The below is an excerpt from a most up-to-date edition of Bitcoin Magazine Pro, Bitcoin Magazine’s top class markets newsletter. To be amongst the predominant to get these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

On-Chain Data Tendencies

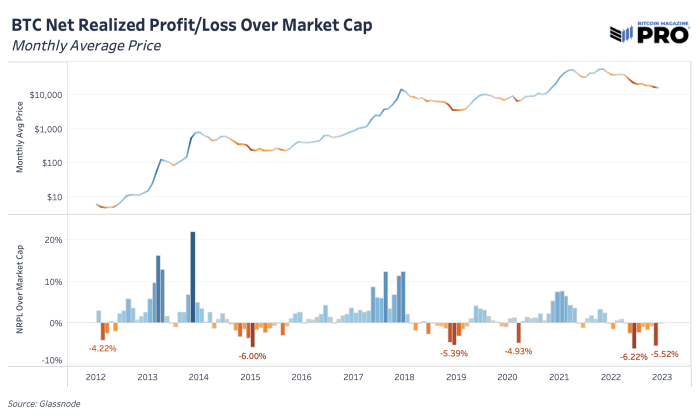

November modified into as soon as a painful month. By taking a secret agent at on-chain realized earnings and loss data, we can see that this modified into as soon as correct for many pressured-sellers of bitcoin. Sooner than any bitcoin observe bottom, an indicator impress that you in actual fact are trying to witness is extended periods of pressured selling, capitulation and rise in realized losses. One manner to bear a look at that is by taking a secret agent at the sum of realized earnings and loss for every month relative to bitcoin’s total market cap. We seen these bottom signals in November 2022, and equally within the July 2022 Terra/LUNA fracture, March 2020 COVID be troubled and December 2018 cycle bottom capitulation events.

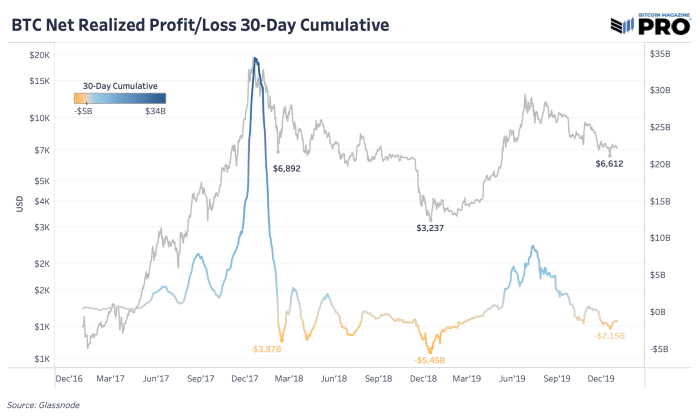

Having a secret agent at the 2018 cycle, the pause modified into as soon as marked by extra realized losses, though this modified into as soon as well-known diverse with the pressured liquidations and cascades of private balance sheet leverage and paper bitcoin unwinding that we seen this year.

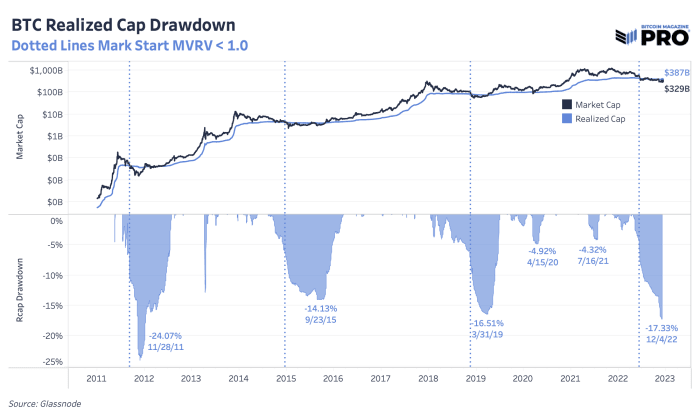

We’ve talked in regards to the most up-to-date drawdown in bitcoin’s observe and the top seemingly procedure that compares to outdated cycles repeatedly over the outdated few months. One more manner to witness at cyclical drawdowns is to contend with bitcoin’s realized market capitalization — the frequent cost foundation of the community which tracks the most up-to-date observe the build every UTXO moved remaining. With observe being more volatile, realized observe is a more stable observe of bitcoin’s mumble and capital inflows. The realized market capitalization is now down 17.33% which is enormously elevated than 2015 and 2018 cycles of 14.13% and 16.51%, respectively.

As for duration, we’re 176 total days into the price being below bitcoin’s realized observe. Those aren’t consecutive days as observe can rapid bolt above realized observe, but observe developments below realized observe in bear market periods. For context, developments in 2018 were rapid-lived at around 134 days and the developments in 2014-15 lasted 384 days.

On one hand, bitcoin’s realized market capitalization has taken a well-known hit within the outdated round of capitulation. That’s a promising bottom-love impress. On the opposite hand, there’s a case to be made that observe being below realized observe would possibly furthermore with out concerns remaining one other six months from historical cycles and the dearth of capitulation in equity markets is serene a well-known headwind and advise.

