DeFi Llama is a decentralized analytics dashboard that tracks DeFi TVL (total price locked) for tasks delight in Ethereum, Terra, and Binance.

Currently, DeFi apps are rather sophisticated to tune due to their decentralized nature, with consumers having to envision each individually to preserve updated with the market. DeFi Llama goals to clear up that.

DeFi Llama presents detailed data for consumers for free by inspecting data throughout the sector’s largest chains,

That’s data on a $172 billion market without spending a penny. A fine honest correct offer whenever you demand us.

To present customers with as great data as possible, DeFi Llama tracks the next:

- DeFi applications

- DeFi chains

- DeFi forks

- DeFi airdrops

- NFTs

- Oracles

The following DeFi Llame data will duvet what DeFi Llama is, how it truly works, how to make expend of DeFi Llama, and its opponents.

What Is DeFi Llama?

DeFi Llama is an API that tracks DeFi LTV to give a top level notion of the sector’s largest chains and the total price of the DeFi market as a complete. Blockchains encompass:

- Ethereum

- BSC

- Terra

- Tron

- Avalanche

- Solana

- Polygon

- Cronos

- Fantom

- Waves

And various extra.

The platform sources its info today from over 80 Layer one blockchains, a complete bunch of decentralized apps, CoinGecko and Uniswap. CoinGecko tracks over 400 exchanges and 5000 DeFi sources, making it one of many sector’s largest cryptocurrency data aggregators. Uniswap presents data on thousands of cryptocurrencies and is one of many largest decentralized exchanges with over $100 billion in total trading quantity.

By compiling this data, customers can without effort gaze which chains are the largest and that are growing quickest. The data is legit because it comes from launch protocols where blockchain data is rapid available in the market to the public.

