There are a immense selection of things happening that many would possibly well well perhaps additionally merely bear in mind bearish; it appears to be like that bitcoin honest doesn’t care.

Final Week In Bitcoin is a series discussing the events of the outdated week that happened in the Bitcoin trade, preserving the general crucial data and evaluation.

Summary Of The Week

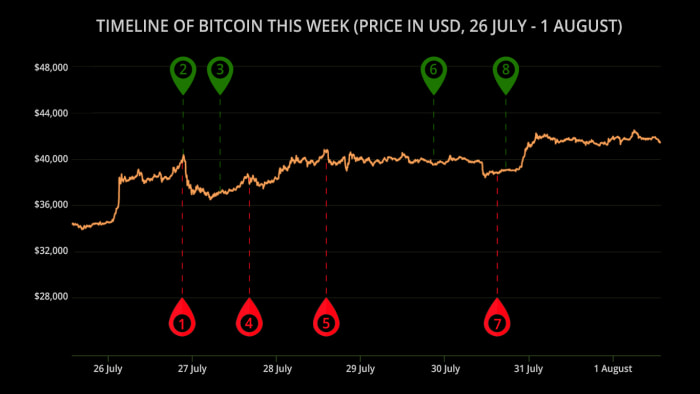

We’re relieve in the 40s, shrimp one! Bitcoin spent most of the week hovering spherical $40,000, spurred by bullish data and unphased by the U.S. Senate’s planned attack on Bitcoin via their new infrastructure bill. There’s a lot to unpack from the week and we have a at hand new timeline to show camouflage how diverse bits of data affected the price over the final week.

In rapid, Michael Saylor and MicroStrategy will preserve HODLing, Amazon will now now not introduce bitcoin funds any time soon, sizable institutional merchants are jumping on the bitcoin bandwagon and Kazakhstan is welcoming Bitcoin with launch arms.

Timeline Of Bitcoin Details This Week

- Amazon Denies Picture Of Accepting Bitcoin As Payment

- Bitcoin Temporarily Tops $40,000 For First Time Since June As Cryptocurrency Rallies After Sell-off

- Kazakhstan Fabricate bigger Its Bitcoin Mining to World Market And Enable Customers To Commence Bank Accounts for Cryptocurrency

- Senator Warren: Crypto Puts Financial Machine in the Hands of ‘Unlit Desirable-Coders’

- Senators Look Cryptocurrency Taxes To Fund Infrastructure Thought

- MicroStrategy Pledges To Add More Bitcoin To Corporate Balance Sheet

- Bitcoin Mining Scenario Rises For The First Time Since Could presumably well well

- $41 Billion Hedge Fund Goldentree Has Added Bitcoin To Its Balance Sheet

Bullish Details

Let’s launch up with the bullish data. Lawful over per week after dipping under $30,000, bitcoin rallied previous the $40,000 imprint, rapid touching $42,000. The sudden surge used to be fueled by a file that Amazon would launch up accepting bitcoin funds. Amazon later denied the file, on the other hand it has remained real spherical the $40,000 range.

But every other immense switch this week that nearly all in the mainstream media have brushed previous is Kazakhstan transferring in direction of very launch Bitcoin regulations. Moreover their efforts to attract bitcoin miners to their shores, they’re going to enable their citizens to launch financial institution accounts dedicated to cryptocurrencies a lot like bitcoin and exercise it across the country. No longer fairly El Salvador-stage adoption, nevertheless extra countries would possibly well well perhaps additionally merely note Kazakhstan’s extra modest playbook over El Salvador’s.

MicroStrategy had their quarterly earning call this week the save CEO and bitcoin aficionado Michael Saylor reiterated that the corporate will continue HODLing in the long stagger, despite seeing their holdings yarn for a arena fabric loss in price as bitcoin dipped all the plot via the reporting period. MicroStrategy stays one of many top possible sizable scale HODLers and their affirmation is a respectable signal for market watchers.

Then there’s a bunch of industrial establishments which have jumped on the bitcoin bandwagon over the final week, at the side of GoldenTree, a $41 billion hedge fund. Thought to be one of Germany’s largest asset managers, Dekabank, is additionally reportedly moving on funding in bitcoin which would possibly well well presumably launch up doors for extra European adoption. Sooner or later, ProFunds offered the launch of the first bitcoin mutual fund in the US that would additionally merely pave the plot for extra in the map future.

Bearish Details

Then there’s the bearish data. Final weekend a file emerged signalling that Amazon would enable bitcoin funds in the map future, sending bitcoin on a bustle. Tuesday, Amazon denied these rumours, which surprisingly didn’t impression bitcoin’s label as phenomenal as one would ask. Despite the fact that bearish in the rapid term, it’s now now not totally contaminated to eradicate they’d enable bitcoin funds lastly.

Senator Elizabeth Warren made waves this week as she infamous bitcoin and other cryptocurrencies save financial preserve watch over in the fingers of “dusky tall coders.” Masses of her remarks and misconceptions all the plot via the week proved misinformed and bearish. However, she did accomplish distinct to point out that crypto would pave the map to financial inclusion for the unbanked.

The U.S. Senate is currently busy trying to catch their $1 trillion infrastructure bill handed which contains a provision to preserve watch over and tax crypto. This would possibly well well perhaps additionally merely point to very bearish and a quantity of Bitcoiners have been vocal against the bill. With any luck the Senate involves their senses, otherwise this would possibly well well perhaps additionally merely peek Bitcoiners and firms focusing on Bitcoin exit the U.S. en masse.

Sooner or later, even supposing now now not basically bearish, Bitcoin mining venture increased for the first time since Could presumably well well as miners resettle in new territories after the Chinese crackdown. With countries look after Kazakhstan, Paraguay and several U.S. states welcoming bitcoin miners with launch arms and commended regulations and incentives, it’s seemingly that mining will now be better unfold for the length of the globe. The tiny draw back right here is that any accomplish bigger in mining venture can push inefficient miners to sell some of their holdings.

Verdict

It’s been a respectable week for Bitcoin and the top possible is yet to return. The truth that bitcoin has remained real spherical $40,000 is candy data, despite the U.S. infrastructure bill’s planned law spherical bitcoin being the top possible element to negatively impression its label and outlook in the rapid term.

At the same time as you happen to sold the dip final week, then you’ve already considered a respectable return. But the top possible is yet to return. Bitcoin is a long-term funding and your complete point of bitcoin isn’t rapid-term riches, nevertheless rather long-term financial freedom. If the U.S. does now stay awake pushing via its “personal bill,” it gained’t be the reside of the sector.