eToro is continuously most continuously known because the “Robinhood of Europe,” drawing comparisons to the U.S. Fin-tech unicorn for its individual-friend trading expertise. For U.S-based eToro users, the platform gives 15 cryptocurrencies for trade, such as Bitcoin and Ethereum. For world eToro users, the offerings expand to stocks and foreign change.

Just a few unparalleled parts give eToro separate eToro from the cryptocurrency change pack: social trading, CopyPortfolio, and CopyTrader– the latter characteristic enables you to merely “reproduction” the are residing portfolio of top cryptocurrency merchants on the platform. Whereas outmoded fund managers are formally accredited and can make investments your money for a price, eToro’s copyable merchants are usual of us who secure had success or expertise trading cryptocurrency.

While the arms-off cryptocurrency investing map could presumably additionally be moderately beautiful, we bustle our readers to be cautious when investing in something else. Cryptocurrency is a extremely unhealthy asset class, and honest in consequence of your trades are on autopilot doesn’t point out it’s possible you’ll presumably perchance presumably’t win rocked your total same (house your live losses!)

The next eToro overview will educate you all the pieces it’s a long way mandatory to grab about the trading platform:

- eToro’s company history

- How to form an account on eToro

- eToro wallets and accounts

- What are eToro charges

- How does trading work on eToro

- What’s the eToro Copytrader characteristic?

Key aspects:

✅ eToro is a individual-pleasant social trading platform that enables United States merchants to trade various cryptocurrencies, and European merchants to trade a wider vary of monetary instruments love stocks, crypto, commodities, currencies, and more. eToro USA LLC does no longer supply CFDs, handiest accurate Crypto resources accessible.

✅eToro is a extremely newbie-pleasant change that enables for a explain fiat to cryptocurrency change– unusual users can win began trading cryptocurrency on eToro for as little as $50.

✅ Choices love CopyTrader and CopyPortfolio are a gorgeous arms-off, albeit unhealthy, method to cryptocurrency trading.

✅ eToro is heavy on “social” trading and encourages users to chat about non permanent and long-term cryptocurrency trades.

❌Buying and selling charges are moderately greater than the industry traditional for most other exchanges. We name this the “UI Tax”

❌Users can’t in actual fact win admission to their resources, they can handiest trade them for fiat. Even though eToro is a huge trading platform, we’re no longer too immense partial to the lack of custodial possession over your cryptocurrency.

eToro’s Company Information

A fast stroll down the history lane of the rising fin-tech superstar leads us thru a individual-first method to manufacture and a pivot to embrace the rising cryptocurrency market.

When turn out to be once eToro founded? Essentially based in 2007 by entrepreneurs David Ring, Ronen Assia, and Yoni Assia in Israel, eToro has since grown to over 500 employees, operations in 140 worldwide locations, and over 13 million users internationally.

How great has eToro raised? eToro in all equity neatly-capitalized and has raised a crammed with $222.7M in funding in over 10 rounds, with primarily the most up-to-date Series E spherical coming in April 2018.

Which companies has eToro purchased: eToro has purchased two organizations–Belgium-based cryptocurrency portfolio tracker app Delta in September 2019, and Danish trim contract infrastructure provider Firmo in March 2019.

The preserving company eToro (UK) Ltd. relies in London, and eToro has extra registered offices in Cyprus, Tel Aviv, New Jersey, Sydney, and Shanghai.

eToro began with a essential focal level on trading fiat currencies and commodities, introducing stocks in July 2013 and a broader array of cryptocurrencies in 2017. eToro equipped Bitcoin trading in 2013 with CFDs and turn out to be once one of many few FinTech platforms of the time offering win admission to to the then-nascent Bitcoin.

In February 2017, eToro expanded its cryptocurrency offerings to Ethereum, XRP, Litecoin, and a handful of different cryptocurrencies. With the ensuing mid-2017 cryptocurrency market enhance, eToro doubled down on its world buyer acquisition to cement itself as a premier change within the cryptocurrency community.

eToro launched its eToro U.S. operations in March 2019, beginning with a handful of cryptocurrencies accessible for trading and within the slay rising to over 15.

The platform is unparalleled within the cryptocurrency industry in consequence of of parts love CopyTrader and social trading, allowing merchants to fraction are residing trading files, reproduction the portfolios of the best-performing merchants, and map cryptocurrency investing from a moderately “arms-off” mapwe’ll win into it under..

*Let’s reiterate this crucial caveat: : don’t make investments something else it’s possible you’ll presumably perchance no longer secure ample money to lose, no platform can supply in actual fact 100% guaranteed positive factors, all investing (specifically cryptocurrency investing) are inclined to approach support with a excessive degree of chance.*

Key Feature #1: What’s the eToro Copytrader characteristic?

In 2010, eToro leaned into the title of being the realm’s first social trading platform with the birth of OpenBook, a characteristic that allowed anyone on this planet to reproduction a success merchants utilizing CopyTrader. OpenBook turn out to be once conception to be a moderately innovative conception in FinTech on the time, winning the Finovate Europe Most efficient of Show mask for 2011.

CopyTrader, in our humble idea, stands as one of many perfect parts in FinTech.

Why? Being ready to respect how and what top merchants are trading is something that some companies strive to charge hundreds of bucks for, or a proportion of resources under management. eToro takes it a step additional by making it that it’s possible you’ll presumably perchance presumably take into consideration to “reproduction” their portfolios with one click. If this conception tickles your luxuriate in, form an eToro account and investigate cross-take a look at the merchants– you’ll secure to win admission to a grunt version of the positioning relying for your enviornment for regulatory reasons: eToro U.S. and eToro Worldwide.

The minimum quantity to reproduction a vendor is $200, and the max is $500,000. You’d reproduction as much as a limit of 100 merchants on the same time.