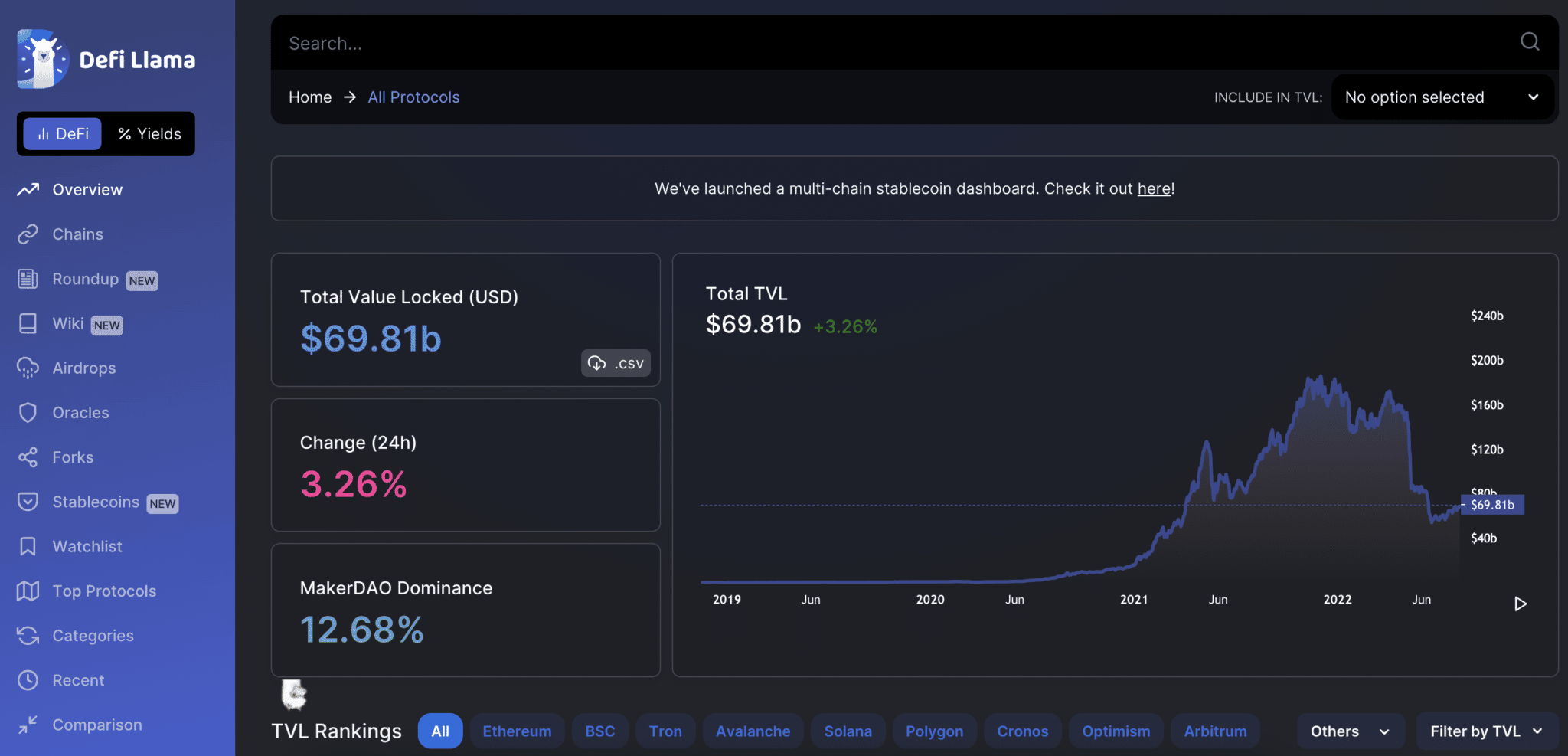

In December 2021, DeFi TVL reached an all-time high of $250 billion (valued at $19.5bn in September 2020), exhibiting how rapid the market is rising.

How Does DeFi Llama Work?

Above we established that DeFi Llama aggregates data from blockchains to produce customers with data. But how exactly does DeFi Llama work?

Before we originate, it’s crucial to imprint that TVL differs from the market cap. By device of market cap, Bitcoin is by some distance the largest cryptocurrency. Nonetheless, it doesn’t give a seize to orderly contracts, so DeFi applications can’t be constructed on them. Therefore, it’s no longer listed on DeFi Llama.

Right here’s how to make expend of DeFi Llama.

DeFi Llama Dashboard

Upon coming into the placement, you’ll crawl straight to the DeFi Llama dashboard exhibiting a chart of DeFi TVL throughout assorted actions. These encompass TVL rankings based entirely on USD, the TVL of change blockchains, protocols, and the proportion switch over one day, seven days, and a month.

Per the July 2022 dashboard, MakerDAO (MKR) has the ideal TVL with $8.43b in sources, with Lido (LDO) in 2d negate with $7.08b.

Users can scroll by TVL rankings based entirely on separate chains similar to Ethereum, BSC, and Tron or preserve a generic overview of the market.

On the left-hand side of the dashboard, you might maybe maybe maybe additionally get particular particular person sections, along side

- Chains

- DeFi Forks

- Airdrops

- Oracles

- Stablecoins

Right here’s how they work.

