Ethereum on-chain facts displays more than 1.2 million ETH has exited exchanges over the last two weeks, a signal that also can very successfully be bullish for the associated price of the crypto.

Ethereum Alternate Reserve Has Observed Predominant Decline In The Final Couple Of Weeks

As pointed out by an analyst in a CryptoQuant submit, the ETH alternate reserve has misplaced over 5% in fee in barely the closing fourteen days.

The “all exchanges reserve” is an indicator that measures the full amount of Ethereum show in wallets of all centralized exchanges.

When the fee of this metric goes down, it methodology shoppers are withdrawing a regain amount of cash upright now. Such a trend can also very successfully be bullish for the associated price of ETH as holders assuredly employ their crypto off exchanges for amassing them.

On the opposite hand, an make bigger within the reserve implies shoppers are depositing Ethereum for the time being. Since holders assuredly switch their money to exchanges for selling recommendations, this roughly trend would possibly perhaps perhaps show to be bearish for the crypto’s price.

Connected Reading | Bitkeep Turns into The Sponsor of Bitcoin 2022, Bringing A Comfortable Unpleasant-Chain Swap Abilities to Bitcoin Holders

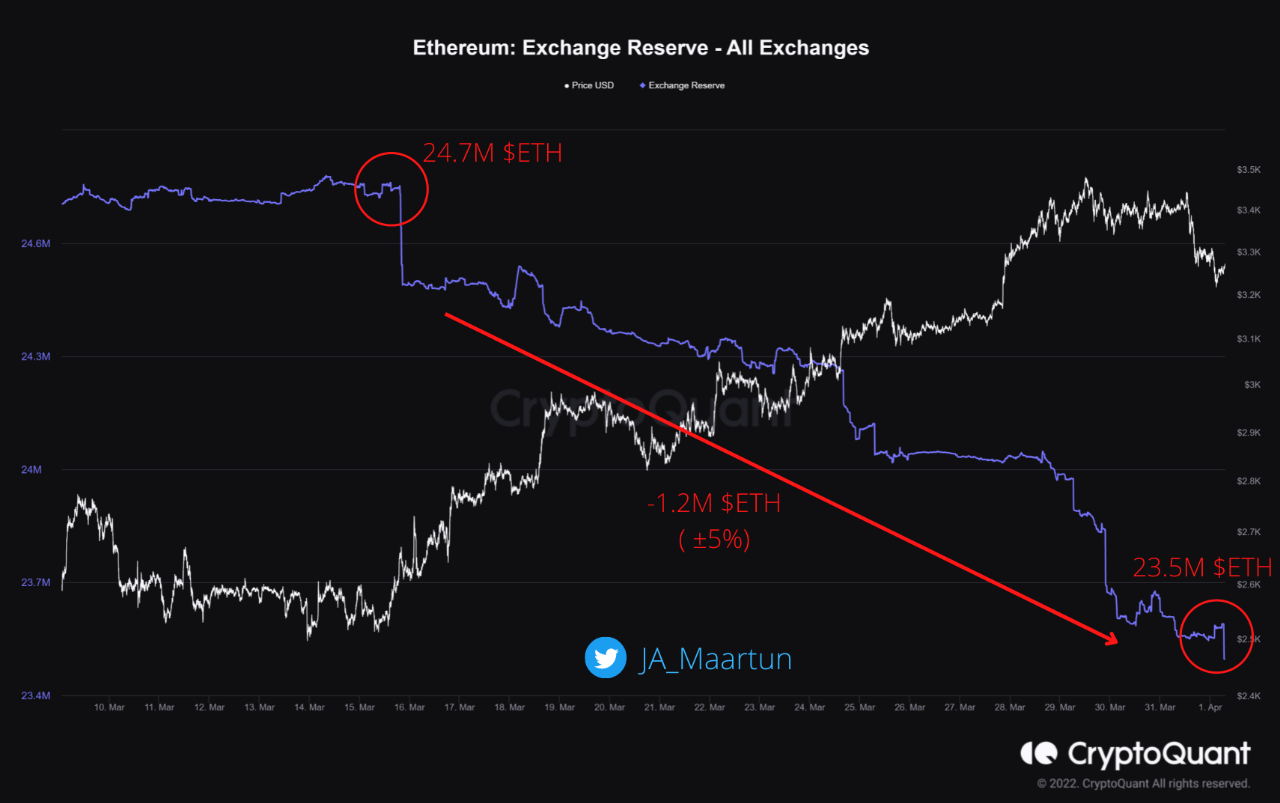

Now, right here is a chart that displays the trend within the Ethereum alternate reserve over the last few weeks:

Appears to be luxuriate in the fee of the indicator has sharply dropped off now not too prolonged ago | Provide: CryptoQuant

As that you just can perhaps also stumble on within the above graph, the Ethereum alternate reserve has noticed well-known decline one day of the period.

In only over the closing couple of weeks, the metric’s fee has long gone from about 24.7 million ETH to round 23.5 million ETH.

Connected Reading | TA: Ethereum Might presumably also Note “Liftoff” if It’s Ready to Serve One Mandatory Stage

Here’s a tumble of round 5% in handiest 14 days, amounting to about 1.2 million ETH, or nearly 4 billion in USD at the unique alternate fee.

This colossal tumble within the reserve within this kind of transient timespan suggests accumulation can also very successfully be going on available within the market upright now.

Exchanges assemble traditionally been practical the “selling offer” of Ethereum. So, attributable to hunt facts from-offer dynamics, its decline can also very successfully be moderately bullish for the associated price ultimately.

ETH Mark

On the time of writing, Ethereum’s price floats round $3.3k, up 4% within the closing seven days. Over the previous month, the crypto has won 12% in fee.

The below chart displays the trend within the associated price of the coin over the closing five days.

The associated price of ETH seems to be to assemble plunged down over the last day | Provide: ETHUSD on TradingView

A pair of days succor, Ethereum surged up in fee, breaking above the $3.4k level. On the opposite hand, within the closing twenty-four hours, the associated price of the crypto looks to assemble all all over again come succor down.

Featured represent from Unsplash.com, charts from TradingView.com, CryptoQuant.com