Right here’s our high-tail-thru of CopyTrader

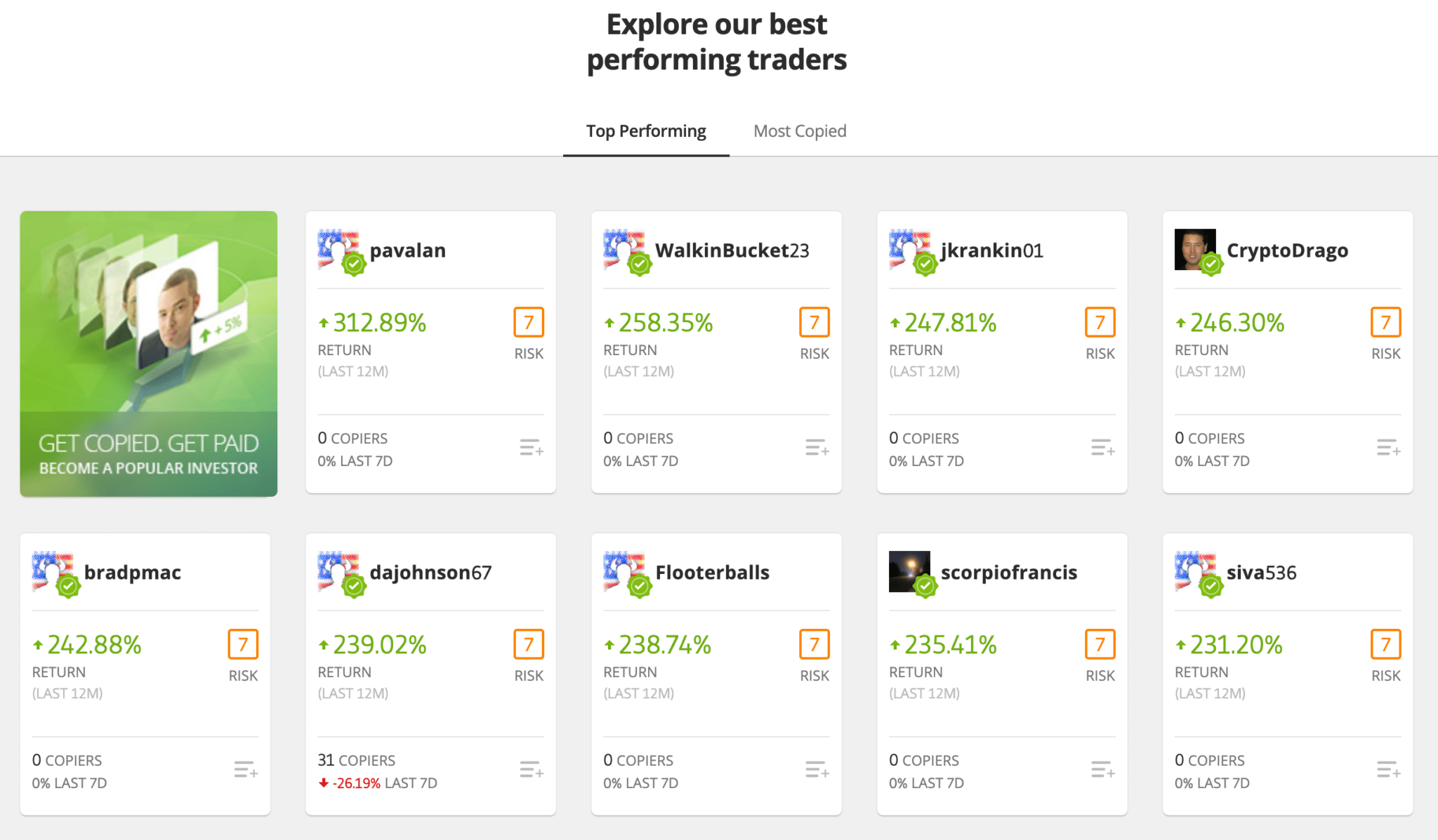

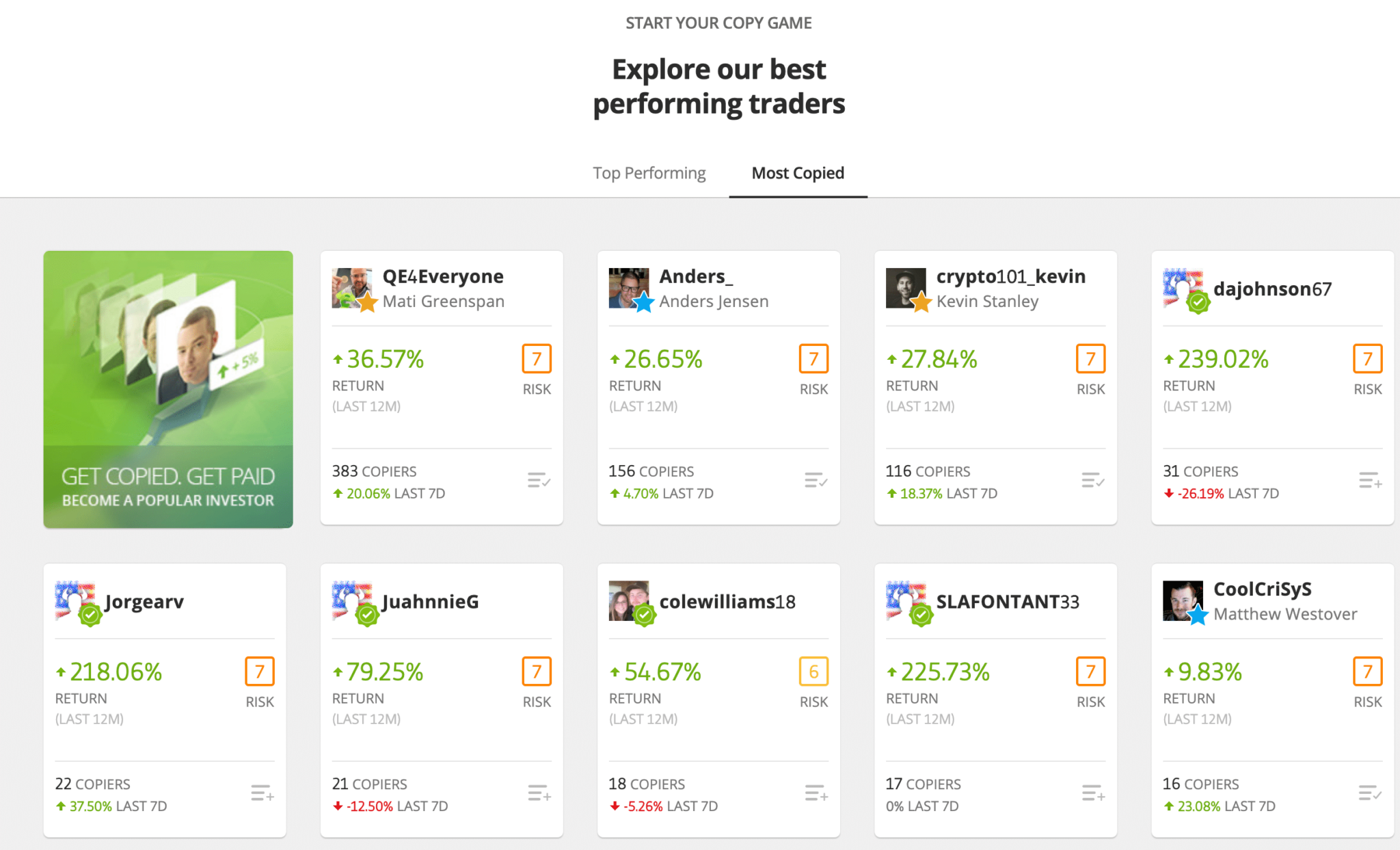

Beneath, there are two sections: “Top Performing” and “Most Copied”

On the Most Copied fraction, we search the platform’s hottest merchants, reputedly sorted in some form of weighted reputation reasonable in desire to proportion manufacture.

Let’s investigate cross-take a look at what makes this QE4Everyone (Mati Greenspan) vendor so celebrated.

