The European Central Bank (ECB) is laying the groundwork for the probable begin of its wholesale and retail central financial institution digital forex (CBDC), the Digital Euro. Christine Lagarde, President of the ECB, shared this update at their most up-to-date press convention. “President Lagarde stressed that the digital euro is ‘extra relevant than ever,’” the ECB tweeted.

Lagarde emphasised that the Digital Euro, the EU’s CBDC resolution, is made up our minds to begin in October 2025—offered it passes the legislative part difficult key stakeholders, including the European Commission, Parliament, and Council. Critically absent from this direction of is the European public, despite the well-known impact this initiative can like on their day after day lives.

🇪🇺 CBDC in EU will begin in Oct. 2025.

Wholesale & retail.

🇮🇱 Israel is following EU’s footsteps – making ready for CBDC with a brand unusual 110 page map doc. pic.twitter.com/fUr1CkBRmy— Efrat Fenigson (@efenigson) March 8, 2025

Why Is the Digital Euro Extra Relevant Than Ever?

Would maybe it’s linked to Ursula von der Leyen’s original “ReArm Europe” announcement, which proposes the creation of an EU military? This initiative requires an estimated €800 billion in funding—money the EU does not like. The alternate choices? Extracting it from EU member states and their electorate or printing unusual funds by ability of the ECB. Either map, it’s time to warm up the ECB’s money printers!

We stay in awful times.

Europe‘s security is threatened in a in fact accurate map.

As we impart time I original ReArm Europe.

A thought for a safer and extra resilient Europe ↓ https://t.co/CYTytB5ZMk

— Ursula von der Leyen (@vonderleyen) March 4, 2025

Moreover, The EU has supplied the “Financial savings and Investments Union”, aiming to redirect €10 trillion in “unused financial savings” from electorate to finance protection force growth and bolster Europe’s protection industry. “We’ll turn non-public financial savings into a lot-wished funding,” tweeted von der Leyen. If this hasn’t stricken you already, I’ll strive and interpret: Here’s a obvious violation of non-public property rights, and an implicit confiscation of Europeans’ wealth, while bluntly the employ of their funds because the EU sees fit, including funding of a protection force industrial advanced, with out even asking them.

If the EU is accelerating toward totalitarian collectivism, as this observation suggests, then a CBDC would be a ambitious tool—enabling tighter management over Europeans’ money with capabilities devour an “on/off” swap and programming skills.

If most of your money remains to be in fiat the financial institution / stocks / mortgaged accurate property and hundreds others. – they don’t need your permission.

They need you proudly owning nothing, despaired & numb.It’s possible you’ll well well well presumably are looking to take into consideration a permissionless, unconfiscatable, with out grief cell & liquid digital asset a lot like… pic.twitter.com/K2xjTpcyS7

— Efrat Fenigson (@efenigson) March 12, 2025

Christine Lagarde not too prolonged ago campaigned at the European Parliament, arguing that the Digital Euro is serious to within the discount of the EU’s dependence on international fee alternate choices. European banks must innovate fee methods, nonetheless the EU’s main field isn’t true reliance on tech giants devour Google Pay or Apple Pay—it’s the aptitude for trendy adoption of decentralized world protocols devour Bitcoin.

The ECB is watching geopolitical traits, noting that the U.S. is embracing crypto, Bitcoin, and stablecoins—technologies that pose a chance to centralized management. Unsurprisingly, they’re selecting a obvious route. In accordance with Reuters, “Eurozone banks need a digital euro to answer to U.S. President Donald Trump’s push to advertise stablecoins” as phase of a broader crypto approach. ECB board member Piero Cipollone reinforced this stance, pointing out, “This resolution extra disintermediates banks as they lose charges, they lose purchasers… That’s why we need a digital euro.”

Bottom line, Lagarde’s and Von der Leyen’s original agendas are aimed to force extra centralised management while strengthening the EU hierarchy, governance and incentive constructing – that has constantly been their feature.

Unique Digital Euro CBDC Stumble on

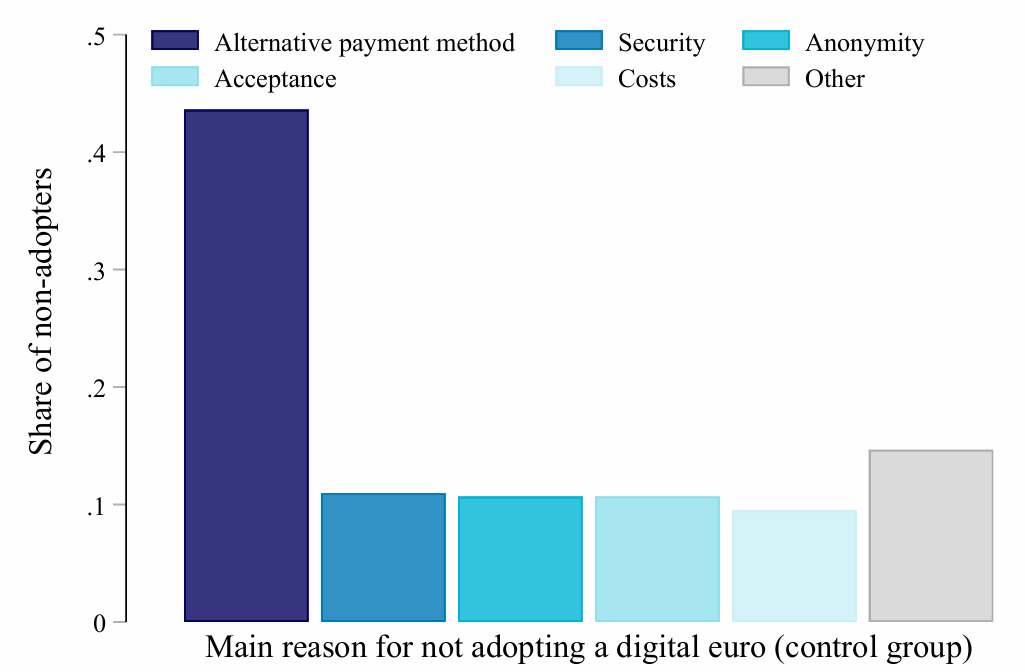

The ECB not too prolonged ago revealed findings from a see on consumer attitudes toward retail CBDC, conducted among 19,000 Europeans across 11 Eurozone worldwide locations. Key takeaways comprise:

1) Lack of Interest – Most Europeans are not attracted to the Digital Euro, as existing fee methods already assist their needs successfully.

