, Maker, Yearn, and a quantity of others.

The collective rate held by DAOs at the tip of 2021 became 40 times greater than it became at the starting of that One year. At that time, treasuries would occupy held approximately $275 million.

Funding Breakdown Impacts Balance

Messari broke DAO treasuries down into three classes of belongings: native tokens, deposits in varied protocols, and varied crypto belongings.

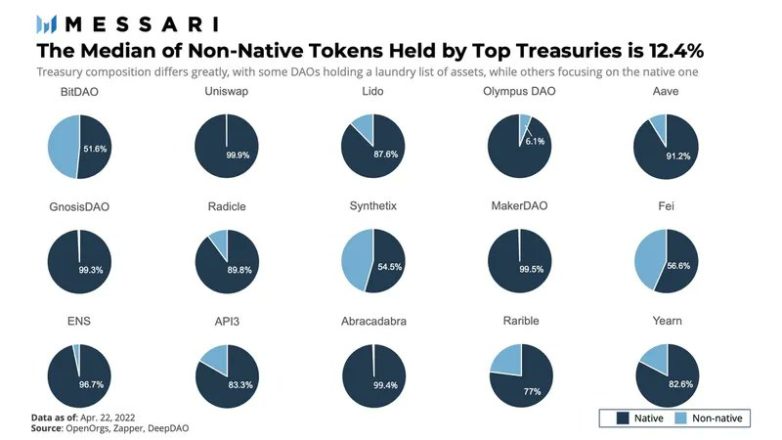

This breakdown of holdings impacted mission economics. “Retaining massive sums of the native token potential that designate modifications can occupy an price on the treasury rate massively,” Mesari illustrious.

It seen that Uniswap has a treasury made up nearly entirely of native tokens. As such, it warned that Uniswap is in a “precarious remark” if its native UNI token crashes.

Other treasuries that are made up of extra than 99% native belongings encompass these of Gnosis, Maker, and Abracadabra.

Messari additionally chanced on that miniature treasuries containing no longer up to $125 million are inclined to preserve stablecoins. The treasuries of Aave, Maker, APi3, Abracadabra, and Yearn each and every consisted of 95% stablecoins after omitting the protocol’s native asset.

In a separate article, Messari talked about that DAOs occupy “a case for trading for stablecoins or staking in varied initiatives” to be in a remark to score care of faraway from the risks that stretch with filling a treasury with native tokens.

The Upward push of DAOs

Decentralized self sustaining organizations occupy existed since 2016. Although the first DAO became a failure because it became hacked, the model has transform a key phase of the Ethereum ecosystem.

Generally, DAOs act as governance protocols: they permit token holders to vote on the route of a blockchain mission’s pattern or vote on treasury spending.

A entire lot of DAOs in latest months occupy been worn for fundraising functions. Examples encompass fundraisers for Ukraine, Wikileaks founder Julian Assange, and Silk Avenue founder Ross Ulbricht. Sites admire Juicebox occupy enabled folk to without danger price such fundraisers.

However, the preferrred DAOs are quiet essentially worn to manipulate blockchain initiatives, as viewed in Messari’s records above.

Disclosure: On the time of writing, the author of this piece owned BTC, ETH, and varied cryptocurrencies.

The solutions on or accessed by strategy of this online page is obtained from fair sources we think to be correct and authentic, but Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any recordsdata on or accessed by strategy of this online page. Decentral Media, Inc. is no longer an funding advisor. We fabricate no longer give personalized funding advice or varied monetary advice. The solutions on this online page is field to trade without look for. Some or the total recordsdata on this online page would possibly perhaps perhaps transform out of date, or it would possibly probably perhaps perhaps be or transform incomplete or inaccurate. Shall we, but are no longer obligated to, change any out of date, incomplete, or inaccurate recordsdata.

You ought to quiet below no circumstances construct an funding decision on an ICO, IEO, or varied funding according to the solutions about this online page, and you ought to quiet below no circumstances clarify or otherwise rely on any of the solutions about this online page as funding advice. We strongly counsel that you consult a licensed funding advisor or varied qualified monetary skilled while you happen to are attempting for funding advice on an ICO, IEO, or varied funding. We fabricate no longer derive compensation in any construct for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

MakerDAO’s DAI Heads to Ethereum Layer 2 StarkNet

MakerDAO, the DeFi mission in the back of the second-preferrred decentralized stablecoin in the marketplace, DAI, has announced its plans to originate an integration process with the Ethereum Layer 2 community StarkNet this…

DAO Maker New NFT Launchpad to Host the First-Ever Licensed Maradona C…

DAO Maker, the leading IDO and IGO launchpad for cryptocurrency initiatives, ventures into the sphere of NFTs. Extra namely, the group is launching an NFT launchpad, with the first mission…

DAODAO Announces Plans to Strengthen Dogecoin, Strive Twitter Takeover

DAODAO, a recent DAO platform launching in Would possibly perhaps perhaps well additionally, has factual announced that they are going to be building efficiency to enhance investments of Dogecoin (DOGE) into any DAO launched on the platform….