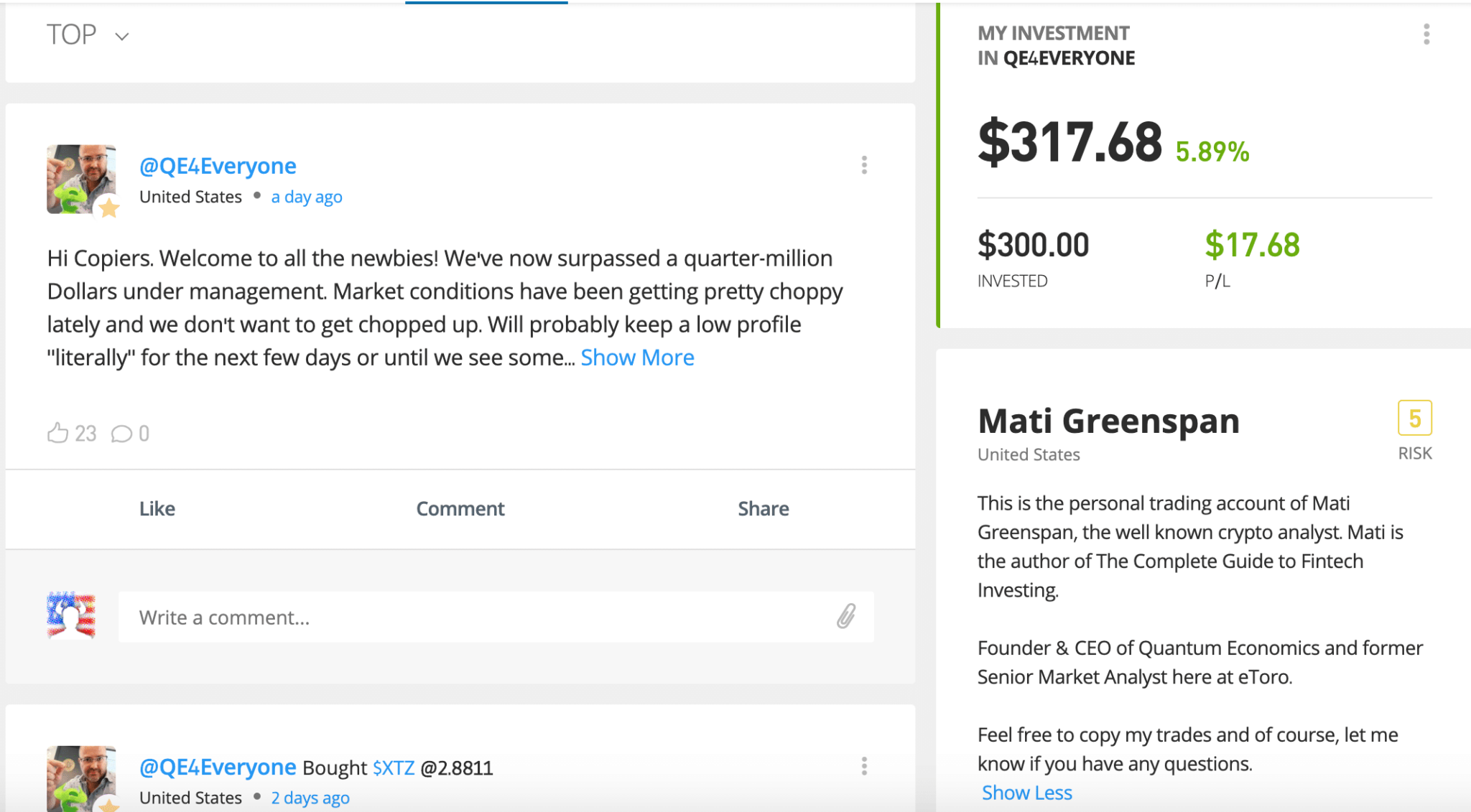

After clicking on Greenspan’s profile, we search his social posts directed towards the eToro trading community, our fresh investment (we deposited $300 to take a look at this characteristic) in his reproduction portfolio and it’s general efficiency– thanks for the $17 bucks, Mr. Greenspan. We also search Greenspan’s bio– a broadcast author, Founder & CEO of an organization known as Quantum Economics, and a outdated Senior Market Analyst at eToro.

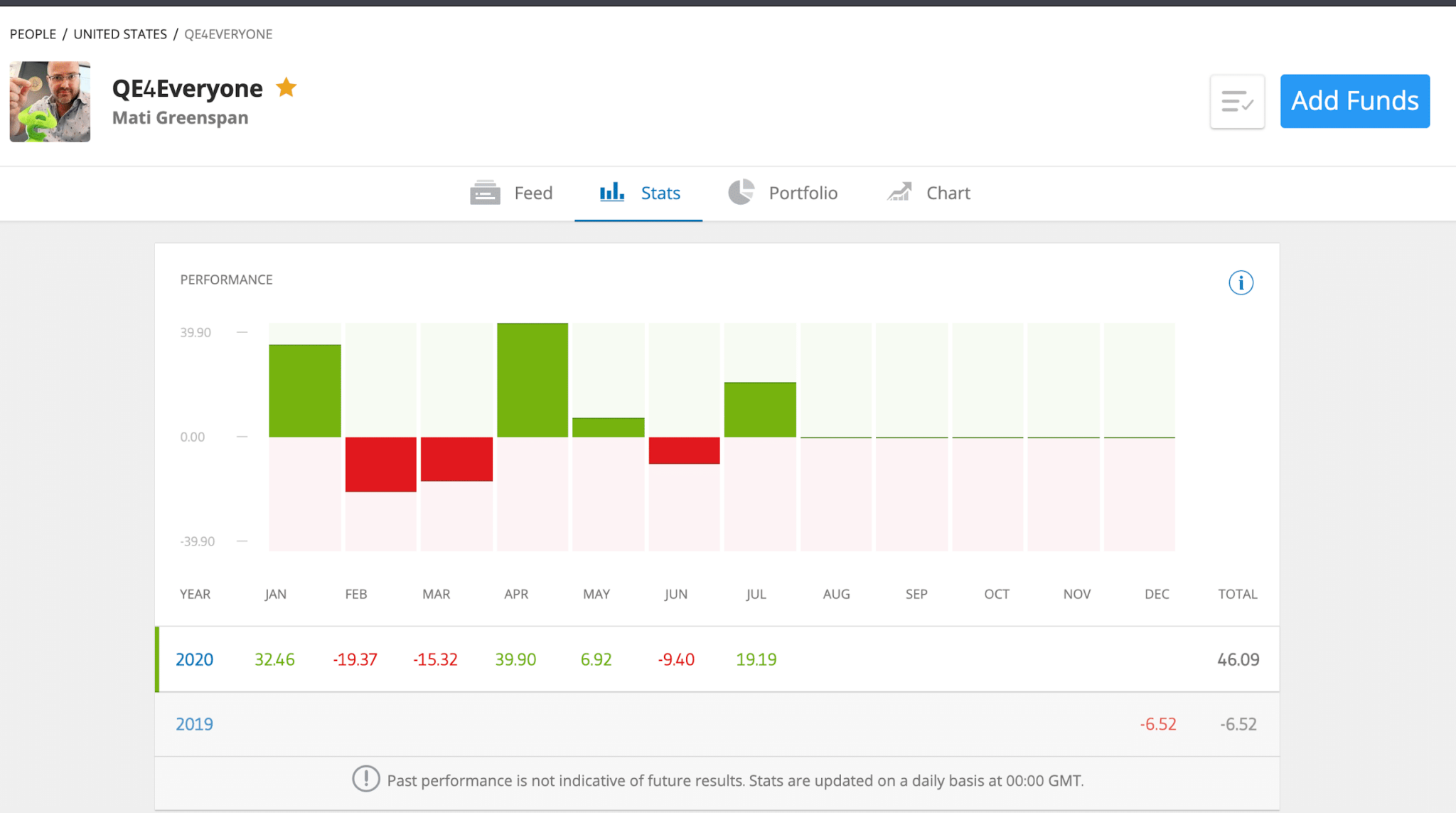

Clicking on his profile stats, we search his cryptocurrency trading efficiency per month. While the cryptocurrency market itself experienced some volatility these months, Greenspan appears to be like to secure handled it gorgeous great.