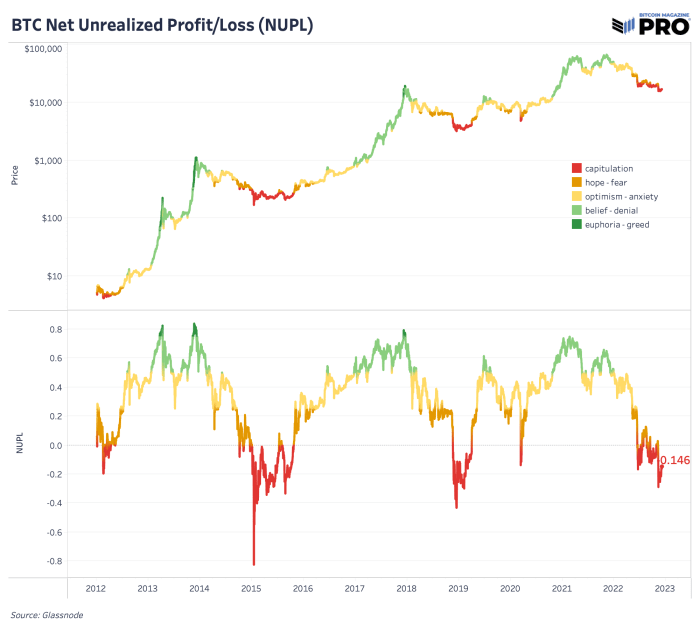

As per the rep-unrealized-earnings/loss (NUPL) ratio, we are firmly within the capitulation share. NUPL would possibly furthermore furthermore be calculated by subtracting the realized cap from market cap and dividing the result by the market cap, as described on this article authored by By Tuur Demeester, Tamás Blummer and Michiel Lescrauwaet.

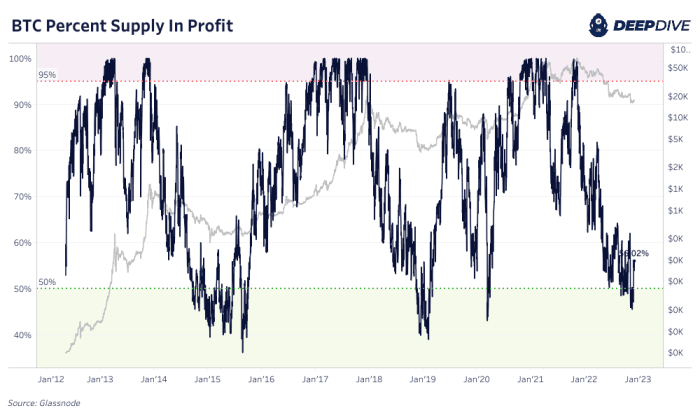

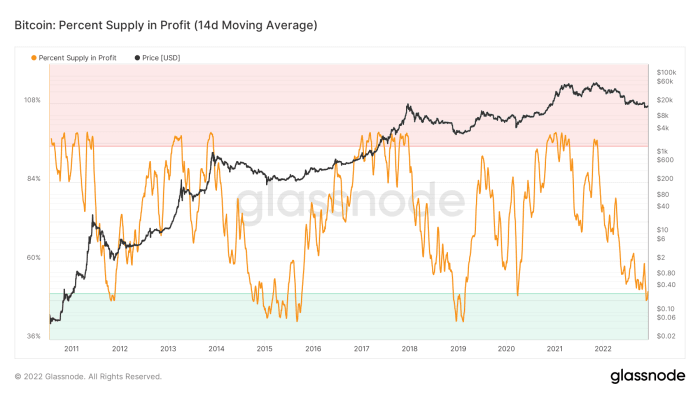

There would possibly per chance be never a denying it: For bitcoin-native cycles, we are firmly within the capitulation share. For the time being, handiest 56% of circulating provide modified into as soon as remaining moved on-chain in earnings. On a two-week appealing practical foundation, under 50% provide modified into as soon as remaining moved above the most up-to-date replace charge, which is something that has handiest ever took space within the depths of outdated bear-market lows.

When thinking of the bitcoin replace charge, the numerator facet of the equation is historically cheap. The Bitcoin community continues to waste a block roughly every 10 minutes in an unabated trend, as hash charge ticks elevated and because the ledger affords an immutable settlement layer for global worth. The speculation, leverage and fraud of the outdated cycle is washing to shore and bitcoin continues to adjust hands.

Bitcoin is objectively cheap relative to its all time history and adoption phases. The genuine search data from over the instantaneous future is the denominator. Now we bear talked at size in regards to the global liquidity cycle and its most up-to-date tune. Despite being historically cheap, bitcoin is no longer proof against a surprising strengthening within the buck because nothing in actual fact is. Substitute rates are relative and if the buck is squeezing elevated, then all the pieces else will which capability of this truth drop — at the least momentarily. As constantly, space sizing and time preference is mandatory for all.

As for the catalyst for a surge elevated within the buck denominator of the bitcoin replace charge (BTC/USD), there are 80 trillion that you would possibly well furthermore deem catalysts…