Dwelling » Markets » First-ever XRP diagram ETF debuts on Brazil’s major stock alternate

Apr. 26, 2025

New opportunities emerge as Brazil reinforces its role in the digital asset funding panorama.

Key Takeaways

- Brazil has introduced the first-ever XRP diagram ETF, debuting on the B3 stock alternate.

- The ETF, managed by Hashdex, is determined to monitor XRP’s accumulate utilizing the Nasdaq XRP Reference Model Index.

Portion this article

The sector’s first ETF that tracks the diagram accumulate of XRP, Ripple’s native crypto asset, officially debuted on Brazil’s major stock alternate B3 on April 25, in step with a press release from Valor Econômico.

The fund, dubbed Hashdex Nasdaq XRP Fundo de Índice, or Hashdex Nasdaq XRP FI, is managed by Hashdex and administered by Genial Investments Securities Brokerage SA. Genial Bank SA is the ETF’s custodian.

The worldwide asset supervisor secured greenlight from Brazil’s Securities and Trade Commission (CVM) to open the XRP-tied fund in February. The approval came after the securities regulator approved Hashdex’s diagram Solana ETF closing August.

Following regulatory approval, the fund entered into a pre-operational section. One day of this section, it was now no longer yet actively trading but was undergoing preparatory steps.

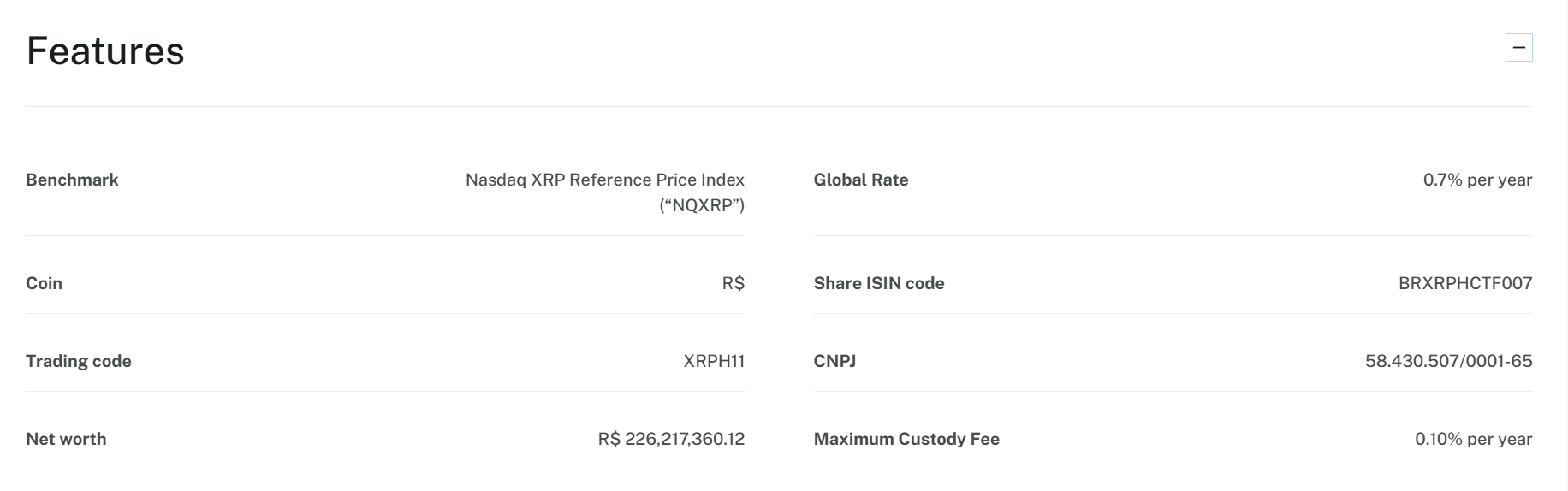

The ETF, now trading on B3 below the ticker XRPH11, replicates the XRP Reference Model Index (NQXRP), which tracks the diagram accumulate of XRP all over major crypto exchanges, in step with the fund’s documents.

The fund will invest now no longer decrease than 95% of its catch property in XRP and connected digital property, securities, or futures contracts linked to the index. As of basically the most contemporary recordsdata, XRPH11’s catch price is simply about $40 million.

The ETF’s charge structure consists of a most global charge of 0.7% each year for administration, management, and distribution, plus a most custody charge of 0.1% per year. No structuring prices apply to the fund.

With the open of XRPH11, Hashdex has expanded its ETF lineup on B3 to nine products, acknowledged Samir Kerbage, CIO of Hashdex.

He added that the brand new fund is a component of Hashdex’s mono-asset ETF neighborhood, which also consists of BITH11, ETHE11, and SOLH11. These funds target sophisticated investors relish institutions who would favor to internet crypto systems on B3.

As Brazil debuts the enviornment’s first XRP ETF, the US is predicted to approve funds that monitor the enviornment’s fourth-greatest crypto asset soon.

If approved by the SEC, diagram Solana and XRP ETFs might per chance well contrivance as a lot as $14 billion in investments, as estimated by JPMorgan analysts.

Portion this article