DeFi Chains

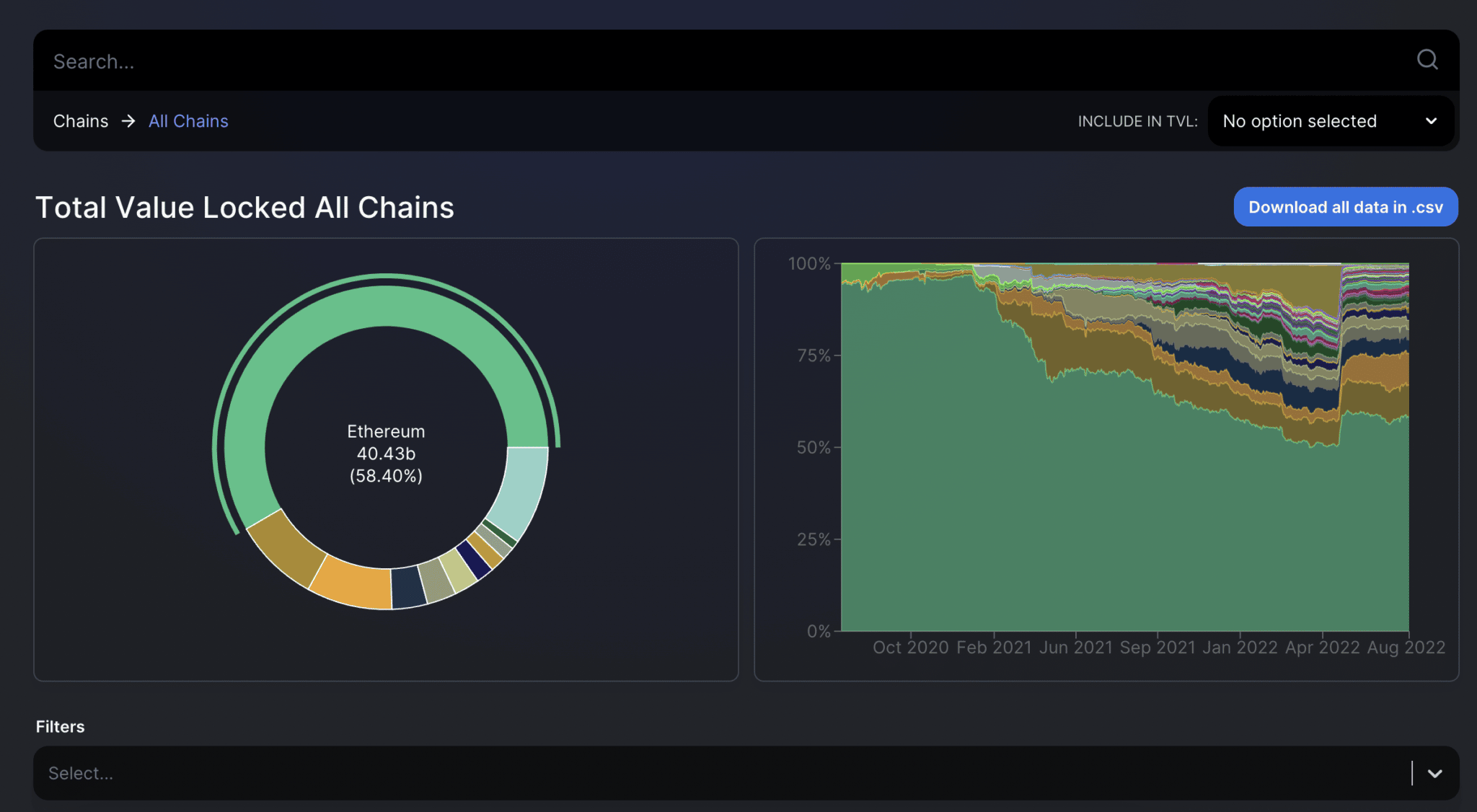

Under the “Chains” menu, customers can take a look at the TVL of the largest blockchains. Once customers click the Chain button, they might be able to also be taken to a listing of Layer 1 chains where apps might maybe maybe maybe additionally be constructed.

The head DeFi chain is Ethereum, with a market a part of 58.7% and a TVL of $39.45b. Despite seeming delight in a tremendous majority of the market, Ethereum’s market part has fallen since 2021, representing 95-97% of all DeFi exercise.

Since its all-time highs, apps similar to UniSwap and OpenSea contain innovated blockchain technology establishing unusual alternate solutions for decentralized trading. Many of these might maybe maybe maybe additionally be found beneath the Chains heading, along side Solana (SOL), Tron (TRX), and Waves (WAVES).