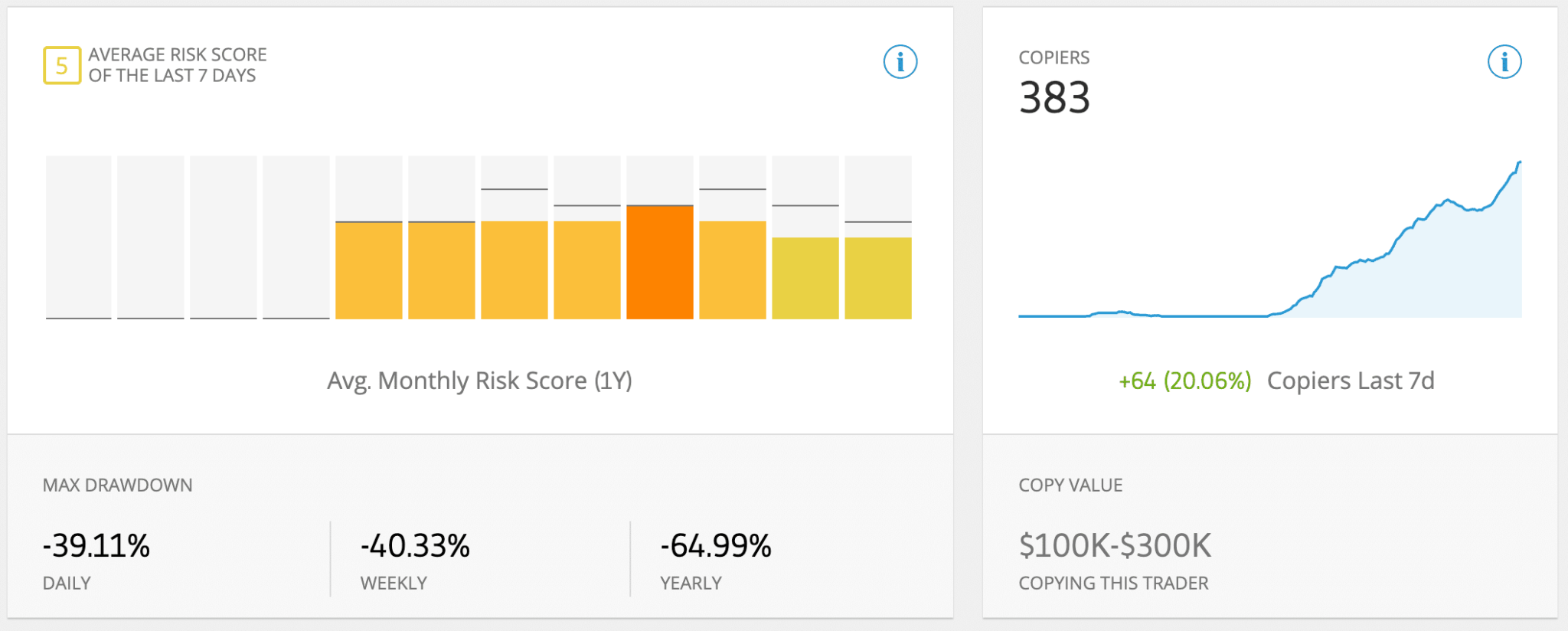

Additional, we search how “unhealthy” this vendor is with a chance ranking assigned by eToro, moreover the sequence of fresh trade copiers (of between $100k to $300k in reproduction label.)

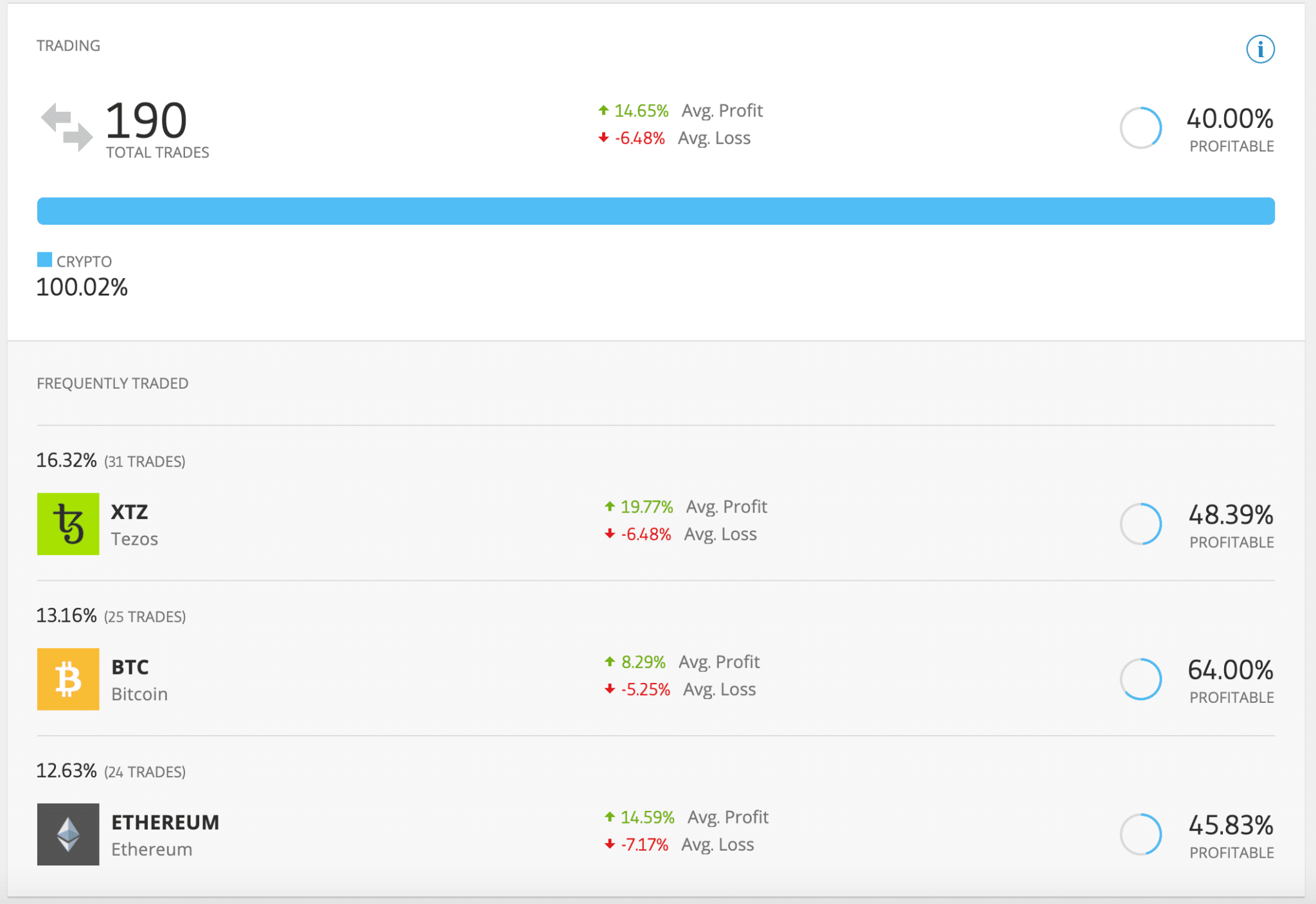

We are in a position to win a little more detail into Greenspan’s trades: we search the final quantity of trades within the past 365 days, and his most generally traded resources.