2) Europeans are Launch to Propaganda – While public interest is low, the see stumbled on that Europeans are receptive to video-based mostly education and training. The ECB’s glimpse means that CBDC-linked videos might maybe well well well force trendy adoption by reshaping consumer beliefs. The document states: “Patrons who’re confirmed a brief video offering concise and obvious conversation about the essential capabilities of the digital euro are significantly extra possible to update their beliefs… which will increase their immediate chance of adopting it.” No wonder the ECB has ramped up its digital euro video order since tiresome 2024. As an instance:

3) Preference for Present Payment Ideas – “Europeans like a solid desire for existing fee methods and ogle no accurate wait on in a brand unusual kind of fee system”. While this discovering sounds devour a gleaming pushback, it can assist as a precursor to a tactic of technological integrations. “At the same time as you might maybe well well maybe’t beat them, be a a part of them” tactic – similarly to the Chinese language e-CNY retail CBDC.

A original Euromoney article highlighted e-CNY’s integration with China’s most trendy apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), a circulation that facilitated its trendy adoption. Despite early struggles, e-CNY now boasts 180 million interior most wallet customers and a cumulative transaction cost of $1 trillion. I not too prolonged ago explored this topic intensive with Roger Huang not too prolonged ago on my podcast.

No longer Correct Retail—Wholesale Too

On the wholesale CBDC front, the EU is experimenting with distributed ledger skills (DLT) to interconnect financial institutions across Europe and former. This follows exploratory work conducted by the Eurosystem between Would maybe presumably also and November 2024. Their trials intelligent 64 participants—including central banks, financial market gamers, and DLT platform operators—conducting over 50 experiments.

Lagarde insists that the Digital Euro is a create of cash, gaslighting and deceptive uninformed Europeans about the dangers of CBDCs. Permission-based mostly CBDCs such because the Digital Euro are inclined to micro levels of management via expiry dates, geofencing and programmability. If Europeans don’t scrutinize these dangers, they gained’t resist the Digital Euro. By framing it as “digital cash,” the ECB ensures smoother public acceptance with diminutive to no public fuss.

[2025] Europeans!

Are you ready for “YOUR Digital Euro”?

Christine Lagarde is prepping you to the following a part of EU’s CBDC, which is every little thing *nonetheless* a create of cash (nice strive even supposing). pic.twitter.com/t6mG5liw26— Efrat Fenigson (@efenigson) January 5, 2025

To be obvious, cash itself is fiat forex—centrally controlled, with out grief debased, and inclined to inflation. Whenever the issuer expands the money provide, electorate undergo from declining buying vitality, in fact being robbed by the enlighten.

“Principles for Thee, Nonetheless No longer for Me”

While trendy electorate are sure by the rule of law, elites continuously evade consequences. A top instance is Christine Lagarde, who changed into as soon as stumbled on responsible of negligence for approving a huge taxpayer-funded payout to controversial French businessman Bernard Tapie. Then again, she refrained from a jail sentence. The Guardian reported in 2016: “A French court convicted the high of the Global Monetary Fund and frail executive minister, who had faced a €15,000 pleasing and as a lot as a year in jail. Nonetheless it completely made up our minds she ought to silent not be punished, and that the conviction would not constitute a criminal document. … The IMF gave her its fats toughen.”

My Prediction for the EU’s CBDC

Despite public disinterest, the ECB (and completely different central banks) will push forward with their CBDCs. To raise the looks of public involvement, they’ll conduct surveys and model engagement tools. Nonetheless finally, the Digital Euro will be constructed-in into existing fee methods and consumer apps—true as China did with e-CNY. This approach will force adoption even with out declare public enthusiasm.

We are, in spite of every little thing, taking part within the sport of “democracy,” ethical?

Geopolitical analyst Alex Krainer not too prolonged ago tweeted in step with Lagarde and von der Leyen’s acceleration of CBDC efforts: “Here is relaxing data; Christine Lagarde and Ursula von der Leyen never took on one thing they didn’t entirely mess up. I am hoping they’ll proceed with their pleasing performance. Godspeed.”

Here is relaxing data; Christine Lagarde and Ursula von der Leyen never took on one thing they didn’t entirely mess up. I am hoping they’re going to proceed with their pleasing performance. Godspeed. https://t.co/vZPmWMS80m

— Alex (Sasha) Krainer (@NakedHedgie) March 15, 2025

Care for tuned as I proceed to be aware central banks’ strikes toward CBDC implementation.

Here’s a visitor post by Efrat Fenigson. Opinions expressed are entirely their hold and construct not necessarily focal point on those of BTC Inc or Bitcoin Magazine.

Efrat Fenigsonhttps://linktr.ee/efenigson

Efrat Fenigson is an just journalist, podcaster, advertising professional, and host of “You’re The Verbalize” podcast, taking audiences on a plug from red to orange tablet. A freedom & bitcoin maxi. Her order might maybe well even be stumbled on here.