DeFi Forks

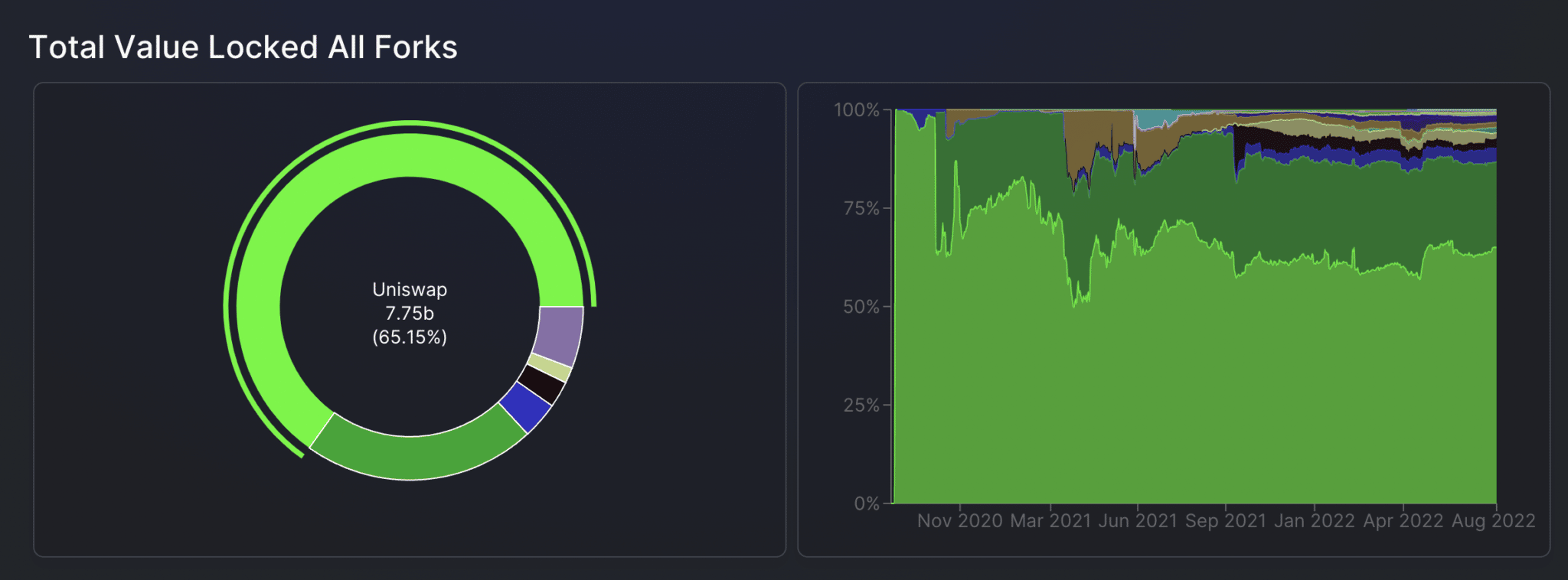

A fork is a reproduction of usual tool that’s been a diminutive altered to perform enhancements. Most DeFi applications are launch-offer, so the code is commercially readily available in the market and might maybe maybe maybe additionally be cloned for assorted tasks. Be mindful the lawsuits in any assorted arena of interest.

Forks aren’t basically a spoiled thing both. Really, forked tasks can on the full contain a bigger TVL than their usual applications. As an instance, on the DeFi forks tab Uniswap (basically the most forked tool in DeFi) has been forked by services and products similar to PancakeSwap (CAKE), SushiSwap (SUSHI), Curve Finance (CRV), SpookySwap (BOO) and has the ideal TVL on DeFi Llama of $7.16b.