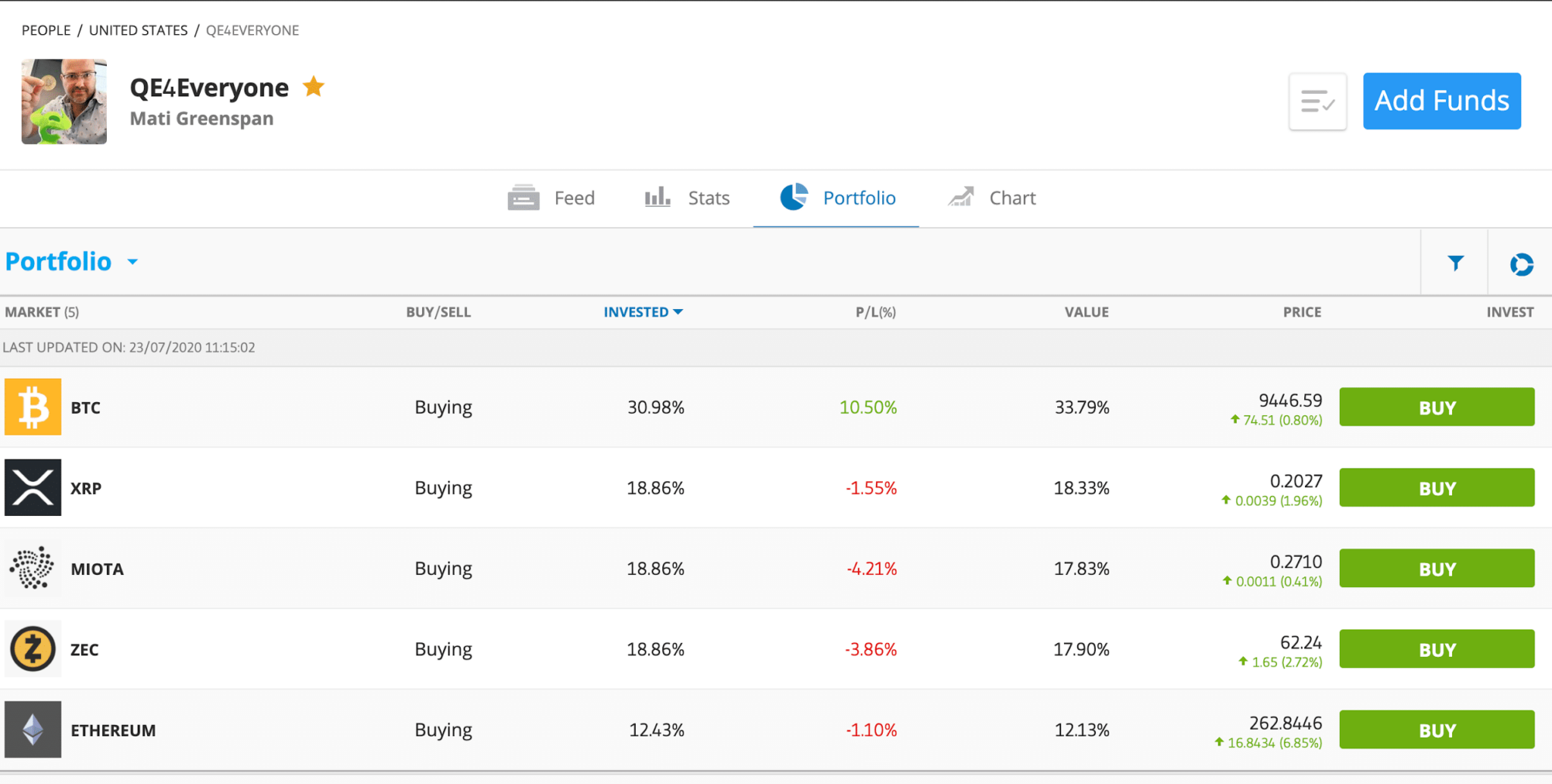

On the portfolio tab, we search exactly what his trades are on the fresh 2nd. From here, we can both take these same resources manually, or once we add some funds, we can reproduction Greenspan’s portfolio, and eToro will robotically mediate his trades till you repeat it to live, or till the reproduction live loss hits.

While the Top Performing profiles look very attention-grabbing, we bustle our readers to attain the suitable quantity of research on eToro’s platform to price how they’ve been ready to manufacture such outcomes.

As an illustration, a form of these merchants secure merely equipped one asset months ago that mooned and haven’t launched a trade since. So, by copying their portfolio, you’d in general honest be “buying” the asset at its fresh label.

How to Expend eToro’s CopyTrader:

CopyTrader is truly simple. When you’ve made your eToro account (eToro U.S. and eToro Worldwide) depart to the CopyTrader fraction, take out a vendor to reproduction, and add the funds required.

