Bulls adjust the crypto market whereas the long-awaited jobs grand weaker than expected US payrolls report sent the US greenback lower. With the unemployment price slipping to 5.2%, it appears less likely that the Fed will pare its big stimulus measures.

The bullishness within the week has Bitcoin shopping and selling above $50,000 and Ether terminate to $4,000 on the weekend. The total market cap is moreover all site to hit $2.4 trillion, very terminate to $2.55 trillion ATH.

The greenback, meanwhile, is falling after a grand weaker than expected US payrolls report. Provided that Federal Reserve officials said that they are having a uncover a look at the job numbers to seek out out the timing to pare its big stimulus measures, it is a long way likely that the US central bank can also simply now not lift out so.

The long-awaited jobs report triggered puny moves within the equity market that saw the S&P 500 sliding a shrimp whereas merchants turned to the protection of tech giants. Overall, the inventory market used to be fairly soundless this week as shopping and selling most incessantly slows down ahead of the Labor Day weekend since markets are closed Monday in observance of the vacation.

Nonfarm payrolls increased by 235,000 in August, whereas economists forecasted 728,000. The unemployment price moreover slipped from 5.4% within the prior month to 5.2%.

The solutions sent the greenback index to its lowest stage since early August at 91.9; at gift, it is a long way at 92.12. Closing week, Fed Chair Jerome Powell said that whereas tapering can also initiating up as early as this year, it would only be if the job enlighten continues. To now not point out the rising COVID-19 cases in recent weeks uncover over all any other time brought support the worries on economic restoration.

“It provides extra anguish or point of curiosity on the October quantity due to now we desire to glance if there is a vogue,” said JB Mackenzie, managing director for futures and forex at TD Ameritrade.

With the Fed “attempting to telegraph that if the financial system continues to heat up and additionally they must fetch motion,” we’re now not seeing a gigantic response to the plot back “since the market feels as if they’ve been given that clear route.”

In accordance with Financial institution of The US Corp, within the flee-as much as the roles report, equity funds attracted $19.2 bln of inflows, and $12.7 bln used to be distributed to bonds. Meanwhile, outflows from money funds were the biggest in seven weeks at $23 bln.

The Most tantalizing Procedure Is Up

In accordance with the September Bloomberg Crypto Outlook report by senior commodity strategist Mike McGlone, Bitcoin at $100k and Ethereum at $5k is the path to least resistance.

In accordance with the report, “bulls are on prime of issues” and in thriving mode after surviving the deep correction. “After enduring a intestine-wrenching correction, we ogle the crypto market extra likely to resume its upward trajectory than fall below the 2Q lows,” notes McGlone.

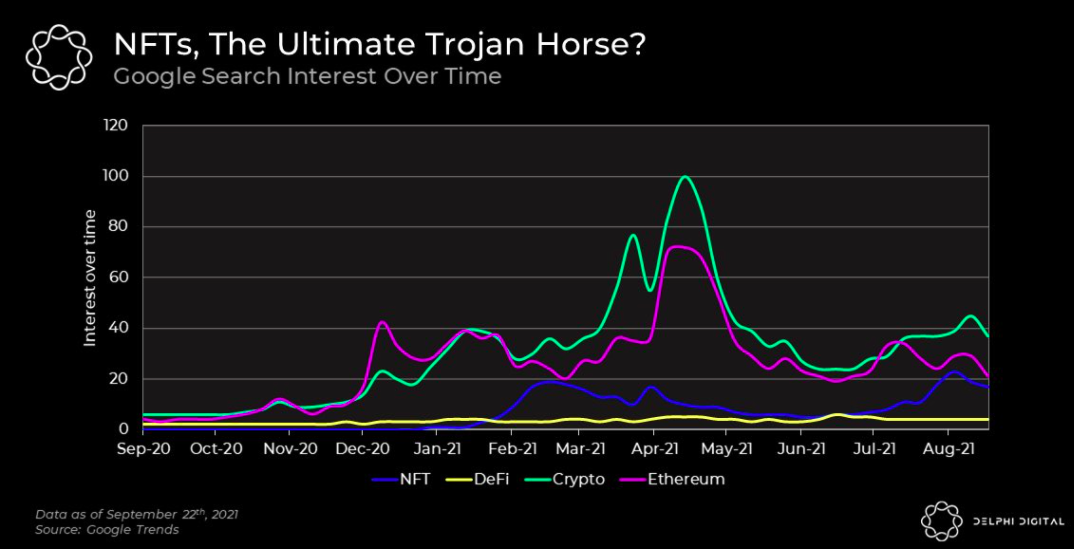

Ether is at gift propelled by the NFT mania and EIP 1559 implementation that has successfully made it a deflationary crypto asset. The second-greatest network is moreover facilitating digital greenback dominance with Tether (USDT) and USDC at the end.

Ethereum is leading the market this time which “appears properly-positioned for extra impress appreciation” because it turns into “the money of the web” whereas seeing an incremental fall in present because of EIP 1559, which led to the burn of roughly 200,000 ETH price bigger than $640 mln in a month.

Following Ether, Bitcoin can moreover march in direction of $100k. Halving that took state in 2020 moreover works within the leading cryptocurrency’s prefer as after closing year’s present carve, Bitcoin has only liked 4x in 2021, which is tame in comparability to 55x in 2013 and 15x in 2017.

Furthermore, whereas growing query and adoption are going through diminishing present, only the truth that it will likely be appropriate hype and hypothesis can also end the onward-and-upward trajectory. “Or it will likely be a revolution in money and finance that is in early impress-discovery days,” he added.

McGlone is a bitcoin bull, and to him, it is a long way on its draw to changing into the digital reserve asset in an world going that draw.

If U.S. Treasury yields resume their enduring downward trajectories, following Japan and most of Europe, gold and Bitcoin uncover high skill to proceed advancing in impress. To now not point out, the Bitcoin-Gold-Bond index has been outperforming the S&P 500 since the tip of 2015, seriously from the initiating of 2020.

![]()