DeFi Airdrops

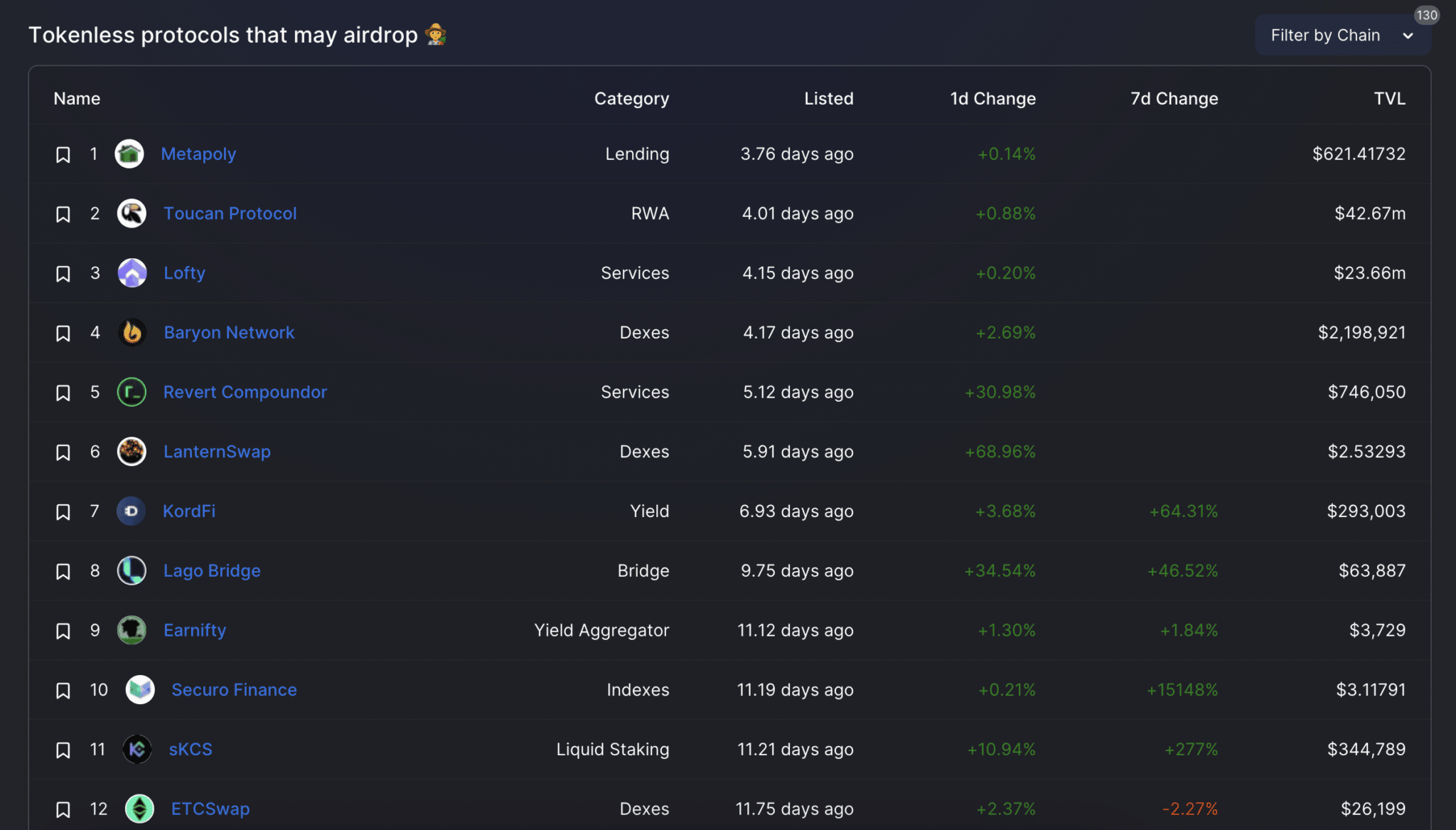

A DeFi airdrop is a token giveaway on the full done when a peculiar cryptocurrency is launched to promote the token and create a community.

A fashioned airdrop became once UniSwap, which dropped customers upwards of $10,000 price of UNI tokens when it launched. Yet any other fashioned airdrop became once by Ethereum Name Carrier (ENS), which sent upwards of $10,000 price of tokens to customers that registered .eth arena names.

By the DeFi Llama Airdrops tab, customers will get tokenless protocols that can airdrop soon. This permits customers to win in early and optimize their earnings. TVL ranks each protocol, with the ideal rated protocol being Arrakis Finance, with a TVL of $1.83b.

Oracles

Blockchain oracles aid decentralized ecosystems talk with the exterior world to validate data, toughen security and halt chains from being isolated by orderly contracts. They ship data similar to cost carrier data, price feeds, and weather data.

Developers might maybe maybe maybe additionally accomplish computerized systems without intermediaries that preserve data from the exact world, even though this course of is reminiscent of passe finance.