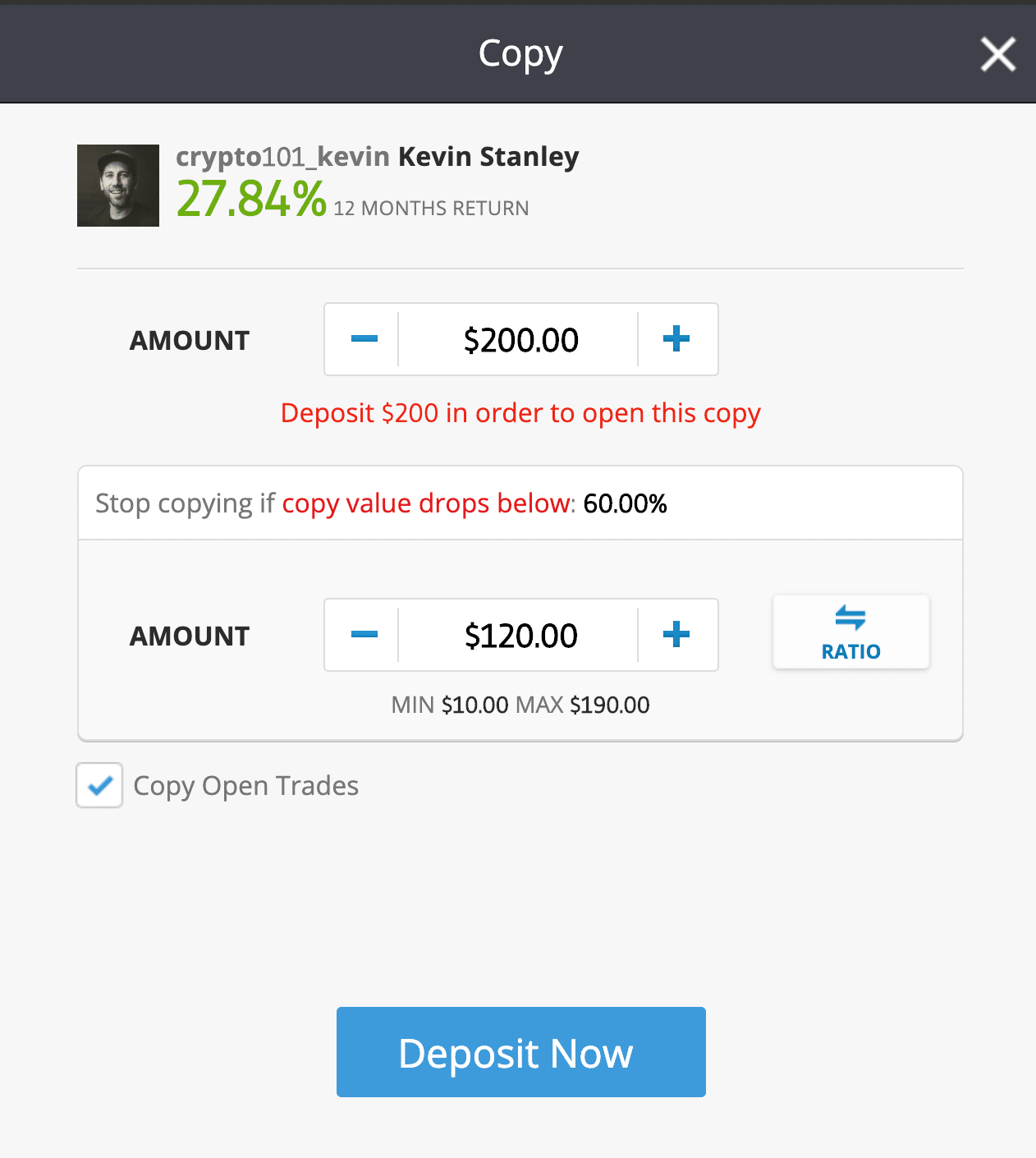

As an illustration, let’s explain we prefer to reproduction crypto101_kevin (Kevin Stanley). He appears to be like love a pleasing guy, but more importantly, he has a exact quantity of different copiers and a 27% manufacture for this 365 days to this level.

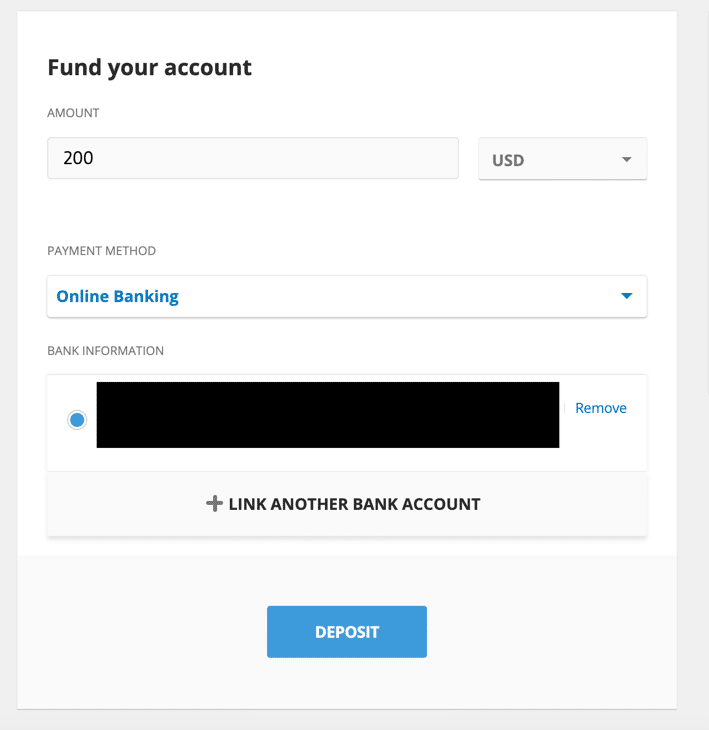

An crucial chance-management characteristic here is the flexibility to straight live copying a vendor’s profile if the price drops under a determined quantity. Let’s grab we’ve made up our minds we can belly a 60% worst-case-enviornment loss on an investment of $200– we would house the volume accordingly and deposit the funds.

We deposit the USD, and enhance– we’re copying a vendor.

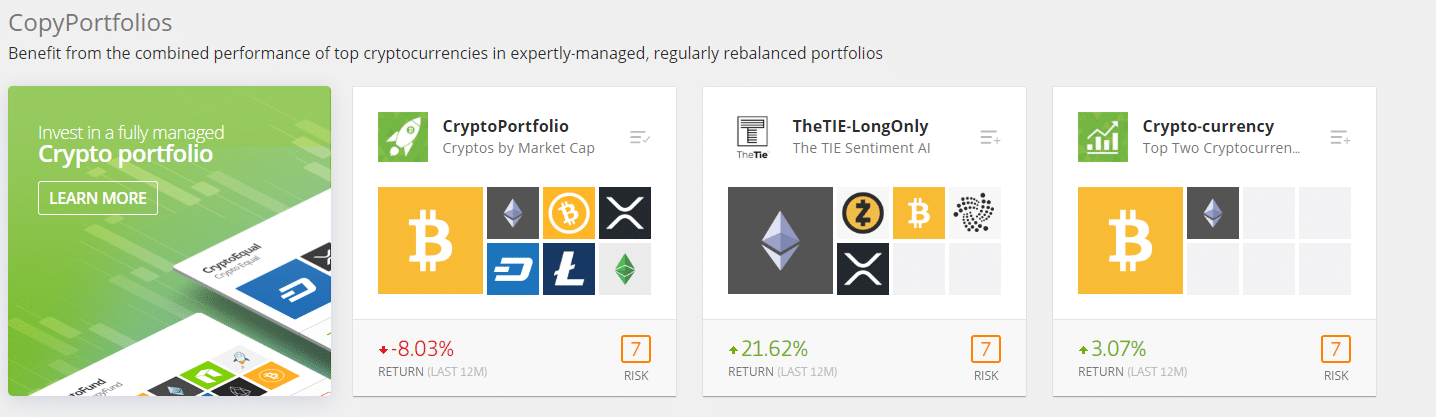

Key Feature #2: CopyPortfolios

In 2016, eToro furthered its social trading offerings with the free up of CopyPortfolios, a long-term thematic investment fabricated from managed portfolios with bundled Top Merchants or explicit resources utilizing a predetermined market method. The majority of eToro’s CopyPortfolios employ machine studying to glance maximum returns.

There are three CopyPortfolios accessible within the US. TheTIE, to illustrate, builds its investment method on sentiment analysis, gauging the sure and unfavorable tone of tweets on Twitter.

Key Feature #3: Digital Portfolio

The eToro virtual portfolio is fully a sandbox, the effect aside users fetch $100k in false money to take a look at-power the platform.

This characteristic doesn’t appear to be accessible within the US honest yet.

eToro USA and eToro Worldwide

An crucial distinction to form for our good readers unfold at some level of the realm: eToro has two various platforms as a result of regulatory compliance: one for eToro U.S. and one for eToro Worldwide users.

Is eToro accessible within the US? Hurry, but handiest the cryptocurrency trading aspects. When you happen to’re within the US, you’ll secure win admission to to the same cryptocurrency investment trading platform as all americans else, moreover the CopyTrader and CopyPortfolio parts, but it’s possible you’ll presumably perchance presumably’t trade stocks or foreign change (yet).

How to Expend eToro in USA – Expend the next link to form an eToro USA account.

eToro USA LLC; Investments are enviornment to market chance, in conjunction with the that it’s possible you’ll presumably perchance presumably take into consideration loss of essential. Archived, “Digital currencies are extremely volatile. Your capital is at chance.”

eToro Worldwide: There’s a cause why eToro is continuously known as the “Robinhood of Europe”– but that’s leaving some label on the table: the platform enables world users to trade foreign change, stocks, and cryptocurrency. When you happen to could presumably additionally be outdoors of the US, employ the next link for eToro world.

Disclaimer: 78% of retail investor accounts lose money when trading CFDs with this provider. It’s essential secure in thoughts whether it’s possible you’ll presumably perchance presumably secure ample money to desire the excessive chance of shedding your money.

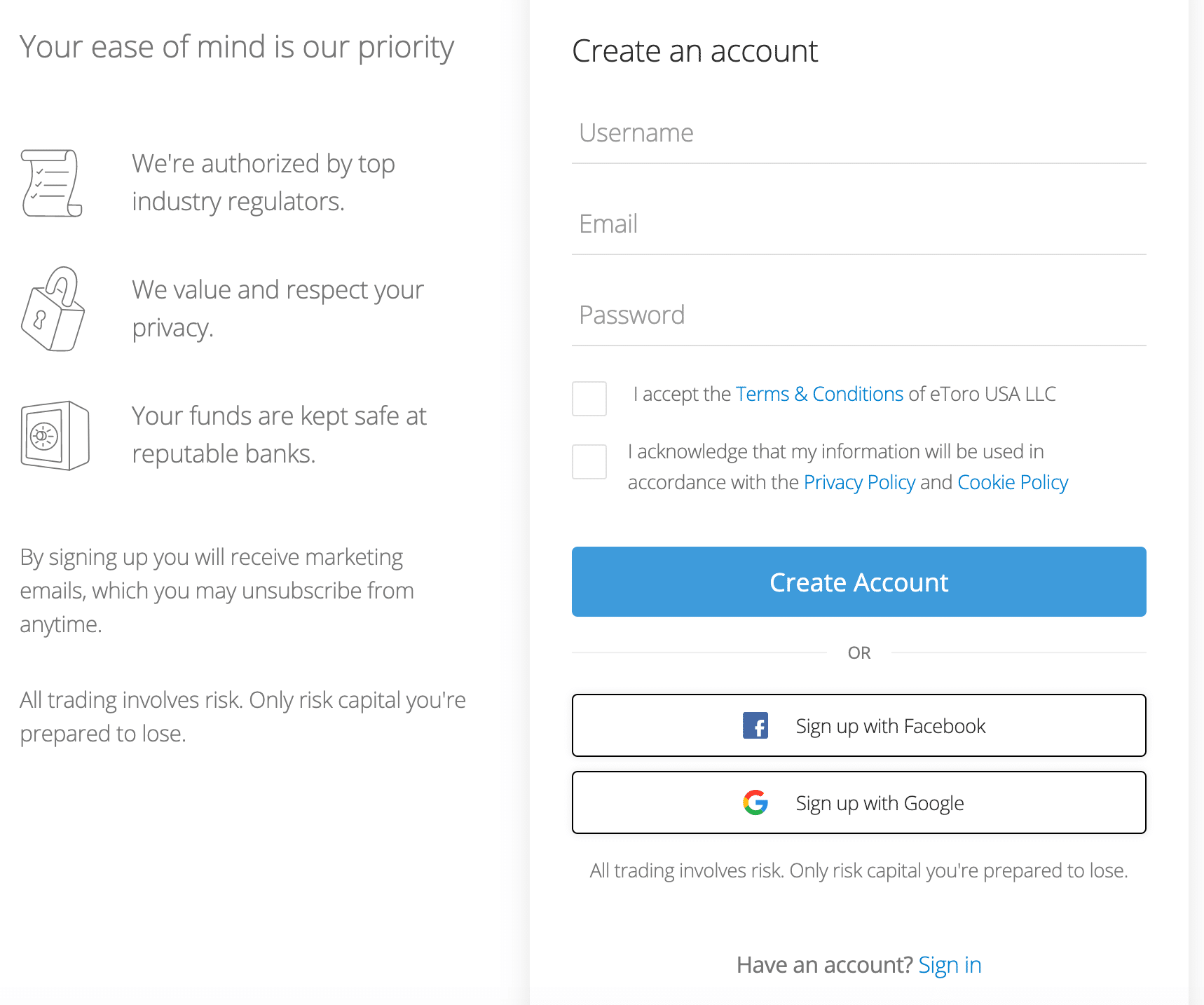

How to Tag Up

Ease of Expend: A+

Signing up for eToro is a extremely streamlined expertise with the mandatory “Know Your Customer” (KYC) requirements most exchanges within the US require.

- When you happen to’re within the US, employ the next link to form an eToro USA account. When you happen to could presumably additionally be outdoors of the US, employ the next link for eToro world. Disclaimer: eToro USA LLC; Investments are enviornment to market chance, in conjunction with the that it’s possible you’ll presumably perchance presumably take into consideration loss of essential. Archived, “Digital currencies are extremely volatile. Your capital is at chance.”

- Hit JOIN NOW and form your account files.

- Before submitting, we recommend taking some time to get to grips with eToro’s Privacy Protection and Phrases & Stipulations. When you’ve completed, take a look at the containers and CREATE ACCOUNT to put up your files.

- Now comes the fun fraction– KYC! As fraction of this route of, newly registered investors are required to present Proof of Id such as a unswerving passport or driver’s license, and in some cases, Confirmation of Predicament (such as a unswerving utility bill.)

- Additional, unusual eToro users will be requested to secure out a fast questionnaire to support eToro better realize which parts are easiest suited to their investor profile. Questions encompass things love: the investor’s official enviornment, degree of files of the capital markets, financial liquidity, acceptable ranges of chance, and investment targets.

- You’re house!