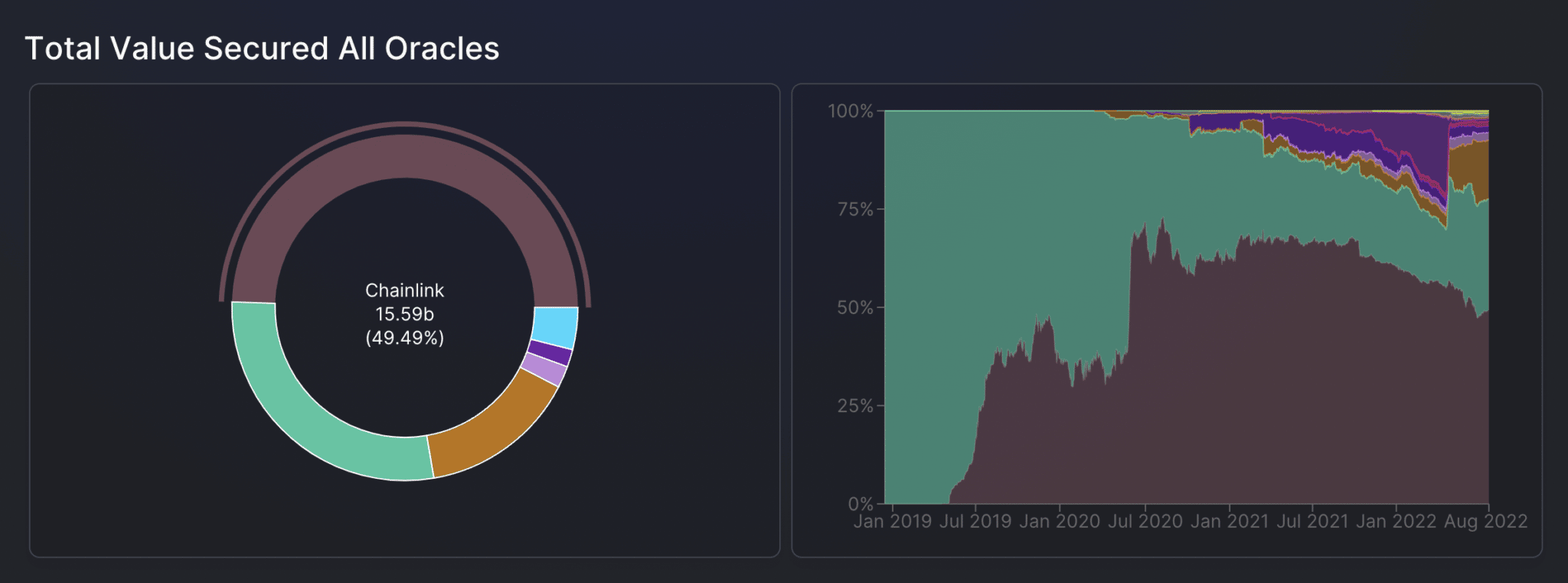

Users can see the halt oracle services and products available in the market by the Oracles tab. As of July 2022, the halt carrier is Chainlink (LINK), with a TVS of $15.94b and a market a part of 50.94%. Right here is adopted by services and products similar to Maker (MKR) ($8.49b), WinkLink $4.55b, and Pthy ($639.97m.)

Stablecoins

Stablecoins is a peculiar option for DeFi Llama. A stablecoin is an asset designed to contain a rather get price, on the full by being pegged to a commodity or forex or having its offer regulated by an algorithm.