What are eToro’s Fees

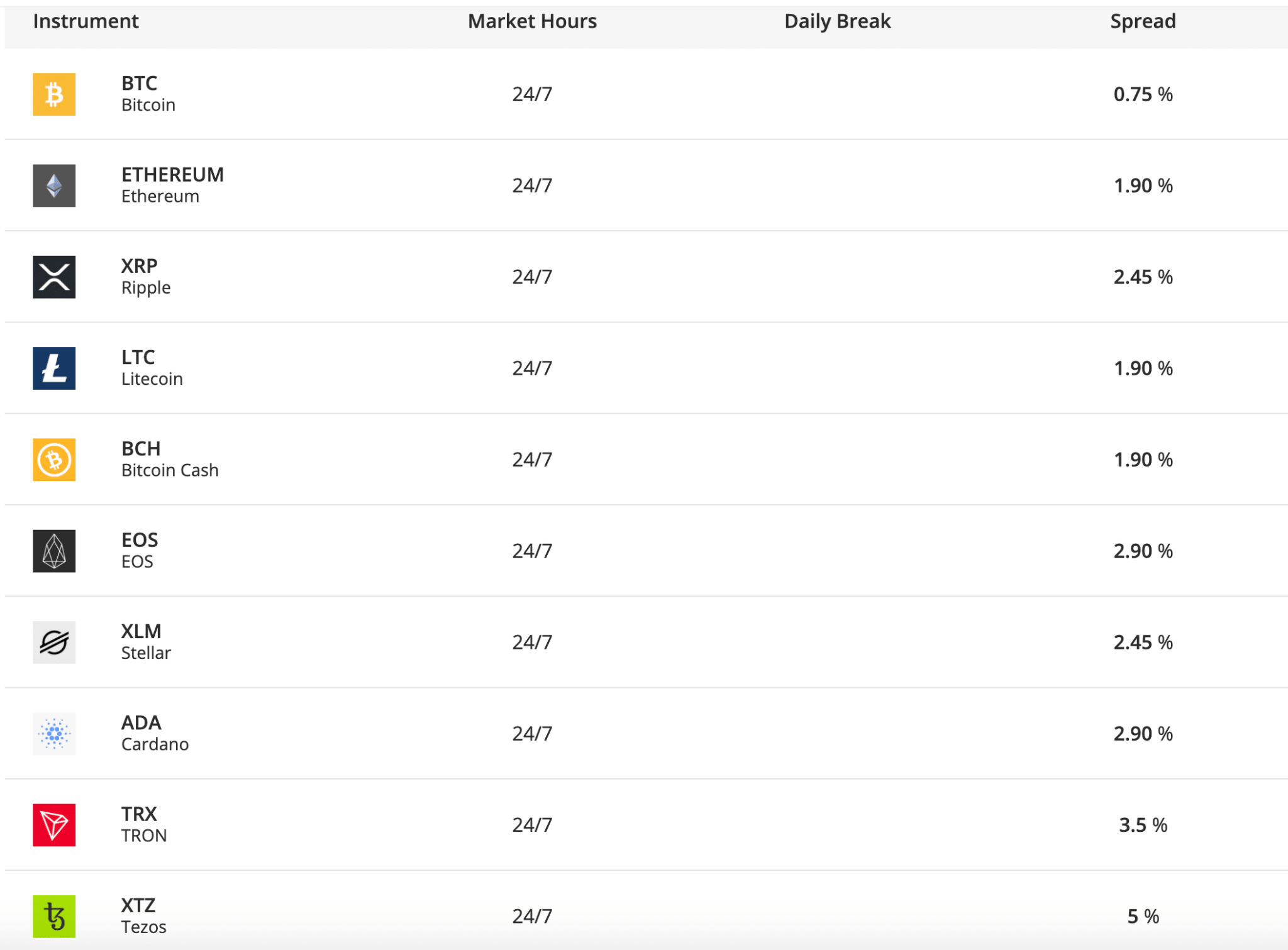

eToro’s pricing policies are moderately clear. They’re greater than the industry traditional of cryptocurrency exchanges love Bittrex or Binance, but eToro is technically a various form of platform than honest a standalone change.

eToro Unfold Fees: Unfold charges are in general how “no commission” brokers and exchanges love Robinhood and eToro form money– it’s a label built into the take and promote label of the cryptocurrency pair you’ll want to trade. The adaptation between what the asset is accessible (ie. ETH = $200.23) and what it charges to purchase it on a determined platform (ie. Accumulate ETH = $200.45)– the price can be an additional $0.22 cents.

These charges are moderately reasonable for most cryptocurrency resources, currently ranging between .75% for BTC to upwards of 5% for Tezos, the latter of which is truly excessive.

eToro Withdrawal Fees: There are no ($0) withdrawal charges on eToro within the US ($5 withdrawal price for all other regions), but there could be as a minimum withdrawing $30.

eToro Pockets charges: eToro doesn’t charge charges for sending or receiving transactions, even if blockchain charges are aloof acceptable. eToro does charge a .1% conversion price house to eToro market rates.

To be taught more about eToro’s charges, focus on over with their price website.

eToro Fund Safety

eToro’s wallets are secured by multisignature and analytic behavior machine studying, which targets to support the platform’s security crew determine and forestall possible threats from malicious third events.

In step with eToro, depositing fiat money into your account is safe, non-public, stable, and for US users, FDIC insured. Cryptocurrency, alternatively, just isn’t any longer covered by FDIC insurance coverage. Transactions are communicated thru Receive Socket Layer (SSL), which helps protect non-public files safe.

How to Change on eToro

We’ll preface this fraction by announcing that nothing within the investment world is guaranteed, and inserting any cryptocurrency outdoors of your financial savings account carries some chance.

That being acknowledged, eToro makes cryptocurrency trading and cryptocurrency chance management a moderately passive, but no longer chance-free, endeavor must you’re utilizing its CopyTrader characteristic. Pairing the CopyTrader characteristic with a Copy Charge portfolio drop threshold must aloof provide you both a cryptocurrency investment method on autopilot (ideally high-tail by an experienced vendor) with coaching wheels in case of a calamity.

Closing Suggestions – Is eToro a Fair appropriate Platform to Expend?

Indirectly, eToro is a individual-first company with ample venture capital money raised to form definite the platform meets the rising wants of its users. All the pieces from the open-market cryptocurrency change to the CopyTrader parts is colossal intuitive.

We are in a position to search this platform being very a success in offering newbie and intermediate users a huge individual expertise.

Nonetheless, it’s price declaring that eToro appears to be like to be primarily designed for trading, and users in actual fact can’t win admission to their cryptocurrency exact now. As an illustration, must you equipped 1 BTC, you wouldn’t be ready to send it to your hardware pockets (it’s possible you’ll presumably perchance additionally be ready to send it to eToro’s pockets, but that’s yet every other product for yet every other day.) You have to perchance presumably perchance presumably secure to promote your BTC for USD, after which transfer your USD support to your bank, after which transfer it to an change that does point out it’s possible you’ll presumably perchance presumably withdraw the digital asset.

That being acknowledged, eToro’s CopyTrader and CopyPortfolio form it a gorgeous awesome product within the arsenal of any cryptocurrency individual. The parts are free and don’t charge you any charges for your positive factors, you honest secure to pay the unfold price as you would on every other change.

eToro is geared towards “social trading” the effect aside users can be taught from every other; as more users join the eToro platform, we predict more experienced merchants will be open to having their portfolios copied to originate their reputations within the home. When you happen to could presumably additionally be an experienced vendor taking a look to affix eToro, they’ve a moderately attention-grabbing compensation program for Common Merchants.

When you happen to attain grab to make employ of eToro, employ one of many next hyperlinks per your enviornment: eToro U.S. and eToro Worldwide.

Disclaimer:

eToro is a multi-asset platform which gives both investing in stocks and cryptoassets, moreover trading CFDs.

Please existing that CFDs are complex instruments and approach with a excessive chance of shedding money all of a sudden as a result of leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. It’s essential secure in thoughts whether how CFDs work, and whether it’s possible you’ll presumably perchance presumably secure ample money to desire the excessive chance of shedding your money.

Past efficiency just isn’t any longer a demonstration of future outcomes. Buying and selling history offered just isn’t any longer as much as 5 total years and can merely no longer suffice as foundation for investment decision.

Copy trading is a portfolio management carrier, equipped by eToro (Europe) Ltd., which is authorised and controlled by the Cyprus Securities and Alternate Charge.

Cryptoasset investing is unregulated in some EU worldwide locations and the UK. No individual safety. Your capital is at chance.

eToro USA LLC does no longer supply CFDs and makes no representation and assumes no prison responsibility as to the accuracy or completeness of the squawk material of this e-newsletter, which has been titillating by our partner utilizing publicly accessible non-entity explicit details about eToro.

Never Omit One more Alternative! Gain hand chosen files & files from our Crypto Consultants so it’s possible you’ll presumably perchance presumably form trained, knowledgeable choices that exact now influence your crypto profits. Subscribe to CoinCentral free e-newsletter now.