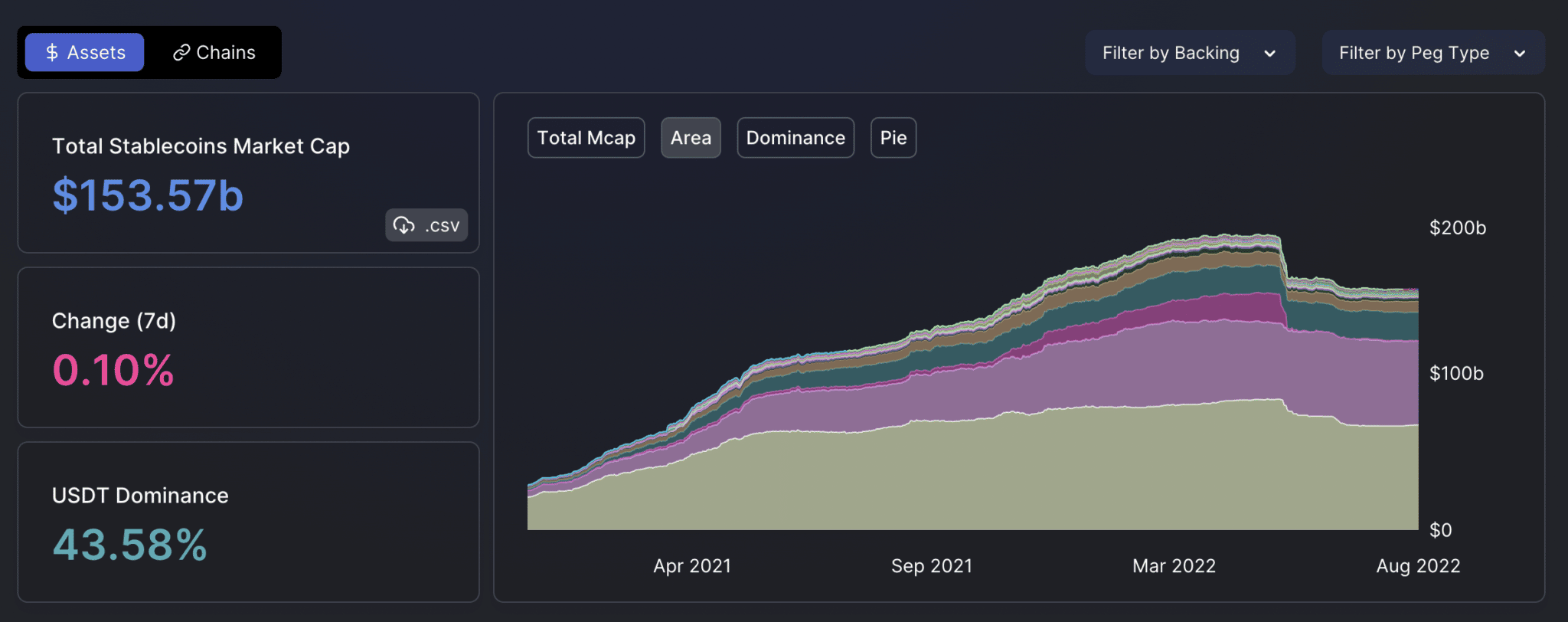

By the Stablecoins tab, customers can see the market’s most well-favored stablecoins, ranked by market caps. The present commerce leader is Tether (USDT), with a market cap of $66.39b, adopted by USD Coin (USDC), with a market cap of $54.11b.

Are There Any DeFi Llama Picks?

DeFi Llama is an infinite data offer for DeFi consumers, but it completely also has many high-price opponents.

DeFi Llama’s opponents also presents extra data for protocols delight in yield farms and toTVL data. These encompass:

- CoinMarketCap

- CoinGecko

- DappRader

- DeFi Pulse

- EtherScan.io

Despite being in the same arena of interest, most of these sites contain assorted specializations to DeFi Llama. As an instance, DappRader also appears at pricing data for NFT tasks similar to Axie Infinity and Bored Ape Yacht Membership, which helps it stand out from assorted commerce data sources.

Closing Suggestions: Future Plans For DeFi Llama

Sites similar to DeFi Llama will permit you to perform investment decisions based entirely on exact data, no longer data promoted by a explicit project, its fan rotten, or an influencer who’s been paid to promote a carrier. Though the associated price on exchanges can also peep honest correct, it’s laborious to search out out price deviations (is principal as slippages) without the full data; even with the data, it will additionally be a diminutive bit disturbing.

Slippage occurs due to several causes, along side oracle manipulation, hacks, high phases of trading, or flash loan assaults when an particular particular person takes out a clean loan to diminish the associated price of an asset on an substitute, which they then resell for a bigger price.

Total, the DeFi Llama API is an infinite offer of data retaining many of the DeFi market. It presents customers with a neat, particular person-friendly interface where they might be able to without effort leer DeFi protocols based entirely on their preferences.

Nonetheless, it isn’t basically the most easy offer of data available in the market. Competitors similar to CoinMarketCap and CoinGecko present very equivalent data, with sites delight in DappRader taking that one step additional.

To win basically the most easy data that can gasoline your resolution-making, we’d relate the usage of a mix of data sources from DeFi Llama and its opponents.

As the market continues to magnify, the recognition of DeFi Llama is possible to grow with it, giving the project extra change to grow its reputation as an data provider in the DeFi commerce.

Never Miss Yet any other Opportunity! Procure hand selected data & info from our Crypto Experts so that you just might maybe maybe maybe accomplish professional, counseled decisions that today have an effect on your crypto earnings. Subscribe to CoinCentral free e-newsletter now.